Economy

Support For National Pipelines And LNG Projects Gain Momentum, Even In Quebec

From the Frontier Centre for Public Policy

Public opinion on pipelines has shifted. Will Ottawa seize the moment for energy security or let politics stall progress?

The ongoing threats posed by U.S. tariffs on the Canadian economy have caused many Canadians to reconsider the need for national oil pipelines and other major resource projects.

The United States is Canada’s most significant trading partner, and the two countries have enjoyed over a century of peaceful commerce and good relations. However, the onset of tariffs and increasingly hostile rhetoric has made Canadians realize they should not be taking these good relations for granted.

Traditional opposition to energy development has given way to a renewed focus on energy security and domestic self-reliance. Over the last decade, Canadian energy producers have sought to build pipelines to move oil from landlocked Alberta to tidewater, aiming to reduce reliance on U.S. markets and expand exports internationally. Canada’s dependence on the U.S. for energy exports has long affected the prices it can obtain.

One province where this shift is becoming evident is Quebec. Historically, Quebec politicians and environmental interests have vehemently opposed oil and gas development. With an abundance of hydroelectric power, imported oil and gas, and little fossil fuel production, the province has had fewer economic incentives to support the industry.

However, recent polling suggests attitudes are changing. A SOM-La Presse poll from late February found that about 60 per cent of Quebec residents support reviving the Energy East pipeline project, while 61 per cent favour restarting the GNL Quebec natural gas pipeline project, a proposed LNG facility near Saguenay that would export liquefied natural gas to global markets. While support for these projects remains stronger in other parts of the country, this represents a substantial shift in Quebec.

Yet, despite this change, Quebec politicians at both the provincial and federal levels remain out of step with public opinion. The Montreal Economic Institute, a non-partisan think tank, has documented this disconnect for years. There are two key reasons for it: Quebec politicians tend to reflect the perspectives of a Montreal-based Laurentian elite rather than broader provincial sentiment, and entrenched interests such as Hydro-Québec benefit from limiting competition under the guise of environmental concerns.

Not only have Quebec politicians misrepresented public opinion, but they have also claimed to speak for the entire province on energy issues. Premier François Legault and Bloc Québécois Leader Yves-François Blanchet have argued that pipeline projects lack “social licence” from Quebecers.

However, the reality is that the federal government does not need any special license to build oil and gas infrastructure that crosses provincial borders. Under the Constitution, only the federal Parliament has jurisdiction over national pipeline and energy projects.

Despite this authority, no federal government has been willing to impose such a project on a province. Quebec’s history of resisting federal intervention makes this a politically delicate issue. There is also a broader electoral consideration: while it is possible to form a federal government without winning Quebec, its many seats make it a crucial battleground. In a bilingual country, a government that claims to speak for all Canadians benefits from having a presence in Quebec.

Ottawa could impose a national pipeline, but it doesn’t have to. New polling data from Quebec and across Canada suggest Canadians increasingly support projects that enhance energy security and reduce reliance on the United States. The federal government needs to stop speaking only to politicians—especially in Quebec—and take its case directly to the people.

With a federal election on the horizon, politicians of all parties should put national pipelines and natural gas projects on the ballot.

Joseph Quesnel is a senior research fellow with the Frontier Centre for Public Policy.

Business

Americans rallying behind Trump’s tariffs

The Trump administration’s new tariffs are working:

The European Union will delay tariffs on U.S. exports into the trading bloc in response to the imposition of tariffs on European aluminum and steal, a measure announced in February by the White House as a part of an overhaul of the U.S. trade policies.

Instead of taking effect March 12, these tariffs will not apply until “mid-April”, according to a European official interviewed by The Hill.

This is not the first time the EU has responded this way to U.S. tariff measures. It happened already last time Trump was in office. One of the reasons why Brussels is so accommodative is that the European Parliament emphasized negotiations already back in February. Furthermore, as Forbes notes,

The U.S. economy is the largest in the world, and many countries rely on American consumers to buy their goods. By import tariffs, the U.S. can pressure trading partners into more favorable deals and protect domestic industries from unfair competition.

More on unfair competition in a moment. First, it is important to note that Trump did not start this trade skirmish. Please note what IndustryWeek reported back in 2018:

Trump points to U.S. auto exports to Europe, saying they are taxed at a higher rate than European exports to the United States. Here, facts do offer Trump some support: U.S. autos face duties of 10% while European cars are subject to dugies of only 2.5% in the United States.

They also noted some nuances, e.g., that the United States applies a higher tariff on light trucks, presumably to defend the most profitable vehicles rolling out of U.S. based manufacturing plants. Nevertheless, the story that most media outlets do not tell is that Europe has a history of putting tariffs on U.S. exports to a greater extent than tariffs are applied in the opposite direction.

Larson’s Political Economy is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Facts notwithstanding, this trade war has caught media attention and is reaching ridiculous proportions. According to CNBC,

Auto stocks are digesting President Donald Trump’s annoncement that he would place 25% tariffs on “all cars that are not made in the United Sates,” as well as certain automobile parts. … Shares of the “Detroit Three” all fell.

They also explain that GM took a particularly hard beating, and that Ferrari is going to use the tariffs as a reason to raise prices by ten percent. This sounds dramatic, but keep in mind that stocks fly up and down with impressive amplitude; what was lost yesterday can come back with a bonus tomorrow. As for Ferrari, a ten-percent price hike is basically meaningless since these cars are often sold in highly customized, individual negotiations before they are even produced.

Despite the media hype, these tariffs will not last the year. One reason is the retaliatory nature in President Trump’s tariffs, which—again—has already caught the attention of the Europeans and brought them to the negotiation table. We can debate whether or not his tactics are the best in order to create more fair trade terms between the United States and our trading partners, but there is no question that Trump’s methods have caught the attention of the powers that be (which include Mexico and Canada).

There is another reason why I do not see this tariffs tit-for-tat continuing for much longer. The European economy is in bad shape, especially compared to the U.S. economy. With European corporations already signaling increased direct investment in the U.S. economy, Europe is holding the short end of this stick.

But the bad news for the Europeans does not stop there. They are at an intrinsic disadvantage going into a tariffs-based trade war. The EU has a “tariff” of sorts that we do not have, namely the value-added tax, VAT. Shiphub.co has a succinct summary of how the VAT affects trade:

When importing (into the European Union), VAT should be taken into account. … VAT is calculated based on the customs value (the good’s value and transport costs … ) plus the due duty amount.

The term “duty” here, of course, refers to trade tariffs. This means that when tariffs go up, the VAT surcharge goes up as well. Aside from creating a tax-on-tax problem, this also means that the inflationary effect from U.S. imports is significantly stronger than it is on EU imports to the United States—even when tariffs are equal.

If the U.S. government wanted to, they could include the tax-on-tax effect of the VAT when assessing the effective EU tariffs on imports from the United States. This would quickly expand the tit-for-tat tariff war, with Europe at an escalating disadvantage.

For these reasons, I do not see how this “trade war” will continue beyond the summer, but even that is a pessimistic outlook.

Before I close this tariff topic and declare it a weekend, let me also mention that the use of tariffs in trade war is neither a new nor an unusual tactic. Check out this little brochure from the Directorate-General for Trade under the European Commission’:

Trade defence instruments, such as anti-dumping or anti-subsidy duties, are ways of protecting European production against international trade distortions.

What they refer to as “defence instruments” are primarily tariffs on imports. In a separate report the Directorate lists no fewer than 63 trade-war cases where the EU imposes tariffs to punish a country for unfair trade tactics.

Trade what, and what countries, you wonder? Sweet corn from Thailand, fused alumina from China, biodiesel from Argentina and Indonesia, malleable tube fittings from China and Thailand, epoxy resins from China, South Korea, Taiwan, and Thailand… and lots and lots of tableware from China.

Like most people, I would prefer a world without taxes and tariffs, and the closer we can get to zero on either of those, the better. But until we get there, we should take a deep breath in the face of the media hype and trust our president on this one.

Larson’s Political Economy is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Business

Trump Reportedly Shuts Off Flow Of Taxpayer Dollars Into World Trade Organization

From the Daily Caller News Foundation

By Thomas English

The Trump administration has reportedly suspended financial contributions to the World Trade Organization (WTO) as of Thursday.

The decision comes as part of a broader shift by President Donald Trump to distance the U.S. from international institutions perceived to undermine American sovereignty or misallocate taxpayer dollars. U.S. funding for both 2024 and 2025 has been halted, amounting to roughly 11% of the WTO’s annual operating budget, with the organization’s total 2024 budget amounting to roughly $232 million, according to Reuters.

“Why is it that China, for decades, and with a population much bigger than ours, is paying a tiny fraction of [dollars] to The World Health Organization, The United Nations and, worst of all, The World Trade Organization, where they are considered a so-called ‘developing country’ and are therefore given massive advantages over The United States, and everyone else?” Trump wrote in May 2020.

The president has long criticized the WTO for what he sees as judicial overreach and systemic bias against the U.S. in trade disputes. Trump previously paralyzed the organization’s top appeals body in 2019 by blocking judicial appointments, rendering the WTO’s core dispute resolution mechanism largely inoperative.

But a major sticking point continues to be China’s continued classification as a “developing country” at the WTO — a designation that entitles Beijing to a host of special trade and financial privileges. Despite being the world’s second-largest economy, China receives extended compliance timelines, reduced dues and billions in World Bank loans usually reserved for poorer nations.

The Wilson Center, an international affairs-oriented think tank, previously slammed the status as an outdated loophole benefitting an economic superpower at the expense of developed democracies. The Trump administration echoed this criticism behind closed doors during WTO budget meetings in early March, according to Reuters.

The U.S. is reportedly not withdrawing from the WTO outright, but the funding freeze is likely to trigger diplomatic and economic groaning. WTO rules allow for punitive measures against non-paying member states, though the body’s weakened legal apparatus may limit enforcement capacity.

Trump has already withdrawn from the World Health Organization, slashed funds to the United Nations and signaled a potential exit from other global bodies he deems “unfair” to U.S. interests.

-

Alberta2 days ago

Alberta2 days agoAlberta Institute urging Premier Smith to follow Saskatchewan and drop Industrial Carbon Tax

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFool Me Once: The Cost of Carney–Trudeau Tax Games

-

Addictions1 day ago

Addictions1 day agoShould fentanyl dealers face manslaughter charges for fatal overdoses?

-

Alberta2 days ago

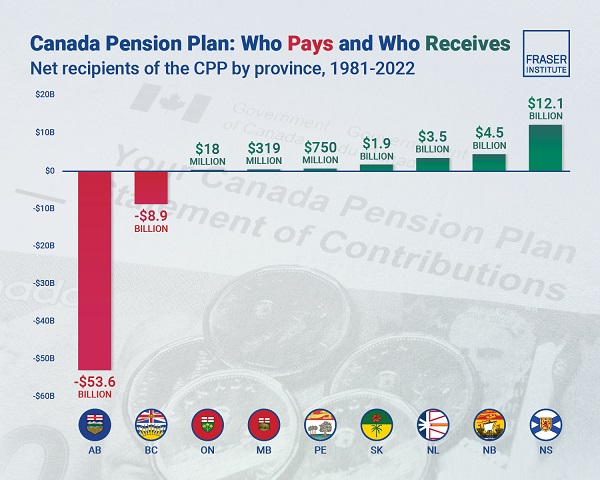

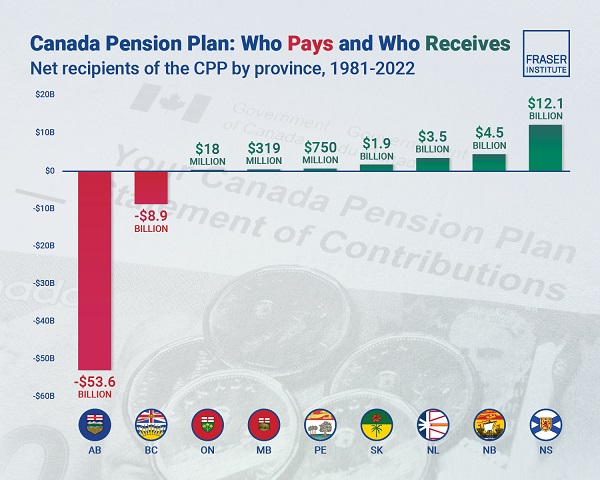

Alberta2 days agoAlbertans have contributed $53.6 billion to the retirement of Canadians in other provinces

-

Also Interesting1 day ago

Also Interesting1 day agoThe bizarre story of Taro Tsujimoto

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoChinese Gangs Dominate Canada: Why Will Voters Give Liberals Another Term?

-

Energy1 day ago

Energy1 day agoEnergy, climate, and economics — A smarter path for Canada

-

J.D. Tuccille18 hours ago

J.D. Tuccille18 hours agoSignal Chat Controversy Is an Endorsement of Encryption Software