Alberta

Alberta activates contingency mail delivery plan

Alberta’s government has a plan to ensure critical government mail continues to be delivered during the service interruption at Canada Post.

In response to the service disruption at Canada Post, Alberta’s government is taking steps to ensure critical mail between Albertans and the government continues to flow.

Starting Tuesday, Nov. 19, mail can be accepted from Albertans at designated Alberta government offices across the province to ensure it reaches the proper destination. No stamps are required. The full list of designated buildings is available on Alberta.ca.

Albertans who receive mail from the provincial government will receive a notification by email or phone indicating where and when they can pick-up/drop-off their mail. Alberta’s government will never ask for personal information over the phone or for anyone to click on a link in an email. Non-critical mail will be held by the originating department until Canada Post mail service resumes.

Some departments are participating in a Canada Post program to deliver social-economic cheques once a month during the disruption. Many departments that issue cheques also offer direct deposit. For more information, or to inquire about signing up for direct deposit, Albertans should contact the government department that issues the payment.

Additional information will be posted online as it becomes available.

Quick facts

- Only critical mail can be delivered to the general public during a work interruption. Non-critical or promotional mail should not be sent during this time.

- Ministries must arrange for staff serving the public to accept and forward critical mail from Albertans to the appropriate government recipients.

- Critical mail is material that must reach its intended recipient to avoid health, safety, financial or other significant harm to Albertans, significant risk or loss to government, or legislative non-compliance and that cannot be delivered expediently by courier, fax, electronic or other means.

- Canada Post employees will deliver federal and provincial government socio-economic cheques one day per month during a work interruption.

- Additional information will be posted on Alberta.ca as it becomes available.

Related information

Government mail drop locations – Effective November 19

| City / Town | Drop Point | Address |

|---|---|---|

| Airdrie | Agricultural Centre | 97 East Lake Ramp NE, Airdrie, AB T4A 0C3 |

| Athabasca | Jewell Building | #2, 3603 – 53 St., Athabasca, AB T9S 1A9 |

| Barrhead | AFSC | 4924 50 Ave, Barrhead, AB T7N 1A4 |

| Blairmore | Provincial Building | 12501 – Crowsnest Pass Provincial Building, Blairmore, AB T0K 1E0 |

| Bonnyville | Provincial Building | P.O. Box 5244, 4904 – 50 Ave., Bonnyville, AB T9N 2G4 |

| Brooks | Provincial Building | 220 – 4 Ave. W, Brooks, AB T1R 1C6 |

| Calgary | West Direct Express | Bay 30, 333 28 Street NE, Calgary, AB T2A 7P4 |

| Camrose | AFSC | P.O. Box 5000, 4910 – 52 St., Camrose, AB T4V 2V4 |

| Canmore | Provincial Building | 3rd Floor, 800 – Railway Ave., Canmore, AB T1W 1P1 |

| Cardston | Provincial Building | 576 – Main St., Cardston, AB T0K 0K0 |

| Caroline | Alberta Highway Services Yard | P.O. Box 160, Caroline, AB T0M 0M0 |

| Castor | Alberta Health Services | 4911 – 50 Avenue Castor, AB T0C 0X0 |

| Claresholm | Provincial Building | P.O. Box 1650, 109 – 46 Ave. W, Claresholm, AB T0L 0T0 |

| Coaldale | RCMP Detachment | 705 – 19A Avenue, Coaldale, AB T1M 1A7 |

| Cochrane | Provincial Building | 2nd Floor, 213 – 1 St. W, Cochrane, AB T4C 1A5 |

| Cold Lake | AB Supports | #408 6501B – 51 Street, Cold Lake, AB T9M 1P2 |

| Consort | Provincial Building | 4916 – 50 St., Consort, AB T0C 1B0 |

| Drayton Valley | Provincial Building | 5136 – 51 Ave., Drayton Valley, AB T7A 1S4 |

| Drumheller | Riverside Centre | 180 – Riverside Centre, Drumheller, AB T0J 0Y4 |

| Edmonton | MSV Building | 12360 – 142 Street NW, Edmonton, AB T5L 2H1 |

| Edson | Provincial Building | 111 – 54 St., Edson, AB T7E 1T2 |

| Evansburg | Health Centre | 5525 – 50 St., Evansburg, AB T0E 0T0 |

| Fairview | AARD | #213, 10209 – 109 St., Fairview, AB T0H 1L0 |

| Falher | AFSC | 701 – Main St., Falher, AB T0H 1M0 |

| Foremost | Provincial Building | 218 – Main St., Foremost, AB T0K 0X0 |

| Fort MacLeod | Fort MacLeod Healthcare Centre | P.O. Box 520, 744 – 26 St., Fort MacLeod, AB T0L 0Z0 |

| Fort McMurray | Provincial Building | 9915 – Franklin Ave., Fort McMurray, AB T9H 2K4 |

| Fort Saskatchewan | Correctional Centre | Bag 10, 7802 – 101 St., Fort Saskatchewan, AB T8L 2P3 |

| Fort Vermilion | Ranger Station | 5001 46 Ave Fort Vermilion, AB T0H 1N0 |

| Fox Creek | Ranger Station | 201 Kaybob Drive, Fox Creek, AB T0H 1P0 |

| Grande Prairie | Provincial Building | 10320 – 99 St., Grande Prairie, AB T8V 6J4 |

| Grimshaw | AFSC | 5306 – 50 Street, Grimshaw, AB T0H 1W0 |

| Hanna | Provinical Building | 401 – Centre St., Hanna, AB T0J 1P0 |

| High Level | Provincial Building | 10106 – 100 Ave., High Level, AB T0H 1Z0 |

| High Prairie | Provincial Building | 5226 – 53 Ave., High Prairie, AB T0G 1E0 |

| High River | Spitzee Crossing Building | 124 – 4 Avenue SW, High River, AB T1V 1M3 |

| Hinton | Hinton Training Centre | 1176 – Switzer Dr., Hinton, AB T7V 1V3 |

| Innisfail | Eastgate Mall | Bay 11, 4804 – 42 Ave., Innisfail, AB T4G 1V2 |

| Killam | Killam Mental Health Clinic | 4811 – 49 Ave., Killam, AB T0B 2L0 |

| Lac La Biche | Health Centre | 9503 – Beaver Hill Rd., Lac La Biche, AB T0A 2C0 |

| Lacombe | AFSC | 5718 – 56 Ave., Lacombe, AB T4L 1B1 |

| Lamont | AFSC | 5014 – 50 Ave., Lamont, AB T0B 2R0 |

| Leduc | Provincial Courthouse | 4612 – 50 St., Leduc, AB T9E 6L1 |

| Lethbridge | Provincial Building | 200 – 5 Ave. S, Lethbridge, AB T1J 4L1 |

| Lloydminster | Provincial Building | 5124 – 50 St., Lloydminster, AB T9V 0M3 |

| Manning | Environment and Parks | #400, 2nd Street SW, Manning, AB T0H 2M0 |

| McLennan | Kirkland Building | P.O. Box 326, 205 – 1 St. E, McLennan, AB T0H 2L0 |

| Medicine Hat | Provincial Building | #1-106, 346 – 3 St. SE, Medicine Hat, AB T1A 0G7 |

| Morniville | Provincial Building | 10008 – 107 St., Morinville, AB T8R 1L3 |

| Olds | Provincial Building | 5030 – 50 St., Olds, AB T4H 1S1 |

| Peace River | Provincial Building | Bag 900, 9621 – 96 Ave., Peace River, AB T8S 1T4 |

| Pincher Creek | Provincial Building | 782 – Main St., Pincher Creek, AB T0K 1W0 |

| Ponoka | Provincial Building | P.O. Box 4426, 5110 – 49 Ave., Ponoka, AB T4J 1S1 |

| Provost | Provincial Building | 5419 – 44 Ave., Provost, AB T0B 3S0 |

| Red Deer | Provincial Building | 4920 – 51 St., Red Deer, AB T4N 6K8 |

| Rimbey | Provincial Building | 2nd Floor, 5025 – 55 St., Rimbey, AB T0C 2J0 |

| Rocky Mountain House | Provincial Building | 2nd Floor, 4919 – 51 St., Rocky Mountain House, AB T4T 1B3 |

| St. Albert | Provincial Building | 30 – Sir Winston Churchill Ave., St. Albert, AB T8N 3A3 |

| St. Paul | Provincial Building | 5025 – 49 Ave., St. Paul, AB T0A 3A4 |

| Sedgewick | Flagstaff Building | 4701 – 48 Ave., Sedgewick, AB T0B 4C0 |

| Sherwood Park | Centre Plaza | 190 Chippewa Road, Sherwood Park, AB T8A 4H5 |

| Slave Lake | Government Centre | 101- 3rd Street SW, Slave Lake, AB T0G 2A4 |

| Smoky Lake | Provincial Building | 2nd Floor, 108 – Wheatland Ave., Smoky Lake, AB T0A 3C0 |

| AB Tree Improvement | P.O. Box 750, 59162 – R.R. 155, Smoky Lake, AB T0A 3C0 | |

| Spirit River | AFSC | 4202 – 50 Street, Spirit River, AB T0H 3G0 |

| Spruce Grove | Provincial Building | #1, 250 – Diamond Ave., Spruce Grove, AB T7X 4C7 |

| Stettler | Provincial Building | 4705 – 49 Ave., Stettler, AB T0C 2L0 |

| Stony Plain | Provincial Building | 4709 – 44 Ave., Stony Plain, AB T7Z 1N4 |

| Strathmore | AFSC | 325 – 3 Ave., Strathmore, AB T1P 1B4 |

| Sundre | Ranger Station | P.O. Box 519, 127 – 1 St. NW, Sundre, AB T0M 1X0 |

| Taber | Provincial Building | 5011 – 49 Ave., Taber, AB T1G 1V9 |

| Three Hills | AFSC | 128 – 3 Avenue, Tofield, AB T0M 2A0 |

| Tofield | Provincial Building | 5024 51 Ave , Tofield, AB T0B 4J0 |

| Ukrainian Village | Ukrainian Village | c/o 8820 – 112 St., Edmonton, AB T6G 2P8 |

| Valleyview | Provincial Building | 5102 – 50 Ave., Valleyview, AB T0H 3N0 |

| Vegreville | Haverhill Building | 5121 – 49 Street E, Vegreville, AB T9C 1S7 |

| Vermilion | Provincial Building | P.O. Box 30, 4701 – 52 St., Vermilion, AB T9X 1J9 |

| Vulcan | AFSC | 104 Centre Street E, Vulcan, AB T0L 2B0 |

| Wainwright | Provincial Building | #4, 810 – 14 Ave., Wainwright, AB T9W 1R2 |

| Westlock | Provincial Building | 2nd Floor, 10003 – 100 St., Westlock, AB T7P 2E8 |

| Wetaskiwin | Provincial Building | 5201 – 50 Ave., Wetaskiwin, AB T9A 0S7 |

| Whitecourt | Provincial Building | 5020 – 52 Ave., Whitecourt, AB T7S 1N2 |

| Youngstown | Special Areas | 404 – 2 Ave , Youngstown, AB T0J 3P0 |

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

-

Business2 days ago

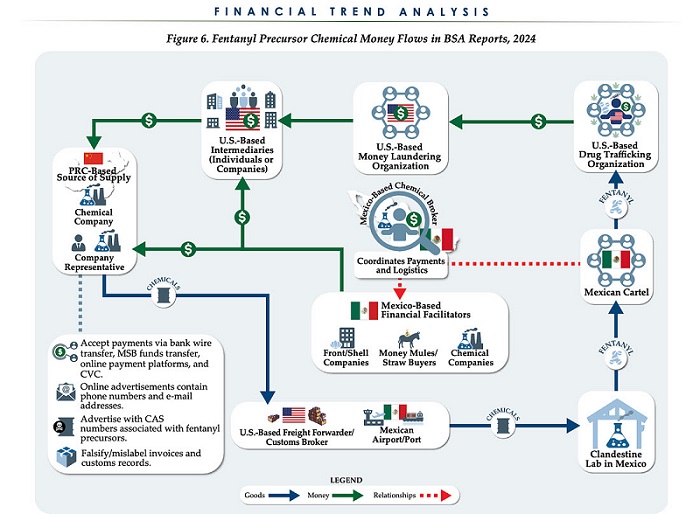

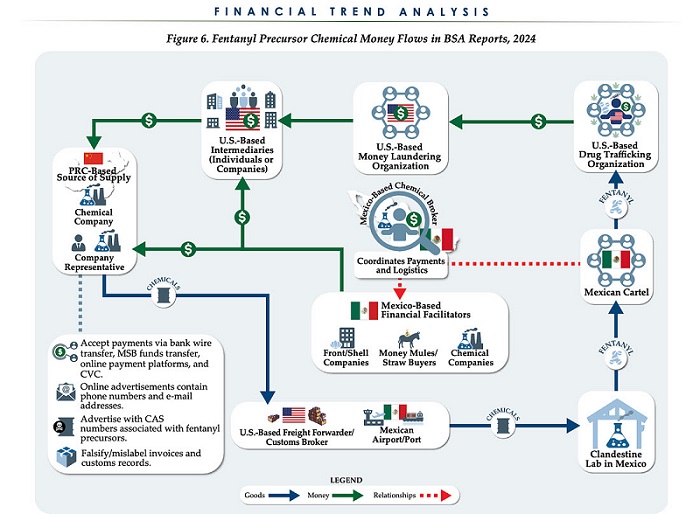

Business2 days agoChina, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

-

espionage2 days ago

espionage2 days agoEx-NYPD Cop Jailed in Beijing’s Transnational Repatriation Plot, Canada Remains Soft Target

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBREAKING from THE BUREAU: Pro-Beijing Group That Pushed Erin O’Toole’s Exit Warns Chinese Canadians to “Vote Carefully”

-

Daily Caller2 days ago

Daily Caller2 days agoTrump Executive Orders ensure ‘Beautiful Clean’ Affordable Coal will continue to bolster US energy grid

-

Daily Caller2 days ago

Daily Caller2 days agoDOJ Releases Dossier Of Deported Maryland Man’s Alleged MS-13 Gang Ties

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAllegations of ethical misconduct by the Prime Minister and Government of Canada during the current federal election campaign

-

Energy2 days ago

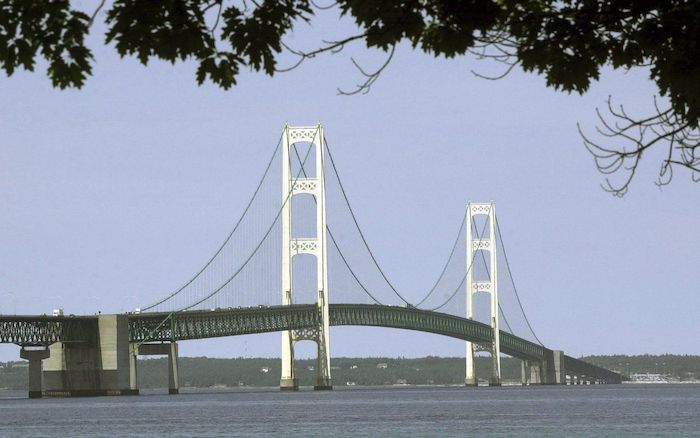

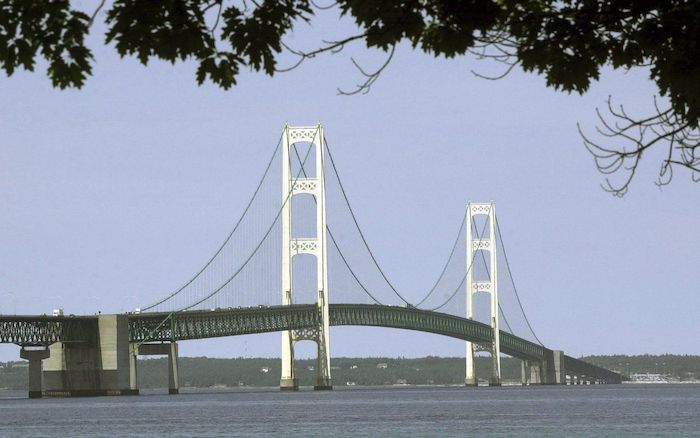

Energy2 days agoStraits of Mackinac Tunnel for Line 5 Pipeline to get “accelerated review”: US Army Corps of Engineers

-

Opinion2 days ago

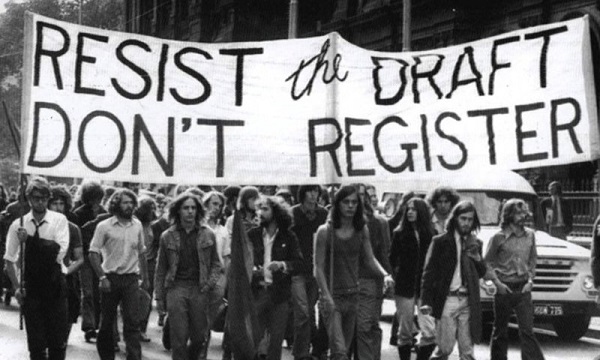

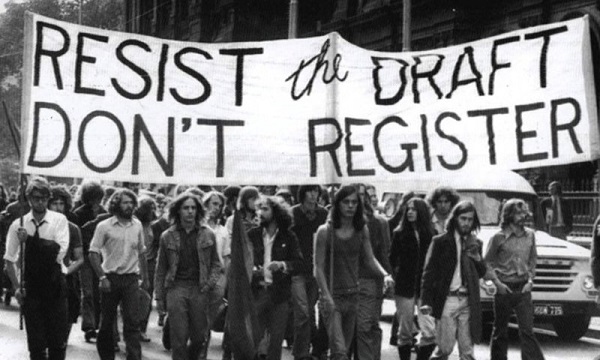

Opinion2 days agoLeft Turn: How Viet Nam War Resisters Changed Canada’s Political Compass