Alberta

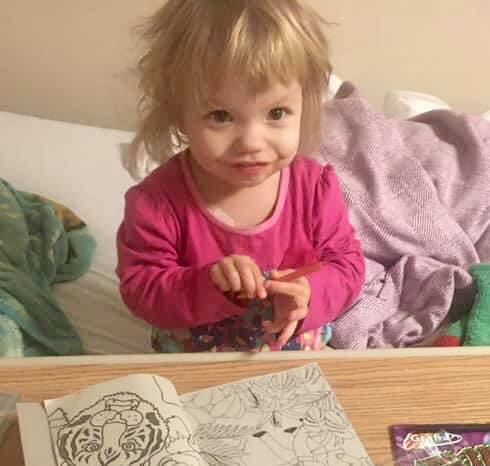

Red Deer family needs a little support as toddler spends 3rd birthday in Children’s Hospital

Article submitted by Roxzane Sisson Armstrong.

From gofundme

Her and Dad spent close to two weeks at the children’s hospital making changes to various medications and when we came home, Codeigh Mae’s hospital schedule was changed to twice a week – once for Albumin and bloodwork and once to get a shot to increase her red blood cell count, which seemed to keep dropping – a common complication of Congenital Nephrotic Syndrome and the secondary conditions it causes, such as blood clots and low iron.

We notice during this time home that Codeigh Mae doesn’t have the same energy levels, she’s puffy and she’s peeing less – even on Albumin days, when we’re used to getting very full wet diapers. After multiple instances of very high blood pressure, it was decided to send her back to the children’s hospital.

She’s now been there for a week and we’re not 100% sure what the going home plan looks like. She even spent her 3rd birthday in the hospital!

Codeigh Mae is really throwing these doctors for a loop. They’ve noticed her bloodwork will be dramatically different based on what time of day it’s taken at or whether it comes from her arm or her port. As soon as they get control of one set of numbers (for example, her sodium), other numbers will go crazy (like her potassium). Her blood pressure has also been hard to manage and on multiple occasions she has had what is called a hypertensive crisis, in which the blood pressure reaches dangerous levels. Her hemoglobin (or red blood cell count) has also been incredibly low – nearing transfusion territory, which we need to avoid for transplant reasons.

Yesterday, Dad met with the surgeon to discuss and get consent for a double nephrectomy. The actual term is Radical Bilateral Nephrectomy – radical meaning the whole kidney (not just a part of it) and bilateral meaning both kidneys.

Yes, you can live with no kidneys!

Essentially, her kidneys, which still function even though she’s on dialysis, are releasing a hormone that tells her blood vessels to constrict – which causes her blood pressure to rise. Remove the kidneys, remove the hormone and cascades that cause funkiness in her other numbers and you almost remove the problem. The dialysis becomes her kidneys entirely and we don’t have to worry about what the actual kidneys are doing and what role they place in the process.

While the surgeon feels comfortable doing the surgery while her hemoglobin is low, the team has ultimately decided to try to boost the hemoglobin as much as we can prior to surgery – which will hopefully negate the need for a transfusion during.

They expect at least another month before we go for the nephrectomy (hence why the title of this update includes May) and are optimistic that Dad and Codeigh Mae will get to come home before we’re admitted again for another undetermined amount of time.

So that’s what we know so far! Be sure to follow Caring for Codeigh Mae on Facebook for more regular updates as they happen:

http://facebook.com/codeigh.mae

Alberta

Premier Smith says Auto Insurance reforms may still result in a publicly owned system

Better, faster, more affordable auto insurance

Alberta’s government is introducing a new auto insurance system that will provide better and faster services to Albertans while reducing auto insurance premiums.

After hearing from more than 16,000 Albertans through an online survey about their priorities for auto insurance policies, Alberta’s government is introducing a new privately delivered, care-focused auto insurance system.

Right now, insurance in the province is not affordable or care focused. Despite high premiums, Albertans injured in collisions do not get the timely medical care and income support they need in a system that is complex to navigate. When fully implemented, Alberta’s new auto insurance system will deliver better and faster care for those involved in collisions, and Albertans will see cost savings up to $400 per year.

“Albertans have been clear they need an auto insurance system that provides better, faster care and is more affordable. When it’s implemented, our new privately delivered, care-centred insurance system will put the focus on Albertans’ recovery, providing more effective support and will deliver lower rates.”

“High auto insurance rates put strain on Albertans. By shifting to a system that offers improved benefits and support, we are providing better and faster care to Albertans, with lower costs.”

Albertans who suffer injuries due to a collision currently wait months for a simple claim to be resolved and can wait years for claims related to more serious and life-changing injuries to addressed. Additionally, the medical and financial benefits they receive often expire before they’re fully recovered.

Under the new system, Albertans who suffer catastrophic injuries will receive treatment and care for the rest of their lives. Those who sustain serious injuries will receive treatment until they are fully recovered. These changes mirror and build upon the Saskatchewan insurance model, where at-fault drivers can be sued for pain and suffering damages if they are convicted of a criminal offence, such as impaired driving or dangerous driving, or conviction of certain offenses under the Traffic Safety Act.

Work on this new auto insurance system will require legislation in the spring of 2025. In order to reconfigure auto insurance policies for 3.4 million Albertans, auto insurance companies need time to create and implement the new system. Alberta’s government expects the new system to be fully implemented by January 2027.

In the interim, starting in January 2025, the good driver rate cap will be adjusted to a 7.5% increase due to high legal costs, increasing vehicle damage repair costs and natural disaster costs. This protects good drivers from significant rate increases while ensuring that auto insurance providers remain financially viable in Alberta.

Albertans have been clear that they still want premiums to be based on risk. Bad drivers will continue to pay higher premiums than good drivers.

By providing significantly enhanced medical, rehabilitation and income support benefits, this system supports Albertans injured in collisions while reducing the impact of litigation costs on the amount that Albertans pay for their insurance.

“Keeping more money in Albertans’ pockets is one of the best ways to address the rising cost of living. This shift to a care-first automobile insurance system will do just that by helping lower premiums for people across the province.”

Quick facts

- Alberta’s government commissioned two auto insurance reports, which showed that legal fees and litigation costs tied to the province’s current system significantly increase premiums.

- A 2023 report by MNP shows

Alberta

Alberta fiscal update: second quarter is outstanding, challenges ahead

Alberta maintains a balanced budget while ensuring pressures from population growth are being addressed.

Alberta faces rising risks, including ongoing resource volatility, geopolitical instability and rising pressures at home. With more than 450,000 people moving to Alberta in the last three years, the province has allocated hundreds of millions of dollars to address these pressures and ensure Albertans continue to be supported. Alberta’s government is determined to make every dollar go further with targeted and responsible spending on the priorities of Albertans.

The province is forecasting a $4.6 billion surplus at the end of 2024-25, up from the $2.9 billion first quarter forecast and $355 million from budget, due mainly to higher revenue from personal income taxes and non-renewable resources.

Given the current significant uncertainty in global geopolitics and energy markets, Alberta’s government must continue to make prudent choices to meet its responsibilities, including ongoing bargaining for thousands of public sector workers, fast-tracking school construction, cutting personal income taxes and ensuring Alberta’s surging population has access to high-quality health care, education and other public services.

“These are challenging times, but I believe Alberta is up to the challenge. By being intentional with every dollar, we can boost our prosperity and quality of life now and in the future.”

Midway through 2024-25, the province has stepped up to boost support to Albertans this fiscal year through key investments, including:

- $716 million to Health for physician compensation incentives and to help Alberta Health Services provide services to a growing and aging population.

- $125 million to address enrollment growth pressures in Alberta schools.

- $847 million for disaster and emergency assistance, including:

- $647 million to fight the Jasper wildfires

- $163 million for the Wildfire Disaster Recovery Program

- $5 million to support the municipality of Jasper (half to help with tourism recovery)

- $12 million to match donations to the Canadian Red Cross

- $20 million for emergency evacuation payments to evacuees in communities impacted by wildfires

- $240 million more for Seniors, Community and Social Services to support social support programs.

Looking forward, the province has adjusted its forecast for the price of oil to US$74 per barrel of West Texas Intermediate. It expects to earn more for its crude oil, with a narrowing of the light-heavy differential around US$14 per barrel, higher demand for heavier crude grades and a growing export capacity through the Trans Mountain pipeline. Despite these changes, Alberta still risks running a deficit in the coming fiscal year should oil prices continue to drop below $70 per barrel.

After a 4.4 per cent surge in the 2024 census year, Alberta’s population growth is expected to slow to 2.5 per cent in 2025, lower than the first quarter forecast of 3.2 per cent growth because of reduced immigration and non-permanent residents targets by the federal government.

Revenue

Revenue for 2024-25 is forecast at $77.9 billion, an increase of $4.4 billion from Budget 2024, including:

- $16.6 billion forecast from personal income taxes, up from $15.6 billion at budget.

- $20.3 billion forecast from non-renewable resource revenue, up from $17.3 billion at budget.

Expense

Expense for 2024-25 is forecast at $73.3 billion, an increase of $143 million from Budget 2024.

Surplus cash

After calculations and adjustments, $2.9 billion in surplus cash is forecast.

- $1.4 billion or half will pay debt coming due.

- The other half, or $1.4 billion, will be put into the Alberta Fund, which can be spent on further debt repayment, deposited into the Alberta Heritage Savings Trust Fund and/or spent on one-time initiatives.

Contingency

Of the $2 billion contingency included in Budget 2024, a preliminary allocation of $1.7 billion is forecast.

Alberta Heritage Savings Trust Fund

The Alberta Heritage Savings Trust Fund grew in the second quarter to a market value of $24.3 billion as of Sept. 30, 2024, up from $23.4 billion at the end of the first quarter.

- The fund earned a 3.7 per cent return from July to September with a net investment income of $616 million, up from the 2.1 per cent return during the first quarter.

Debt

Taxpayer-supported debt is forecast at $84 billion as of March 31, 2025, $3.8 billion less than estimated in the budget because the higher surplus has lowered borrowing requirements.

- Debt servicing costs are forecast at $3.2 billion, down $216 million from budget.

Related information

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoThe Most Devastating Report So Far

-

Business2 days ago

Business2 days agoCarbon tax bureaucracy costs taxpayers $800 million

-

ESG1 day ago

ESG1 day agoCan’t afford Rent? Groceries for your kids? Trudeau says suck it up and pay the tax!

-

John Stossel1 day ago

John Stossel1 day agoGreen Energy Needs Minerals, Yet America Blocks New Mines

-

Daily Caller1 day ago

Daily Caller1 day agoLos Angeles Passes ‘Sanctuary City’ Ordinance In Wake Of Trump’s Deportation Plan

-

Alberta1 day ago

Alberta1 day agoProvince considering new Red Deer River reservoir east of Red Deer

-

MAiD2 days ago

MAiD2 days agoOver 40% of people euthanized in Ontario lived in poorest parts of the province: government data

-

Addictions1 day ago

Addictions1 day agoBC Addictions Expert Questions Ties Between Safer Supply Advocates and For-Profit Companies