Business

PETER SUTHERLAND SR GENERATING STATION POWERS NORTHEAST ONTARIO

PETER SUTHERLAND SR GENERATING STATION POWERS NORTHEAST ONTARIO

On the Abitibi River in northeastern Ontario, the Peter Sutherland Sr. Generating Station (GS) powers 25,000 homes and businesses with renewable waterpower. The development was a partnership between Ontario Power Generation (OPG) and Coral Rapids Power: a wholly-owned company of the Taykwa Tagamou Nation (TTN). The development is named after a respected elder from TTN. The $300-million project was completed in 2017.

On the Abitibi River in northeastern Ontario, almost two years of construction and eight years of planning have culminated in a new hydroelectric station capable of powering 25,000 homes and businesses with clean, renewable, and affordable power.

The 28-megawatt (MW) Peter Sutherland Sr. Generating Station (GS), located about 80 kilometres north of the town of Smooth Rock Falls on the New Post Creek, went into service on April 2017, well ahead of its scheduled 2018 target. In addition, the $300- million project stayed on budget.

That’s a testament to the solid planning and execution between OPG and its partner in the development, Coral Rapids Power, a wholly-owned company of the Taykwa Tagamou Nation (TTN). The development, which is named after a respected elder from TTN, has already had a positive impact on the First Nation community.

“We had about 50 TTN members working on the project at one point or another, which was significant for our First Nation partner,” said Paul Burroughs, Project Director at OPG. “They were part of the project team working to help make this a success.”

As part of the project agreement, Coral Rapids Power has a one-third ownership in the facility, meaning they will receive a share of profits from the station and be a partner for life over the 90 or so years the plant is expected to operate. As TTN’s first foray into hydro development, the project took several decades to get off the ground before the First Nation agreed to partner with OPG in 2007 as part of a past grievances settlement. Construction of the station began in 2015.

Construction work on the Peter Sutherland Sr. Generating Station

The project provides the TTN community with a long-term investment opportunity and a sustainable economic base. Further, it provides spinoff benefits for the entire northeast region.

“The relationship we’ve built with OPG is based on a foundation of respect, trust, and all working toward a common goal,” said Wayne Ross, President of Coral Rapids Power. “There have been many benefits from this project for our community, including good-paying jobs, transferable skills and a long-term revenue stream.”

In addition, approximately $53.5 million in subcontracts were awarded to TTN joint- venture businesses during the construction phase of the station.

“The partnership is about creating a lifelong relationship with the First Nation,” said Burroughs.

The project has created skilled jobs and unique learning opportunities benefitting TTN members who will pursue work in a range of different career fields. Labour needs included engineers, equipment operators, labourers, drillers, cement workers, ironworkers, electricians, welders, carpenters, and camp support services.

At the peak of construction, there were about 220 workers employed on the project, many of whom reside in the local community.

“Our partnership is about more than just megawatts,” said Mike Martelli, President, Renewable Generation. “It’s also about creating skilled jobs and ongoing revenue that will benefit this community for years to come.”

In addition to the direct employment opportunities, existing local businesses and the regional economy benefitted from contracting work, as well as local project purchasing and expenditures. The estimated sales multiplier associated with the project is $1.50 – that is for every dollar expended an additional $0.50 was spent in northern Ontario.

The new station is operated by OPG’s northeastern operations control room in Timmins and is maintained by technicians located at a nearby work centre at Abitibi Canyon.

Inside the completed Peter Sutherland Sr. Generating Station

Peter Sutherland Sr. GS is the latest asset in OPG’s clean energy portfolio, which includes successful joint ventures with other First Nations. In early 2015, OPG and the Moose Cree First Nation celebrated the completion of the Lower Mattagami Hydroelectric Project, northern Ontario’s largest hydroelectric project in 50 years.

Ontario’s 58 northeastern hydroelectric facilities provide a clean, renewable, and reliable source of power to Ontarians year- round. Their combined capacity is over 3,000 MW.

Thanks to Todayville for helping us bring our members’ stories of collaboration and innovation to the public.

Click to read a foreward from JP Gladu, Chief Development and Relations Officer, Steel River Group; Former President and CEO, Canadian Council for Aboriginal Business.

JP Gladu, Chief Development and Relations Officer, Steel

River Group; Former President & CEO, Canadian Council for Aboriginal Business

Click to read comments about this series from Jacob Irving, President of the Energy Council of Canada.

Jacob Irving, President of Energy Council of Canada

The Canadian Energy Compendium is an annual initiative by the Energy Council of Canada to provide an opportunity for cross-sectoral collaboration and discussion on current topics in Canada’s energy sector. The 2020 Canadian Energy Compendium: Innovations in Energy Efficiency is due to be released November 2020.

Click below to read more stories from Energy Council of Canada’s Compendium series.

INDIGENOUS CONSULTATION AND ENGAGEMENT AT CANADA’S ENERGY AND UTILITY REGULATORS

Hydro-Québec takes partnerships, environmental measures and sharing of wealth to new levels

Business

Broken ‘equalization’ program bad for all provinces

From the Fraser Institute

By Alex Whalen and Tegan Hill

Back in the summer at a meeting in Halifax, several provincial premiers discussed a lawsuit meant to force the federal government to make changes to Canada’s equalization program. The suit—filed by Newfoundland and Labrador and backed by British Columbia, Saskatchewan and Alberta—effectively argues that the current formula isn’t fair. But while the question of “fairness” can be subjective, its clear the equalization program is broken.

In theory, the program equalizes the ability of provinces to deliver reasonably comparable services at a reasonably comparable level of taxation. Any province’s ability to pay is based on its “fiscal capacity”—that is, its ability to raise revenue.

This year, equalization payments will total a projected $25.3 billion with all provinces except B.C., Alberta and Saskatchewan to receive some money. Whether due to higher incomes, higher employment or other factors, these three provinces have a greater ability to collect government revenue so they will not receive equalization.

However, contrary to the intent of the program, as recently as 2021, equalization program costs increased despite a decline in the fiscal capacity of oil-producing provinces such as Alberta, Saskatchewan, and Newfoundland and Labrador. In other words, the fiscal capacity gap among provinces was shrinking, yet recipient provinces still received a larger equalization payment.

Why? Because a “fixed-growth rule,” introduced by the Harper government in 2009, ensures that payments grow roughly in line with the economy—even if the gap between richer and poorer provinces shrinks. The result? Total equalization payments (before adjusting for inflation) increased by 19 per cent between 2015/16 and 2020/21 despite the gap in fiscal capacities between provinces shrinking during this time.

Moreover, the structure of the equalization program is also causing problems, even for recipient provinces, because it generates strong disincentives to natural resource development and the resulting economic growth because the program “claws back” equalization dollars when provinces raise revenue from natural resource development. Despite some changes to reduce this problem, one study estimated that a recipient province wishing to increase its natural resource revenues by a modest 10 per cent could face up to a 97 per cent claw back in equalization payments.

Put simply, provinces that generally do not receive equalization such as Alberta, B.C. and Saskatchewan have been punished for developing their resources, whereas recipient provinces such as Quebec and in the Maritimes have been rewarded for not developing theirs.

Finally, the current program design also encourages recipient provinces to maintain high personal and business income tax rates. While higher tax rates can reduce the incentive to work, invest and be productive, they also raise the national standard average tax rate, which is used in the equalization allocation formula. Therefore, provinces are incentivized to maintain high and economically damaging tax rates to maximize equalization payments.

Unless premiers push for reforms that will improve economic incentives and contain program costs, all provinces—recipient and non-recipient—will suffer the consequences.

Authors:

Alberta

Alberta’s fiscal update projects budget surplus, but fiscal fortunes could quickly turn

From the Fraser Institute

By Tegan Hill

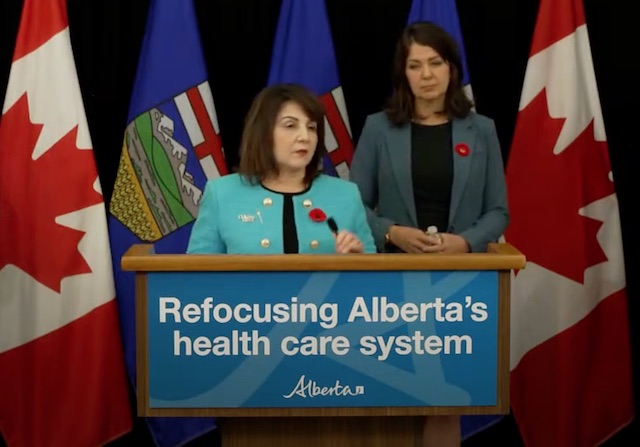

According to the recent mid-year update tabled Thursday, the Smith government projects a $4.6 billion surplus in 2024/25, up from the $2.9 billion surplus projected just a few months ago. Despite the good news, Premier Smith must reduce spending to avoid budget deficits.

The fiscal update projects resource revenue of $20.3 billion in 2024/25. Today’s relatively high—but very volatile—resource revenue (including oil and gas royalties) is helping finance today’s spending and maintain a balanced budget. But it will not last forever.

For perspective, in just the last decade the Alberta government’s annual resource revenue has been as low as $2.8 billion (2015/16) and as high as $25.2 billion (2022/23).

And while the resource revenue rollercoaster is currently in Alberta’s favor, Finance Minister Nate Horner acknowledges that “risks are on the rise” as oil prices have dropped considerably and forecasters are projecting downward pressure on prices—all of which impacts resource revenue.

In fact, the government’s own estimates show a $1 change in oil prices results in an estimated $630 million revenue swing. So while the Smith government plans to maintain a surplus in 2024/25, a small change in oil prices could quickly plunge Alberta back into deficit. Premier Smith has warned that her government may fall into a budget deficit this fiscal year.

This should come as no surprise. Alberta’s been on the resource revenue rollercoaster for decades. Successive governments have increased spending during the good times of high resource revenue, but failed to rein in spending when resource revenues fell.

Previous research has shown that, in Alberta, a $1 increase in resource revenue is associated with an estimated 56-cent increase in program spending the following fiscal year (on a per-person, inflation-adjusted basis). However, a decline in resource revenue is not similarly associated with a reduction in program spending. This pattern has led to historically high levels of government spending—and budget deficits—even in more recent years.

Consider this: If this fiscal year the Smith government received an average level of resource revenue (based on levels over the last 10 years), it would receive approximately $13,000 per Albertan. Yet the government plans to spend nearly $15,000 per Albertan this fiscal year (after adjusting for inflation). That’s a huge gap of roughly $2,000—and it means the government is continuing to take big risks with the provincial budget.

Of course, if the government falls back into deficit there are implications for everyday Albertans.

When the government runs a deficit, it accumulates debt, which Albertans must pay to service. In 2024/25, the government’s debt interest payments will cost each Albertan nearly $650. That’s largely because, despite running surpluses over the last few years, Albertans are still paying for debt accumulated during the most recent string of deficits from 2008/09 to 2020/21 (excluding 2014/15), which only ended when the government enjoyed an unexpected windfall in resource revenue in 2021/22.

According to Thursday’s mid-year fiscal update, Alberta’s finances continue to be at risk. To avoid deficits, the Smith government should meaningfully reduce spending so that it’s aligned with more reliable, stable levels of revenue.

Author:

-

ESG2 days ago

ESG2 days agoCan’t afford Rent? Groceries for your kids? Trudeau says suck it up and pay the tax!

-

John Stossel2 days ago

John Stossel2 days agoGreen Energy Needs Minerals, Yet America Blocks New Mines

-

Daily Caller2 days ago

Daily Caller2 days agoLos Angeles Passes ‘Sanctuary City’ Ordinance In Wake Of Trump’s Deportation Plan

-

Alberta2 days ago

Alberta2 days agoProvince considering new Red Deer River reservoir east of Red Deer

-

Addictions2 days ago

Addictions2 days agoBC Addictions Expert Questions Ties Between Safer Supply Advocates and For-Profit Companies

-

Aristotle Foundation1 day ago

Aristotle Foundation1 day agoToronto cancels history, again: The irony and injustice of renaming Yonge-Dundas Square to Sankofa Square

-

armed forces1 day ago

armed forces1 day agoJudge dismisses Canadian military personnel’s lawsuit against COVID shot mandate

-

conflict2 days ago

conflict2 days agoPutin Launches Mass-Production of Nuclear Shelters for his People