News

Around Red Deer March 21st……

2:30 pm – Yesterday, RCMP issued a media release in which three accused’s were identified as being charged with 88 offences. Since that release, Ponoka RCMP have learned that Miles Appenrodt was not involved in the offences whatsoever and is in fact, a victim of identity theft. When arrested, the male – whose name cannot yet be released – produced an Alberta drivers license to police in the name of Miles Appenrodt and held himself out to be that person for the duration of his time in custody. The RCMP deeply regrets this error and apologizes to Mr. Appenrodt for the difficulties this has caused. We are doing all we can to remove any re-posts of the original publication from social media and we are issuing this media release to ensure that its message gets to all forms of media that posted our original statement. The RCMP has now correctly identified the male responsible and a warrant is being sought. The charges will now include personation and possession of identity document, in addition to the original offences.

12:20 pm – After Alberta’s Education school projects announcement this morning, St. Patrick’s Community School is one of seven schools on the list to undergo a modernization. “We are truly grateful for the tireless lobbying from our Senior Administrators and Board Members to the government over the past five years. The announcement of this modernization is wonderful news for all of our students, families and staff. We are excited about the collaborative spaces this will provide our students and teachers, which will enhance their learning environments. We feel very blessed to have been chosen as one of the seven schools in the province to receive this news,” said Principal, Terri Lynn Mundorf at St. Patrick’s Community School. “We are very excited about this announcement. St. Patrick’s Community School has been our number one capital priority for many years as it’s currently at 730 students or 130% capacity. It needs more effective learning spaces for students,” said Board Chair Guy Pelletier at Red Deer Catholic Regional Schools. A specific dollar amount for the modernization is not yet known but Pelletier estimates it could be in the $8-10 million range. He hopes to see the modernization complete within two years.

11:45 am – A retirement has lead to the naming of a new Associate Superintendent for the Red Deer Public School District. Read More.

10:18 am – More Red Deerians can now keep chickens in their yard. Read More.

For more local news, click here!

8:56 am – St. Thomas Aquinas Middle School will host an Exhibition of Learning for parents and the community on March 21 from 1:30 – 2:30 p.m. at the Red Deer College Library. Grade 9 students at St. Thomas Aquinas Middle School have teamed up with the Biology Department and Library at Red Deer College for a Biology/Biodiversity project-based learning experience. Students will demonstrate their knowledge of biological interactions by presenting posters and showcasing puzzle pieces created through project-based-learning. People will have an opportunity to ask students about their projects, their learning experience, and project-based learning in general. Research shows that students feel a greater sense of ownership of their work when they know it will have an audience beyond their teachers.

8:50 am – What do a non-profit greenhouse in Manitoba, a community fruit orchard in Saskatchewan, a farmer’s potluck mixer in Alberta, and an historical farming exhibit in British Columbia have in common? They are examples of community projects funded by the Peavey Mart Community Agricultural Grant. Since 2013, non-profit groups have received more than $180,000 from the grant, which funds ideas that promise to strengthen towns or cities through community agriculture. This year, a $50,000 grant is up for grabs. “We want people to build on their great ideas by getting community support and feedback, and putting those ideas into plans,” say Jest Sidloski, director of customer experience for Peavey Industries. “A good idea for a community initiative won’t succeed unless it has a good plan.” Sidloski says the grant typically does not fund buildings or renovations. “The focus is on operating community agriculture.” The application form is available on the Peavey Mart website, and applications are accepted until May 31.

8:25 am – Father Henri Voisin School will host an Exhibition of Learning for parents and the community on March 22 from 5:30 to 6:45 p.m. The Exhibition of Learning will showcase students’ project-based learning and hard work over the past year. Grade 1-5 students will share their new discoveries through cross-curricular projects by demonstrating their authentic learning experiences at this event based on curriculum and 21st Century competencies. “This event is a testimonial to the authentic and engaging learning experiences that our students experience through Catholic education,” says Rob Coumont, Assistant Principal. “During this evening, students have the opportunity to share with guests the process and journey of their learning through the different projects they created.” All are invited to walk around and engage students in conversation about their innovative projects.

International

UK Supreme Court rules ‘woman’ means biological female

Susan Smith (L) and Marion Calder, directors of ‘For Women Scotland’ cheer as they leave the Supreme Court on April 16, 2025, in London, England after winning their appeal in defense of biological reality

From LifeSiteNews

By Michael Haynes, Snr. Vatican Correspondent

The ruling, in which the court rejected transgender legal status, comes as a victory for campaigners who have urged the recognition of biological reality and common sense in the law.

The U.K. Supreme Court has issued a ruling stating that “woman” in law refers to a biological female, and that transgender “women” are not female in the eyes of the law.

In a unanimous verdict, the Supreme Court of the United Kingdom ruled today that legally transgender “women” are not women, since a woman is legally defined by “biological sex.”

Published April 16, the Supreme Court’s 88-page verdict was handed down on the case of Women Scotland Ltd (Appellant) v. The Scottish Ministers (Respondent). The ruling marks the end of a battle of many years between the Scottish government and women’s right campaigners who sought to oppose the government’s promotion of transgender ideology.

In 2018, the Scottish government issued a decision to allow the definition of “woman” to include men who assume their gender to be female, opening the door to allowing so-called “transgender” individuals to identify as women.

This guidance was challenged by women’s rights campaigners, arguing that a woman should be defined in line with biological sex, and in 2022 the Scottish government was forced to change its definition after the court found that such a move was outside the government’s “legislative competence.”

Given this, the government issued new guidance which sought to cover both aspects: saying that biological women are women, but also that men with a “gender recognition certificate” (GRC) are also considered women. A GRC is given to people who identify as the opposite sex and who have had medical or surgical interventions in an attempt to “reassign” their gender.

Women Scotland Ltd appealed this new guidance. At first it was rejected by inner courts, but upon their taking the matter to the Supreme Court in March last year, the nation’s highest judicial body took up the case.

Today, with the ruling issued against transgender ideology, women’s campaigners are welcoming the news as a win for women’s safety.

“A thing of beauty,” praised Lois McLatchie Miller from the Alliance Defending Freedom legal group.

“They looked at the whole argument, not just who goes in what bathroom and trans women. This is going to change organizations, employers, service providers,” Maya Forstater, chief executive of Sex Matters, told the Telegraph. “Everyone is going to have to pay attention to this, this is from the highest court in the land. It’s saying sex in the Equality Act is biological sex. Self ID is dead.”

“Victory,” commented Charlie Bently-Astor, a prominent campaigner for biological reality against the transgender movement, after she nearly underwent surgical transition herself at a younger age.

“After 15 years of insanity, the U.K. Supreme Court has ruled that men who say they are ‘trans women’ are not women,” wrote leader of the Christian political movement David Kurten.

Leader of the Conservative Party – the opposition to the current Labour government – Kemi Badenoch welcomed the court’s ruling, writing that “saying ‘trans women are women’ was never true in fact and now isn’t true in law, either.”

Others lamented the fact that the debate even was taking place, let alone having gone to the Supreme Court.

“What a parody we live in,” commented Reform Party candidate Joseph Robertson.

Rupert Lowe MP – who has risen to new prominence in recent weeks for his outspoken condemnation of the immigration and rape gang crisis – wrote, “Absolute madness that we’re even debating what a woman is – it’s a biological fact. No amount of woke howling will ever change that.”

However, the Supreme Court did not wish to get pulled into siding with certain arguments, with Lord Hodge of the tribunal stating that “we counsel against reading this judgment as a triumph of one or more groups in our society at the expense of another. It is not.”

The debate has taken center stage in the U.K. in recent years, not least for the role played by the current Labour Prime Minister Keir Starmer. Starmer himself has become notorious throughout the nation for his contradictions and inability to answer the question of what a woman is, having flip-flopped on saying that a woman can have a penis, due to his support for the transgender movement.

At the time of going to press, neither Starmer nor his deputy Angela Rayner issued a statement about the Supreme Court ruling. There has been no statement issued from the Scottish government either, nor from the office of the first minister.

Transgender activists have expectedly condemned the ruling as “a disgusting attack on trans rights.” One leading transgender campaigner individual told Sky News, “I am gutted to see the judgement from the Supreme Court which ends 20 years of understanding that transgender people with a GRC are able to be, for all intents and purposes, legally recognized as our true genders.”

International

Tulsi Gabbard tells Trump she has ‘evidence’ voting machines are ‘vulnerable to hackers’

From LifeSiteNews

By Stephen Kokx

Last month, Trump signed an executive order directing federal election-related funds to be conditioned on states “complying with the integrity measures set forth by Federal law, including the requirement that states use the national mail voter registration form that will now require proof of citizenship.”

Director of National Intelligence Tulsi Gabbard announced during a Cabinet meeting last week at the White House that voting machines across the U.S. are not secure.

“We have evidence of how these electronic voting systems have been vulnerable to hackers for a very long time, and vulnerable to exploitation to manipulate the results of the votes being cast,” she said about a half hour into the meeting.

Gabbard’s remarks confirm what millions of Americans have long suspected about elections across the U.S.

President Donald Trump himself has maintained skepticism of current voting methods and has called for paper ballots to prevent cheating.

MyPillow CEO Mike Lindell was one of only a few voices to publicly argue that voting machines, like those run by Dominion and Smartmatic which were used during the 2020 presidential election, were compromised. GOP Congresswoman Marjorie Taylor-Greene took to X to praise the businessman after Gabbard made her remarks.

“Mike Lindell along with MANY others vindicated!!” she exclaimed on X. “Another conspiracy theory being proven right! Guess what Democrats already knew this and publicly talked about it in 2019! And then lied and lied and lied!!!”

Last month, Trump signed an executive order directing federal election-related funds to be conditioned on states “complying with the integrity measures set forth by Federal law, including the requirement that states use the national mail voter registration form that will now require proof of citizenship.”

Congress has also taken steps to ensure election integrity by voting on the Safeguard American Voter Eligibility Act (also known as the SAVE Act) last week. Dubbed “controversial” by the media and left-wing groups, the common sense bill would require persons to show proof of citizenship before voting. The House approved the measure 220-208 with four Democrats in support. The bill now heads to the Senate where it will face an uphill battle for the required 60 votes. Republicans currently have a 53 seat majority.

Gabbard told Trump at the meeting that the evidence she found “further drives forward your mandate to bring about paper ballots across the country so that voters can have faith in the integrity of our elections.”

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoRCMP Whistleblowers Accuse Members of Mark Carney’s Inner Circle of Security Breaches and Surveillance

-

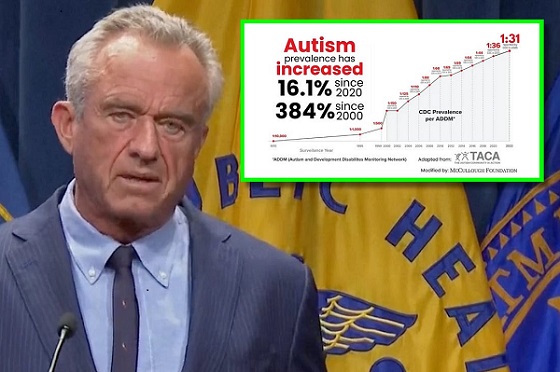

Autism2 days ago

Autism2 days agoAutism Rates Reach Unprecedented Highs: 1 in 12 Boys at Age 4 in California, 1 in 31 Nationally

-

Health2 days ago

Health2 days agoTrump admin directs NIH to study ‘regret and detransition’ after chemical, surgical gender transitioning

-

Autism1 day ago

Autism1 day agoRFK Jr. Exposes a Chilling New Autism Reality

-

Bjorn Lomborg2 days ago

Bjorn Lomborg2 days agoGlobal Warming Policies Hurt the Poor

-

Also Interesting1 day ago

Also Interesting1 day agoBetFury Review: Is It the Best Crypto Casino?

-

2025 Federal Election2 days ago

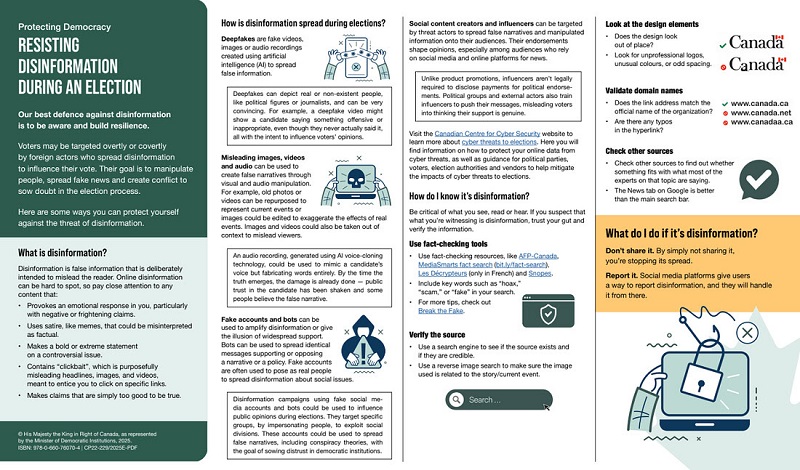

2025 Federal Election2 days agoAI-Driven Election Interference from China, Russia, and Iran Expected, Canadian Security Officials Warn

-

COVID-191 day ago

COVID-191 day agoCanadian student denied religious exemption for COVID jab takes tech school to court