Business

Taxpocalypse 2025: Trudeau Rings in the New Year with Higher Taxes and Empty Wallets

Taxpayer Federation’s report reveals how Trudeau’s government is using new taxes to crush the middle class, fund wasteful projects, and expand a bloated bureaucracy while Canadians struggle

When the clock strikes midnight, it won’t just be the start of 2025—it’ll mark the beginning of Taxpocalypse 2025, a year where Justin Trudeau’s government will hit the middle class harder than ever before.

The Canadian Taxpayers Federation has released a report that lays bare the financial storm Canadians are about to endure. It’s not just inflation draining your wallet; it’s an avalanche of new taxes designed to fund Trudeau’s bloated government and its endless corruption. Let’s go through the numbers, because you deserve to know what’s really happening.

First, payroll taxes are going up. If you earn $81,200 or more, you’ll be paying $403 more in Canada Pension Plan and Employment Insurance contributions this year. Your employer will also fork out nearly $6,000 per employee. Small businesses—already struggling with inflation and high costs—are being crushed under this weight. This isn’t job creation; it’s job destruction.

Then there’s the carbon tax. Starting tomorrow, it jumps from $80 per tonne to $95, adding 20.9¢ per litre to the cost of gasoline. Filling up a 70-litre tank will now cost you almost $15 in carbon taxes alone. If you heat your home with natural gas, get ready to pay an additional $415 this year. Trudeau claims this is about fighting climate change, but in reality, it’s just another excuse to fill government coffers.

And if you thought inflation was bad, bracket creep makes it worse. As your income grows slightly due to inflation, you’re pushed into higher tax brackets without actually having more buying power. So, you’ll pay more in income tax on money that doesn’t go as far as it did last year. Meanwhile, the wealthy use loopholes to avoid taxes, and the poor get targeted rebates. Once again, it’s the middle class holding the bag.

Don’t believe me about how bad things have gotten under Trudeau? Let’s talk inflation—specifically food inflation. Here are the year-over-year increases:

- 2021: 4.0% (September)

- 2022: 11.0% (October)

- 2023: 8.3% (June)

- 2024: 2.7% (October)

Now, let’s compound that year over year. Since 2021, food prices have soared 28.37%. Think about that—almost a third of your grocery budget wiped out. A dollar that used to buy a loaf of bread now barely buys three-quarters of one. And this year, Trudeau’s new taxes will take even more out of your wallet.

But while you’re paying more for less, Trudeau has been busy inflating something else: the federal public service. Since he took office in 2015, he has added 108,793 new public servants to the federal payroll—a 42% increase in the size of the federal public service. And for what? Are hospitals better staffed? Are services more efficient? Absolutely not. Wait times for healthcare are worse than ever. Infrastructure projects are endlessly delayed.

I’m an independent Canadian journalist exposing corruption, delivering unfiltered truths and untold stories. Join me on Substack for fearless reporting that goes beyond headlines

If you ask me, Trudeau bloated the public sector to artificially keep unemployment numbers down. Let’s be clear: it’s the private sector that provides for the public sector, not the other way around. Every new bureaucrat added to the payroll is funded by taxes from hardworking Canadians—people like you—who are already struggling to make ends meet.

So, under Trudeau, you’re paying more for groceries, more in taxes, and getting less in return. This isn’t governance; it’s theft. But here’s the real insult: all of this money is going to fund Trudeau’s swamp of waste and corruption. Take the ArriveCAN app, a disaster that cost $54 million—for what? A glorified QR code. Contracts were handed out to insiders, many of whom didn’t even do any work.

Then there’s the Green Slush Fund, which has wasted nearly $400 million on pet projects rife with conflicts of interest. Liberal insiders funneled taxpayer money into their own businesses, and Trudeau’s government just shrugged.

The alcohol escalator tax is going up too, adding 2% more to the already sky-high taxes on beer, wine, and spirits. And don’t forget the digital services tax, a 3% levy on platforms like Amazon and Netflix. Experts say most of this cost will be passed directly to consumers.

Final Thoughts

This is Justin Trudeau’s Canada: a nation where the poor are shielded, the rich find their loopholes, and the middle class—the backbone of this country—is bled dry. Payroll taxes, carbon taxes, alcohol taxes, income taxes—it’s all part of an elaborate scheme to fund the bloated vanity projects and corruption of a government that no longer even pretends to care about the people footing the bill.

And while Canadians are working longer hours to afford less, struggling to put food on their tables, start families, or even dream of owning a home, Trudeau jet-sets around the world like royalty. Whether it’s sipping top-shelf wine at a global summit or skiing the pristine slopes of Red Mountain, this guy lives like a king while the rest of you pick up the tab.

It’s no wonder Canadians are booing him in public—it’s not only justified, it’s well deserved. He’s earned every jeer, every shout of frustration, because his leadership has failed this country at every turn. Under Trudeau, affordability has become a joke, and hard work no longer guarantees success.

But here’s the best part, Justin: there’s an election this year. Canadians finally get the chance to tell you exactly what they think of your disastrous leadership. They’ll send your Liberal ship straight into the iceberg, where it belongs.

So, go ahead, call the election. Take the globalist agenda you’ve been so proud to champion, pack it up with your carbon-tax hypocrisy, and prepare for your next gig as a keynote speaker for the World Economic Forum. You’ve proven you’re great at reading from a script that someone else writes—just not at running a country.

Enjoy your top sirloin tonight, Justin. Canadians? They’ll be eating Kraft Dinner while watching your government fall apart. Happy New Year. And Canada, don’t forget: Taxpocalypse 2025 starts tomorrow. Let’s make it the year we take our country back.

Invite your friends and earn rewards

Business

Essential goods shouldn’t be taxed

From the Canadian Taxpayers Federation

By Jay Goldberg

The Trudeau government’s two-month GST holiday on certain items has been called many things.

Former finance minister Chrystia Freeland resignation letter suggests she thinks it’s a “gimmick.”

Conservative Leader Pierre Poilievre has called it a “tax trick.”

But here’s a more fundamental question: If the government thinks Canadians needs a sales tax holiday on certain items, why are those basics taxed in the first place?

Items like car seats, diapers, and pre-prepared foods are all taxed by the feds. They’re all also subject to the federal government’s sales tax holiday, which Prime Minister Justin Trudeau says was triggered because Canadians are having a hard time making ends meet.

“Our government can’t set prices, but we can give Canadians, and especially working Canadians, more money back in their pocket,” said Trudeau at his GST holiday announcement.

At least Trudeau seems to know it’s bad for governments to set prices. But the government does raise prices by adding sales tax on top of goods Canadians have to buy.

And you don’t need to be a parent to know that car seats and diapers are among the most essential goods on a parent’s shopping list.

Take a car seat. A mid-tier car seat costs around $250. The federal sales tax, which is currently at five per cent, adds $12.50 to the final cost of that car seat.

Parents across the country are no doubt asking why things like car seats and diapers were taxed by the feds in November, will be taxed again by the feds in March, but aren’t being taxed right now.

What justification can the government possibly give to parents on Feb. 16, 2025 – the day this sales tax holiday ends – for once again taxing things like car seats and diapers?

The same goes for pre-prepared meals. Many Canadians buy pre-prepared food at grocery stores to bring to work for lunch or to eat on the go. Why are the ingredients for that pre-prepared meal not taxed but the final meal is? And why take the tax off a grocery store deli sandwich now but not a few months from now?

There’s even more of an argument to be made on this front because many provinces don’t tax a lot of the items that are part of the feds’ sales tax holiday.

Take Ontario as an example.

Canada’s most populous province doesn’t tax things like books, children’s clothing, car seats, and diapers. Some pre-prepared foods aren’t taxed either.

If provinces don’t tax these items, why do the feds?

The Trudeau government took inspiration from the NDP when it comes to the GST break. It ought to also take inspiration from the party’s call to make relief permanent.

Trudeau’s GST announcement came just days after NDP Leader Jagmeet Singh called for the permanent removal of the federal sales tax on items like pre-prepared meals, diapers, and car seats. Singh’s proposal actually went much further, and included ending the GST on home heating, as well as internet and phone bills.

In touting his proposal, Singh argued that “those taxes never should have been there in the first place.”

Singh is right. Essential goods shouldn’t be subject to the GST. Period.

Just days after Singh’s announcement, Trudeau played copycat with one of his own.

But a two-month reprieve pales in comparison to permanent relief.

If the Trudeau government wants to deliver real relief to struggling Canadian families, essential items that most provinces already don’t tax, such as diapers, car seats, and pre-prepared meals, should be permanently exempt from the GST.

Permanent sales tax relief is more than doable. The feds could deliver on it without hiking the deficit by taking a sledgehammer to the more than $40 billion a year they hand out in corporate welfare.

Anything less than a permanent sales tax break simply won’t cut it when it comes to cutting costs for Canadians.

Business

US Expands Biometric Technology in Airports Despite Privacy Concerns

Biometric systems promise efficiency at airports, but concerns over data security and transparency persist.

If you’re tired of censorship and surveillance, subscribe to Reclaim The Net.

Biometric technology is being rolled out at US airports at an unprecedented pace, with plans to extend these systems to hundreds more locations in the coming years. The Transportation Security Administration (TSA) is driving a significant push toward facial recognition and other biometric tools, claiming improved efficiency and security. However, the expansion has sparked growing concerns, with privacy advocates and lawmakers voicing concerns about data security, transparency, and the potential for misuse of such technology.

US Customs and Border Protection (CBP) has already implemented its Biometric Facial Comparison system at 238 airports, including 14 international locations. This includes all CBP Preclearance sites and several major departure hubs. CBP says its Biometric Exit program is rapidly gaining traction, with new airport partners joining monthly and positive feedback reported from passengers.

Meanwhile, the TSA has equipped nearly 84 airports with its next-generation Credential Authentication Technology (CAT-2) scanners, which incorporate facial recognition. This rollout is part of a broader effort to bring biometrics to over 400 airports nationwide. These advancements are detailed in a TSA fact sheet aimed at building public awareness of the initiative.

Opposition and Privacy Concerns

Despite assurances from TSA and CBP, critics remain skeptical. Some lawmakers, led by Senator Jeff Merkley, argue that the TSA has yet to justify the need for biometric systems when previous technologies already authenticated IDs effectively. Privacy advocates warn that the widespread use of facial recognition could set a dangerous precedent, normalizing surveillance and threatening individual freedoms.

The debate is closely tied to the federal REAL ID Act, introduced two decades ago to standardize identification requirements for air travel. As of now, many states have failed to fully implement REAL ID standards, and only a portion of Americans have acquired compliant credentials. Reports indicate that fewer than half of Ohio residents and just 32 percent of Kentuckians have updated their IDs, even as the May 7, 2025, deadline approaches.

Biometric Adoption on the Global Stage

Beyond the US, biometric systems are gaining momentum worldwide. India’s Digi Yatra program has attracted 9 million active users, adding 30,000 new downloads daily. The program processes millions of flights while emphasizing privacy by storing data on users’ mobile devices rather than centralized databases. Plans are underway to expand the program further, including international pilots scheduled for mid-2025.

While biometric technology offers alleged benefits, such as faster boarding and enhanced security, it also poses serious risks. Privacy advocates caution against unchecked implementation, especially since, one day, this form of check-in is likely to be mandatory.

The TSA’s aggressive push for biometrics places the United States at the forefront of this global shift.

-

Economy7 hours ago

Economy7 hours agoThe Green Army Will Keep Pushing Unrealistic Energy Transition in 2025 Despite “Reality”

-

Energy8 hours ago

Energy8 hours agoCanada’s Most Impactful Energy Issues in 2024

-

Economy18 hours ago

Economy18 hours agoWhen Potatoes Become a Luxury: Canada’s Grocery Gouging Can’t Continue

-

COVID-1913 hours ago

COVID-1913 hours agoNew Study Finds COVID-19 ‘Vaccination’ Doubles Risk of Post-COVID Death

-

Frontier Centre for Public Policy19 hours ago

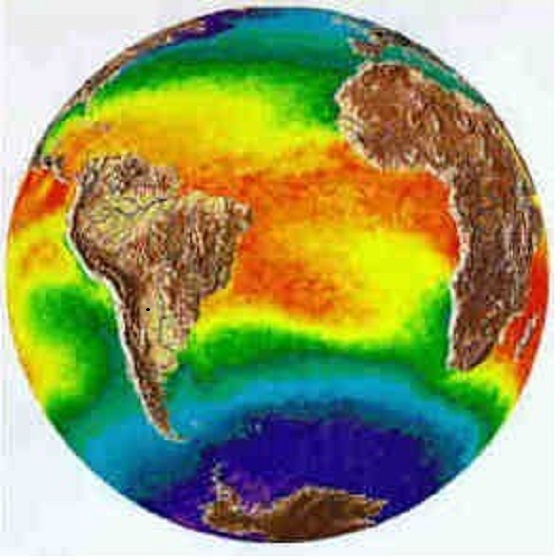

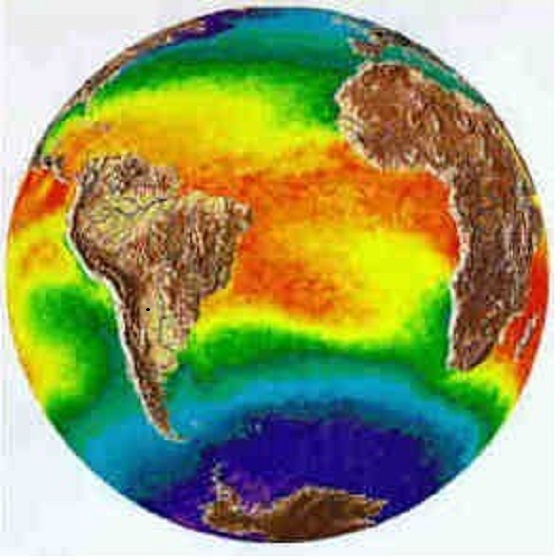

Frontier Centre for Public Policy19 hours agoGlobal Warming Predictions of Doom Are Dubious

-

Health14 hours ago

Health14 hours agoWellness Revolution

-

Censorship Industrial Complex20 hours ago

Censorship Industrial Complex20 hours agoHere’s How The Trump Admin Could Help Crush The Censorship Industry

-

Crime2 days ago

Crime2 days agoDriver of Cybertruck shot himself in head before Vegas explosion