Alberta

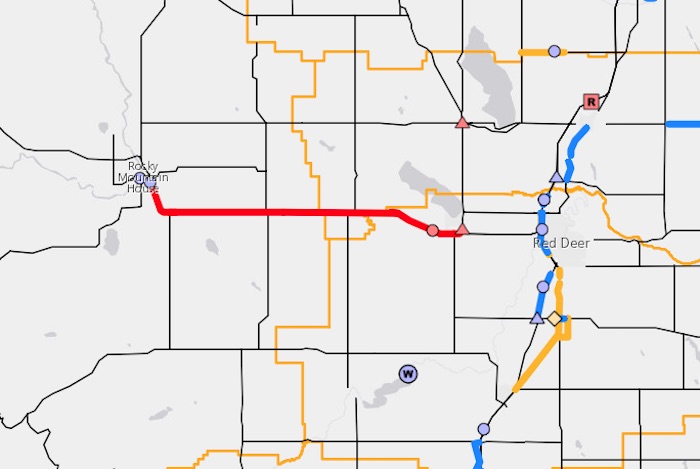

Alberta 2023 budget plows ahead with twinning highway 11 from Sylvan Lake to Rocky Mountain House

Building Alberta’s economic corridor network

Budget 2023 includes strategic investments in Alberta’s highway network to build economic corridors, creating jobs, improving safety and supporting economic development.

Budget 2023 includes $8 billion for the Ministry of Transportation and Economic Corridors’ three-year capital plan, a $718-million increase compared with Budget 2022.

“Budget 2023 is focused on securing Alberta’s future by growing the economy. Our investments will enhance economic corridors that provide vital links to markets in and out of Alberta, helping our industries expand and succeed. These projects will increase the safety and efficiency of our provincial highway network, improving travel for Albertans and commercial carriers in key industries.”

The total capital investment is $2 billion for planning, design and construction of major highway and bridge projects. This work focuses on improving traffic flow and supporting investments in the province’s major trade corridors. Examples of projects across the province that are receiving funding include the Calgary and Edmonton ring roads, Highway 3 twinning, Highway 11 twinning, and replacing the Highway 2 and Highway 556 interchange at Balzac. This capital investment funding also includes $75.5 million over three years for 23 engineering or planning projects to address known future needs.

“Budget 2023 is investing in Alberta drivers through improvements to Highway 60 through Acheson. These improvements will help families save time on their commute while improving the efficient movement of goods across the province. Budget 2023 also responds to safety concerns from the community with a new intersection at Highway 16A and Range Road 20 in Parkland County. The new intersection will not only help area residents get to and from home safely but will also improve traffic flow along this major economic corridor.”

“Highway 63, north of Fort McMurray, is a critical link in northern Alberta for oversize and overweight vehicles transporting goods for the energy sector. Twinning this highway will improve efficiency and safety for both commercial drivers and commuters. It also enables oilsands workers to more easily commute from Fort McMurray, which we know provides a healthier lifestyle for them and their families as opposed to flying from out of province and living in a camp. The workers who decide to make this move will see the benefits of living in such an amazing province like Alberta.”

“Alberta’s Industrial Heartland Association is pleased that the 55-year-old Vinca Bridge replacement is included in the Government of Alberta’s 2023 budget. As a vital component of Alberta’s high-load corridor and a strategic connector in Alberta’s Industrial Heartland, the bridge services a thriving industrial zone with over $45 billion in total capital investment and billions more expected in the coming years. Replacing Vinca Bridge will shorten travel times, reduce greenhouse gas emissions and enhance the competitiveness of both the Industrial Heartland and the manufacturing supply chain that contributes to its success.”

“We have been advocating hard for twinning and rail grade separation for Highway 60, and we are pleased to see this commitment from the Government of Alberta. Acheson is not only the beating, industrial heart of Parkland County, it is one of the largest industrial areas in Western Canada. Completing this work in a timely matter will improve access and movement along Highway 60 and allow for further development in Acheson, which will contribute to economic growth and job creation throughout Parkland County and the Edmonton region.”

“Representing hundreds of businesses in the Acheson area, the Acheson Business Association is thrilled with and would like to thank the Government of Alberta for this latest announcement for the twinning and rail grade separation for Highway 60. Highway 60 is an important connector of arterial highways, allowing products to move all directions through the metro Edmonton area, and the twinning and overpass will create a safer route for employees, travellers and business owners who are passing through this stretch of road every day. This will also enable the region to continue to attract more investors and businesses by reducing delays and eliminating congestion along this major trade corridor.”

Budget 2023 also includes $1.7 billion over three years for capital maintenance and renewal, which extends the life of the province’s existing road and bridge network and helps industry create and maintain jobs. These investments will allow the province to maintain existing roads and bridges to support safe and efficient travel to benefit Albertans and the economy.

Transportation and Economic Corridors will also be providing $3.9 billion for capital grants to municipalities over the next three years. This includes maintaining the funding commitment to Calgary and Edmonton for their LRT projects and continuing to provide funding for the Strategic Transportation Infrastructure Program to help municipalities improve critical local transportation infrastructure. Ongoing investments in water and wastewater infrastructure programs will also ensure all Albertans have reliable access to clean drinking water and effective wastewater services.

Additionally, Budget 2023 will provide nearly $400 million to support building and repairing water management infrastructure that provides irrigation for the agriculture sector and flood mitigation for Alberta communities such as the Springbank Off-stream Reservoir.

Budget 2023 secures Alberta’s future by transforming the health-care system to meet people’s needs, supporting Albertans with the high cost of living, keeping our communities safe and driving the economy with more jobs, quality education and continued diversification.

Alberta

Big win for Alberta and Canada: Statement from Premier Smith

Premier Danielle Smith issued the following statement on the April 2, 2025 U.S. tariff announcement:

“Today was an important win for Canada and Alberta, as it appears the United States has decided to uphold the majority of the free trade agreement (CUSMA) between our two nations. It also appears this will continue to be the case until after the Canadian federal election has concluded and the newly elected Canadian government is able to renegotiate CUSMA with the U.S. administration.

“This is precisely what I have been advocating for from the U.S. administration for months.

“It means that the majority of goods sold into the United States from Canada will have no tariffs applied to them, including zero per cent tariffs on energy, minerals, agricultural products, uranium, seafood, potash and host of other Canadian goods.

“There is still work to be done, of course. Unfortunately, tariffs previously announced by the United States on Canadian automobiles, steel and aluminum have not been removed. The efforts of premiers and the federal government should therefore shift towards removing or significantly reducing these remaining tariffs as we go forward and ensuring affected workers across Canada are generously supported until the situation is resolved.

“I again call on all involved in our national advocacy efforts to focus on diplomacy and persuasion while avoiding unnecessary escalation. Clearly, this strategy has been the most effective to this point.

“As it appears the worst of this tariff dispute is behind us (though there is still work to be done), it is my sincere hope that we, as Canadians, can abandon the disastrous policies that have made Canada vulnerable to and overly dependent on the United States, fast-track national resource corridors, get out of the way of provincial resource development and turn our country into an independent economic juggernaut and energy superpower.”

Alberta

Energy sector will fuel Alberta economy and Canada’s exports for many years to come

From the Fraser Institute

By any measure, Alberta is an energy powerhouse—within Canada, but also on a global scale. In 2023, it produced 85 per cent of Canada’s oil and three-fifths of the country’s natural gas. Most of Canada’s oil reserves are in Alberta, along with a majority of natural gas reserves. Alberta is the beating heart of the Canadian energy economy. And energy, in turn, accounts for one-quarter of Canada’s international exports.

Consider some key facts about the province’s energy landscape, as noted in the Alberta Energy Regulator’s (AER) 2023 annual report. Oil and natural gas production continued to rise (on a volume basis) in 2023, on the heels of steady increases over the preceding half decade. However, the dollar value of Alberta’s oil and gas production fell in 2023, as the surging prices recorded in 2022 following Russia’s invasion of Ukraine retreated. Capital spending in the province’s energy sector reached $30 billion in 2023, making it the leading driver of private-sector investment. And completion of the Trans Mountain pipeline expansion project has opened new offshore export avenues for Canada’s oil industry and should boost Alberta’s energy production and exports going forward.

In a world striving to address climate change, Alberta’s hydrocarbon-heavy energy sector faces challenges. At some point, the world may start to consume less oil and, later, less natural gas (in absolute terms). But such “peak” consumption hasn’t arrived yet, nor does it appear imminent. While the demand for certain refined petroleum products is trending down in some advanced economies, particularly in Europe, we should take a broader global perspective when assessing energy demand and supply trends.

Looking at the worldwide picture, Goldman Sachs’ 2024 global energy forecast predicts that “oil usage will increase through 2034” thanks to strong demand in emerging markets and growing production of petrochemicals that depend on oil as the principal feedstock. Global demand for natural gas (including LNG) will also continue to increase, particularly since natural gas is the least carbon-intensive fossil fuel and more of it is being traded in the form of liquefied natural gas (LNG).

Against this backdrop, there are reasons to be optimistic about the prospects for Alberta’s energy sector, particularly if the federal government dials back some of the economically destructive energy and climate policies adopted by the last government. According to the AER’s “base case” forecast, overall energy output will expand over the next 10 years. Oilsands output is projected to grow modestly; natural gas production will also rise, in part due to greater demand for Alberta’s upstream gas from LNG operators in British Columbia.

The AER’s forecast also points to a positive trajectory for capital spending across the province’s energy sector. The agency sees annual investment rising from almost $30 billion to $40 billion by 2033. Most of this takes place in the oil and gas industry, but “emerging” energy resources and projects aimed at climate mitigation are expected to represent a bigger slice of energy-related capital spending going forward.

Like many other oil and gas producing jurisdictions, Alberta must navigate the bumpy journey to a lower-carbon future. But the world is set to remain dependent on fossil fuels for decades to come. This suggests the energy sector will continue to underpin not only the Alberta economy but also Canada’s export portfolio for the foreseeable future.

-

2025 Federal Election19 hours ago

2025 Federal Election19 hours agoMark Carney refuses to clarify 2022 remarks accusing the Freedom Convoy of ‘sedition’

-

2025 Federal Election23 hours ago

2025 Federal Election23 hours agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

Bruce Dowbiggin21 hours ago

Bruce Dowbiggin21 hours agoAre the Jays Signing Or Declining? Only Vladdy & Bo Know For Sure

-

2025 Federal Election22 hours ago

2025 Federal Election22 hours agoFixing Canada’s immigration system should be next government’s top priority

-

Daily Caller20 hours ago

Daily Caller20 hours agoBiden Administration Was Secretly More Involved In Ukraine Than It Let On, Investigation Reveals

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCanada Continues to Miss LNG Opportunities: Why the World Needs Our LNG – and We’re Not Ready

-

Health2 days ago

Health2 days agoSelective reporting on measles outbreaks is a globalist smear campaign against Trump administration.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoMark Carney is trying to market globalism as a ‘Canadian value.’ Will it work?