Alberta

Hope is Edmonton Prospects & WCBL biggest ally these days

Until about a month ago, the Edmonton Prospects appeared on the way towards a home-run and their most successful season in the Western Canadian Baseball League (WCBL). The league itself looked a lot healthier than it has ever been.

“We were really looking forward – our 2020 roster was in good shape; we had a secure (one-year) lease on RE/MAX Field; our relationship and negotiations with the city had moved forward from what there was before.” owner-general manager Pat Cassidy

With the pending arrival of a 2021 franchise in Sylvan Lake, added to the growing optimism. Then, of course, came the coronavirus pandemic. Covid-19, halted to everything. Now, among every other endeavour in this nation, it’s like a rain delay; a really long rain delay.

Edmonton Prospects run onto the RE/MAX Field in 1019. Will it happen in 2020? Photo Courtesy/Prospects

For how long? That has yet to be determined. A partial answer may take shape next Tuesday after a scheduled meeting to update all league principals on any potential opening dates.

Pre-coronavirus plans called for the Prospects to open at home with two tilts during the May 24 weekend, with firework after the first game. Now? Cassidy pitched, “the most likely expectation is a delay until June 16 or later.” Another batting lineup could look like a calendar to include openers on or about Canada Day, July 1. Cassidy explained, “We won’t know until some serious ideas are raised at our meeting, a lot of things remain for us to go through.”

“Sure, we have rosters ready – at least, most of us have – but we can’t possibly know if the signed players will be able to come in. Who knows whether they will have to be isolated for a period of time after they do come in?”

Will Edmonton Prospects “PLAY BALL” at RE-MAX Field in 2020? TBA Photo Courtesy/Prospect

All-star outfielder Travis Hunt and infielder Brendan Luther both had committed to return from last year’s roster, which survived an incredible run of bad weather before being eliminated in playoffs by the champion Okotoks Dawgs. “We have Hunt signed but we also have an agreement that he would be free to leave if the pros took him in the draft or signed him.” spit Cassidy.

Pencilled in on the pitching staff are (or were) Trever Berg and Jesse Poniewozik, who spent much of the 2019 season in the bullpen before both became essential as starters or relievers by playoff time.

Poniewozik, the young, promising Spruce Grove right-hander whose season ended when a wicked line drive hit him on the head and forced him out, for the brief remainder of the season.

Cassidy raised another very important question, surely to be considered by not just the WCBL, but all other leagues anxious to start; if you play, will they come? Will it be a full count or, “What size of crowds can we expect?

“I’m sure we all want to get going but I don’t believe we’ll find large groups of fans want to go into a ballpark and sit next to people without the six-foot separation (self-distancing).

“Questions, that’s all we’ve got so far.” Cassidy conceded.

The owner and GM competitive instincts surfaced after president Gary Hoover of the Northwoods League, which includes the Thunder Bay Border Cats and teams from North Dakota, Minnesota, Iowa, Michigan, Indiana and Illinois, confirmed that plans to open on May 26 had been scrubbed. “We don’t have (the same page),” the Prospects operator said, partly in jest, after Hoover claimed “flexibility” could be a big help in designing the Northwoods League future.

To this point, the WCBL has not been forced to adjust to the loss of the Melville Millionaires and Yorkton Cardinals, who received one-year leaves of absence to consider whether to remain in a league that has grown stronger and more competitive. “It was difficult for them,” Cassidy is not yet calling them out, “Whatever the operators decide, I wish them luck.”

As for the positive outlook from a month ago when it looked like it was going to be a homer, with the runner circling the bases? Or will it be caught for the final out at the fence? A final out, before the first pitch of the season is even thrown? Time will tell, right now we are still in the middle of a rain delay.

Read more stories on Todayville Edmonton

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP Whistleblowers Accuse Members of Mark Carney’s Inner Circle of Security Breaches and Surveillance

-

Also Interesting2 days ago

Also Interesting2 days agoBetFury Review: Is It the Best Crypto Casino?

-

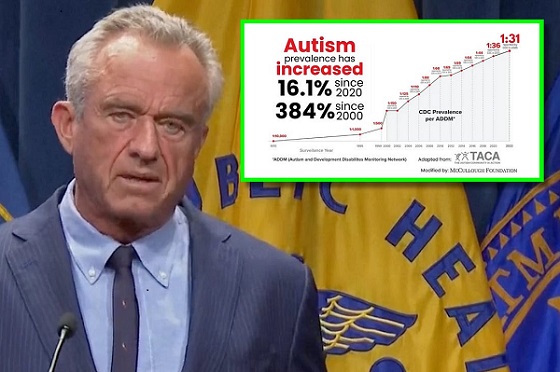

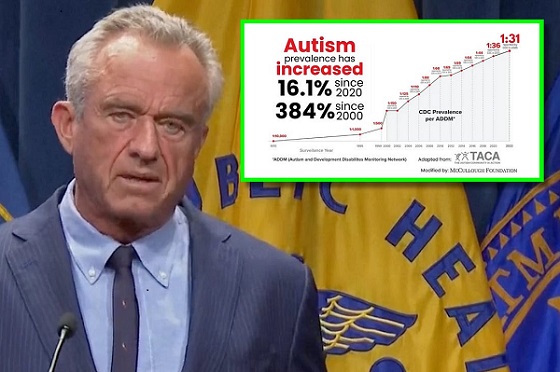

Autism2 days ago

Autism2 days agoRFK Jr. Exposes a Chilling New Autism Reality

-

COVID-191 day ago

COVID-191 day agoCanadian student denied religious exemption for COVID jab takes tech school to court

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBureau Exclusive: Chinese Election Interference Network Tied to Senate Breach Investigation

-

International2 days ago

International2 days agoUK Supreme Court rules ‘woman’ means biological female

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoNeil Young + Carney / Freedom Bros

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoTucker Carlson Interviews Maxime Bernier: Trump’s Tariffs, Mass Immigration, and the Oncoming Canadian Revolution