David Clinton

The Hidden and Tragic Costs of Housing and Immigration Policies

We’ve discussed the housing crisis before. That would include the destabilizing combination of housing availability – in particular a weak supply of new construction – and the immigration-driven population growth.

Parsing all the data can be fun, but we shouldn’t forget the human costs of the crisis. There’s the significant financial strain caused by rising ownership and rental costs, the stress so many experience when desperately searching for somewhere decent to live, and the pressure on businesses struggling to pay workers enough to survive in madly expensive cities.

If Canada doesn’t have the resources to house Canadians, should there be fewer of us?

Well we’ve also discussed the real problems caused by low fertility rates. As they’ve already discovered in low-immigration countries like Japan and South Korea, there’s the issue of who will care for the growing numbers of childless elderly. And who – as working-age populations sharply decline – will sign up for the jobs that are necessary to keep things running.

How much are the insights you discover in The Audit worth to you?

Consider becoming a paid subscriber.

The odds are that we’re only a decade or so behind Japan. Remember how a population’s replacement-level fertility rate is around 2.1 percent? Here’s how Canadian “fertility rates per female” have dropped since 1991:

Put differently, Canada’s crude birth rate per 1,000 population dropped from 14.4 in 1991, to 8.8 in 2023.

As a nation, we face very difficult constraints.

But there’s another cost to our problems that’s both powerful and personal, and it exists at a place that overlaps both crises. A recent analysis by the Parliamentary Budget Officer (PBO) frames it in terms of suppressed household formation.

Household formation happens when two more more people choose to share a home. As I’ve written previously, there are enormous economic benefits to such arrangements, and the more permanent and stable the better. There’s also plenty of evidence that children raised within stable families have statistically improved economic, educational, and social outcomes.

But if households can’t form, there won’t be a lot of children.

In fact, the PBO projects that population and housing availability numbers point to the suppression of nearly a half a million households in 2030. And that’s incorporating the government’s optimistic assumptions about their new Immigration Levels Plan (ILP) to reduce targets for both permanent and temporary residents. It also assumes that all 2.8 million non-permanent residents will leave the country when their visas expire. Things will be much worse if either of those assumptions doesn’t work out according to plan.

Think about a half a million suppressed households. That number represents the dreams and life’s goals of at least a million people. Hundreds of thousands of 30-somethings still living in their parents basements. Hundreds of thousands of stable, successful, and socially integrated families that will never exist.

And all that will be largely (although not exclusively) the result of dumb-as-dirt political decisions.

Who says policy doesn’t matter?

How much are the insights you discover in The Audit worth to you?

Consider becoming a paid subscriber.

For the full experience, upgrade your subscription.

Business

The Strange Case of the Disappearing Public Accounts Report

A few days ago, Public Services and Procurement Canada tabled their audited consolidated financial statements of the Government of Canada for 2024. This is the official and complete report on the state of government finances. When I say “complete”, I mean the report’s half million words stretch across three volumes and total more than 1,300 pages.

Together, these volumes provide the most comprehensive and authoritative view of the federal government’s financial management and accountability for the fiscal year ending March 31, 2024. The tragedy is that no one has the time and energy needed to read and properly understand all that data. But the report identifies problems serious enough to deserve the attention of all Canadians – and especially policy makers.

The Audit is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Following the approach of my Parliamentary Briefings series, I uploaded all three volumes of the report to my AI research assistant and asked for its thoughts. Each one of the observations that came out the other end is significant and, in calmer and more rational times, could easily have driven a week’s worth of news coverage. But given the craziness of the past few weeks and months, they’re being largely ignored.

With that in mind, I’ve made this special edition of the Parliamentary Briefings series fully accessible to all subscribers.

We begin with a summary of the purpose and scope of the three uploaded volumes of the Public Accounts of Canada for 2023–2024:

Volume I: Summary Report and Consolidated Financial Statements

- Purpose: Provides a high-level overview of the federal government’s financial performance, presenting the consolidated financial statements audited by the Auditor General. It serves as the primary accountability report.

- Scope:

- Audited financial statements.

- Analysis of revenues, expenses, and the accumulated deficit.

- Overview of assets, liabilities, and financial position.

- Discussion of economic context, risks, uncertainties, and ten-year comparative financial data.

Volume II: Details of Expenses and Revenues

- Purpose: Presents the financial operations of the government, broken down by ministries and agencies, for detailed accountability.

- Scope:

- Financial transactions segregated by ministry.

- Details of appropriations, revenues, and transfer payments.

- Summary tables on ministerial expenditures by type, object, and other dimensions.

- Appendices providing additional details on budgetary authorities and their sources.

Volume III: Additional Information and Analyses

- Purpose: Offers supplementary analyses and financial data beyond what is included in the first two volumes, focusing on revolving funds, professional services, and shared-cost programs.

- Scope:

- Financial statements of revolving funds (e.g., Passport Canada, Canadian Grain Commission).

- Expenditure details on acquisitions, transfer payments, and public debt charges.

- Analyses of federal-provincial shared-cost programs and claims against the Crown.

- Miscellaneous financial and operational data for broader transparency.

The Audit: Based on these documents, could you identify the most serious threats to Canada’s economic stability?

From the Public Accounts of Canada 2023–2024, several serious threats to Canada’s economic security can be identified. These threats emerge from the broader fiscal and economic analyses, contingent liabilities, and uncertainties highlighted in the documents.

1. Growing Public Debt and Debt Servicing Costs

- Observation: Canada’s public debt charges increased significantly in 2024, rising by 35.2% year-over-year, largely due to higher interest rates on debt. The total accumulated federal debt stood at $1.24 trillion, representing 42.1% of GDP, up from 41.1% the previous year.

- Risk: Rising debt servicing costs reduce fiscal space for critical public investments, making the economy vulnerable to future economic shocks or downturns.

2. Contingent Liabilities and Indigenous Claims

- Observation: The government recorded $16.4 billion in contingent liabilities related to Indigenous claims in 2024, reflecting ongoing efforts to address past injustices. These liabilities have been increasing at an average annual growth rate of 30% since 2016.

- Risk: The unpredictable nature and scale of these liabilities could create significant financial pressures if settlements or court decisions require substantial payouts.

3. Legacy Costs from the COVID-19 Pandemic

- Observation: The government recorded $4.7 billion in pandemic-related expenses for 2024, including write-offs for expired vaccines and provisions for unrecovered loans and benefits.

- Risk: These costs highlight vulnerabilities in emergency financial planning and expose the government to further financial risks if similar large-scale public health crises occur.

4. Economic Pressures from High Inflation and Interest Rates

- Observation: Inflation returned to the Bank of Canada’s 2% target by mid-2024 after 41 consecutive months above this threshold. However, elevated interest rates (peaking at 5%) contributed to a softening economy.

- Risk: Prolonged periods of high interest rates could suppress household and business spending, slowing economic growth and increasing the likelihood of a recession.

5. Climate Change and Environmental Commitments

- Observation: Significant spending is allocated to addressing climate change, with over $1 billion dedicated to environmental programs in 2024, including pollution pricing proceeds and clean energy initiatives.

- Risk: Canada’s reliance on resource-intensive industries and increasing costs to meet climate targets create economic vulnerabilities, particularly in regions heavily reliant on fossil fuels.

6. Global Economic Instability

- Observation: Global supply chain disruptions, energy price volatility, and geopolitical events (e.g., Russia’s invasion of Ukraine) significantly impacted Canada’s economy, with slower GDP growth (1.5% in 2023) and reduced trade.

- Risk: External shocks could exacerbate domestic economic challenges, such as rising import costs or reduced demand for Canadian exports.

7. Labor Market and Productivity Challenges

- Observation: While job creation remained positive, population growth outpaced employment gains, leading to an increase in the unemployment rate to 6.5% by October 2024. Productivity improvements have been uneven.

- Risk: Labor shortages in key sectors and declining workforce participation among certain demographics (e.g., aging population) could undermine economic resilience.

8. Dependence on Resource Revenues

- Observation: Volatile global commodity prices impacted nominal GDP growth, with gains slowing to 2.9% in 2023 after double-digit growth in prior years.

- Risk: Fluctuations in resource revenues leave Canada exposed to external shocks, particularly in provinces like Alberta and Saskatchewan, heavily reliant on oil and gas.

These challenges underscore the need for proactive fiscal and policy measures to safeguard economic stability, manage liabilities, and address emerging risks.

The Audit: What would you recommend as the three most urgent areas to address to avoid deepening the economic crisis?

1. Manage Rising Public Debt and Debt Servicing Costs

- Why It’s Urgent: The rapid increase in public debt charges (35.2% in 2024) is crowding out fiscal space for essential programs. The federal debt, at 42.1% of GDP, has become a significant liability, with interest rate fluctuations posing an ongoing threat.

- Recommendations:

- Introduce stricter fiscal discipline by prioritizing expenditures that yield long-term economic benefits (e.g., infrastructure, innovation).

- Develop a comprehensive debt reduction strategy to stabilize the debt-to-GDP ratio in the medium term.

- Explore debt refinancing strategies to lock in lower interest rates where feasible.

- Impact: Reducing debt servicing pressures will free up resources for critical investments and improve Canada’s fiscal resilience.

2. Mitigate the Economic Impact of Contingent Liabilities

- Why It’s Urgent: Contingent liabilities related to Indigenous claims have grown exponentially (30% annually since 2016), creating fiscal unpredictability and potentially overwhelming future budgets.

- Recommendations:

- Accelerate settlement negotiations to limit litigation costs and interest on outstanding claims.

- Establish a transparent reserve fund specifically for contingent liabilities, ensuring predictable future payouts.

- Increase collaboration with Indigenous communities to address systemic issues and prevent further claims.

- Impact: Resolving liabilities promptly will reduce fiscal uncertainty and demonstrate Canada’s commitment to reconciliation.

3. Address Structural Labor Market and Productivity Challenges

- Why It’s Urgent: Despite job creation, rising unemployment (6.5% in late 2024) and productivity stagnation threaten long-term economic growth. Labor shortages in critical sectors further exacerbate vulnerabilities.

- Recommendations:

- Expand skilled immigration programs to address labor shortages in healthcare, technology, and green industries.

- Increase investment in workforce retraining programs, particularly for sectors undergoing automation or transition due to climate policies.

- Promote workplace flexibility and childcare access to increase labor force participation, particularly among women and aging workers.

- Impact: Enhancing workforce productivity and participation will strengthen the economic foundation and support GDP growth.

Rationale for Prioritization

These areas represent the most immediate threats to economic security and fiscal stability. Addressing them proactively can reduce vulnerabilities and position Canada for sustainable growth.

The Audit: What are the most surprising and disturbing details in these documents?

1. Rapid Growth of Public Debt Charges

- Detail: Public debt charges increased by 35.2% year-over-year to $47.3 billion, representing one of the fastest-growing expense categories. This reflects a combination of higher interest rates and the significant size of Canada’s debt.

- Why Disturbing: Such a rapid increase in debt servicing costs could divert funds from essential public services and programs. It also signals limited fiscal flexibility in the event of future economic shocks.

2. Ballooning Contingent Liabilities

- Detail: The federal government recorded $16.4 billion in expenses for Indigenous contingent liabilities in 2024. This is part of an ongoing surge, with liabilities increasing by 30% annually since 2016.

- Why Disturbing: While reconciliation efforts are vital, the sheer scale and rapid growth of these liabilities are fiscally unsustainable without structural changes or dedicated funding mechanisms. The risk of further liabilities emerging adds to fiscal uncertainty.

3. Significant Write-offs and Provisions for Pandemic Programs

- Detail: The government wrote off $1.2 billion in expired COVID-19 vaccines and therapeutics and recorded $3.5 billion in provisions for unrecovered pandemic-era loans.

- Why Disturbing: These figures highlight inefficiencies in planning and administration during the pandemic response, leading to substantial financial losses. The scale of unrecovered funds also raises questions about accountability in the deployment of emergency programs.

4. Rising Unemployment Despite Job Creation

- Detail: While 475,000 jobs were created in 2023, the unemployment rate rose to 6.5% by late 2024 due to population growth outpacing employment gains.

- Why Surprising: Despite strong job creation, an inability to keep pace with population growth signals structural issues in labor force integration. This poses a risk to Canada’s economic competitiveness and social cohesion.

5. Declining Corporate Income Tax Revenues

- Detail: Corporate income tax revenues decreased by 0.7%, driven by reduced taxable income despite an overall increase in total revenues.

- Why Surprising: The decline in corporate tax revenues during a period of economic recovery raises concerns about potential tax avoidance, economic inequality, or over-reliance on other revenue streams, such as personal income taxes.

6. Substantial Environmental and Climate Spending

- Detail: Over $1 billion was allocated to environmental programs, including pollution pricing proceeds. However, the documents note Canada’s slow progress toward net-zero targets and risks to resource-dependent provinces.

- Why Disturbing: While necessary, this spending may be insufficient given the scale of the climate challenge. The mismatch between spending and measurable progress on climate goals risks long-term environmental and economic consequences.

7. Unanticipated Costs of Indigenous Reconciliation

- Detail: Beyond contingent liabilities, the government is facing unpredictable settlement costs due to increasing litigation and the complexity of claims. These have already exceeded $60 billion since 2016.

- Why Disturbing: The ongoing financial impact of these settlements reflects Canada’s historical neglect of Indigenous issues. Resolving these claims is essential, but the lack of predictability or dedicated funding highlights systemic shortcomings in reconciliation strategies.

8. Softened GDP Growth and Inflation Challenges

- Detail: Real GDP growth slowed to 1.5% in 2023, and inflation remained high throughout the year, only reaching the Bank of Canada’s 2% target by mid-2024.

- Why Disturbing: The prolonged inflationary period and sluggish growth signal a fragile recovery. These economic conditions could exacerbate income inequality and lead to further fiscal strain.

9. High Provisions for Unrecovered Loans

- Detail: Provisions of $3.5 billion were recorded for emergency loans provided during the pandemic. The government continues to face difficulties in recovering these funds.

- Why Disturbing: This provision raises serious questions about the efficiency of loan administration and the government’s ability to safeguard public funds during emergencies.

10. Heavy Dependence on Volatile Resource Revenues

- Detail: Nominal GDP growth slowed to 2.9% in 2023, largely due to easing commodity prices after a surge in 2022. Resource dependence remains a key economic vulnerability.

- Why Surprising: Despite global shifts toward renewable energy, Canada’s reliance on resource revenues remains high, posing long-term risks to economic diversification and stability.

Invite your friends and earn rewards

Business

Global Affairs Canada Foreign Aid: An Update

Canadian Taxpayers are funding programs in foreign countries with little effect

Back in early November I reached out to Global Affairs Canada (GAC) for a response to questions I later posed in my What Happens When Ministries Go Rogue post. You might recall how GAC has contributed billions of dollars to the Global Fund to Fight AIDS, Tuberculosis and Malaria, only to badly miss their stated program objectives. Here, for the record, is my original email:

I’m doing research into GAC program spending and I’m having trouble tracking down information. For instance, your Project Browser tool tells me that, between 2008 and 2022, Canada committed $3.065 billion to the Global Fund to Fight AIDS, Tuberculosis and Malaria. The tool includes very specific outcomes (like a drop of at least 40 per cent in malaria mortality rates). Unfortunately, according to reliable public health data, none of the targets were even close to being achieved – especially in the years since 2015.

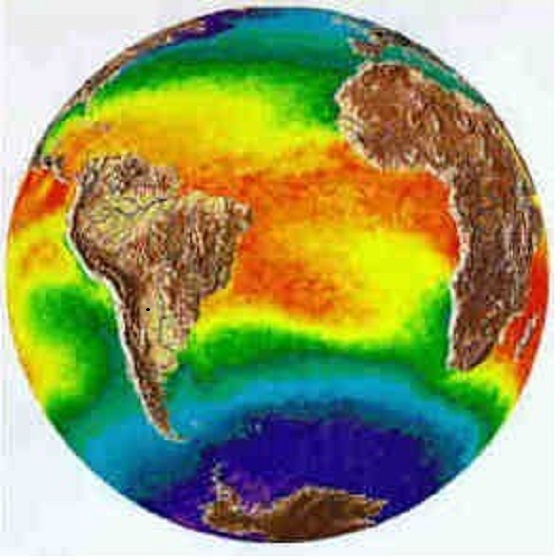

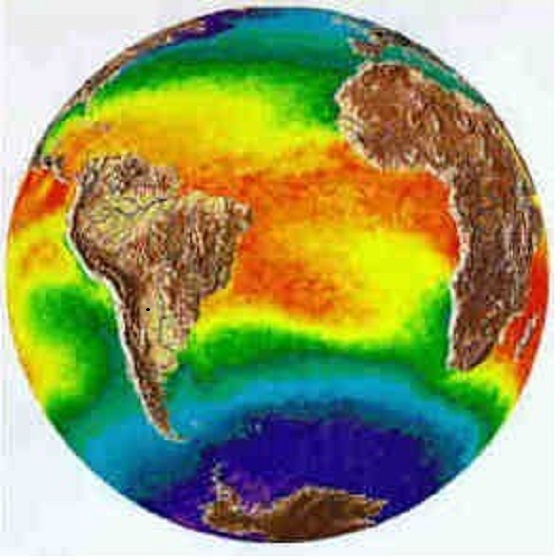

Similarly, Canada’s $125 million of funding to the World Food Programme between 2016 and 2021 to fight hunger in Africa roughly corresponded to a regional rise in malnutrition from 15 to 19.7 percent of the population since 2013.

I’ve been able to find no official documentation that GAC has ever conducted reviews of these programs (and others like it) or that you’ve reconsidered various funding choices in light of such failures. Is there data or information that I’m missing?

Just a few days ago, an official in the Business Intelligence Unit for Global Affairs Canada responded with a detailed email. He first directed me to some slightly dated but comprehensive assessments of the Global Fund, links to related audits and investigations, and a description of the program methodology.

The Audit is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

To their credit, the MOPAN 2022 Global Fund report identified five areas where important targets were missed, including the rollout of anti-corruption and fraud policies and building resilient and sustainable systems for health. That self-awareness inspires some confidence. And, in general, the assessments were comprehensive and serious.

What initially led me to suggest that GAC was running on autopilot and ignoring the real world impact of their spending was, in part, due to the minimalist structure of the GAC’s primary reporting system (their website). But it turns out that the one-dimensional objectives listed there did not fully reflect the actual program goals.

Nevertheless, none of the documents addressed my core questions:

- Why had the programs failed to meet at least some of their mortality targets?

- Why, after years of such shortfalls, did GAC continue to fully fund the programs?

The methodology document did focus a lot of attention on modelling counterfactuals. In other words, estimating how many people didn’t die due to their interventions. One issue with that is, by definition, counterfactuals are speculative. But the bigger problem is that, given at least some of the actual real-world results, they’re simply wrong.

As I originally wrote:

Our World in Data numbers give us a pretty good picture of how things played out in the real world. Tragically, Malaria killed 562,000 people in 2015 and 627,000 in 2020. That’s a jump of 11.6 percent as opposed to the 40 percent decline that was expected. According to the WHO, there were 1.6 million tuberculosis victims in 2015 against 1.2 million in 2023. That’s a 24.7 percent drop – impressive, but not quite the required 35 per cent.

I couldn’t quickly find the precise HIV data mentioned in the program expectations, but I did see that HIV deaths dropped by 26 percent between 2015 and 2021. So that’s a win.

I’m now inclined to acknowledge that the Global Fund is serious about regularly assessing their work. It wouldn’t be fair to characterize GAC operations as completely blind.

But at the same time, over the course of many years, the actual results haven’t come close to matching the programs objectives. Why has the federal government not shifted the significant funding involved to more effective operations?

The Audit is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

-

Economy1 day ago

Economy1 day agoThe Green Army Will Keep Pushing Unrealistic Energy Transition in 2025 Despite “Reality”

-

Energy1 day ago

Energy1 day agoCanada’s Most Impactful Energy Issues in 2024

-

Economy2 days ago

Economy2 days agoWhen Potatoes Become a Luxury: Canada’s Grocery Gouging Can’t Continue

-

espionage16 hours ago

espionage16 hours agoIn 2025 Critical Political Choices Will Define Canada’s Future: Clement

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoGlobal Warming Predictions of Doom Are Dubious

-

COVID-191 day ago

COVID-191 day agoNew Study Finds COVID-19 ‘Vaccination’ Doubles Risk of Post-COVID Death

-

Health1 day ago

Health1 day agoWellness Revolution

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoHere’s How The Trump Admin Could Help Crush The Censorship Industry