Fraser Institute

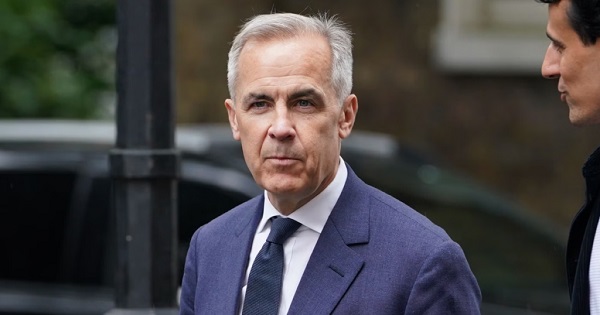

New Prime Minister Carney’s Fiscal Math Doesn’t Add Up

From the Fraser Institute

By Jason Clemens and Jake Fuss

For the first time in Canada’s history, the Prime Minister has never sought or won a democratic election in any parliament. Mark Carney’s victory to replace Justin Trudeau as the leader of the Liberal Party means he is now the Prime Minister. Carney’s resume and achievements make him one of the most accomplished prime ministers ever. Still, there are a number of basic questions about Carney’s fiscal and economic math that Canadians need to consider carefully as we enter an election.

Carney’s accomplishments should be recognized. He has a bachelor’s degree in economics from Harvard and both a masters and doctoral degrees in economics from Oxford University. He spent over a decade at Goldman Sachs, a leading US-based financial firm then left to take up senior positions at both the Bank of Canada and later the Department of Finance. He became the Governor of the Bank of Canada in 2007 and then the Governor of the Bank of England in 2012. After his tenure at the Bank of England, Carney took up a number of private sector posts including chairman at Brookfield Asset Management, a major Canadian company.

Despite these obvious accomplishments and a deep CV, Carney’s proposed fiscal policies pose a number of serious questions.

Carney self-characterizes as a pragmatist and someone who will bring the Liberal Party back to the political centre after having been pushed to the left by former prime minister Justin Trudeau. Even former prime minister Jean Chrétien, one of the country’s most electorally successful prime ministers called for the party to move back to the centre.

Specifically, Carney said he would “cap” the size of the federal government workforce and reduce federal spending through a review of program spending as was done in 1994-95. He also indicated that the operating budget would be balanced within three years. He criticized the current government for spending too much and not investing enough, and for missing spending targets and violating its own fiscal guardrails. The implication of all these policies is that the role of the federal government will be rolled back with reductions in spending and federal employment, and reducing regulations. In many ways, these policies mirror those of former prime minister Chrétien.

However, there are numerous statements by Carney that seem to contradict these policies, or at the very least, water them down significantly. Consider, for instance, that Carney has indicated there will be no cuts to transfers to provincial governments (19.8 per cent of budget spending), no reductions in the income-transfers to individuals and families (25.8 per cent), and the government doesn’t determine interest charges on its debt (another 9.7 per cent). So, Carney has already taken over half the federal budget off the table for reductions.

It’s not clear whether he would reduce what’s referred to as “Other Transfers” which includes support for EV programs and investment incentives. This represents 17.9 per cent of the current budget. And if you read any of Carney’s climate-related initiatives, it appears this category of spending will actually increase, not decrease. Moreover, Carney stated he won’t touch some transfers such as the national dental care and pharmacare programs.

The major remaining category of federal spending is “operating expenses”, which includes the costs of running more than 100 government departments, agencies and Crown corporations. It’s expected to reach $130.6 billion this year and represents 23.4 per cent of the federal budget. But again, Carney has only committed to “capping” the federal workforce despite significant growth since 2015 and then review programs. Unless he’s willing to actually reduce federal employment and/or challenge existing contracts with the civil service, it’s not clear how he can find meaningful savings in the short term.

Recall that the expected deficit this year is $42.2 billion and to balance the budget over the next three years, Carney needs to find roughly $30 billion in savings. (Some of the deficit reduction is expected to come from economic growth, which increases government revenues).

However, this ignores the pressure on the federal government to markedly and quickly increase defense spending. A recent analysis estimated that the federal government would have to increase defense spending in 2027-28 by $68.8 billion to meet its NATO commitment, which is what President Trump is demanding. This single measure of spending could materially derail the new prime minister’s commitment to a balanced budget within three years.

But Carney has complicated the nation’s finances by committing to separating operating spending from capital spending. The former are annual spending requirements like salaries and wages to federal employees, income transfers to people through programs like EI and Old Age Security, and transfers to the provinces for health and social programs. Carney has committed to balancing the revenues collected for these purposes against spending.

However, he wants to remove anything that is deemed an “investment” or “capital”. That means spending on infrastructure like roads and ports, defense spending on equipment, and energy projects.

While Carney has committed to only running a “small deficit” on such spending, the commitment is eerily similar to Trudeau’s commitment in 2015 to run “small deficits” for just “three years” and the budget will balance itself through economic growth. The total federal gross debt has increased from $1.1 trillion when Trudeau took office in 2015 to an estimated $2.3 trillion this year.

The clear risk is that a Carney government will simply reduce spending in the operating budget and move it to the capital budget, thus balancing the latter while still piling up government debt.

Clarity is required from the new prime minister with respect to: 1) What operating expenses does he plan to reduce (or perhaps more generally is open to reducing) over the next three years to reach a balanced operating budget? 2) What specific commitment is Carney making on defense spending over the next three years? 3) What current spending will the new prime minister move or potentially move from the budget to his new capital budget? And finally, 4) What measures will be taken if revenues don’t materialize as expected and/or spending increases more than planned to ensure a balanced operating budget in three years?

Until greater clarity and details are provided, it’s hard, even near impossible, to know the extent to which the new prime minister is pragmatically offering a plan for more sustainable government finances versus playing politics by promising everything to everyone.

Business

Time to unplug Ottawa’s EV sales mandates

From the Fraser Institute

With a federal election looming, a group of Canadian automobile associations want Ottawa to pull the plug on the Trudeau plan to mandate that all new light-duty vehicles sold in Canada be emission-free by 2035. The Canadian Vehicle Manufacturers’ Association, the Global Automakers of Canada and the Canadian Automobile Dealers Association collectively made the request after the government recently ended its incentive program, which included rebates of up to $5,000 for electric vehicle (EV) purchases. Quebec’s EV subsidies are also drying up.

Brian Kingston, head of the Canadian Vehicle Manufacturer’s Association, said the government’s mandate is now “increasingly unrealistic.” No doubt because Canadians remain reluctant to embrace EVs. According to recent report, while 48 per cent of Canadians will shop for a car this year (up from 42 per cent last year), only half (50 per cent) will consider EVs, down 2 per cent since last year.

Similarly, an Auto Trader survey finds that while almost half of non-EV owners are open to buying an EV for their next vehicle, interest in EVs declined for the second year in a row, from 68 per cent to 56 per cent. Things are somewhat rosier for plug-in hybrid vehicles, with purchase consideration for traditional gas-electric hybrids (HEVs) and plug-in hybrids (PHEVs) increasing.

Another 2024 report from J.D. Power finds that “Just 11% of new-vehicle shoppers in Canada say they are ‘very likely’ to consider an electric vehicle (EV) for their next purchase, down 3 percentage points from 2023.” And a recent report from RBC said a softening economy and inflation helped lead to only 28 per cent of Canadians considering an EV purchase in 2024, down from 47 per cent in 2022.

It’s increasingly clear that the Trudeau government’s vaunted EV revolution, where all new cars sold in 2035 are to be EVs, is unlikely to come to pass—particularly without large subsidies that the Trudeau government ended and that Donald Trump is dismantling in the United States. Neither Canadians nor Americans are particularly interested in buying EVs that come with high price tags and inferior performance compared to traditional internal combustion vehicles.

The next federal government—whoever that may be—should heed the call of Canada’s vehicle trade associations and pull the plug on the EV sales mandates for 2035. And allow automakers to plan for making vehicles consumers want now, and will likely still want in 2035.

Business

Next federal government has to unravel mess created by 10 years of Trudeau policies

From the Fraser Institute

It’s no exaggeration to describe the Trudeau years as almost a “lost decade” for Canadian prosperity.

The Justin Trudeau era is ending, after nine-and-a-half years as prime minister. His exit coincides with the onset of a trade crisis with the United States. Trudeau leaves behind a stagnant Canadian economy crippled by dwindling productivity, a long stretch of weak business investment, and waning global competitiveness. These are problems Trudeau chose to ignore throughout his tenure. His successors will not have that luxury.

It’s no exaggeration to describe the Trudeau years as almost a “lost decade” for Canadian prosperity. Measured on a per-person basis, national income today is barely higher than it was in 2015, after stripping out the effects of inflation. On this core metric of citizen wellbeing, Canada has one of the worst records among all advanced economies. We have fallen far behind the U.S., where average real income has grown by 15 per cent over the same period, and most of Europe and Japan, where growth has been in the range of 5-6 per cent.

Meanwhile, Ottawa’s debt has doubled on Trudeau’s watch, and both federal government spending and the size of the public service have ballooned, even as service levels have generally deteriorated. Housing in Canada has never been more expensive relative to average household incomes, and health care has never been harder to access. The statistics on crime point to a decline in public safety in the last decade.

Reviving prosperity will be the most critical task facing Trudeau’s successor. It won’t be easy, due in part to a brewing trade war with the U.S. and the retreat from open markets and free trade in much of the world. But a difficult external environment is no reason for Canada to avoid tackling the domestic impediments that discourage economic growth, business innovation and entrepreneurial wealth creation.

In a recent study, a group of economists and policy advisors outlined an agenda for renewed Canadian prosperity. Several of their main recommendations are briefly summarized below.

Return to the balanced budget policies embraced by the Chretien/Martin and Harper governments from 1995 to 2015. Absent a recession, the federal government should not run deficits. And the next government should eliminate ineffective spending programs and poor-performing federally-funded agencies.

Reform and reduce both personal and business income taxes. Canada’s overall income tax system is increasingly out of line with global best practise and has become a major barrier to attracting private-sector investment, top talent and world-class companies. A significant overhaul of the country’s tax policies is urgently needed.

Retool Ottawa’s existing suite of climate and energy policies to reduce the economic damage done by the long list of regulations, taxes, subsidies and other measures adopted Trudeau. Canada should establish realistic goals for lowering greenhouse gas emissions, not politically manufactured “targets” that are manifestly out of reach. Our climate policy should reflect the fact that Canada’s primary global comparative advantage is as a producer and exporter of energy and energy-intensive goods, agri-food products, minerals and other industrial raw materials which collectively supply more than half of the country’s exports.

Finally, take a knife to interprovincial barriers to trade, investment and labour mobility. These long-standing internal restrictions on commerce increase prices for consumers, inhibit the growth of Canadian-based companies, and result in tens of billions of dollars in lost economic output. The next federal government should lead a national effort to strengthen the Canadian “common market” by eliminating such barriers.

-

Economy1 day ago

Economy1 day agoHere’s how First Nations can access a reliable source of revenue

-

Alberta1 day ago

Alberta1 day agoFormer Chief Judge of Manitoba Proincial Court will lead investigation into AHS procurement process

-

National18 hours ago

National18 hours agoTrudeau fills Canadian courts with Liberal-appointed judges before resigning as prime minister

-

Alberta1 day ago

Alberta1 day agoProvince announces funding for interim cardiac catheterization lab at the Red Deer Regional Hospital

-

International1 day ago

International1 day agoFreeland hints nukes from France, Britain can protect Canada from the Trump ‘threat’

-

Red Deer23 hours ago

Red Deer23 hours agoHistoric Gift to Transform Cardiac Care in Central Alberta

-

Business24 hours ago

Business24 hours agoPremiers Rally For Energy Infrastructure To Counter U.S. Tariff Threats

-

Censorship Industrial Complex21 hours ago

Censorship Industrial Complex21 hours agoMisinformed: Hyped heat deaths and ignored cold deaths