2025 Federal Election

An In-Depth Campaign Trail “Interview” With Pierre Poilievre

David Clinton

David Clinton

Unlike Mark Carney’s performance to date, Conservative leader Pierre Poilievre has given multiple serious long-form interviews over the past months. But also unlike Mark Carney, Poilievre doesn’t have nearly as extensive an in-print record on policy. And, as far as I know, neither party has published comprehensive policy platform documents yet.

So as a follow-up to last week’s “interview” with Mark Carney, here’s The Audit pretending to sit down with Pierre Poilievre. The exchange began with these instructions to my AI:

Given everything you know about Pierre Poilievre and his Conservative Party, would you stand in for the Conservative leader for this pre-election interview. I want you to respond as though you are Pierre Poilievre and use everything that you know to provide robust and consistent answers.

Here’s the first question:

The Audit: You’re committed to providing opportunities for Canadians to join well-paying trades, but considerable job demand and training opportunities already exist: how do you plan to incentivize young Canadians to actually choose those paths – especially considering how few have shown sufficient interest until now?

Absolutely, we’ve got a massive opportunity here. Canada is facing a shortage of skilled workers—plumbers, electricians, welders, carpenters—the backbone of our economy. And you’re right, there are training programs and jobs out there, but not enough young Canadians are stepping up to fill them. Why? Because for too long, the system has pushed everyone toward university degrees, leaving the trades undervalued and overlooked. That ends with a Conservative government.

Here’s how we’ll incentivize young Canadians to choose these well-paying paths. First, we’re going to cut the red tape and fund more apprenticeships—real, hands-on opportunities where you earn while you learn. Under the Liberals, bureaucracy has choked these programs, leaving employers desperate and kids without options. We’ll partner with provinces and industry to double the number of apprenticeships within five years. That’s a commitment.

Second, we’ll bring back respect for the trades. I’m talking about a national campaign—ads, school outreach, you name it—to show young people that a welder can make six figures, buy a house, and support a family just as well as any desk jockey with a degree. We’ll celebrate the dignity of hard work, not just the prestige of a diploma.

Third, tax credits. If you’re a young Canadian starting in the trades, we’ll give you a break on your income tax for the first few years to help you get established. Employers will get incentives too—tax relief for hiring and training apprentices. It’s a win-win: businesses get the workers they need, and young people get a clear financial reason to jump in.

And let’s be real—part of the problem is Trudeau’s economy. Inflation’s through the roof, housing’s unaffordable, and kids feel like they’re stuck. They’re not inspired to take risks or try new paths. By axing the carbon tax, lowering taxes overall, and getting government spending under control, we’ll make it easier for young people to see a future where hard work in the trades pays off—literally.

The bottom line? We’re not just dangling opportunities; we’re building a system that rewards hustle and gives Canadians a real shot at prosperity. Next question!

The Audit: You’ve promised to lower climate-related and various other taxes. Assuming that those revenue shortfalls won’t be immediately filled by an instant energy boom, it looks like you’ll be reliant on significant program and civil service employment cuts to balance your budget. What specific cuts are you looking at?

I’m here to deliver straight talk on how we’ll balance the budget while putting more money back in Canadians’ pockets. You’re right to ask about the revenue side—when we axe the carbon tax and lower other taxes, we’re not banking on some magical energy boom to fill the gap overnight. We’re going to do what families do when times are tight: prioritize, cut the fat, and live within our means.

First off, let’s be clear—our plan isn’t about slashing blindly. It’s about ending the waste and getting government focused on what matters: delivering services Canadians actually need. Under Trudeau, federal spending has ballooned—nearly doubled since 2015—and what do we have to show for it? A bloated bureaucracy, endless consultants, and programs that don’t deliver. That’s where we start.

Specific cuts? Number one, we’re going after the $40 billion in annual corporate welfare—handouts to big businesses that don’t need taxpayer help. Why are we subsidizing profitable multinationals when small businesses and workers are struggling? That cash gets redirected to tax relief for Canadians and investments in critical infrastructure—like roads and bridges, which, by the way, tradespeople will build.

Number two, the civil service. Look, I respect public servants who do real work—nurses, border guards, the folks keeping us safe and healthy. But the federal workforce has grown by over 40% under the Liberals, and a lot of that is middle management and paper-pushers. We’ll freeze hiring, let natural attrition bring numbers down, and refocus on front-line services. No sacred cows here—every department, from Environment to Heritage, gets a line-by-line review to axe overlap and inefficiency. The goal? Get back to pre-Trudeau staffing levels within four years, saving billions without touching essential services.

Third, we’re scrapping failed Liberal pet projects. Take the $4.5 billion Canada Infrastructure Bank—supposed to build stuff, but it’s mostly a money pit for consultants. Or the ArriveCAN app—$54 million for a glitchy scandal-ridden mess. That’s done. We’ll redirect those funds to things that work, like speeding up housing construction by cutting red tape.

And here’s the kicker—we’re not just cutting for the sake of it. Every dollar saved goes back to Canadians through lower taxes or paying down the debt Trudeau’s racked up. We’ll balance the budget in our first term, and we’ll do it by ending the gravy train, not by punishing workers or gutting health care. The energy sector will rebound—sure, with our plan to unleash pipelines and projects—but until then, we’re relying on discipline, not fairy tales.

What’s your next question? Let’s keep this rolling!

The Audit: Can you give me one or two specific examples of “corporate welfare” that you’ll be cutting?

I’m happy to shine a light on the corporate welfare mess we’re going to clean up. Canadians are tired of seeing their hard-earned tax dollars funneled to big corporations that don’t need a handout, while they’re struggling to pay bills. Here are two specific examples of what’s on the chopping block.

First, let’s talk about the $2 billion the Liberal government has shoveled into the Strategic Innovation Fund for big players like Volkswagen and Stellantis to build electric vehicle battery plants. These are global giants with deep pockets—Volkswagen raked in over $15 billion in profit last year alone. Why are Canadian taxpayers footing the bill for their factories? Under a Conservative government, that’s done. If they want to invest here, they can do it with their own money—we’ll make Canada attractive with low taxes and less red tape, not handouts.

Second, take a look at the $1.3 billion in subsidies dished out to Bombardier over the years—hundreds of millions of that under Trudeau’s watch. This is a company that’s gotten bailout after bailout, yet still lays off workers and ships jobs overseas. In 2016, they got $372 million from Ottawa, no strings attached, while executives pocketed bonuses. Enough’s enough. We’re not in the business of propping up perpetual welfare cases—Bombardier can stand on its own two feet or face the market like everyone else.

That’s $3 billion-plus right there, and it’s just the start. We’ll comb through every line of corporate welfare—$40 billion a year’s worth—and redirect it to lower taxes for working Canadians and small businesses who actually create jobs, not beg for favours. That’s the Conservative way: reward hustle, not cronies. What’s your next question?

The Audit: You’ve been clear that you intend to increase the movement of energy products across the country. But, even if you repeal Bill C-69, how do you expect to convince Quebec, BC, and various powerful activist groups to agree?

I’ll tackle this head-on with the same common-sense approach Canadians expect from me. Getting energy moving across the country—whether it’s oil, gas, or hydro—isn’t just about jobs; it’s about affordability, energy security, and uniting this country economically. Repealing Bill C-69, the “No More Pipelines Act,” is step one—it’s killed projects with endless delays and red tape. But you’re right—Quebec, BC, and activist groups won’t just roll over. Here’s how we’ll make it happen.

First, we’re going to lead with facts and fairness. In Quebec, they’re proud of their hydro power—and they should be. We’ll frame this as a national energy strategy: Quebec’s clean hydro can flow west and east, while Alberta’s oil and gas move to markets. It’s not a zero-sum game. I’ll sit down with Premier Legault and say, “Look, your hydro gets a bigger market, your economy wins, and we all get cheaper energy.” We’ll streamline approvals for hydro transmission lines—same as pipelines—so Quebecers see the benefit, not just the burden.

In BC, it’s about jobs and dollars. Coastal GasLink and Trans Mountain are already in motion, despite the protests. We’ll double down by fast-tracking permits for LNG projects—think Kitimat, Prince Rupert—that bring thousands of well-paying jobs to local communities, including Indigenous nations who’ve signed on. I’ll meet with Premier Eby and say, “You want economic growth? This is it—billions in investment, not handouts.” We’ll also enforce the rule of law—blockades and sabotage won’t be tolerated. The RCMP will have the resources to keep projects on track, period.

As for activist groups—look, they’re loud, but they don’t speak for most Canadians. Polls show a majority want energy projects if it means jobs and lower costs. We’ll counter their noise with transparency: public hearings, yes, but with strict timelines—90 days, not years. No more endless stalling. And we’ll expose their hypocrisy—many of these groups are funded by foreign interests who’d rather see Canada’s energy stay in the ground while they profit elsewhere. I’ll call that out, loud and clear.

Here’s the clincher: money talks. We’ll tie federal infrastructure cash—like transit or housing funds—to provinces playing ball on energy corridors. If Quebec or BC want their share, they’ll need to stop obstructing what’s good for the whole country. It’s not blackmail; it’s fairness—every region has to contribute, not just take.

Will everyone agree? No. But leadership isn’t about pleasing everyone—it’s about doing what’s right. We’ll build a coalition of workers, Indigenous partners, and everyday Canadians who want cheaper gas and heat. That’s how we’ll get it done. Next question!

The Audit: In the context of your plan to cut GST on new home construction, how will you prevent the extra purchasing power in the hands of home buyers from sparking bidding wars and price hikes?

I’m glad you brought up our plan to axe the GST on new home construction—it’s a cornerstone of our strategy to make housing affordable again. The goal is simple: get more homes built and bring prices down so Canadians can actually buy them. But you’re right to ask about bidding wars and price hikes. Here’s how we’ll stop that from happening and make sure the extra purchasing power works for homebuyers, not against them.

First off, this isn’t just about giving buyers a tax break—it’s about turbocharging supply. By cutting the GST on new builds, we’re slashing costs for developers by 5% right off the bat. For a $600,000 home, that’s $30,000 back in their pocket per unit. That makes projects pencil out—especially mid-sized ones like townhouses and small apartments that have been stalled by Trudeau’s inflation and red tape. We’re pairing this with a “build, baby, build” approach: fast-tracking permits, cutting municipal fees, and tying federal funds to cities that hit housing targets. The result? More homes flooding the market—think 50,000 extra units a year within two years. When supply shoots up, prices don’t skyrocket, even if buyers have more cash.

Second, we’re targeting the cut strategically. The GST break applies only to new construction under a price cap—say, $800,000—to focus on starter homes and middle-class housing, not luxury mansions. This keeps the benefit in the hands of regular Canadians, not speculators or flippers looking to bid up million-dollar properties. We’ll also crack down on foreign buyers and house-flipping profiteers with tougher rules—no more letting them crowd out first-time buyers.

Third, we’re tackling the root causes of bidding wars: low inventory and crazy borrowing. Trudeau’s carbon tax and runaway spending have jacked up inflation, driving interest rates through the roof. We’ll axe the carbon tax, rein in spending, and work with the Bank of Canada to stabilize rates. Lower rates mean buyers aren’t desperate to bid beyond their means—they can borrow sensibly, and the GST cut gives them breathing room, not a license to overpay.

Will some builders try to pocket the savings? Sure, a few might. That’s why we’ll monitor prices and call out gouging publicly—market pressure works. But the data backs this up: when Australia cut taxes on new builds in the early 2000s, supply spiked, and price growth slowed within three years. We’ll do the same here.

The bottom line: more homes, smarter rules, and a grip on inflation mean the GST cut builds houses, not bidding wars. Canadians get roofs over their heads, not sticker shock. What’s your next question? Let’s keep this going!

The Audit: One more question: You’ve spoken a lot about boosting housing construction by rewarding or penalizing municipalities for their local home production. But does the federal government really have enough financial leverage to have an impact? And how will your plan take into account facts on the ground that might lie beyond the control of municipal governments?

I’m fired up to tackle this housing question—it’s at the heart of what’s broken in Canada right now, and our Conservative plan’s got the teeth to fix it. You’re asking if the feds have enough financial muscle to move the needle with municipalities, and how we’ll handle the messy realities they face. Let’s break it down.

Does the federal government have leverage? You bet it does. Ottawa sends billions to cities every year—think infrastructure cash like the $30 billion Investing in Canada Plan, or housing funds like the $4 billion Housing Accelerator. Right now, that money’s a free-for-all—no strings, no results. Under Trudeau, cities take the cash and still sit on their hands while homebuilding lags. We’ll flip that script. Our plan ties every dollar to hard targets: hit your housing starts—say, 15% above the five-year average—or your funding gets cut. Miss by a mile? You’re off the gravy train. On the flip side, exceed your goal? You get a bonus—extra cash for roads, transit, whatever you need. It’s carrots and sticks, and with billions on the line, mayors will feel the heat.

Take Toronto—gets over $1 billion a year from Ottawa for infrastructure. If they’re short 10,000 homes, that’s $200 million docked. Vancouver? Same deal. They’ll either zone for high-rises and cut permit delays, or they’ll watch their budgets shrink. The feds don’t control zoning, but we control the purse strings—and trust me, cash talks louder than council debates.

Now, what about those “facts on the ground” beyond municipal control? Fair point—cities aren’t all-powerful. Labour shortages, land costs, or provincial rules can gum things up. We’ve thought that through. First, we’re not just leaning on cities—we’re clearing the deck federally. Axing GST on new builds, slashing red tape for developers, and fast-tracking federal land for housing—like old military bases—means more shovels in the ground, no excuses. Second, we’ll adjust targets to fit reality. A rural town with no cranes isn’t held to Toronto’s standard—targets will scale to population, past performance, and local capacity. Stats Canada data shows housing starts vary wildly—Calgary’s at 15,000 a year, Halifax is half that. We’ll set fair bars, not fantasy ones.

And if a city’s bottleneck is out of their hands—like a provincial ban on greenfield development—we’ll step in. I’ll call up premiers and say, “Fix this, or your highway funds take a hit too.” We did the math: provinces get $20 billion a year from Ottawa in transfers. They’ll play ball when their own wallets are at stake. Plus, we’re boosting trades training—50,000 more workers in five years—so labour shortages don’t derail progress.

Will some mayors cry foul? Sure. But most Canadians—76% in a recent Angus Reid poll—say housing’s a crisis. They’re done with excuses. Our plan’s not about punishing cities—it’s about results. More homes, faster, period. That’s how we turn renters into owners and fix Trudeau’s mess.

Subscribe to The Audit.

For the full experience, upgrade your subscription.

2025 Federal Election

Canada drops retaliatory tariffs on automakers, pauses other tariffs

MxM News

MxM News

Quick Hit:

Canada has announced it will roll back retaliatory tariffs on automakers and pause several other tariff measures aimed at the United States. The move, unveiled by Finance Minister François-Philippe Champagne, is designed to give Canadian manufacturers breathing room to adjust their supply chains and reduce reliance on American imports.

Key Details:

- Canada will suspend 25% tariffs on U.S. vehicles for automakers that maintain production, employment, and investment in Canada.

- A broader six-month pause on tariffs for other U.S. imports is intended to help Canadian sectors transition to domestic sourcing.

- A new loan facility will support large Canadian companies that were financially stable before the tariffs but are now struggling.

Diving Deeper:

Ottawa is shifting its approach to the escalating trade war with Washington, softening its economic blows in a calculated effort to stabilize domestic manufacturing. On Tuesday, Finance Minister François-Philippe Champagne outlined a new set of trade policies that provide conditional relief from retaliatory tariffs that have been in place since March. Automakers, the hardest-hit sector, will now be eligible to import U.S. vehicles duty-free—provided they continue to meet criteria that include ongoing production and investment in Canada.

“From day one, the government has reacted with strength and determination to the unjust tariffs imposed by the United States on Canadian goods,” Champagne stated. “We’re giving Canadian companies and entities more time to adjust their supply chains and become less dependent on U.S. suppliers.”

The tariff battle, which escalated in April with Canada slapping a 25% tax on U.S.-imported vehicles, had caused severe anxiety within Canada’s auto industry. John D’Agnolo, president of Unifor Local 200, which represents Ford employees in Windsor, warned the BBC the situation “has created havoc” and could trigger a recession.

Speculation about a possible Honda factory relocation to the U.S. only added to the unrest. But Ontario Premier Doug Ford and federal officials were quick to tamp down the rumors. Honda Canada affirmed its commitment to Canadian operations, saying its Alliston facility “will operate at full capacity for the foreseeable future.”

Prime Minister Mark Carney reinforced the message that the relief isn’t unconditional. “Our counter-tariffs won’t apply if they (automakers) continue to produce, continue to employ, continue to invest in Canada,” he said during a campaign event. “If they don’t, they will get 25% tariffs on what they are importing into Canada.”

Beyond the auto sector, Champagne introduced a six-month tariff reprieve on other U.S. imports, granting time for industries to explore domestic alternatives. He also rolled out a “Large Enterprise Tariff Loan Facility” to support big businesses that were financially sound prior to the tariff regime but have since been strained.

While Canada has shown willingness to ease its retaliatory measures, there’s no indication yet that the U.S. under President Donald Trump will reciprocate. Nevertheless, Ottawa signaled its openness to further steps to protect Canadian businesses and workers, noting that “additional measures will be brought forward, as needed.”

2025 Federal Election

Tucker Carlson Interviews Maxime Bernier: Trump’s Tariffs, Mass Immigration, and the Oncoming Canadian Revolution

From Tucker Carson on Youtube

It’s hard to overstate how dystopian and threatening Canada has become. An update from longtime Canadian government official Maxime Bernier.

-

illegal immigration2 days ago

illegal immigration2 days agoDespite court rulings, the Trump Administration shows no interest in helping Abrego Garcia return to the U.S.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoEuthanasia is out of control in Canada, but nobody is talking about it on the campaign trail

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoConservative MP Leslyn Lewis warns Canadian voters of Liberal plan to penalize religious charities

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoRCMP Whistleblowers Accuse Members of Mark Carney’s Inner Circle of Security Breaches and Surveillance

-

Autism1 day ago

Autism1 day agoAutism Rates Reach Unprecedented Highs: 1 in 12 Boys at Age 4 in California, 1 in 31 Nationally

-

Education2 days ago

Education2 days agoSchools should focus on falling math and reading grades—not environmental activism

-

2025 Federal Election2 days ago

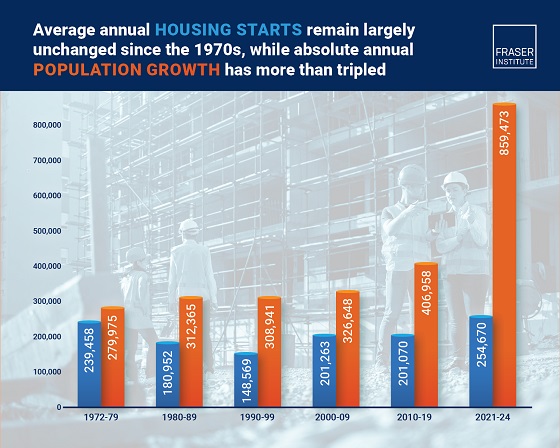

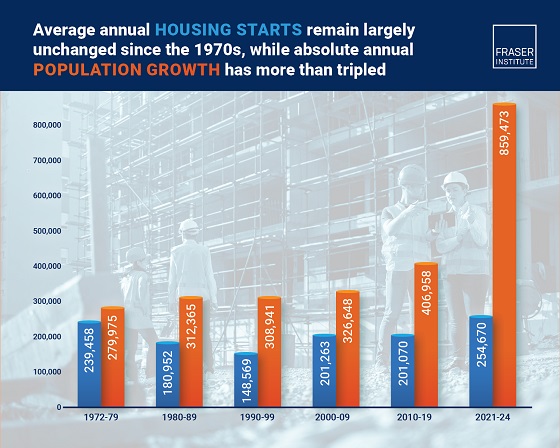

2025 Federal Election2 days agoHousing starts unchanged since 1970s, while Canadian population growth has more than tripled

-

Health1 day ago

Health1 day agoTrump admin directs NIH to study ‘regret and detransition’ after chemical, surgical gender transitioning