Crime

Stopping Crime Debt in its tracks….

For years, Canadian criminals have been robbing their fellow citizens blind.

This is no secret, and with the wave of bust and boom economies, home break-ins and vehicle theft have been a curse to our society. Yet, despite promises of greater funding by federal and provincial governments and increased scrutiny via security cameras and Citizens On Patrol there has been no great reduction in crime rates.

To the everyday citizen, not only is there frustration when someone is struck with theft-personal or business and IF the individual is caught, there is no punishment that seemingly impacts their poor personal choices.

After all, is not theft violating one of the 10 Commandments?

Not only that, but even IF an individual or crime ring IS caught in a sting AND charges are laid by RCMP, the odds are that most or all of the convictions will be thrown out and the perpetrator (s) will be free to commit crimes once again AND escape without penalty. Meanwhile, those whose goods have been stolen are left to pick up the pieces and face increased insurance costs and security issues.

Therein lies the crux of our dilemma.

We have a legal system that is supposed to punish law breakers.

The question is whether or not a thief, or ring of thieves are ever penalized accordingly.

Let me tell you about a real life case that occurred in Central Alberta where a house was repeatedly reported for disturbances at all hours of the night and over a period of a couple of years, police raided the house and took truck loads of stolen items out of the garage. During that time, this home also was used to sell drugs and was involved in a vehicular homicide case.

More than 50 charges were laid to 2 individuals.

Fewer than 5 charges were laid and during their crime spree, they were released and broke bail AND stole vehicles and led police on a chase through another community.

The final value of items stolen was upwards of $500,000 yet there was no financial penalty to the individuals and it can be assumed that after their minimal jail time, they went back to work stealing the fruits of others labors!

This is by no means a solo story, but rather a common tale that has frustrated hard working individuals around Canada.

How can society at large and the court systems put a real stop to criminal activities?

As young people, we are taught not to lie and steal, that human life is sacred and that we are to honour our mother and father. Yet we tolerate games like Grand Theft Auto, where players are supposed to steal vehicles and escape. We tolerate entertainment that glorifies gangsters, pedophiles, rapists, thieves, drug dealers and murderers. In fact, we often even give them Academy Awards for excellence of something.

There is a simple concept that was entrenched in old societies and some native tribes as well that dealt with debt and theft.

Jewish custom demanded that if you stole something, you returned it or recompensed the owner of the item. Tribal beliefs and customs often demanded the same of thieves.

In society today, we have abandoned the concept of personal financial responsibility of theft. Can you imagine the ‘fictional’ couple who stole more than $500,000 of items in a couple of years in addition to their other activities if they had to repay every one of their victims?

Insurance, as we know it, is designed to repay owners for lost goods but it really diverts responsibility for the actions of those who believe it is their right to loot and steal the goods and rewards of others labor.

If you have goods stolen today, you call the police, file a police report and call your insurance company.

No problem, right…wrong.

The problem is that those who forced you to claim a theft, have penalized you in a few ways while they go on their way and fence the items and buy drugs, and other illicit items and services. They may even build a deck or go on a vacation.

As the victim, you are penalized by your insurance company when your rates go up because you claimed the theft. As the victim, you have to accept the fact that the value of your goods is likely more than what you will be paid out, so you lose. If your company does not direct bill, then you pay first, then bill the company. Not only that, but the more theft occurs, the rates across a region or province rise faster and just when you think you have it under control, you may get broken into again and start over!

Not to mention, the loss of security and safety by the homeowners themselves.

There is no winner.

You lose as the victim because the cost of the crime escalates our protections.

The criminal loses because there is NO financial penalty to make them aware that their choices cost people large amounts of money! Morally, there is no lesson when they are caught as the laws will give them the least penalty possible! They learn to use the system and nothing else.

Crime scene

If criminals are never forced to recompense victims, then how will our justice system ever work. It is at best, a perpetual crime inducement factory!

Please listen law makers and government representatives.

Make criminals financially liable for their crimes! If they steal $10,000 worth, then they repay $10,000!

There should be no limit to the costs they have to repay. Theft is a selfish crime, and the consequences of their actions does not stop after they fence the items.

If we look down the line just one generation, and the children of the criminals have seen that their parents have stolen and ‘prospered,’ what will they do? Will they turn their back on the immoral teaching and lead an honest work life? We would hope that at some point that the children would, but if we look at our society the analogy of sexual or spousal abuse does not often stop in the 2nd generation and is viewed as normal and guides each and every decision as long as the victim lives.

What is the real responsibility of our court systems?

Is it to penalize offenders or teach offenders? Or is our justice system functioning as a complicated means to minimize the consequences of our actions?

In the case of household and business theft, I have ONE recommendation for the government of the day. ENACT a law that repays DOLLAR FOR DOLLAR victims of theft by the thieves!

I firmly believe that this will go a long way to stopping crime in our society.

Poor decisions lead to poor outcomes. Crime is Crime. Dishonesty is Dishonesty. There can be no sugar coating. If we use the language of Jewish laws, the transgression is not to be condoned!

It is up to the law makers to make a stand and the governments of our day to truly create a penalty that STOPS instead of DIVERTS and DELAYS.

Banks

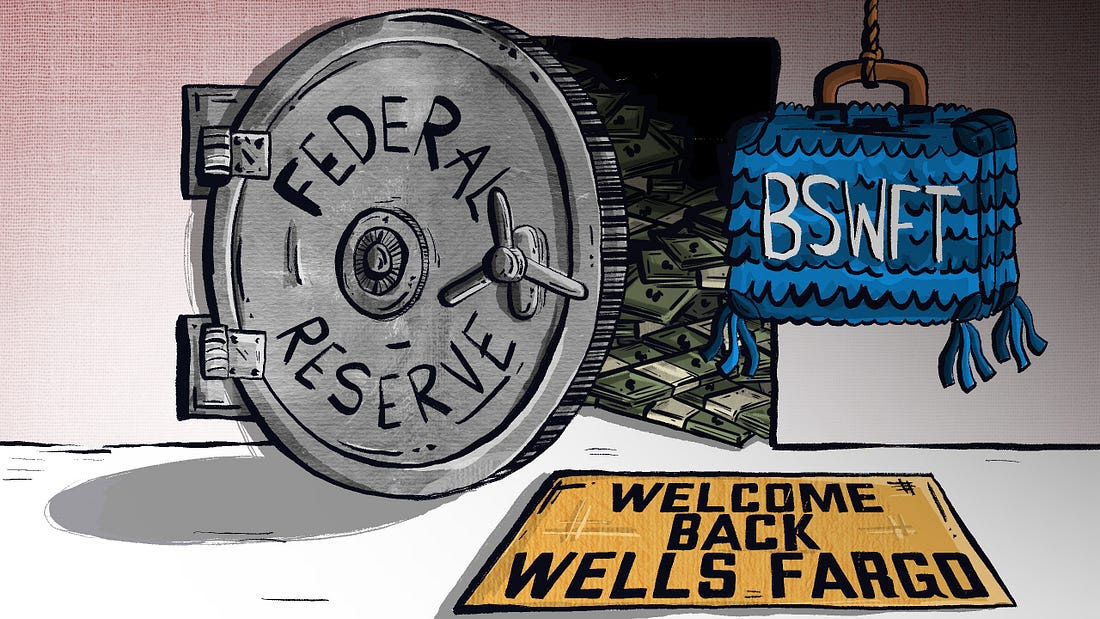

Welcome Back, Wells Fargo!

Racket News

Racket News

By Eric Salzman

The heavyweight champion of financial crime gets seemingly its millionth chance to show it’s reformed

The past two decades have been tough ones for Wells Fargo and the many victims of its sprawling crime wave. While the banking industry is full of scammers, Wells took turning time honored street-hustles into multi-billion dollar white-collar hustles to a new level.

The Federal Reserve announced last month that Wells Fargo is no longer subject to the asset growth restriction the Fed finally enforced in 2018 after multiple scandals. This was a major enforcement action that prohibited Wells from growing existing loan portfolios, purchasing other bank branches or entering into any new activities that would result in their asset base growing.

Upon hearing the news that Wells was being released from the Fed’s penalty box, my mind turned to this pivotal moment in the classic movie “Slapshot.”

Here are some of Wells Fargo’s lowlights both before and after the Fed’s enforcement action:

- December 2022: Wells Fargo paid more than $2 billion to consumers and $1.7 billion in civil penalties after the Consumer Financial Protection Bureau (CFPB) found mismanagement — including illegal fees and interest charges — in several of its biggest product lines, such as auto loans, mortgages, and deposit accounts.

- September 2021: Wells Fargo paid $72.6 million to the Justice Department for overcharging foreign exchange customers from 2010-2017.

- February 2020: Wells Fargo paid $3 billion to settle criminal and civil investigations by the Justice Department and SEC into its aggressive sales practices between 2002 and 2016. About $500 million was eventually distributed to investors.

- January 2020: The Office of the Comptroller of the Currency (OCC) banned two senior executives, former CEO John Stumpf and ex-Head of Community Bank Carrie Tolstedt, from the banking industry. Stumpf and Tolstedt also incurred civil penalties of $17.5 million and $17 million.

- August 2018: The Justice Department levied a $2.09 billion fine on Wells Fargo for its actions during the subprime mortgage crisis, particularly its mortgage lending practices between 2005 and 2007.

- April 2018: Federal regulators at the CFPB and OCC examined Wells’ auto loan insurance and mortgage lending practices and ordered the bank to pay $1 billion in damages.

- February 2018: The aforementioned Fed enforcement action. In addition to the asset growth restriction, Wells was ordered to replace three directors.

- October 2017: Wells Fargo admitted wrongdoing after 110,000 clients were fined for missing a mortgage payment deadline — delays for which the bank was ultimately deemed at fault.

- July 2017: As many as 570,000 Wells Fargo customers were wrongly charged for auto insurance on car loans after the bank failed to verify whether those customers already had existing insurance. As a result, up to 20,000 customers may have defaulted on car loans.

- September 2016: Wells Fargo acknowledged its employees had created 1.5 million deposit accounts and 565,000 credit card accounts between 2002 and 2016 that “may not have been authorized by consumers,” according to CFPB. As a result, the lender was forced to pay $185 million in damages to the CFPB, OCC, and City and County of Los Angeles.

Additionally, somehow in 2023 Wells even managed to drop $1 billion in a civil settlement with shareholders for overstating their progress in complying with their 2018 agreement with the Fed to clean themselves up!

I imagine if Wells were in any other business, it wouldn’t be allowed to continue. But Wells is part of the “Too Big to Fail” club. Taking away its federal banking charter would be too disruptive for the financial markets, so instead they got what ended up being a seven-year growth ban. Not exactly rough justice.

While not the biggest settlement, my favorite Wells scam was the 2021 settlement of the seven-year pilfering operation, ripping off corporate customers’ foreign exchange transactions.

Like many banks, Wells Fargo offers its corporate clients with global operations foreign exchange (FX) services. For example, if a company is based in the U.S. but has extensive dealings in Canada, it may receive payments in Canadian dollars (CAD) that need to be exchanged for U.S. dollars (USD) and vice versa. Wells, like many banks, has foreign exchange specialists who do these conversions. Ideally, the banks optimize their clients’ revenue and decrease risk, in return for a markup fee, or “spread.”

There’s a lot of trust involved with this activity as the corporate customers generally have little idea where FX is trading minute by minute, nor do they know what time of day the actual orders for FX transactions — commonly called “BSwifts” — come in. For an unscrupulous bank, it’s a license to steal, which is exactly what Wells did.

According to the complaint, Wells regularly marked up transactions at higher spreads than what was agreed upon. This was just one of the variety of naughty schemes Wells used to clobber their customers. My two favorites were “The Big Figure Trick” and the “BSwift Pinata.”

The Big Figure Trick

Let’s say a client needs to sell USD for CAD, and that the $1 USD is worth $1.32 CAD. In banking parlance, the 32 cents is called the “Big Figure.” Wells would buy the CAD at $1.32 for $1 USD and then transpose the actual exchange rate on the customer statement from $1.32 to $1.23. If the customer didn’t notice, Wells would pocket the difference. On a transaction where the client is buying 5 million CAD with USD, the ill-gotten gain for Wells would be about $277,000 USD!

Conversely, if the customer did notice the difference, Wells would just blame it on the grunts in its operational back office, saying they accidentally transposed the number and “correct” the transaction. From the complaint, here is some give and take between two Wells FX specialists:

“You can play the transposition error game if you get called out.” Another FX sales specialist noted to a colleague about a previous transaction that a customer “didn’t flinch at the big fig the other day. Want to take a bit more?”

The BSwift Piñata

The way this hustle would work is, let’s say the Wells corporate customer was receiving payment from one of their Canadian clients. The Canadian client’s bank would send a BSwift message to Wells. The Wells client was in the dark about the U.S. dollar-Canadian dollar exchange rate because it had no idea what time of day the message arrived. Wells took advantage of that by purchasing U.S. dollars for Canadian dollars first. For simplicity, think of the U.S. dollar-Canadian dollar exchange rate as a widget that Wells bought for $1. If the widget increased in value, say to $1.10 during the day, Wells would sell the widget they purchased for $1 to the client for $1.10 and pocket 10 cents. If the price of the widget Wells bought for $1 fell to 95 cents, Wells would just give up their $1 purchase to the client, plus whatever markup they agreed to.

Heads, Wells wins. Tails, client loses.

The complaint notes that a Wells FX specialist wrote that he:

“Bumped spreads up a pinch,” that “these clients who are in the mode of just processing wires will most likely not notice this slight change in pricing” and that it “could have a very quick positive impact on revenue without a lot of risk.”

Talk about a boiler room operation. Personally, I think calling what you are doing to a client a “piñata” should have easily put Wells in the Fed’s penalty box another 5 years at least!

Wells has been released from the Fed’s 2018 enforcement order. I would like to think they have learned their lesson and are reformed, but I would lay good odds against it. A leopard can’t change its spots.

Racket News is a reader-supported publication.

Consider becoming a free or paid subscriber.

Crime

Bryan Kohberger avoids death penalty in brutal killing of four Idaho students

Quick Hit:

Bryan Kohberger will plead guilty to murdering four Idaho college students, avoiding a death sentence but leaving victims’ families without answers. The plea deal means he’ll spend life in prison without ever explaining why he committed the brutal 2022 killings.

Key Details:

- Kohberger will plead guilty at a hearing scheduled for Wednesday at 11 a.m. local time.

- The plea deal removes the possibility of death by firing squad but ensures life in prison without parole.

- Victims’ families say the state “failed” them by agreeing to a deal that denies them an explanation for the murders.

Diving Deeper:

Bryan Kohberger, a former PhD criminology student at Washington State University, is expected to plead guilty to the November 2022 murders of four University of Idaho students, sparing himself the death penalty but also avoiding any explanation for his motive. Idaho defense attorney Edwina Elcox told the New York Post that under the plea, Kohberger will have to admit to the killings but won’t have to provide a reason for his actions. “There is no requirement that he says why for a plea,” Elcox explained.

Prosecutors reached the plea deal just weeks before the scheduled trial, which many believed would have revealed the full details and motives behind the shocking quadruple homicide. Kohberger is accused of murdering Kaylee Goncalves, 21; Madison Mogen, 21; Ethan Chapin, 20; and Xana Kernodle, 20, with a military-style Ka-Bar knife as they slept in their off-campus home in Moscow, Idaho. His DNA was allegedly found on a knife sheath left at the scene.

The Goncalves family blasted the state for the deal, saying, “They have failed us.” They had hoped a trial would uncover why Kohberger targeted their daughter and her friends. Prosecutors, however, argued that the plea ensures a guaranteed conviction and prevents the years of appeals that typically follow a death sentence, providing a sense of finality and keeping Kohberger out of the community forever.

Sentencing will not take place for several weeks following Wednesday’s hearing, which is expected to last about an hour as the judge confirms the plea agreement is executed properly. While the families may find some closure in knowing Kohberger will never be free again, they are left without the one thing a trial could have provided: answers.

(AP Photo/Matt Rourke, Pool)

-

Business2 days ago

Business2 days agoLatest shakedown attempt by Canada Post underscores need for privatization

-

Business2 days ago

Business2 days agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

Alberta2 days ago

Alberta2 days agoPierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoHow Vimy Ridge Shaped Canada

-

MxM News2 days ago

MxM News2 days agoUPenn strips Lia Thomas of women’s swimming titles after Title IX investigation

-

Alberta1 day ago

Alberta1 day agoAlberta Provincial Police – New chief of Independent Agency Police Service

-

Energy2 days ago

Energy2 days agoIf Canada Wants to be the World’s Energy Partner, We Need to Act Like It

-

International2 days ago

International2 days agoCBS settles with Trump over doctored 60 Minutes Harris interview