Business

Trump announces “fair and reciprocal” tariffs, warning days of trade abuse are “over”

Quick Hit:

President Donald Trump on Thursday signed a memorandum directing his administration to implement a “fair and reciprocal” trade policy, ensuring that foreign nations imposing high tariffs on American goods will face identical treatment. In a statement on Truth Social, Trump declared that the days of the U.S. being economically exploited are over, vowing to retaliate against trade policies that unfairly disadvantage American businesses.

Key Details:

-

Trump wrote on Truth Social, “For purposes of fairness, I will charge a RECIPROCAL Tariff meaning, whatever Countries charge the United States of America, we will charge them—No more, no less!”

-

The policy will consider Value-Added Tax (VAT) systems—widely used in Europe—as trade barriers equivalent to tariffs, with Trump arguing they are “far more punitive” and used to harm American exports.

-

The administration will crack down on trade loopholes, including countries shipping goods through third-party nations to evade tariffs. “Sending merchandise, product, or anything by any other name through another Country, for purposes of unfairly harming America, will not be accepted,” Trump warned.

Diving Deeper:

Trump’s reciprocal tariff plan is designed to end decades of one-sided trade deals that he says have crippled American industries and workers. By enforcing equal tariffs on foreign nations, Trump is making it clear: If a country charges the U.S. high tariffs, they will face the same in return.

Trump specifically called out countries that manipulate Value-Added Tax (VAT) systems, arguing that these taxes function as hidden trade barriers designed to punish U.S. exports while protecting foreign industries. He declared, “For purposes of this United States Policy, we will consider Countries that use the VAT System, which is far more punitive than a Tariff, to be similar to that of a Tariff.”

Beyond traditional tariffs, Trump’s administration is also cracking down on non-monetary trade barriers, such as regulations designed to block American businesses from competing fairly overseas. He emphasized, “Provisions will be made for Nonmonetary Tariffs and Trade Barriers that some Countries charge in order to keep our product out of their domain or, if they do not even let U.S. businesses operate.”

Additionally, Trump warned against countries attempting to game the system by shipping goods through third-party nations to avoid tariffs. “Sending merchandise, product, or anything by any other name through another Country, for purposes of unfairly harming America, will not be accepted,” he stated.

Critics, including some business groups and investors, argue that tariffs could increase costs for U.S. consumers, but Trump’s supporters say securing fair trade is worth any short-term disruption. JPMorgan CEO Jamie Dimon defended the approach, stating, “If it’s a little inflationary but it’s good for national security, so be it. I mean, get over it.”

Meanwhile, Federal Reserve Chair Jerome Powell sidestepped questions about the policy but acknowledged that trade barriers could influence economic conditions, saying, “It’s not the Fed’s job to make or comment on tariff policy. That’s for elected people.”

Alberta

Snapshots of Alberta and Canadian trade with the US

News release from the Alberta UCP

|

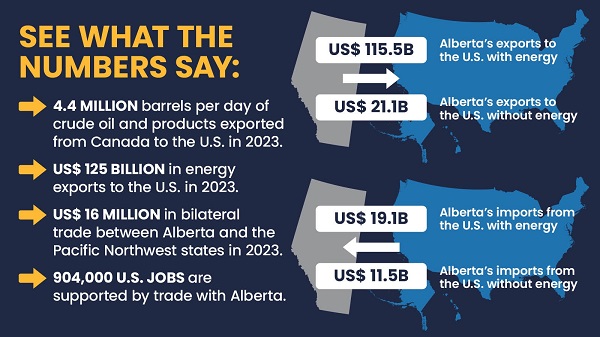

Alberta’s strong relationship with the U.S. is built on energy, trade, and jobs. These numbers highlight just how vital Alberta is to the U.S. economy—and why standing up for our energy sector matters now more than ever.

|

|

|

Alberta’s unmatched energy contributions supply over half of U.S. imported oil through a vast pipeline network—enough to circle the Earth 11 times. This is why protecting Alberta’s energy industry matters for North America’s prosperity.

|

|

|

Alberta’s energy exports fuel U.S. refineries across key states, creating over 25,000 jobs and turning billions of dollars’ worth of Alberta oil into essential products Americans rely on every day.

|

|

|

This snapshot of top U.S. exports to Canada highlights how vital our trade relationship is, with Alberta playing a key role as a major partner and market for American goods.

|

|

|

Energy leads U.S. imports from Canada, with Alberta’s resources powering industries across America and reinforcing our critical economic partnership.

|

|

|

This chart highlights how much Canadians buy from the U.S. compared to what Americans buy from Canada, with Canadians spending over seven times more per person on U.S. goods. Meanwhile, 904,000 American jobs depend on trade with Alberta, making our province a key economic partner.

|

Business

The political gimmick ends: Last day for the GST holiday on booze and books

By Carson Binda

The Canadian Taxpayers Federation is reminding Canadians to stock up on books, beer and baby clothes before the federal government’s GST/HST holiday ends on Feb. 15.

“Even though this temporary tax holiday was a political gimmick, folks should still stock up now to save on the GST,” said Carson Binda, CTF B.C. Director. “Ottawa needs to do more than temporary sales tax holidays, which means politicians must find real savings so taxes can go down permanently.

“But in the meantime, people should take advantage of the tax break before it goes back up.”

The federal government temporarily suspended its sales taxes on a range of goods between Dec. 14, 2024, and Feb. 15, 2025. The temporary tax cut applied to food, alcohol beverages, restaurant meals, children’s clothing, car seats, diapers, toys, Christmas trees and books.

“The government shouldn’t be taxing your baby’s diapers or picture-books,” Binda said. “And restaurants across Canada need long-term tax relief instead of a GST holiday gimmick.”

Nearly two thirds of Canadian restaurants, or 62 per cent, are operating at a loss or barely breaking even, according to data from Restaurants Canada.

The reimposed GST will add five per cent to the cost of restaurant meals in B.C., Alberta, Saskatchewan, Manitoba, the Territories and Quebec. The HST will add 13 per cent in Ontario and 15 per cent in the Atlantic provinces.

The end of the GST holiday would drive up the cost of a case of beer by an average of $4.40 across Canada. Provinces with a harmonized sales tax will see the biggest increases, with a case of beer increasing in cost by $8.04 in Nova Scotia once the sales tax holiday ends.

“Taxpayers and job creators need tax relief from Ottawa,” Binda said. “The government needs to go line-by-line through the federal budget to find real savings for taxpayers.”

-

Crime2 days ago

Crime2 days agoWhy is Trump threatening Canada? The situation is far worse than you think!

-

Health2 days ago

Health2 days agoSenate confirms RFK Jr. as Trump’s secretary of Health and Human Services

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoCollision Course: Boomers Love Canada. Millennials Want A Better Offer

-

Alberta Law Enforcement Response Team1 day ago

Alberta Law Enforcement Response Team1 day agoAlleged Human Traffickers arrested in Red Deer, Montreal, and Edmonton

-

Business2 days ago

Business2 days agoCarbon tariff proposal carries risks and consequences for Canada

-

Business2 days ago

Business2 days agoAn era of Indigenous economic leadership in Canada has begun

-

Community1 day ago

Community1 day agoNew Documentary “Cooking with Hot Stones” Explores History of Fort Assiniboine, Alberta

-

Daily Caller1 day ago

Daily Caller1 day ago‘The One Place We Really Need To Change Policies’: One Of RFK Jr.’s Top Priorities