News

Take A Photo Tour Of Red Deer’s Newest Fire Station!

Written by Sheldon Spackman

Photos by Lindsay Wiebe

Numerous dignitaries were on hand for the official ribbon-cutting ceremony to open Red Deer’s newest fire hall on Monday. Mayor Tara Veer, City Manager Craig Curtis and members of City Council among others were on hand to get an inside tour of Fire Station # 4 in the Timberlands neighbourhood.

The facility which cost over $7 Million dollars and largely funded by the province, was completed on time and under budget. City officials say significant cost-savings were achieved by using a design made to suit two new stations, #3 and #4, with only slight variations between the two. The difference being a training tower at the Timberlands station that isn’t at the new Fire Station # 3 by the Collicut Centre.

Officials say Fire Station # 4’s multi-use areas incorporate training areas in the stairwell, apparatus bay and in multiple places on the roof. These training areas will allow firefighters to practice high angle rescues, repel drills, standpipe operations and firefighter survival evolutions. Fire Chief Brian Makey says the facility was largely designed with input from their staff, utilizing the best concepts and ideas that came from those consultations. He says “There’s training components for high-angle rescue and confined spaces that are built right into the structure.” Makey adds that it’s a pre-fab building made of pre-cast concrete, which allowed for the building to go up quickly and get done sooner. He points out this resulted in the project coming in under budget, saving the City money for future Capital projects. Makey says the location of the building will also ensure they can meet provincial regulations for response times of ten minutes or less. He says “This hall allows for the development in this area to go and as you can see just around the building, all the schools, the commercial buildings, the residential, that was because this hall’s here.”

Mayor Tara Veer says “This facility is absolutely essential for the safety of Red Deerians, not only for existing population in the northeast of the community but for future population as well. It is imperative that we meet our service level standards, so that when people in the northeast call 911, there is a fire truck or an ambulance available to respond to that call.” Veer adds, “Red Deer Emergency Servicse continues to be a model that other communities across the country aspire to, because we integrate our fire and ambulance service. Not only is it efficient from an operations perspective and a financial perspective but ultimately, it fulfills the objective of providing advanced life support and timely response to Red Deerians when they have to make that 911 call.”

Fire Station # 4 in the Timberlands has been in operation since January 17th, 2017 and currently requires an average of six staff at a time. However, it can accommodate up to 10 in preparation for long-term growth. An Open House is anticipated later this year.

Daily Caller

Bari Weiss Reportedly Planning To Blow Up Legacy Media Giant

From the Daily Caller News Foundation

CBS News editor-in-chief Bari Weiss is reportedly planning to dramatically change the network’s coverage to eliminate left-wing bias and make the newsroom more efficient.

Weiss has been handed a mandate for change by Paramount SkyDance’s David Ellison, the CEO of CBS News’ parent company, which bought her company, The Free Press, for $150 million, according to The Wall Street Journal (WSJ). Ellison wants Weiss to bring “news that reflects reality” and journalism that “doesn’t seek to demonize, but seeks to understand.”

“I wanna blow things up,” Weiss has reportedly told her colleagues during meetings.

During the hiring process, Weiss has reached out to outside talent directly rather than speaking to their agents, which is considered the traditional method of communication, according to the WSJ. She has also reportedly been highly involved in booking guests in an attempt to fix the network’s ratings and make a lasting change.

Weiss is focused on trying to reshape “CBS Evening News,” which has consistently ranked third place in comparison to the evening programs on ABC News and NBC News. “CBS Evening News” typically averages around 4 million total viewers. On the week of November 3, the program garnered 4.2 million total viewers and 564,000 viewers in the 25 to 54 key demographic, while “NBC Nightly News” and “ABC World News Tonight” averaged 7.2 million and 6.6 million total viewers, as well as 929,000 and 883,000 in the 25-54 demo, according to AdWeek.

John Dickerson, who currently hosts “CBS Evening News,” announced on Oct. 27 that he will be departing the network in January. Weiss has reportedly considered poaching CNN’s Anderson Cooper and Fox News’ Bret Baier, though Baier said he will remain at Fox News in the short-term since his contract goes through the end of 2028, according to the WSJ.

A source close to Cooper told the WSJ that the CNN host is not interested in hosting “CBS Evening News.”

“CBS Mornings” host Gayle King’s contract is up in early 2026, prompting Weiss to reportedly consider finding a cheaper alternative to her $15 million salary, according to WSJ.

The median age of viewers who watch CBS News is 58 years old, according to a Pew Research survey.

When she stepped into her role, Weiss sent emails to staff asking them to outline their jobs and provide feedback on “how we can make CBS News the most trusted news organization in America and the world.” Weiss said she would have had to “throw in the towel a very, very long time ago” if she were concerned about the negative press her decisions will receive.

Approximately 100 staffers were laid off once Weiss took over in October, which were part of Paramount’s layoffs of about 1,000 employees. The CBS News Race and Culture Unit, founded in July 2020, was completely wiped out as part of the layoffs.

Media

Breaking News: the public actually expects journalists to determine the truth of statements they report

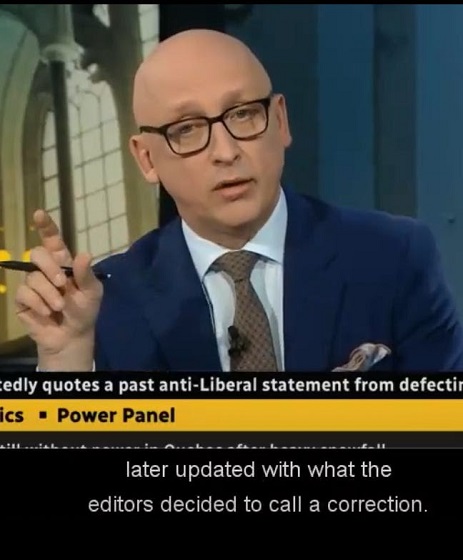

CBC’s David Cochrane explaining to viewers how the CBC is blameless for accurately reporting a statement later determined to be false

Who knew? Plus! Online smartassery by reporters continues to curse the industry, Vancouver loves Harry Potter (shhhh!), layoffs continue and newspaper revenue now in uncontrolled descent

Journalists just love sensational political accusations and way too many of them are more than happy to spread them far and wide while shrugging aside their first obligation, the truth.

Why they put so much faith in the honesty of politicians, who have a history of being a bit, shall we say, truthy, is quite beyond me, but reporters often seem more interested in it being true something salacious was said than they are whether the scandalous thing that was said is true.

To help save journalism from bad journalism please subscribe to The Rewrite.

A fine example of this behaviour, which continues to undermine public trust in journalism, unfolded a week ago. That was when freshly-minted Liberal MP and Tory turncoat Chris d’Entremont told the CBC’s Catherine Cullen that, after publicly musing about crossing the floor, “Conservative House leader Andrew Scheer and party whip Chris Warkentin “barged” into his office, pushed open the door — almost knocking down his assistant — and yelled at him about “how much of a snake” he was.”

The Conservatives, in response, issued a statement accusing d’Entremont of telling barefaced lies and described a much calmer scenario. CBC then issued a correction after d’Entremont “clarified” an embellishment but some journalists were happy to ignore that and stick with repeating the original, more salacious version.

Stu Benson of The Hill Times enthusiastically Tweeted that ““[D’Entremont] says Conservative House leader Andrew Scheer and party whip Chris Warkentin ‘barged’ into his office, pushed his assistant aside and yelled at him about ‘how much of a snake’ he was.”

National Newswatch, despite CBC’s correction still had a Tweet up days later stating “Pushing, yelling from Conservative leadership ‘sealed the deal’ on defection: d’Entremont. MP says Conservatives felt like ‘part of a frat house rather than a serious political party.”

Ignoring the correction and “clarification,” CBC’s Power & Politics used the clip of d’Entremont’s self-confessed embellishment and repeated what both he and the CBC knew not to be true. To be fair, the segment that can be found here fully details the Conservatives’ response but, according to one of the CBC’s most diligent critics, no on air correction has been made. Instead, host David Cochrane went out of his way to point out that while his editors had used the term “correction,” the CBC was blameless for reporting d’Entremont’s admittedly false representation of the event.

The pattern of behaviour indicates to the public that news organizations do not take their obligation to the truth seriously. The public actually expects journalists to seek to establish the truth of statements they are reporting before they report them.

Edmonton City News reporter Sean Amato meanwhile managed to take foolish online smartassery to a new level when, repeating the Liberals’ Trump = Tories theme, he posted:

“Quite the press conference from (Conservative Leader) Pierre Poilievre in Calgary today. Basically…the Liberals suck, the media sucks and a lot of other stuff in Canada sucks. Hey, it worked for Trump.”

Tens of thousands of views and (at time of writing) more than 500 comments later, he replied with renewed smug smartassery:

“Never thought a tweet that says “the Liberals suck, the media sucks” would anger so many Conservatives. But here we are  .”

.”

Here we are, indeed. Amato appears to have set a new personal best for comments in response to one of his Tweets while simultaneously embedding the impression that not only he but all journalists are biased against Conservatives. And, I ask, for what? And why?

Maybe think before you Tweet or, better yet, just shut up. Many good journalists find that works just fine.

Amato, though, seems determined to prioritize personal commentary over journalism. When he recently got some pushback on lack of objectivity, his response was unrepentant.

“Bonnie…mute me, follow people you like, no hard feelings. But let me be free too. Cheers!”

Liberation awaits.

The “controversial” Harry Potter Forbidden Forest experience opened 10 days ago in Vancouver, weeks after the parks board, cowed by trans activists, vowed such an event would never happen again.

The distress of the “Qmunity” over the connection to J.K. Rowling and her vocal insistence on a traditional definition of women was well documented in the weeks leading up to the event. But there was nary a peep from CTV, CBC or Global News when organizers announced on media day that the pre-sales were the largest they had experienced anywhere in the world.

I found coverage in The Daily Hive and in Black Press papers in British Columbia. But it wasn’t until Remembrance Day that one of the city’s legacy media, the Vancouver Sun, delivered a review of any kind. CBC, CTV and Global News appear to be boycotting.

To help save journalism from bad journalism please subscribe to The Rewrite.

Operating revenue for Canada’s publishers continues to plummet – an indication the nation’s newspapers are increasingly unable to deliver the readers needed to provide results to advertisers.

Statscan reported a decline of a whopping 17.9 per cent since 2022, which compares with a drop of 7.3 percent from 2020-2022.

News Media Canada lobbyist Paul Deegan, meanwhile, confessed to a House of Commons committee that operators “cannot make a buck as a digital-only publisher,” have failed to transition their business models and still need revenue from print.

Profit margins, according to Statscan, are down to 3.2 per cent.

Postmedia, meanwhile, is later than usual in posting its annual report but has a little under another two weeks to do so.

Last week, The Rewrite noted how an extra $150 million from the government for the CBC would be bad news for everyone else in the business. This week, Groupe TVA announced it was eliminating 87 positions and laid the blame squarely at Prime Minister Mark Carney’s door.

“Repeated appeals to government authorities to support the private television industry, at a time when it faces fierce competition from the web giants and CBC/Radio-Canada, have been ignored,” a company statement explained.

Poilievre, who has been the focus lately of much of the press inclined to favour the Liberals, tried to shame media into paying some attention to dissent from the likes of Beaches-East York MP Nate Erskine-Smith within Liberal ranks.

It was left to the Toronto Star’s Althia Raj to gently explain to his Deputy Leader, Melissa Lantsman, why dissent within Liberal ranks is not a story because, unlike dissent with Conservative ranks, it’s in the best interests of the country.

“Nate has normalized independent thought so it isn’t new/s,” she wrote. “IMO it would be nice to see this from other MPs. Those outside of cabinet, their job is to hold the govt to account. More independent thought means better reports, better debate, better policy. Better social cohesion too.”

Take that, you silly Tories!  The narrative is entrenched.

The narrative is entrenched.

Some of you will remember how last fall, CTV News terminated two employees following the doctoring of Poilievre’s quotes in a fashion not too dissimilar to that used by the producers of a Panorama documentary at the BBC. Two of the BBC’s senior executives walked the plank there when it was revealed its team had intentionally misrepresented a speech by US President Donald Trump, who then threatened to sue the organization for $1 billion.

Well, one of those fired CTV employees, Derek Thacker, is back on the list of approved Parliamentary Press Gallery members as an employee of Global News.

Don’t forget to check out this week’s Full Press podcast and, if you haven’t done so yet, click at least one of the Subscribe, Share or Donate buttons provided.

(Peter Menzies is a commentator and consultant on media, Macdonald-Laurier Institute Senior Fellow, a past publisher of the Calgary Herald, a former vice chair of the CRTC and a National Newspaper Award winner.)

To help save journalism from bad journalism please subscribe to The Rewrite.

For the full experience, upgrade your subscription.

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoDeath by a thousand clicks – government censorship of Canada’s internet

-

Daily Caller1 day ago

Daily Caller1 day agoChinese Billionaire Tried To Build US-Born Baby Empire As Overseas Elites Turn To American Surrogates

-

Automotive1 day ago

Automotive1 day agoPoliticians should be honest about environmental pros and cons of electric vehicles

-

Great Reset1 day ago

Great Reset1 day agoViral TikTok video shows 7-year-old cuddling great-grandfather before he’s euthanized

-

Digital ID24 hours ago

Digital ID24 hours agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Community21 hours ago

Community21 hours agoCharitable giving on the decline in Canada

-

Alberta1 day ago

Alberta1 day agoSchools should go back to basics to mitigate effects of AI

-

Bruce Dowbiggin23 hours ago

Bruce Dowbiggin23 hours agoNFL Ice Bowls Turn Down The Thermostat on Climate Change Hysteria