Business

Within a month, 6 largest U.S. banks leave UN Net-Zero Banking Alliance

From The Center Square

Texas Comptroller Glenn Hegar has expressed skepticism about companies claiming to withdraw from ESG commitments, noting there is often doublespeak in their announcements

Within one month of each other, six of the largest U.S. banks left the United Nations Net-Zero Banking Alliance (NZBA) not soon after Donald Trump was elected president.

Last month, Goldman Sachs was the first to withdraw from the alliance, followed by Wells Fargo, The Center Square reported.

By Dec. 31, Citigroup and Bank of America left, followed by Morgan Stanley on Jan. 6 and JPMorgan on Jan. 7.

They did so after joining the alliance several years ago pledging to require environmental social governance standards (ESG) across their platforms, products and systems.

According to the “bank-led and UN-convened” alliance, global banks joined, pledging to align their lending, investment and capital markets activities with a net-zero greenhouse gas emissions by 2050, NZBA explains.

Since April 2021, 141 banks in 44 countries with more than $61 trillion in assets had joined NZBA, the alliance says. That’s down from 145 banks with more than $73 trillion in assets it reported last month after Wells Fargo and Goldman Sachs withdrew.

“In April 2021 when NZBA launched, no bank had set a science-based sectoral 2030 target for its financed emissions using 1.5°C scenarios,” it says. “Today, over half of NZBA banks have set such targets.”

They started to drop off after President-elect Donald Trump vowed to increase domestic oil and natural gas production and pledged to go after “woke” companies.

They also announced their departure two years after 19 state attorneys general launched an investigation into them for alleged deceptive trade practices connected to ESG.

Four states led the investigation: Arizona, Kentucky, Missouri and Texas. Others involved include Arkansas, Indiana, Kansas, Louisiana, Mississippi, Montana, Nebraska, Oklahoma, Tennessee and Virginia. Five state investigations aren’t public for confidentiality reasons.

In Texas, the state legislature passed a bill, which Gov. Greg Abbott signed into law, that prohibits governmental entities from entering into contracts with companies that boycott the oil and natural gas industry. The law also requires state entities to divest from financial companies that boycott the industry through ESG policies.

To date, 17 companies and 353 publicly traded investment funds are on Texas’ ESG divestment list.

After financial institutions withdraw from the NZBA, they are permitted to do business with Texas, the office of Texas Attorney General says.

However, Texas Comptroller Glenn Hegar has expressed skepticism about companies claiming to withdraw from ESG commitments, noting there is often doublespeak in their announcements, The Center Square reported.

Notably, when leaving the alliance, a Goldman Sachs spokesperson said the company was still committed to the NZBA goals and has “the capabilities to achieve our goals and to support the sustainability objectives of our clients,” EST Today reported. The company also said it was “very focused on the increasingly elevated sustainability standards and reporting requirements imposed by regulators around the world.”

“Goldman Sachs also confirmed that its goal to align its financing activities with net zero by 2050, and its interim sector-specific targets remained in place,” EST Today reported.

Five Goldman Sachs funds are listed in Texas’ ESG divestment list.

While announcing it was leaving the alliance, a JPMorgan spokesperson also affirmed the company’s commitment to reaching net-zero emissions. “We aim to contribute to real-economy decarbonization by providing our clients with the advice and capital needed to transform business models and lower carbon intensity,” the spokesperson said, Reuters reported.

Yahoo!Finance also notes that JPMorgan will continue to work with Glasgow Financial Alliance for Net Zero. “We will also continue to support the banking and investment needs of our clients who are engaged in energy transition and in decarbonizing different sectors of the economy,” the spokesperson said.

Citigroup and Bank of America also remain committed to net-zero objectives, including continuing to report on efforts to achieve 2030 net-zero targets and reducing CO2 emissions associated with corporate lending, FiNews reported.

The Comptroller’s office remains committed to “enforcing the laws of our state as passed by the Texas Legislature,” Hegar said. “Texas tax dollars should not be invested in a manner that undermines our state’s economy or threatens key Texas industries and jobs.”

2025 Federal Election

Poilievre will cancel Mark Carney’s new Liberal packaging law and scrap the Liberal plastic ban!

From Conservative Party Communications

Conservative Leader Pierre Poilievre promised today that a new Conservative government will stop Mark Carney’s proposed Liberal food tax and scrap the existing Liberal plastic ban. Poilievre will:

- Stop proposed new labelling and packaging requirements that will raise the cost of fresh produce by as much as 34% and cost the average Canadian household an additional $400 each year.

- Scrap the Liberal plastics ban, including the ban on straws, grocery bags, food containers and cutlery, and other single-use plastics, letting consumers and businesses choose what works for them.

- Protect restaurants, grocers, and low-income Canadians from one-size-fits-all packaging rules that disproportionately affect those who can least afford it.

“After the Lost Liberal Decade, many Canadians can barely afford to put food on the table. And now Mark Carney and the Liberals want to make it even harder with a new food packaging law that will raise the price of food–again,” said Poilievre. “A new Conservative government will keep food prices down by scrapping the Liberal plastic ban and stopping Carney’s new Liberal food tax.”

After a decade of out-of-control spending and massive tax increases, families are spending $800 more on food this year than they did in 2024, and food banks had to handle a record two million visits in a single month. In Montreal, 44 percent of CEGEP students are experiencing some form of food insecurity, while places like Hawkesbury, Kingston, Toronto and Mississauga have all declared food insecurity emergencies.

And food prices are still rocketing upwards, surging by 3.2% over the last year, with no end in sight. In the last month alone, food inflation increased by 1.9 percentage points—the largest monthly jump in food prices in decades.

As if this wasn’t bad enough, Liberals have made life even more expensive and inconvenient for Canadians by banning plastics – including everything from straws to bags to food packaging. The current Liberal ban on single-use plastics will cost Canadians $1.3 billion dollars over the next decade.

Now Mark Carney wants to make it worse by adding complicated and costly new food packaging rules that will drive up the price of food even more–in effect, a new Liberal food tax. Plastic food packaging makes up 1/3 of all plastic packaging in Canada. The proposed Liberal food tax will cost the average Canadian household an additional $400 each year, waste half a million tonnes of food, decrease access to imported fruit and produce, and increase food inflation. The Chemistry Industry Association of Canada has also warned that this tax will put up to 60,000 Canadians out of work.

“The Liberals’ ideological crusade against convenience has already driven up food prices and the last thing Canadians need is Mark Carney’s new food tax added directly to your grocery bill,” said Poilievre. “The choice for Canadians is clear, a fourth Liberal term that will make food even more expensive or a new Conservative government that will axe the food tax and bring back straws, grocery bags and other items, to make life more affordable and convenient for Canadians – For a Change.”

Business

Ted Cruz, Jim Jordan Ramp Up Pressure On Google Parent Company To Deal With ‘Censorship’

From the Daily Caller News Foundation

By Andi Shae Napier

Republican Texas Sen. Ted Cruz and Republican Ohio Rep. Jim Jordan are turning their attention to Google over concerns that the tech giant is censoring users and infringing on Americans’ free speech rights.

Google’s parent company Alphabet, which also owns YouTube, appears to be the GOP’s next Big Tech target. Lawmakers seem to be turning their attention to Alphabet after Mark Zuckerberg’s Meta ended its controversial fact-checking program in favor of a Community Notes system similar to the one used by Elon Musk’s X.

Cruz recently informed reporters of his and fellow senators’ plans to protect free speech.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here. Thank you!

“Stopping online censorship is a major priority for the Commerce Committee,” Cruz said, as reported by Politico. “And we are going to utilize every point of leverage we have to protect free speech online.”

Following his meeting with Alphabet CEO Sundar Pichai last month, Cruz told the outlet, “Big Tech censorship was the single most important topic.”

Jordan, Chairman of the House Judiciary Committee, sent subpoenas to Alphabet and other tech giants such as Rumble, TikTok and Apple in February regarding “compliance with foreign censorship laws, regulations, judicial orders, or other government-initiated efforts” with the intent to discover how foreign governments, or the Biden administration, have limited Americans’ access to free speech.

“Throughout the previous Congress, the Committee expressed concern over YouTube’s censorship of conservatives and political speech,” Jordan wrote in a letter to Pichai in March. “To develop effective legislation, such as the possible enactment of new statutory limits on the executive branch’s ability to work with Big Tech to restrict the circulation of content and deplatform users, the Committee must first understand how and to what extent the executive branch coerced and colluded with companies and other intermediaries to censor speech.”

Jordan subpoenaed tech CEOs in 2023 as well, including Satya Nadella of Microsoft, Tim Cook of Apple and Pichai, among others.

Despite the recent action against the tech giant, the battle stretches back to President Donald Trump’s first administration. Cruz began his investigation of Google in 2019 when he questioned Karan Bhatia, the company’s Vice President for Government Affairs & Public Policy at the time, in a Senate Judiciary Committee hearing. Cruz brought forth a presentation suggesting tech companies, including Google, were straying from free speech and leaning towards censorship.

Even during Congress’ recess, pressure on Google continues to mount as a federal court ruled Thursday that Google’s ad-tech unit violates U.S. antitrust laws and creates an illegal monopoly. This marks the second antitrust ruling against the tech giant as a different court ruled in 2024 that Google abused its dominance of the online search market.

-

Business1 day ago

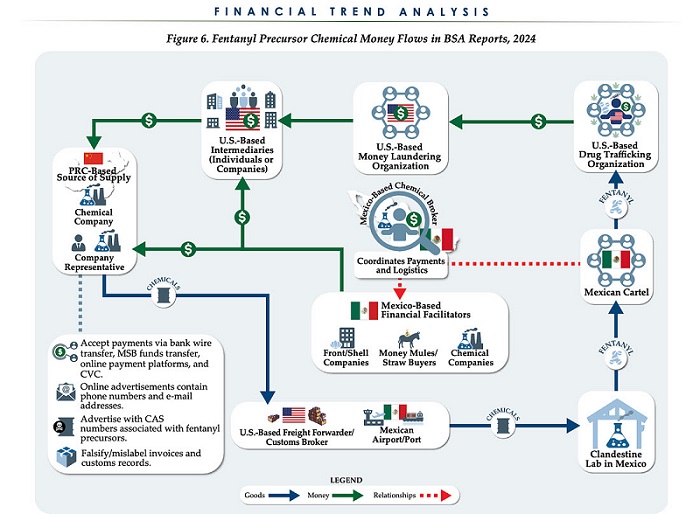

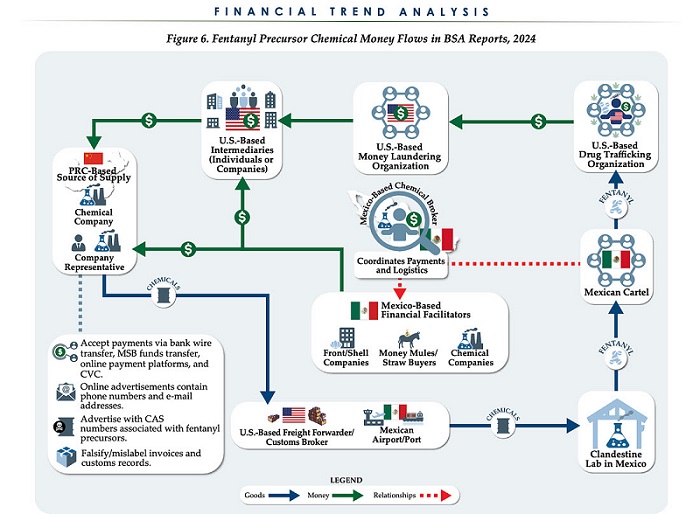

Business1 day agoChina, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoTucker Carlson Interviews Maxime Bernier: Trump’s Tariffs, Mass Immigration, and the Oncoming Canadian Revolution

-

espionage1 day ago

espionage1 day agoEx-NYPD Cop Jailed in Beijing’s Transnational Repatriation Plot, Canada Remains Soft Target

-

Business2 days ago

Business2 days agoDOGE Is Ending The ‘Eternal Life’ Of Government

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBREAKING from THE BUREAU: Pro-Beijing Group That Pushed Erin O’Toole’s Exit Warns Chinese Canadians to “Vote Carefully”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCanada drops retaliatory tariffs on automakers, pauses other tariffs

-

Daily Caller1 day ago

Daily Caller1 day agoDOJ Releases Dossier Of Deported Maryland Man’s Alleged MS-13 Gang Ties

-

Daily Caller1 day ago

Daily Caller1 day agoTrump Executive Orders ensure ‘Beautiful Clean’ Affordable Coal will continue to bolster US energy grid