Business

What Is It About Politicians and Corporate Bribery Scandals?

By David Clinton

By David Clinton

Another possible case of influence peddling – this time on behalf of Brookfield Asset Management

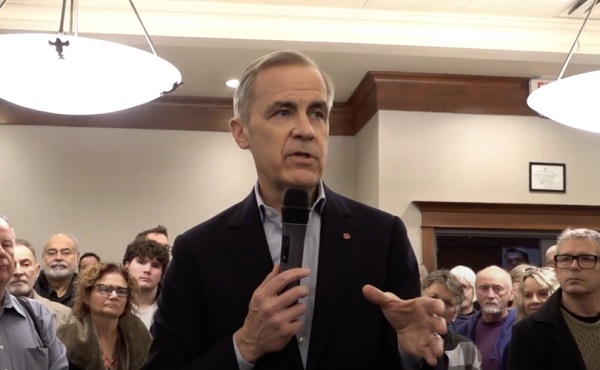

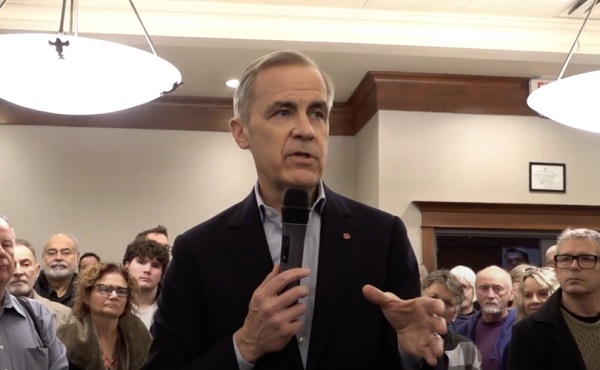

On the surface, this is about a strange venture involving Canadian private equity firm Brookfield Asset Management – whose chair until a few weeks ago was Mark Carney. But it seems to me that this particular event is really just one example of a much larger pattern.

In 2016, as Matt Taibbi recently wrote, the U.S. Justice Department settled a claim against the Brazilian construction conglomerate Odebrecht on a case “involving at least $788 million in illegal payments to officials all over the world, as a means of rigging bids and securing contracts.”

As the terms of the settlement were being negotiated, Brookfield made a big purchase from Odebrecht: a 57 percent stake in Rutas de Lima, a private road toll authority in Peru. According to the U.S. Justice Department, Rutas de Lima has demonstrably engaged in corrupt activities.

What’s of interest to us right now is how the 2016 settlement didn’t include – or even mention – Rutas de Lima. That, presumably, would be to Rutas de Lima’s considerable advantage, as their assets would thereby be shielded from the U.S. government. It’s notable that one of the two Justice Department officials who signed off on the settlement had – both before and after his time at Justice – also happened to work for a law firm that represented Brookfield in Washington.

None of which proves any wrongdoing on the part of Brookfield. But it does hint to an association between them and a combination of criminal behavior and political influence peddling. And it turns out that, not only does Brookfield still own Rutas de Lima in 2025, but they’re still actively engaged in legal efforts to recover profitable concessions lost after in the aftermath of the original prosecution.

To be clear, Mark Carney only joined Brookfield in 2020 – long after the Odebrecht settlement – so it’s unlikely any of this directly impacts him.

The thing is, that corporate bribery and government influence peddling are not exactly rare events. In fact, they’re not even rare in Canada.

Remember SNC-Lavalin? That’s the Montreal-based engineering and construction firm that got into some trouble back in 2018 when they were caught bribing (there’s that word again) Libyan officials with upwards of $48 million to secure contracts.

That was a problem. But the Liberal government in Ottawa seemed to have felt that a criminal conviction for SNC-Lavalin in the case would have been a much larger problem. A conviction, after all, would have limited the company’s ability to bid for future federal construction contracts.

During the summer of 2019, as you probably don’t recall, Ethics Commissioner Mario Dion concluded that Prime Minister Trudeau used inappropriate means in an attempt to “circumvent, undermine and ultimately discredit” the decision of the Director of Public Prosecutions. In other words, political heavy hitters went to bat to protect favored corporations from the consequences of an international case of criminal bribery (and fraud).

In the end, SNC-Lavalin Construction Inc. pleaded guilty to just one fraud charge related to Libya, and agreed to a $280 million fine and three years’ probation. Other charges were dropped, avoiding a full trial on the broader allegations. And SNC-Lavalin – since rebranded as AtkinsRéalis – is still happily signing on for many of the largest infrastructure projects in the country.

I suppose government contracts and bribery go together like peanut butter and jam. The Libyan scandal wasn’t even SNC_Lavalin’s first kick at the can. There was, after all, the McGill University Health Centre (MUHC) bribery scandal of 2007 where company executives funneled $22.5 million to MUHC executives to seal the $1.3 billion contract for the new Glen site hospital in Montreal.

But I’m specifically interested in the close personal relationships that seem to inspire powerful government officials to actively subvert the judicial process to cover for such massive crimes. Those seem to represent the greatest threat to our social contract. And, as we’ve just seen from developments in the Brookfield/Rutas de Lima case, they’re aren’t showing signs of disappearing.

Business

Three face federal charges for “domestic terrorism” after targeting Teslas

MxM News

MxM News

Quick Hit:

Attorney General Pam Bondi announced Thursday that three individuals are facing severe federal charges for violent attacks against Tesla vehicles and charging stations. The suspects allegedly used Molotov cocktails and other incendiary devices in what Bondi labeled “domestic terrorism.” Each faces a minimum of five years in prison, with potential sentences of up to 20 years.

Key Details:

-

Bondi warned that the Justice Department would aggressively prosecute anyone engaging in attacks on Tesla properties, stating, “The days of committing crimes without consequence have ended.”

-

One suspect, armed with a suppressed AR-15 rifle, allegedly threw eight Molotov cocktails at a Tesla dealership in Salem, Oregon.

-

Bondi did not release the names of the suspects or specify the full list of charges but emphasized that these crimes will be met with severe legal consequences.

Diving Deeper:

On Thursday, Attorney General Pam Bondi announced charges against three individuals accused of violent attacks targeting Tesla properties in multiple states. The suspects allegedly used Molotov cocktails and other incendiary weapons to destroy Tesla vehicles and charging stations, prompting Bondi to classify the incidents as acts of “domestic terrorism.”

“The days of committing crimes without consequence have ended,” Bondi stated. “Let this be a warning: If you join this wave of domestic terrorism against Tesla properties, the Department of Justice will put you behind bars.”

The attacks spanned Oregon, Colorado, and South Carolina, according to DOJ officials. In Salem, Oregon, one suspect reportedly carried a suppressed AR-15 rifle while hurling Molotov cocktails at a Tesla dealership. In Loveland, Colorado, another suspect was apprehended after allegedly trying to set Tesla vehicles ablaze with similar incendiary devices. Authorities later found the individual in possession of additional materials capable of producing more firebombs.

A third suspect, operating in Charleston, South Carolina, allegedly defaced Tesla charging stations with anti-Trump graffiti before setting them on fire using Molotov cocktails.

While the Justice Department has not released the names of the suspects, each individual faces a minimum of five years in prison, with potential sentences reaching up to 20 years. Bondi reiterated that law enforcement is committed to stopping politically motivated destruction of private property, vowing aggressive prosecution for those responsible.

Business

It’s Time for Canadians to Challenge the American Domination of the LNG Space

From EnergyNow.Ca

By Susan McArthur

Canada is now among the top 10 countries with natural gas reserves. It’s time to take advantage of that

Canadians are starting to understand the Americans ate our breakfast, lunch and dinner when it comes to selling liquefied natural gas (LNG) on the global market while simultaneously undermining our national security.

They are finally waking up to the importance of the urgent request by oil and gas CEOs to all federal party leaders calling for the removal of legislation and regulation impeding and capping the development of our resources.

The LNG story in the United States is one of unprecedented growth, according to a recent Atlantic Council report by Daniel Yergin and Madeline Jowdy. Ten years ago, the U.S. did not export a single tonne of LNG. Today, U.S. exports account for 25 per cent of the global market and have contributed US$400 billion to its gross domestic product (GDP) over the past decade.

The U.S. is now the world’s largest LNG supplier, edging out Qatar and Australia, and according to Yergin and Jowdy, its export market is on track to contribute US$1.3 trillion to U.S. GDP by 2040 and create an average of 500,000 jobs annually.

Last week, Alberta announced a sixfold increase in its proven natural gas reserves to 130 trillion cubic feet (tcf). The new figures push Canada into the top 10 countries with natural gas reserves.

Unfortunately, notwithstanding this vast resource, Canada didn’t even make it to the LNG party and the Americans have been laughing all the way to the bank at Canada’s expense. Our decade-long anti-pipeline and natural resource agenda has cost us dearly and Donald Trump’s trade tariffs are a stake to the heart.

As the world grapples with global warming, natural gas is the perfect transition fuel. It generates half the CO2 emissions of coal, provides needed grid backup for intermittent renewable wind and solar power, and it is relatively easy to commission.

Canada has extensive natural gas reserves, but these reserves are less valuable if we can’t get them to offshore markets where countries will pay a premium for energy generation. Canadian gas is abundant, but, given our smaller market, typically trades at a discount to U.S. gas and a massive discount to European and Asian markets.

The capital-intensive nature of LNG facilities requires long-term supply contracts. Generally, 20-year supply contracts with creditworthy counterparties are required to secure the financing required to build gas infrastructure and liquefaction plants.

For example, as part of a larger strategic deal, Houston-based LNG company NextDecade Corp. signed a 20-year offtake agreement to supply 5.4 million tonnes per annum (mtpa) to French multinational TotalEnergies SE.

As the market grows and matures, the spot market is gaining share, but term contracts continue to represent most of the market. This is a problem for Canada as it tries to break into the market, as much of current and future demand is already committed.

More than half the current LNG market demand, or 225 mtpa, is under contract until 2040, according to Shell PLC’s LNG outlook report for 2024. A further 100 mtpa is contracted to 2045. Shell recently revised its LNG market growth forecast upward to 700 mtpa by 2040 and it estimates the LNG supply currently in operation or under construction already accounts for about 525 mtpa, or almost 75 per cent of the estimated market in 2040.

Even if Canada secured 100 per cent of the available market share (impossible), this represents a fraction of the 130 trillion cubic feet of reserves in Alberta and an infinitesimal amount of Canada’s natural gas reserve.

If Canada wants to sell its LNG to the global market, it needs to be at the starting line now. Canada has seven LNG export projects in various stages of development. They are all in British Columbia. The capacity of these export plants is 50 mtpa and the capital cost is estimated to be $110 billion.

After significant delays and cost overruns, our first export facility, LNG Canada’s 14 mtpa Phase 1 in Kitimat, is set to ship its first cargo to Asia later this year. Phase 2, representing a further 14 mtpa, is still awaiting a final investment decision. The Cedar LNG, Ksi Lisims LNG and Woodfibre LNG projects are licensed, at various stages of development and represent a further 17 mtpa.

Canada’s LNG exports today are a drop in the bucket compared to both our potential and the 88 mtpa exported by the U.S. in 2024. We have one project completed and, if history repeats itself and Canada doesn’t get its act together, the runway for the remaining licensed projects will be long, painful and costly.

Financing large capital projects requires predictability with respect to timing and cost. This is also a problem for Canada. As the oil and gas CEOs have pointed out, LNG market players have lost trust in Canada as an investible jurisdiction for these projects.

In the face of Trump’s trade war, Canadians have become pipeline evangelists. Wishful thinking and political talking points won’t be enough if we repeat our decade of own goals on this file. We have literally left billions on the table.

Governments should fast-track all licensed projects, limit special interest distractions and provide the required muscle and financial support to get these projects up and running as soon as possible.

From Churchill, Man., to Quebec to the Maritimes to British Columbia, we should be making plans for LNG terminals and the required pipeline infrastructure to get this valuable and clean resource to market. And Canadians should pray we haven’t totally missed the market.

Susan McArthur is a former venture capital investor, investment banker and current corporate director. She has previously served on a chemical logistics and oil service board.

-

Business2 days ago

Business2 days agoMaxime Bernier urges Canada to stop threatening US with ‘silly retaliatory tariffs’

-

Business2 days ago

Business2 days agoElon Musk Exposes the System Keeping Government Fraud Alive

-

espionage1 day ago

espionage1 day agoCSIS report says China infiltrated Provincial and Federal Party leadership races in 2022

-

Daily Caller2 days ago

Daily Caller2 days agoBiden Admin ‘Intentionally Buried’ Inconvenient Study To Justify Major Energy Crackdown, Sources Say

-

Courageous Discourse1 day ago

Courageous Discourse1 day agoEurope Turns Totalitarian

-

National1 day ago

National1 day agoDaughter of Canadian PM Mark Carney uses ‘they/them’ pronouns

-

International2 days ago

International2 days agoTrump admin releases long awaited files on JFK, RFK, MLK assassinations

-

Community1 day ago

Community1 day agoThe 2025 Red Deer Hospital Lottery is here! Lower ticket prices!!