International

Afghan Evacuee Added to CIS National Security Vetting Failures Database

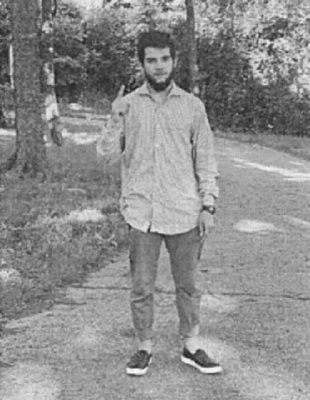

Nasir Ahmad Tawhedi displaying a pro-ISIS hand gesture common among ISIS militants. He posted this photo on a Tik Tok account while in Oklahoma, resulting in an account ban. Photo courtesy of an FBI complaint filed as part of his criminal court case.

From the Center for Immigration Studies

By Todd Bensman

Former CIA guard is charged with terrorism; assurances that he was vetted turn out to be untrue

An Afghan evacuee from the August 2021 fall of Kabul who stands charged with multiple terrorism offenses that include a mass-casualty firearms attack plot is the latest addition to the Center for Immigration Studies National Security Vetting Failures Database, bringing the total number of cases to 49.

In March 2023, the Center published the database collection to draw “remedial attention” to ongoing government vetting failures lest they “drift from the public mind and interest of lawmakers, oversight committee members, media, and homeland security practitioners who would otherwise feel compelled to demand process reforms”, according to an explanatory Center report titled “Learning from our Mistakes”.

The latest addition is Nasir Ahmad Tawhedi, who worked in Afghanistan as an outside guard for a Central Intelligence Agency facility and was authorized for air evacuation from a third country a month after the August 2021 fall of Kabul to Dallas, Texas, on a hastily approved humanitarian parole.

He was among nearly 100,000 mostly Afghan evacuees, of whom about 77,000 were initially admitted into the United States via humanitarian parole through a program called Operation Allies Welcome. All became eligible for more permanent Special Immigrant Visas (SIV) mainly intended to protect Afghans who collaborated with U.S. military operations from reprisals by the Taliban group that seized control of the country.

After arriving in the United States on September 9, 2021, on humanitarian parole, Tawhedi settled with his wife and infant near Oklahoma City on an SIV. He initially worked as a Lyft driver in Dallas and later as an auto mechanic in Oklahoma.

Some 37 months after arriving, in October 2024, the FBI arrested the 27-year-old Tawhedi and a juvenile co-conspirator — Tawhedi’s brother-in-law — for an alleged plot to conduct an Election Day terrorist firearms attack in the United States on behalf of the Islamic State of Iraq and al-Sham (ISIS), a designated foreign terrorist organization still active in Afghanistan. The unidentified co-conspirator, an Afghan, entered the United States in 2018 also on an SIV, but little else is known about his vetting processes.

Their plot involved liquidating a house and personal assets to fund the repatriation of Tawhedi’s wife and child to Afghanistan and weapons necessary for him and the juvenile to conduct a mass-casualty attack during which they would be killed, a criminal complaint alleged. The pair obtained semi-automatic rifles and ammunition for the attack, although by then FBI undercover agents had penetrated the plot.

Shortly after the arrests, U.S. government officials claimed that Tawhedi was “thoroughly” vetted three times: first to work for the CIA in Afghanistan, then “recurrently” by DHS for the humanitarian parole status allowing him to fly into the United States, and then for the Special Immigrant Visa once he was settled, probably sometime in 2022.

No red flags turned up, they asserted, without providing evidence.

“Afghan evacuees who sought to enter the United States were subject to multilayered screening and vetting against intelligence, law enforcement and counterterrorism information. If new information emerges after arrival, appropriate action is taken,” a DHS spokesperson told Fox News Digital in October 2024.

But within weeks of making those assertions, U.S. officials reversed course and acknowledged that Tawhedi did not undergo the previously claimed vetting. The State Department, in fact, never vetted or approved Tawhedi, nor had he been very thoroughly vetted for his CIA guard post job in Afghanistan, they said. DHS did not “thoroughly” vet Tawhedi for humanitarian parole on a recurring basis as initially claimed about all Afghan evacuees, either, before allowing him to fly from the unknown third country into the United States.

The screening process for Afghan evacuees in the program includes probing for any possible ties to terrorism, ISIS, or the Taliban using databases the U.S. compiled over 20 years in Afghanistan that include data from applicant electronic devices, biometrics, and other sources.

It’s unclear when Tawhedin radicalized in ways that might have been detected. U.S. officials initially told U.S. media they believed that happened only after he was admitted into the United States. In court records, the FBI says Tawhedi’s initial crime — sending $540 in cryptocurrency to ISIS — occurred in March 2024. But his ties and extremist proclivities almost certainly predated the currency transfer.

Had Tawhedi been thoroughly vetting when he was supposed to be, red flags were more likely than not available to be found both before and after he arrived in the U.S.

For instance, adjudicators might have found pre-existing extremist ideological proclivities within Tawhedi’s immediate family because two brothers evacuated to France also were arrested in September 2024 for a terrorism plot there to attack a French soccer match or shopping center, according to numerous media accounts and information that surfaced during an October 2024 Oklahoma City federal court hearing. (The French and Americans collaborated on both cases).

Furthermore, court records reveal that Tawhedi maintained relationships with well-known ISIS figures that were sufficiently trusting to have enabled direct communications with them by phone and on encrypted apps.

In fact, Tawhedi trusted these operatives to care for his repatriated wife and child after he was killed in the U.S. attack and to gift substantial remaining funds from the sale of the Oklahoma house. Lastly, an FBI investigator in the October 2024 court complaint indicated that most extended family members in Tawhedi’s Oklahoma circle were aware of the plot, approved, and could still be charged as co-conspirators as of that time.

The fact that many family members in the U.S. and abroad felt this way about Tawhedi’s plans further indicates that their extremism pre-dated U.S. entry and might have red-flagged during face-to-face interviews, database checks, and other standard security vetting practices.

Underscoring the admitted Tawhedi vetting failure, a September 2022 DHS Office of Inspector General report found, in part, that U.S. Customs and Border Protection “admitted or paroled evacuees who were not fully vetted into the United States” and that, “As a result, DHS may have admitted or paroled individuals into the United States who pose a risk to national security and the safety of local communities.”

Crime

Hero bystander disarms shooter in Australian terror attack

Insane footage shows a bystander attacking and disarming one of the terrorists, who appears to have been armed with a long rifle, during today’s shooting attack on an event celebrating Hanukkah at Bondi Beach in Sydney, Australia. pic.twitter.com/mJceco22bJ

— OSINTdefender (@sentdefender) December 14, 2025

The chaos that struck Australia on Sunday night produced one moment of astonishing courage: a Sydney shopkeeper, armed with nothing but instinct and grit, charged a gunman at Bondi Beach and wrestled the rifle out of his hands as terrified families ran for cover. Authorities say the act likely prevented even more deaths in what officials have already called an antisemitic terror attack that left 12 people dead and dozens wounded during a Hanukkah celebration along the water.

The hero has been identified as 43-year-old fruit shop owner Ahmed Al Ahmed, a father of two who happened to be nearby when gunfire erupted at the beachfront event “Hanukkah by the Sea,” which had drawn more than 200 people. Footage captured the moment he marched toward the shooter, grabbed hold of the rifle, and overpowered him in a brief, violent struggle. As the gunman hit the pavement, Al Ahmed momentarily pointed the weapon back at him but didn’t fire, instead placing it against a tree before another attacker opened up from a bridge above. He was hit in the hand and shoulder and is now recovering after emergency surgery.

A relative told Australia’s Channel Seven that Al Ahmed had never handled a gun in his life. “He’s a hero — he’s 100 percent a hero,” the family member said. New South Wales Premier Chris Minns echoed the praise, calling the scene “unbelievable,” adding, “A man walked up to someone who had just fired on the community and single-handedly disarmed him. Many people are alive tonight because of his bravery.”

Police say two shooters stepped out of a vehicle along Campbell Parade around 6:40 p.m. and began firing toward the beach. One gunman was killed, the other is in custody in critical condition. Detectives are also investigating whether a third attacker was involved, and bomb units swept the area after reports that an explosive device may have been planted beneath a pedestrian bridge. The toll is staggering: 12 dead, including one shooter, and at least 29 wounded — among them children and two police officers.

Prime Minister Anthony Albanese condemned what he called “a targeted attack on Jewish Australians on the first day of Hanukkah,” saying, “What should have been a night of joy and peace has been shattered by this horrifying evil attack.” Emergency crews flooded the beach as hundreds of panicked people sprinted away from the gunfire. Video shows one attacker firing down toward the sand from the bridge behind Bondi Park before being shot himself in a final standoff captured by drone footage. Both gunmen appeared to be carrying ammunition belts, with witnesses estimating up to 50 rounds were fired.

Australian police have cordoned off properties linked to the suspects and continue to canvass Bondi for additional threats. What remains clear is that Sunday’s attack was met with extraordinary acts of self-sacrifice, none more dramatic than a shopkeeper from Sutherland who walked into gunfire to stop further slaughter.

Crime

Terror in Australia: 12 killed after gunmen open fire on Hanukkah celebration

One of the suspected gunmen of the Bondi Beach massacre shooting in Australia has been identified as Naveed Akram

What was supposed to be a peaceful Sunday evening celebration of Hanukkah on one of the world’s most famous beaches instead descended into chaos and bloodshed, as two attackers opened fire on crowds gathered at Sydney’s Bondi Beach, killing 12 people — including one of the gunmen — and injuring at least 11 others.

The violence erupted shortly after 5 p.m. local time, just as more than a thousand people were gathering for “Hanukkah by the Sea,” an annual event held near a playground at the Bondi foreshore. According to Australian outlets, the shooting began as families were lighting candles and singing, sending parents scrambling to shield children and worshippers diving for cover along the promenade.

New South Wales Premier Chris Minns confirmed late Sunday that one attacker was killed at the scene and a second was arrested. He said the evidence already points unmistakably toward an anti-Jewish terror attack. “What should have been a night of peace and joy was shattered by a horrifying, evil attack,” Minns told reporters, noting investigators believe the plot was “designed to target Sydney’s Jewish community.”

NSW Police Commissioner Mal Lanyon said well over a thousand people were present when the shooting started, including two state police officers who were among those struck by gunfire, according to ABC News. Police also located what appeared to be an improvised explosive device in the vicinity shortly after the initial gunfire. Bomb technicians neutralized the device while officers locked down the area and urged residents to shelter in place.

Around 9 p.m., with ambulances and tactical units pouring in, authorities described the unfolding chaos as a “developing incident” and warned anyone nearby to stay indoors. Multiple victims were treated on the sand and the surrounding walkways before being rushed to hospitals across Sydney.

As investigators piece together the attackers’ movements and motive, officials say the toll could have been even worse given the size of the crowd and the presence of children throughout the event. What remains is a shaken city, a grieving Jewish community, and a country once again confronting the threat of political and religious extremism on its own soil.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoWayne Gretzky’s Terrible, Awful Week.. And Soccer/ Football.

-

espionage1 day ago

espionage1 day agoWestern Campuses Help Build China’s Digital Dragnet With U.S. Tax Funds, Study Warns

-

Focal Points1 day ago

Focal Points1 day agoCommon Vaccines Linked to 38-50% Increased Risk of Dementia and Alzheimer’s

-

Opinion2 days ago

Opinion2 days agoThe day the ‘King of rock ‘n’ roll saved the Arizona memorial

-

Automotive15 hours ago

Automotive15 hours agoThe $50 Billion Question: EVs Never Delivered What Ottawa Promised

-

Agriculture2 days ago

Agriculture2 days agoCanada’s air quality among the best in the world

-

Business1 day ago

Business1 day agoCanada invests $34 million in Chinese drones now considered to be ‘high security risks’

-

Health23 hours ago

Health23 hours agoThe Data That Doesn’t Exist