Business

There’s a cost to bad recruiting practices

We all hear about the frustration job seekers feel when they submit their job application online and never hear another word. But how much does this damage your brand? Here is some really good advice from a contributor from Edmonton.

The cost of a bad experience – by Shane Calder

(Photo by Brooke Cagle on Unsplash)

“In 2015, Virgin Media received approximately 150,000 job applications, translating into 3,500 new hires. The company estimated that 27,000 (18%) of those applicants were also customers—and that poor candidate experiences led 7416 of those applicant customers to churn from Virgin Media.”

Bad experience costs you?

Virgin Media lost 6 million dollars in revenue as a result of their candidates experience.

(Photo by Robin Worrall on Unsplash)

How is it costing your company?

It’s simple. It’s negatively impacting your brand.

“Nearly 60% of Job Seekers have had a poor candidate experience & 72% talk about it.”

Candidates want to be contacted with progress of their application. 80% of applicants are discouraged to reapply if they received no feedback. Poor experience can be detrimental to your candidate search and your company’s online reputation. Candidates actually value knowing about the status of their application more than a polished website or a well-designed careers page.

Source: https://workplacetrends.com/candidate-experience-study/

Technology Woes

(Photo by Adam Birkett on Unsplash)

Have you lost the personal touch?

Candidates who were unsuccessful in a job application doubt a person even reviewed their application. If 85% of the applicants who apply to a job posting doubt that it was ever reviewed by an actual person, imagine the negative impact on your brand and how you are viewed. Will this activity help attract talent?

Add the personal touch.

Augment your resources. Don’t remove your HR professionals from the conversation. Build a rapport with your candidates. Use emails, live chats and social media.

Source: https://www.thetalentboard.org/cande-awards/cande-research-reports/

Rejected offers

(Photo by Ian Tuck on Unsplash)

In the IBM white paper “The far reaching impact of candidate experience” it was discovered that if a candidate has a good experience there is a 54% chance they will accept an offer. If the experience was a disappointment only 39% would accept an offer of employment. Candidates with a positive experience are 2 times more likely to become a customer. The candidate experience is your company’s opportunity to build brand advocates even if no offer is given.

Source: https://www.ibm.com/downloads/cas/YMOARJJG

Social License To Operate

Photo by Nicole Honeywill on Unsplash

The candidate experience impacts your company and is an opportunity to showcase your company. Don’t miss out on the opportunity to improve the experience. The rewards of increased revenue, reduced costs, advocates and finding good talent are within your control.

Treat job candidates well, give them a great experience and you will be rewarded.

Shane Calder is Principal, 132 ENG Inc. He can be reached at [email protected]

132 ENG is an exclusive Engineering and Technical Services Company, providing placement and recruiting services. Discover our real results. 132Eng experts have proven expertise and depth of knowledge that is powerful. Let us make it easy, save you time and make you look amazing. It will be our secret.

2025 Federal Election

Does Canada Need a DOGE?

From the Fraser Institute

By Philip Cross

The legions of Canadians wanting to see government spending shrink probably look enviously at how Elon Musk’s Department of Government Efficiency (DOGE) is slashing some government programs in the United States, even if DOGE’s non-surgical chainsaw approach is controversial, to say the least.

Some problems are common to cutting any government’s spending. Ironclad job security for union employees with seniority means cuts are skewed disproportionately to junior staff still on probation, with the regrettable side effect of denying an injection of fresh blood into a sclerotic workforce. Cutting employees and not programs makes it easier for higher staffing to resume: as documented by Carleton University Professor Ian Lee in How Ottawa Spends, even prolonged bouts of austerity do not derail government spending from long-term trend of higher growth. Across the board cuts do not allow for the surgical removal of redundant or inefficient programs and poor performing employees.

Canada has some unique problems with federal government spending. Savoie documents how 41 per cent of federal civil servants are located in Ottawa, versus 16 per cent in Washington and 19 per cent in London, despite Canada having the most decentralized federation in the G7. The concentration in Ottawa partly reflects the exceptional influence exerted by central agencies on all departments. As well, University of Cambridge Professor Dennis Grube found Canada’s civil service was the most resistant to public scrutiny and the most risk adverse in a comparative study of public servants in the U.S., the United Kingdom, Australia, New Zealand and Canada.

Canada’s federal employees are among the most expensive anywhere. The average civil servant costs taxpayers $146,500 a year including all salary, benefits and costs such as computers and training. Multiplying this average cost by 366,316 federal employees yields a total labour bill of $53.7 billion, not including other spending such as $17.8 billion on consultants. All the recent increase in the ranks of the civil service happened in Justin Trudeau’s tenure, expanding 38.5 per cent after Stephen Harper had cut them 9 per cent between 2010 and 2015 in his determination to balance the budget.

While the cost of government employees has risen sharply, the services they provide to the public are dwindling as government spending increasingly is devoted to managing its unwieldy and bloated bureaucracy. As Savoie observes, unions like to paint civil servants as providing essential services such as food inspectors and rescue workers, when in reality most are involved in a vast web of “policy, coordination, liaison, and performance evaluation units.” The fastest growing occupations in the federal government are in administrative services and program administration, whose share of jobs rose from 25.1 per cent in 2010 to 31.9 per cent in 2023 according to the latest report from the Treasury Board.

A chronic problem is the fierce defense offered by public service unions in “protecting non-performers and insulating the public sector from effective outside scrutiny” as Savoie wrote. The refusal to acknowledge and root out non-performers depresses the morale of the average civil servant who’s unfairly tarred with the reputation of a minority. It also motivates the across-the-board chainsaw approach of DOGE, which critics then decry as not discriminating between good and bad employees. The latter could easily be targeted by senior managers, who know exactly who the non-performers are but cannot be bothered with the years of documentation and bureaucratic headaches needed to get rid of them. The cost of poor performers is substantial; if even 10 per cent of the civil service was eliminated as redundant non-performers, the government would save $5.4 billion a year. Potential savings are likely well over $10 billion.

The federal government potentially has enormous leverage in negotiating civil service pay and getting rid of non-performers, because it can unilaterally change the federal pension plan without negotiating with public-sector unions. The federal pension plan is so generous that it’s referred to as the “golden handcuffs” that tie employees to their jobs irrespective of their pay or working conditions. To protect their lucrative pensions, unions inevitably would be willing to make concessions that substantially lower the burden on Canada’s taxpayers and still improve morale within the civil service.

2025 Federal Election

Don’t double-down on net zero again

From the Fraser Institute

In the preamble to the Paris Agreement, world leaders loftily declared they would keep temperature rises “well below 2°C” and perhaps even under 1.5°C. That was never on the cards—it would have required the world’s economies to effectively come to a grinding halt.

The truth is that the “net zero” green agenda, based on massive subsidies and expensive legislation, will likely cost more than CAD$38 trillion per year across the century, making it utterly unattractive to voters in almost every nation on Earth.

When President Trump withdrew the United States from the Paris Climate Agreement for the first time in 2017, then-Canadian Prime Minister Justin Trudeau was quick to claim the moral high ground, declaring that “we will continue to work with our domestic and international partners to drive progress on one of the greatest challenges we face as a world.”

Trudeau has now been swept from the stage. On his first day back in office, President Trump signed an executive order that again begins the formal, twelve-month-long process of withdrawing the United States from the Paris Agreement.

It will be tempting for Canada to step anew into the void left by the United States. But if the goal is to make effective climate policy, whoever is Canada’s prime minister needs to avoid empty virtue signaling. It would be easy for Canada to declare again that it’ll form a “coalition of the willing” with Europe. The truth is that, just like last time, that approach would do next to nothing for the planet.

Climate summits have generated vast amounts of attention and breathless reporting giving the impression that they are crucial to the planet’s survival. Scratch the surface, and the results are far less impressive. In 2021, the world promised to phase-down coal. Since then, global coal consumption has only gone up. Virtually every summit has promised to cut emissions but they’ve increased almost every single year, and 2024 reached a new high.

Way before the Paris Agreement was inked, the Kyoto Protocol was once sold as a key part of the solution to global warming. Yet studies show it achieved virtually nothing for climate change.

In the preamble to the Paris Agreement, world leaders loftily declared they would keep temperature rises “well below 2°C” and perhaps even under 1.5°C. That was never on the cards—it would have required the world’s economies to effectively come to a grinding halt.

The truth is that the “net zero” green agenda, based on massive subsidies and expensive legislation, will likely cost more than CAD$38 trillion per year across the century, making it utterly unattractive to voters in almost every nation on Earth.

The awkward reality is that emissions from Canada, the EU, and other countries pursuing climate policies matter little in the 21st century. Canada likely only makes up about 1.5 per cent of the world’s emissions. Add together Canada’s output with that of every single country of the rich-world OECD, and this only makes up about one-fifth of global emissions this century, using the United Nations’ ‘middle of the road’ forecast. The other four-fifths of emissions come mostly from China, India and Africa.

Even if wealthy countries like Canada impoverish themselves, the result is tiny — run the UN’s standard climate model with and without Canada going net-zero in 2050, and the difference is immeasurable even in 2100. Moreover, much of the production and emissions just move to the Global South—and even less is achieved.

One good example of this is the United Kingdom, which—like Prime Minister Trudeau once did—has leaned into climate policies, suggesting it would lead the efforts for strong climate agreements. British families are paying a heavy price for their government going farther than almost any other in pursuing the climate agenda: just the inflation-adjusted electricity price, weighted across households and industry, has tripled from 2003 to 2023, mostly because of climate policies. This need not have been so: the US electricity price has remained almost unchanged over the same period.

The effect on families is devastating. Had prices stayed at 2003 levels, an average family-of-four would now be spending CAD$3,380 on electricity—which includes indirect industry costs. Instead, it now pays $9,740 per year.

Rising electricity costs make investment less attractive: European businesses pay triple US electricity costs, and nearly two-thirds of European companies say energy prices are now a major impediment to investment.

The Paris Treaty approach is fundamentally flawed. Carbon emissions continue to grow because cheap, reliable power, mostly from fossil fuels, drives economic growth. Wealthy countries like Canada, the US, and European Union members have started to cut emissions—often by shifting production elsewhere—but the rest of the world remains focused on eradicating poverty.

Poor countries will rightly reject making carbon cuts unless there is a huge flow of “climate aid” from rich nations, and want trillions of US dollars per year. That won’t happen. The new US government will not pay, and the other rich countries cannot foot the bill alone.

Without these huge transfers of wealth, China, India and many other developing countries will disavow expensive climate policies, too. This potentially leaves a rag-tag group led by a few Western European progressive nations, which can scarcely afford their own policies and have no ability to pay off everyone else.

When the United States withdrew from the Paris Agreement in 2017, Canada’s doubling down on the Paris Treaty sent the signal that it would be worthwhile spending hundreds of trillions of dollars to make no real difference to temperatures. We fool ourselves if we pretend that doing so for a second time will help the planet.

We need to realize that fixing climate change isn’t about sanctimonious summits, lofty speeches, and bluster. In coming weeks I’ll outline the case for efficient policies like innovation, adaptation and prosperity.

-

Podcasts2 days ago

Podcasts2 days agoTrump’s Tariffs: The US, Canada, and the rest of the world

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoMark Carney Comes to B.C. and Delivers a Masterclass in Liberal Arrogance

-

Alberta1 day ago

Alberta1 day agoProvince introducing “Patient-Focused Funding Model” to fund acute care in Alberta

-

2025 Federal Election1 day ago

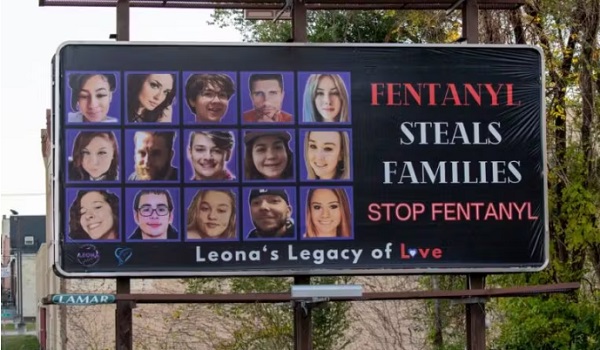

2025 Federal Election1 day agoPoilievre to invest in recovery, cut off federal funding for opioids and defund drug dens

-

Business1 day ago

Business1 day agoTrump threatens additional 50% tariffs on China, urges ‘patience’

-

Alberta1 day ago

Alberta1 day agoMedical regulator stops short of revoking license of Alberta doctor skeptic of COVID vaccine

-

Business2 days ago

Business2 days agoTrump says tariffs on China will remain until trade imbalance is corrected

-

International1 day ago

International1 day agoUN committee urges Canada to repeal euthanasia for non-terminally ill patients