Also Interesting

Important Steps You Need To Take Before Hitting The Road

Passing your driving test and buying a new car is a big milestone and something certainly exciting. However, it also carries great responsibility. You may be aware that there are many road collisions occurring on a daily basis, and your behavior on the road can impact your safety and that of other drivers. There are a few things that you will need to make sure to have in place before getting in your car and going on your journey.

This article will provide you with important steps you need to take before hitting the road so that you are fully prepared before you take off, no matter how experienced you are.

Have All Your Documents Ready

When you start driving, there are a few documents you are required to have with you. This will vary from country and location, but the majority of authorities require you to have your full or provisional driving license on you, as well as additional forms of identification. You may also be expected to have confirmation of car insurance and a vehicle safety certificate. You will need to keep these documents safe in the vehicle, as police officers may ask to verify them if you are ever stopped or involved in an accident. You may be penalized with a fine if you do not have these, or in worst-case scenarios, you may be brought into the police station.

Have Appropriate Insurance

Insurance is crucial when driving, and you will certainly need to have this before you hit the road. It is against the law to drive without insurance. Without insurance, you would be responsible to pay for any damages and medical costs associated with the accident. With appropriate coverage, you will not have to worry about this. It can be expensive to insure your car, depending on the experience of the driver, the make of the car, and whether you have previous claims. But there are many companies offering different prices. Make sure to look for top car insurance providers and request a quote, so you know how much to pay. Doing this will help you to compare insurance companies and save money in the process.

Keep Up With Maintenance Checks

Every vehicle requires an appropriate inspection by a professional mechanic. During this session, the professional will look at specific things within the vehicle that may jeopardize the safety of the car. This is a vital check as vehicle malfunctions can lead to fatal accidents, even if you are a defensive driver.

Have Additional Breakdown Coverage

Insurance coverage is not always about car accidents, as vehicles can break down unexpectedly. Not all insurance covers additional breakdown coverage, although this can give you peace of mind. You should most definitely talk to insurance providers about breakdown coverage. This will increase the costs, which is why many people do not usually add it, but there is nothing worse than breaking down in the middle of the road without having professionals coming to the rescue.

If you are a driver, there are a few things you will always need to keep in mind. Make sure to follow the important steps discussed here before hitting the road as they will help you stay safe and give you peace of mind so you can enjoy your time on the road.

Also Interesting

Mortgage Mayhem: How Rising Interest Rates Are Squeezing Alberta Homeowners

As interest rates continue to climb, Alberta homeowners are facing a financial reckoning. With approximately 1.2 million Canadians set to renew their mortgages in 2025, many of whom secured loans during periods of historically low interest rates, a significant number are anticipating higher payments upon renewal. This financial strain is poised to impact households across the province, leading to tough financial choices and lifestyle adjustments.

The real estate market in Alberta has long been a beacon of affordability compared to cities like Toronto and Vancouver. However, with rising interest rates, even this relative advantage is beginning to erode. Homeowners who took on variable-rate mortgages or secured loans during historically low-interest periods are now feeling the squeeze. Many face mortgage payments that could increase by hundreds, if not thousands, of dollars each month.

Tough Choices: Cutting Back on Essentials and Luxuries

With nearly 60 percent of mortgage holders in the province expecting higher payments upon renewal in 2025, financial strain is set to hit households hard. According to recent reports, 35 percent of homeowners anticipate a slight increase, while 25 per cent brace for a significant hike. For many, this means tough financial choices and lifestyle adjustments.

Among those expecting a rise in mortgage payments, a significant portion anticipates financial pressure on their household. In response, Albertans are slashing discretionary spending, with many cutting back on non-essentials. Travel budgets are taking a hit, with some reducing or eliminating trips altogether. Even more concerning, others say they will have to trim spending on essentials like groceries and gas to stay afloat.

The strain extends beyond just the affected homeowners. Local businesses, especially those in retail, hospitality, and tourism, are likely to feel the ripple effects. When a significant portion of the population pulls back on spending, economic activity slows, and small businesses may struggle to stay profitable.

Financial advisors suggest that those facing increased mortgage payments should revisit their household budgets, explore refinancing options, and consult with their lenders to see if adjustments can be made.

The Alberta Economic Factor: Boom, Bust, and Mortgage Stress

Unlike other regions in Canada, Alberta’s economy remains tightly linked to the oil and gas sector, leading to greater volatility in household incomes. While wages can be high, employment remains unpredictable, making financial resilience more difficult to maintain. This economic unpredictability has always been a challenge for residents. When the oil industry booms, wages surge, employment rates rise, and homeownership becomes more accessible.

But during downturns, layoffs become common, and homeowners can find themselves struggling to keep up with payments. This cycle makes high mortgage payments especially daunting for Albertans, many of whom may not have significant emergency savings to weather financial storms.

In cases where savings run out, some homeowners may need alternative financial solutions, such as a line of credit from Fora Credit, to cover emergency expenses and avoid missing payments.

A Housing Shift: Downsizing and Relocating

For those struggling to manage higher mortgage payments, some are considering drastic moves. Downsizing or relocating to more affordable areas has become a viable option for many Albertans. Homeowners are exploring opportunities to reduce monthly carrying costs, whether by moving to smaller homes or shifting to regions with lower real estate prices.

There is also a growing interest in multi-generational living arrangements. Families are pooling resources to purchase homes together, enabling them to split mortgage costs and share living expenses. While this approach has been common in other parts of the world, it is becoming an increasingly attractive solution in Alberta as mortgage affordability diminishes.

What’s Next for Alberta’s Housing Market?

As the Bank of Canada continues to grapple with inflation, interest rates may remain elevated for the foreseeable future. This could further strain homeowners and cool Alberta’s once-hot housing market. Higher mortgage rates make it more difficult for new buyers to enter the market, leading to decreased demand and potentially stabilizing or reducing home prices in some areas.

Experts suggest that while home values may soften slightly, a full market crash is unlikely. Alberta’s relatively low housing costs compared to major metropolitan areas in Canada provide some buffer against drastic devaluations.

Still, for those facing renewal in 2025, preparation is key. Financial advisors recommend stress-testing mortgage payments, meaning homeowners should calculate potential increases and adjust their budgets accordingly.

How to Prepare for Rising Mortgage Costs

Homeowners who anticipate higher payments should take action now rather than waiting until their renewal date arrives. Some strategies to consider include:

● Refinancing: If possible, homeowners should explore refinancing options that might offer lower rates or extended amortization periods to reduce monthly payments.

● Cutting Expenses: Budget adjustments, such as reducing discretionary spending and optimizing essential costs, can help cushion the impact of higher mortgage payments.

● Increasing Income: Seeking additional income sources, whether through side gigs, renting out portions of their home, or negotiating for a salary increase, can help mitigate financial strain.

● Seeking Professional Advice: Consulting with mortgage brokers, financial advisors, and lenders can provide tailored solutions for those struggling to meet their new financial obligations.

For Albertans facing mortgage renewal in 2025, now is the time to assess financial options, seek expert advice, and prepare for a potentially rocky road ahead. While the challenge is significant, proactive planning and smart financial decisions can help homeowners navigate this difficult period and maintain stability despite rising interest rates.

Also Interesting

Exploring Wildrobin Technological Advancements in Live Dealer Games

In the rapidly evolving world of online gaming, Wildrobin casino stands out for its innovative approach to live dealer games, setting new standards in user experience and technological advancements. Wildrobin continues to refine these features for a truly immersive setting.

Live dealer games have become a cornerstone of the online casino industry, offering players an immersive experience that closely mirrors the excitement of a physical casino. This format combines the convenience of online gaming with the authenticity of real-time interaction, facilitated by professional dealers and high-definition streaming technology.

The Rise of Live Dealer Games

The evolution of live dealer games has been marked by significant technological milestones. From basic single-camera setups to sophisticated multi-angle broadcasting systems, the industry has witnessed remarkable growth.

Modern platforms now utilize advanced OCR (Optical Character Recognition) technology to instantly digitize physical card movements and game outcomes, ensuring complete transparency and real-time data transmission to players worldwide. Wildrobin fully embraces these technologies to enhance player trust.

Technological Innovations at This Casino

Wildrobin casino has been at the forefront of integrating cutting-edge technology into its live dealer offerings. By leveraging advancements in extended reality and real-time data processing, the casino enhances the gaming experience, providing players with seamless and interactive gameplay. These innovations improve visual and audio quality and ensure a more engaging and realistic environment for users. Moreover, Wildrobin pursues continuous experimentation with cutting-edge solutions to stay ahead of industry trends.

The integration of sophisticated bandwidth optimization techniques and adaptive streaming technologies ensures uninterrupted gameplay across various devices and network conditions. This technical infrastructure allows for seamless scaling of concurrent users while maintaining high-quality video streams and minimal latency, crucial factors in delivering an authentic casino experience to players regardless of their location.

Enhancing User Experience

The focus on user experience is evident in Wildrobin casino’s commitment to continuous improvement. The implementation of advanced algorithms and AI-driven analytics allows for personalized gaming experiences, catering to individual player preferences and behaviors. This approach increases player satisfaction and fosters a loyal customer base.

Advanced chat systems and interactive features create a social atmosphere where players can interact with dealers and fellow participants in real-time. The implementation of customizable user interfaces allows players to adjust their viewing angles, table statistics, and betting options according to their preferences. These personalization options, combined with intuitive navigation and seamless payment processing, contribute to a more engaging and user-friendly gaming environment.

The Future of Live Dealer Games

As technology continues to evolve, Wildrobin casino is poised to lead the way in the next generation of live dealer games. With ongoing research and development, the casino aims to integrate even more sophisticated technologies, such as virtual reality and augmented reality, to further blur the lines between virtual and physical gaming environments.

This commitment to innovation ensures that Wildrobin casino remains a key player in the online gaming industry. Wildrobin is also dedicated to implementing breakthroughs that will shape the future of immersive casino entertainment.

-

Business2 days ago

Business2 days agoStocks soar after Trump suspends tariffs

-

COVID-192 days ago

COVID-192 days agoBiden Admin concealed report on earliest COVID cases from 2019

-

Business2 days ago

Business2 days agoScott Bessent Says Trump’s Goal Was Always To Get Trading Partners To Table After Major Pause Announcement

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoResearchers Link China’s Intelligence and Elite Influence Arms to B.C. Government, Liberal Party, and Trudeau-Appointed Senator

-

Business1 day ago

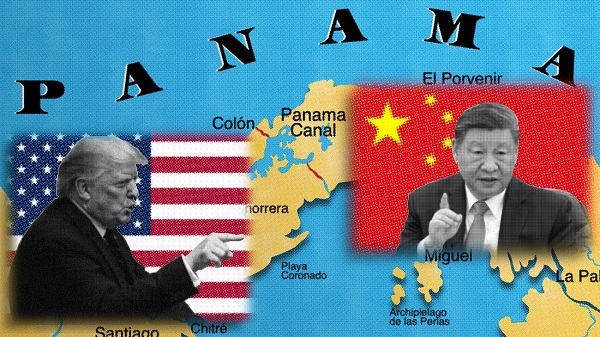

Business1 day agoTimeline: Panama Canal Politics, Policy, and Tensions

-

COVID-191 day ago

COVID-191 day agoFauci, top COVID officials have criminal referral requests filed against them in 7 states

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP memo warns of Chinese interference on Canadian university campuses to affect election

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThe status quo in Canadian politics isn’t sustainable for national unity