Opinion

Middle Class

The middle class.

This phrase is shrouded in mystery but typically refers to ones occupation, income, education and social status in relation to others.

Depending on the political party using the term, the underlying definition can change.

The Liberal Party has an entire section of it’s 2019 election platform dedicated to the middle class and people working hard to join it.

Unfortunately, the Minister of Middle-Class Prosperity has had difficulties defining the characteristics of the people she was elected to represent.

Excuse me if I’m a little concerned that the middle class might be forgotten as a result.

Making Life More Affordable

Any claims of government giving anything to citizens “tax free” should be met with scrutiny.

All government funding ultimately comes from taxpayers so to suggest that government can give you tax free funds is simply not accurate. Someone is being taxed in order to provide the benefits.

Effective for 2016 tax filings, the Liberal Government lowered the tax rate on income in the 2nd tax bracket by 1.5%. This bracket currently applies to income between $48,535 to $97,069. All other brackets have either remained the same or increased since that time.

For those earning up to the maximum of $97,069, this results in tax savings of $1,456.

In conjunction with the 1.5% tax drop, the Liberal Government removed the Family Tax Cut (FTC). This allowed families with children to notionally transfer income from the spouse with higher annual income to the other spouse.

Depending on your situation, this could result in a tax credit of up to $2,000.

Effective in 2019, the Liberal Government implemented an increase in the Canada Pension Plan annual rates. By 2023, this will result in additional annual employee contributions of $1,107 for those earning above the annual ceiling of $65,700.

The employer portion would increase in proportion, putting further pressure on small business cash flows.

While the Liberal Government may claim that they are “making life more affordable”, the numbers above paint a different picture.

What should the government do?

The Canadian Income Tax Act (ITA) has not seen a major review since the late 1960’s. It is now a patchwork of legislation that is difficult for even seasoned Chartered Professional Accountants to apply into practice.

Complexities within the ITA result in a significant added administrative burdens. Instead of focusing on growing your business, creating jobs or planning for retirement, significant time is lost navigating the ITA.

The government should immediately engage in a full scale review of the ITA. The review must consult the private sector and address all major industries across Canada. The revisions should be made in such a way as to allow for amendments in future as the economy continues to evolve.

Key areas that should be the focus of a review:

-

Simplify: The tax system needs to be fair, efficient and competitive.

-

Modernize: Tax policy needs to be able to keep up with the digital economy.

-

Be Supportive: Changes to Canada Revenue Agency (CRA) policies that will ease compliance for taxpayers.

Simple:

In Alberta, there are now nine personal tax brackets, a patch work of credits and numerous complexities to navigate in complying with regulations relating to owner-operator business.

Serious consideration should be given to shift away from taxing income and toward taxing consumption instead. It is far more beneficial to tax activities that reduce the wealth of society, ie. consumption, rather than tax the creation of wealth.

The simplest way to make the shift to a consumption based tax system would be to increase the rate of federal GST. This would be offset with reductions in personal tax rates. The personal tax rate drops could be implemented in a manner that preserves the progressive tax regime, but with significantly fewer tax brackets.

For those in the lower tax brackets, the majority of their annual income is spent on non-GST’able expenditures such as groceries, rent and health care. Those with higher disposable incomes would contribute more to government revenues as a result. This preserves the progressive tax regime, protects the vulnerable and doesn’t penalize the creation of wealth.

More comprehensive reforms could also be analyzed to determine the best solution for Canadians.

Modernize:

In recent months, there has been a growing call for government to implement a “wealth tax”. The New Democratic Party has suggested that a 1% on families with a net worth in excess of $20 million would generate net tax revenue of $5.6 billion in 2020-21.

As mentioned above, government should not introduce further tax on the creation of wealth. This tax policy will only further drive investment out of the country at a time that we can ill afford it.

Additionally, there have been calls to add an additional layer of tax on big tech companies, most notably Google, Amazon, Facebook and Apple. There is no doubt that these companies have seen record profits in 2020 but haphazardly implementing a 3% tax on the revenues of these companies will likely back fire.

The reason why large corporations are able to take advantage of low tax rates in foreign jurisdictions is due to varied rates across the globe. If one jurisdiction makes the decision to implement a tax increase, naturally, corporations will seek out lower tax jurisdictions.

If government is concerned with tech giants skirting federal taxes, they need to consult with all jurisdictions in which these companies operate. A unilateral tax will simply resulting in these corporations moving profits to lower tax jurisdictions.

Be Supportive:

The Canada Revenue Agency is typically thought of with disdain by many Canadian taxpayers. Some of these feelings are self induced, others are not.

Much like the difficulties that individuals and businesses have in navigating the Income Tax Act (ITA), the same can be said for CRA agents. While the senior agents typically have specific training and field experience, the majority of front line CRA agents simply do not have the necessary training to effectively help taxpayers navigate the complexities of the ITA.

In order for the CRA to provide more supportive service to taxpayers, they too need to see a reform in the ITA. It simply is not fair to ask agents to be able to interpret the ITA and how it applies to each taxpayer they speak with.

Secondly, the CRA needs to revise audit training procedures for their agents that considers materiality of each case. Far too often I see audit cases that request significant amounts of supporting documentation in response to a taxpayers nominal expense claim. Some of these being less than $100.

This places a significant administrative burden on taxpayers, specifically small business owners. It also leads to a great deal of frustration, which further damages the relationship between this government agency and the general public.

Final Thoughts

Canada’s middle class has fallen on difficult times in recent years. This has only been exasperated by the impacts of COVID-19.

For far too long, Canada has lost investment and stymied growth due to its archaic tax regime.

The Liberal government has promised to “build back better” and create an economy that is just and equitable for all. Details of these plans remain to be seen.

Instead of grandiose plans stemming from pie-in-the-sky slogans, the government should immediately look to reform the tax system.

Focusing on simplicity, modernization and reducing administrative burden will give taxpayers the confidence to know that their hard work will translate into consistent after-tax earnings.

It’s time to unleash the power of the Canadian worker, supported by a competitive and modern tax regime. Future generations depend on it.

https://www.jaredpilon.com/

Alberta

Alberta’s fiscal update projects budget surplus, but fiscal fortunes could quickly turn

From the Fraser Institute

By Tegan Hill

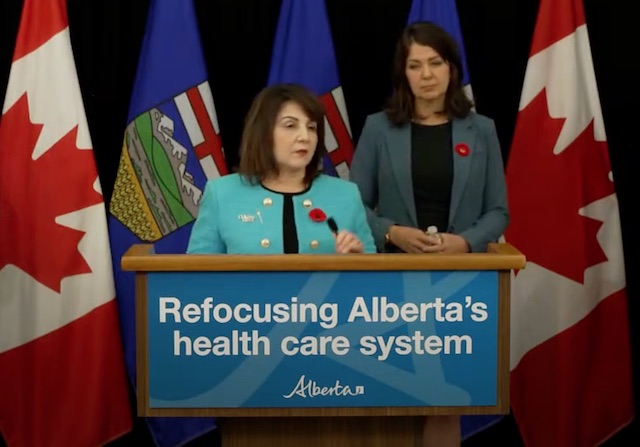

According to the recent mid-year update tabled Thursday, the Smith government projects a $4.6 billion surplus in 2024/25, up from the $2.9 billion surplus projected just a few months ago. Despite the good news, Premier Smith must reduce spending to avoid budget deficits.

The fiscal update projects resource revenue of $20.3 billion in 2024/25. Today’s relatively high—but very volatile—resource revenue (including oil and gas royalties) is helping finance today’s spending and maintain a balanced budget. But it will not last forever.

For perspective, in just the last decade the Alberta government’s annual resource revenue has been as low as $2.8 billion (2015/16) and as high as $25.2 billion (2022/23).

And while the resource revenue rollercoaster is currently in Alberta’s favor, Finance Minister Nate Horner acknowledges that “risks are on the rise” as oil prices have dropped considerably and forecasters are projecting downward pressure on prices—all of which impacts resource revenue.

In fact, the government’s own estimates show a $1 change in oil prices results in an estimated $630 million revenue swing. So while the Smith government plans to maintain a surplus in 2024/25, a small change in oil prices could quickly plunge Alberta back into deficit. Premier Smith has warned that her government may fall into a budget deficit this fiscal year.

This should come as no surprise. Alberta’s been on the resource revenue rollercoaster for decades. Successive governments have increased spending during the good times of high resource revenue, but failed to rein in spending when resource revenues fell.

Previous research has shown that, in Alberta, a $1 increase in resource revenue is associated with an estimated 56-cent increase in program spending the following fiscal year (on a per-person, inflation-adjusted basis). However, a decline in resource revenue is not similarly associated with a reduction in program spending. This pattern has led to historically high levels of government spending—and budget deficits—even in more recent years.

Consider this: If this fiscal year the Smith government received an average level of resource revenue (based on levels over the last 10 years), it would receive approximately $13,000 per Albertan. Yet the government plans to spend nearly $15,000 per Albertan this fiscal year (after adjusting for inflation). That’s a huge gap of roughly $2,000—and it means the government is continuing to take big risks with the provincial budget.

Of course, if the government falls back into deficit there are implications for everyday Albertans.

When the government runs a deficit, it accumulates debt, which Albertans must pay to service. In 2024/25, the government’s debt interest payments will cost each Albertan nearly $650. That’s largely because, despite running surpluses over the last few years, Albertans are still paying for debt accumulated during the most recent string of deficits from 2008/09 to 2020/21 (excluding 2014/15), which only ended when the government enjoyed an unexpected windfall in resource revenue in 2021/22.

According to Thursday’s mid-year fiscal update, Alberta’s finances continue to be at risk. To avoid deficits, the Smith government should meaningfully reduce spending so that it’s aligned with more reliable, stable levels of revenue.

Author:

Censorship Industrial Complex

Congressional investigation into authors of ‘Disinformation Dozen’ intensifies

From LifeSiteNews

By Dr. Michael Nevradakis of The Defender

The Center for Countering Digital Hate, authors of ‘The Disinformation Dozen,’ faces a Nov. 21 deadline to provide Congress with documents related to its alleged collusion with the Biden administration and social media platforms to censor online users.

The Center for Countering Digital Hate (CCDH), authors of the “Disinformation Dozen,” faces a Nov. 21 deadline to provide Congress with documents related to its alleged collusion with the Biden administration and social media platforms to censor online users.

Rep. Jim Jordan (R-Ohio), chairman of the House Judiciary Committee, on Nov. 7 subpoenaed CCDH as part of an ongoing congressional investigation, launched in August 2023, into the nonprofit’s censorship-related activities.

The subpoena requests all communications and documents “between or among CCDH, the Executive Branch, or third parties, including social media companies, relating to the identification of groups, accounts, channels, or posts for moderation, deletion, suppression, restriction, or reduced circulation.”

The subpoena also requests all records, notes, and other “documents of interactions between or among CCDH and the Executive Branch referring or relating to ‘killing’ or taking adverse action against Elon Musk’s X social media platform (formerly Twitter).”

CCDH previously included Kennedy on its “Disinformation Dozen” list, published in March 2021, of the 12 “leading online anti-vaxxers.”

Leaked CCDH documents released last month by investigative journalists Paul D. Thacker and Matt Taibbi revealed that CCDH sought to “kill” Twitter and launch “black ops” against Robert F. Kennedy Jr., President-elect Donald J. Trump’s nominee for secretary of the U.S. Department of Health and Human Services (HHS).

CCDH included Kennedy, founder of Children’s Health Defense (CHD), on its list of “The Disinformation Dozen” when he was still chairman of CHD.

“Black ops” are defined as a “secret mission or campaign carried out by a military, governmental or other organization, typically one in which the organization conceals or denies its involvement.”

A subsequent report by Taibbi and Thacker showed that CCDH employed tactics it initially developed to help U.K. Prime Minister Keir Starmer and the U.S. Democratic Party, to target Musk, Kennedy and others.

CCDH used ‘explicit military terminology’ to target speech

Thacker told The Defender the leaked documents “definitely spurred” Jordan’s subpoena.

Sayer Ji, the founder of GreenMedInfo, was also listed among “The Disinformation Dozen.” He said the leaked documents were “chilling” and that CCDH’s efforts were part of “the largest coordinated foreign influence operation targeting American speech since 1776.”

Ji told The Defender:

The leaked documents confirm what we experienced firsthand: CCDH wasn’t just targeting 12 individuals – we were test cases for deploying military-grade psychological operations against civilians at scale.

Just as the British Crown once used seditious libel laws to silence colonial dissent, CCDH’s operation expanded to silence hundreds of millions globally, from doctors sharing clinical observations to parents discussing vaccine injuries.

Ohio physician Dr. Sherri Tenpenny, also on “The Disinformation Dozen” list, told The Defender, “The exposure of the manipulation that went on behind the scenes to silence us is what we suspected, and now we know … We have the sad last laugh against their attacks. They are the ones with blood on their hands.”

Ji said CCDH’s internal communications reveal not just bias, “but explicit military terminology – ‘black ops,’ ‘target acquisition,’ ‘strategic deployment’ – coordinated between Five Eyes networks and dark money interests to target constitutionally protected speech.”

Writing on GreenMedInfo, Ji said, “CCDH’s ‘black ops’ approach includes coordinated media smears, economic isolation, and digital censorship.” Ji said CCDH’s activities represent “a new level of institutionalized power directed at civilian targets, often bypassing constitutional safeguards.”

Thacker said Jordan’s investigation should expand to include CCDH’s “black ops.”

“I don’t want to speculate on what CCDH was doing with ‘black ops’ against Kennedy,” Thacker said. “I think that should be explored by a congressional committee, with CCDH CEO Imran Ahmed put under oath,” Thacker said.

CCDH facing multiple lawsuits, possible Trump administration investigation

Jordan’s subpoena is the latest in a series of legal challenges for CCDH. According to GreenMedInfo, the organization faces several lawsuits and government investigations.

Following last month’s CCDH document leak, the Trump campaign said an investigation into CCDH “will be at the top of the list.”

The campaign also filed a complaint against the Harris campaign with the Federal Election Commission, “for making and accepting illegal foreign national contributions” – namely, from the U.K. Labour Party.

This followed the release of evidence indicating that the Biden administration coordinated with the U.K. Foreign Office as part of what GreenMedInfo described “as a systematic censorship regime involving CCDH and affiliated organizations.”

A lawsuit Musk filed against CCDH in July 2023 for allegedly illegally obtaining data and using it in a “scare campaign” to deter advertisers from X will likely proceed on appeal. A federal court initially dismissed the lawsuit in March.

Discovery in the Missouri v. Biden free speech lawsuit may also “shed further light and legal scrutiny on the critical role that CCDH played in allegedly suppressing and violating the civil liberties of U.S. citizens,” according to GreenMedInfo.

CCDH, others flee X in protest

Earlier this week, CCDH deleted its account on X, the platform it wanted to “kill.”

Writing on Substack, Ji said CCDH’s departure from X, during the same week Trump nominated Kennedy to lead HHS, represents a “seismic shift” and marks “a watershed moment, signaling the unraveling of entrenched systems of control and the rise of a new era for health freedom and open discourse.”

Several other left-leaning organizations and individuals, including The Guardian and journalist Don Lemon, also said they will stop using X, after Trump tapped Musk to lead a federal agency tasked with increasing government efficiency.

According to NBC News, many ordinary users are also fleeing X, citing “bots, partisan advertisements and harassment, which they all felt reached a tipping point when Donald Trump was elected president last week with Musk’s support.”

But according to Adweek, X’s former top advertisers, including Comcast, IBM, Disney, Warner Bros. Discovery and Lionsgate Entertainment, resumed ad spending on the platform this year, but at “much lower rates” than before.

“Elon Musk’s ties with Donald Trump might spur some advertisers to think spending on X is good for business,” Adweek reported.

Thacker said CCDH’s deletion of its X account was “aligned” with the departure of “other organizations and ‘journalists’ aligned with the Democratic Party.” He said it appears to have been a “coordinated protest.”

Ji said organizations like CCDH view X “as an existential threat.” He added:

Having experienced both Twitter 1.0’s AI-driven censorship system and X’s more open environment, I understand exactly why CCDH sees X as an existential threat. X represents what Twitter 1.0’s embedded censorship infrastructure was designed to prevent: a truly free digital public square.

Under Musk’s commitment to free speech, their tactical advantage disappeared. They’re not leaving because X is toxic. They’re leaving because they can’t control it.

Online censorship ‘may no longer be sustainable under intensified scrutiny’

According to GreenMedInfo, CCDH’s departure from X “appears to reflect an internal recognition that their operational model – characterized by critics as a US-U.K. intelligence ‘cut-out’ facilitating unconstitutional suppression of civil liberties – may no longer be sustainable under intensified scrutiny.”

In recent months, several mainstream media outlets have corrected stories that relied upon CCDH reports claiming “The Disinformation Dozen” was responsible for up to two-thirds of vaccine-related “misinformation” online.

According to Thacker, this reflects an increasing awareness by such outlets that readers are turning their backs on such reporting.

“The outlets that promoted CCDH propaganda are being investigated by their own readers, who are fleeing in droves. Readers are voting against this type of propaganda by refusing to subscribe to these media outlets,” Thacker said.

Yet, “many outlets continue to host these demonstrably false narratives without correction,” Ji said.

According to Ji, these false narratives resulted in medical professionals fearing the loss of their licenses for expressing non-establishment views, self-censorship among scientists “to avoid career destruction,” suppression of “critical public health discussions” and the labeling of millions of posts as “misinformation.”

“This isn’t just about suppressing speech. It’s about establishing a new form of digital control that echoes the colonial-era suppression our founders fought against,” Ji said.

“CCDH has polluted political discourse by pretending there is some absolute definition of the term ‘misinformation’ and that they hold the dictionary,” Thacker said. “That’s nonsense. They spread hate and misinformation to attack perceived political enemies of the Democratic Party.”

Ji called upon Congress to investigate “The full scope of those silenced beyond the ‘Disinformation Dozen,’” the “systematic suppression of scientific debate,” “media organizations’ role in amplifying foreign influence operations” and “dark money funding networks” supporting such organizations.

Thacker said Congress should examine possible CCDH violations of the Foreign Agents Registration Act. “We need to also look at how much foreign money they took in and whether we as a nation are comfortable with foreign influence trying to alter the law and political discussions.”

“The fight isn’t just about correcting past wrongs or personal vindication. It’s about preserving fundamental rights to free speech and scientific inquiry in the digital age,” Ji said. “If we don’t address this systematic abuse of power, we risk surrendering the very freedoms our founders fought to establish.”

This article was originally published by The Defender – Children’s Health Defense’s News & Views Website. Please consider subscribing to The Defender or donating to Children’s Health Defense.

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoThe Most Devastating Report So Far

-

Business2 days ago

Business2 days agoCarbon tax bureaucracy costs taxpayers $800 million

-

ESG2 days ago

ESG2 days agoCan’t afford Rent? Groceries for your kids? Trudeau says suck it up and pay the tax!

-

John Stossel2 days ago

John Stossel2 days agoGreen Energy Needs Minerals, Yet America Blocks New Mines

-

Daily Caller2 days ago

Daily Caller2 days agoLos Angeles Passes ‘Sanctuary City’ Ordinance In Wake Of Trump’s Deportation Plan

-

Alberta2 days ago

Alberta2 days agoProvince considering new Red Deer River reservoir east of Red Deer

-

Addictions1 day ago

Addictions1 day agoBC Addictions Expert Questions Ties Between Safer Supply Advocates and For-Profit Companies

-

Aristotle Foundation1 day ago

Aristotle Foundation1 day agoToronto cancels history, again: The irony and injustice of renaming Yonge-Dundas Square to Sankofa Square