Business

Government Subsidies and the Oil and Gas Industry

A look at Strathcona Resources Ltd.

Does the Canadian government subsidize companies operating in our oil and gas sector? According to research by science and technology journalist Emily Chung, between $4.5 billion and $81 billion of public funds are spent each year for assistance to the industry. But Chung notes how ambiguous definitions (what exactly is a subsidy?) mean that those numbers come with serious caveats.

I thought I’d make this discussion a bit more manageable by focusing on just one industry player: Strathcona Resources Ltd.

Strathcona is big. They produce around 185,000 barrels of oil equivalent each day and the company is currently ranked 98th among publicly traded companies in Canada in terms of market cap ($5 billion) and 88th for operating margin (21.59%).

The Audit does this work in part because paid subscribers share the load. Why not join, too?

What Is a Subsidy?

In the context of their report on the fossil fuel industry, the Department of Finance Canada asserts that “subsidies” can include:

- tax expenditures,

- grants and contributions,

- government loans or loan guarantees at favourable rates,

- resources sold by government at below-market rates

- research and development funding

- government intervention in markets to lower prices

The report defines tax expenditures as:

A type of tax measure, such as a preferential tax rate, exemption, deduction, deferral, or credit, with which the government aims to achieve public policy objectives through the tax system.

In the specific context of Strathcona, I could find no evidence that they’d received any direct public funding or “bailouts”. The government did recently announce a billion dollar partnership with the Canada Growth Fund (CGF) to build carbon capture and sequestration infrastructure, but that’s clearly an investment and not a subsidy. CGF is a Canadian arm’s-length crown corporation whose investments are managed by the Public Sector Pension Investment Board.

Strathcona’s 2023 Annual Report includes a reference to only one loan liability, but that had already been paid off and, in any case, wasn’t guaranteed by any level of government.

What Tax Benefits Does Strathcona Receive?

Many. The company’s annual report discusses its $6.1 billion “tax pool”. The pool is made up of deductions and credits that it can’t use this year, but that can be deferred for use in future years. Here’s how those break down:

The “Other Tax Deductions” item includes the Scientific Research and Experimental Development (SRED) deduction. That represents amounts spent on SRED-eligible research that companies can deduct from their payable taxes.

What Grant Funding Does Strathcona Receive?

Open Government data reports that only two federal grants were awarded to Strathcona, both in 2023. The first, worth $3.2 million, came from Natural Resources Canada as part of their Energy Innovation Program. Its purpose was development of Lindbergh Semi-Closed Cycle Flue Gas Recirculation and Carbon Capture.

The second grant was worth $12.5 million. It involved Environment and Climate Change Canada looking for an Orion Organic Rankine Cycle Waste Heat Recovery and Power Generation Project.

What Benefits Do Governments Receive From Strathcona?

Government subsidies don’t exist in a vacuum. As a rule, it’s assumed that subsidies to the private sector work as an investment whose primary payback is in profitable economic activity. Governments can also enjoy direct benefits.

In 2023, for example, Strathcona paid more than $405 million in crown royalties to provincial governments. They also spent $2.4 billion as operating expenses that included labor, energy costs, transportation, processing, and facility maintenance. Most of that money was spent in Canada.

A very rough estimate would suggest that total annual personal income taxes generated by people employed by Strathcona would be somewhere around $14 million. Vendors might pay another $13 million in corporate taxes.

There are also indirect benefits. For instance, those with jobs around the oil patch are, obviously, not unemployed and receiving EI benefits.

We could also take into account the larger impact Strathcona has on the general economy. Think about the food, shelter, clothing, and entertainment spending done by the families of Strathcona (and their vendors’) employees. That money, too, performs important social and economic service.

So does Strathcona receive more from government subsidies than the money they feed back into government accounts? Well, the $405 million in crown royalties are likely annual payments, as are the $27 million paid as income taxes. That’s what governments get. On the other side of the balance sheet, there is the $6.1 billion in deferred taxes and $16 million in grants. Those will probably be amortized over multiple years.

But does the word “subsidy” really describe tax benefits in any useful way? After all, there’s no company in all Canada – my own company included – that doesn’t deduct legitimate business expenses. And each and every Canadian receives similar benefits whenever they file their T1. For illustration, a Canadian whose total income happened to match the national average ($55,600) pays around $5,600 less in taxes each year due to various deductions and credits – including the basic personal amount.

Does that mean we’re all receiving government subsidies? There’s nothing wrong with thinking about it that way, but it does kind of strip the word of any real meaning.

Now you could reasonably argue that $6 billion is an awful lot of deferred tax, especially for a company with a 22% operating margin. And you could look to the tax code’s complexity for answers as to how this could have happened. But that’s not a subsidy in any coherent sense.

Think the tax code should be reformed? The line forms right behind me. However, the problem with playing around with the tax code is that changes apply to everyone, not just Strathcona or some other preferred target. Successfully anticipating how that might play out in dark and unanticipated ways isn’t the kind of thing for which governments are famous.

The Audit does this work in part because paid subscribers share the load. Why not join, too?

Business

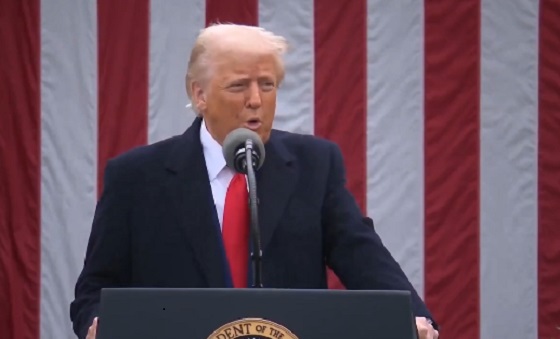

Trump’s ‘Liberation Day’ – Good News for Canadian Energy and Great News for WCSB Natural Gas

By Maureen McCall

April 2 was ‘Liberation Day’ according to U.S. President Donald Trump. While the announcement of U.S. reciprocal tariffs was not good news for many countries, Trump’s announcement also had some good news for Canadian Energy companies – 0% tariffs. Some tariffs against Canada are still in place, but for now, no energy sector tariffs against Canada underscores the importance of Canadian energy to the Trump administration.

President Trump announced new tariffs on April 2nd, which he dubbed “Liberation Day” with a 10% baseline tariff for all U.S. trading partners, to go into effect on April 5th. He also announced more reciprocal tariffs against the “worst offenders,” which will go into effect on April 9th but no tariffs on Canadian energy were announced.

Trump’s Reciprocal Tariffs Announcement

Alberta Premier Danielle Smith celebrated the win which she says is precisely what she has been advocating for from the U.S. Administration for months.

“The United States has decided to uphold the majority of the free trade agreement (CUSMA) between our two nations. It also appears this will continue to be the case until after the Canadian Federal election has concluded and the newly elected Canadian government is able to renegotiate CUSMA with the U.S. Administration. It means that the majority of goods sold into the United States from Canada will have no tariffs applied to them, including 0% tariffs on energy, minerals, agricultural products, uranium, seafood, potash and a host of other Canadian goods.”

This is great news for Canadian energy producers, especially natural gas producers who are experiencing dramatic growth in the Montney.

At this year’s S&P Global CERAWeek, Mike Verney, Executive Vice-President of petroleum reserves with McDaniel & Associates Consultants Ltd. had great news for Canadian companies.

McDaniel’s study, commissioned by the Alberta Energy Regulator (AER), reported data indicating that Alberta has proven natural gas reserves of 130 trillion cubic feet (TCF), compared to previous provincial estimates of only 24 TCF. According to the study, if probable gas reserves are added in, the overall figure is 144 TCF.

As reported in the Financial Post, Verney said “We’re growing like mad in the Montney. The major natural gas plays in the U.S. are actually declining versus the Montney that is actually growing.”

This message was echoed by Michael Rose, the Chairman, President and Chief Executive Officer of Tourmaline Oil, Canada’s largest natural gas producer during his keynote address at the SPE Canadian Energy Technology Conference and Exhibition last month in Calgary.

Not a Sunset Industry

Michael Rose – Chairman, President and Chief Executive Officer of Tourmaline Oil

Rose opened his keynote speech with optimism saying: “This is not a sunset industry- it is closer to sunrise than sunset” and spoke about Canada’s compelling opportunity for natural gas production as well as Tourmaline’s successes.

Reuters reports that analysts are wondering about the U.S.’s ability to meet the demand growth of booming liquefied natural gas (LNG) projects and also to meet huge domestic demand for natural gas-fired electricity generation to supply new data centre growth. Canada’s resources in Alberta’s Deep Basin and the North East BC Montney will be a huge supply source.

Deep Basin and the Montney are where the most competitive gas plays are found, and where Tourmaline operates as well as producing oil in the Peace River Triassic Lake.

Rose credits technology development and the building and ownership of midstream infrastructures as keys to affordability and profitability for Canadian companies which can control costs by controlling more of the production cycle. In addition, AI optimization has helped the company increase production. He also pointed out the environmental advantage of natural gas production. Since society needs the energy density of hydrocarbons to power industries, natural gas is the best choice as it is “the cleanest member of the fossil fuel stack.” He quoted Arjun Murti– 30 year Wall Street research analyst, buy-side investor, and advisor covering the global energy sector now with Veriten.com who asserts that there is no real energy transition and the only thing humans have actually transitioned off in the energy world is whale oil.

Rose said that 2022 statistics indicated the world set a record for all sources of energy. He pointed out that coal was supposed to replace wood 200 years ago, and it still hasn’t while wood, which has been renamed as biomass is still 7% of the overall energy stack.

The Golden Age of Gas

Rose’s natural gas outlook to 2028 in Canada was rosy saying gas “never looked better.” Beyond 2028 also looks good with a proliferation of electricity generation planned to feed data centre growth. In Alberta alone, 15 projects are in queue which will create a material increase in demand. In the U.S. however, some large U.S. natural gas supply basins have reached a tipping point with only 50% estimated ultimate recovery (EUR) left. Rose reported that drilling inventory is an issue in the U.S. but not in Canada. For example, Tourmaline has over 20 years of Tier 1 drilling inventory left while its U.S. peers don’t have the same luxury. He noted that U.S. M&A is currently driven by a quest for inventory. He noted that U.S. companies will chase profitable acquisitions in a quest for inventory to lower future costs saying “Things are still cheap in Canada.”

Canadian Resources – Will we ever be an energy superpower?

With global exploration down sharply, focus has turned to the WCSB where in the case of the Montney, only 5% has been produced so far.

“All you hear about is the western Canadian sedimentary basin and it is a monster, and it is the gift that keeps on giving, but we’re actually blessed with multiple other opportunities. Like the U.S., a number of them are off limits for government policy reasons, but certainly changes are in order.”

Some of the undeveloped basins in Canada which Rose referred to as “forbidden basins” are located on the West Coast and in the lowlands in Quebec. The tariff issue may be changing attitudes towards oil and gas development in those areas. Dealing with an unsupportive Federal Government for the last decade has made capital attraction difficult. Routine talk about phasing out Oil and Gas and the series of regulations, bills and initiatives that have stalled basin development and new pipelines have taken its toll. It has discouraged capital from flowing into the sector – a period that Rose said “ felt like an endless hurricane.”

So what is the right path forward?

The challenge for industry and policymakers is finding the right balance between energy and the environment according to Rose. He advises that setting unrealistic goals and timelines that are not based in science/technology or economics won’t work, and notes a shift away from the time frame set by net zero.

“We look at the whole environment, air, land and water, and we develop plans to improve performance in all three. We have a group of young engineers working on what amounts to an embedded clean tech business within our company, and I think they’re having a lot of fun doing it.”

One of Tourmaline’s longest initiatives, is the conversion of drilling rigs from diesel to natural gas, using field gas for fuel. The result is that projects have an improved economic return as well as reduced emissions. Rose says this year, Tourmaline will cross a “200 million barrier” and will have displaced 200 million litres of diesel and save $200 million including the makeup gas used. He says they like to think of it as a drill bit to burn initiative.

Mike Rose still had an optimistic view of the path forward for energy companies that is certainly more relevant after yesterday’s “Liberation Day” announcement from Trump.

“We’ve missed 10 years of opportunities,” Rose said. “It would have made us so much stronger than we are today as an industry and a country. Still, late is better than never. The only thing I’ll say about tariffs is that they are just another curve ball. We’ve had nothing but curve balls for 10 years, and we’ll figure out how to hit this one too. Given how integrated both countries’ energy systems are and will continue to be, I think a great narrative that just might appeal is: ‘Let’s make North America the world’s preeminent energy and oil and gas superpower’.”

Maureen McCall is an energy professional who writes on issues affecting the energy industry.

Business

B.C. Credit Downgrade Signals Deepening Fiscal Trouble

Dan Knight

Dan Knight

Spending is up, debt is exploding, and taxpayers are footing the bill—how David Eby’s reckless economics just pushed British Columbia one step closer to the brink.

So here’s something they’re not going to explain on CBC—British Columbia just got slapped with yet another credit downgrade. Actually, two. On April 2nd, both S&P Global and Moody’s—two of the most powerful financial watchdogs on the planet—downgraded B.C.’s credit rating. And not by accident. This wasn’t a glitch in the system or some market hiccup. This was a direct consequence of political recklessness.

Let’s talk numbers. S&P cut B.C.’s rating from ‘AA-’ to ‘A+’. Moody’s dropped it from ‘aa1’ to ‘aa2’. That’s the fourth downgrade in four years. Four. This is a province that used to hold AAA status—the financial gold standard. That means British Columbia was once considered one of the most fiscally stable jurisdictions not just in Canada, but globally. Not anymore.

Even more alarming? S&P didn’t just hit their long-term rating—they downgraded the short-term rating too, from ‘A-1+’ to ‘A-1’. Why? Because even in the short term, B.C. is starting to look like a risk. A liquidity risk. That means the money might not be there when it’s needed. That’s a red flag for anyone with a calculator and a memory longer than five minutes.

This is not some vague bureaucratic move. This is a direct indictment of the NDP’s economic policies in British Columbia. This is what happens when you treat taxpayers like an ATM machine and the economy like a social experiment. And now, international financial institutions are officially saying what a lot of people have been screaming for years: B.C. is in serious fiscal trouble.

Causes: Spending, Deficits, and Revenue Pressure

The core driver behind the downgrades is the ballooning of operating and capital deficits, coupled with aggressive government spending. According to B.C.’s 2025 budget, unveiled by Finance Minister Brenda Bailey on March 4, the provincial deficit is projected to hit $10.9 billion in 2025–26—up from $9.1 billion the previous year. Moody’s projects an even higher shortfall of $14.3 billion, raising red flags about B.C.’s ability to fund programs without unsustainable borrowing.

S&P cited the impact of reduced immigration levels and ongoing trade uncertainty as key headwinds, limiting economic growth and shrinking the province’s revenue base. Moody’s pointed to persistent budgetary gaps and limited progress on deficit reduction, highlighting the growing gap between revenue and expenditure.

Additionally, spending growth has significantly outpaced both population and inflation. Data from the Fraser Institute shows that between 2019/20 and 2024/25, program spending increased by 51.6%, whereas only 29.2% was needed to keep pace with demographic and price trends. This excess has pushed real per-capita expenditures to historic highs, without a corresponding rise in revenue.

Opposition Blames NDP Mismanagement for Downgrade

But what does that actually mean for real people—not bureaucrats, not lobbyists—but the mom on a fixed income buying groceries? So I reached out to John Rustad, leader of the Official Opposition in B.C., to ask exactly that.

“Two downgrades! Absolute disaster,” he told me. “Under David Eby, we’ve gone from a AAA status to a single A with a negative outlook. This government’s reckless spending and irresponsible management will have a devastating effect—not just today, but for generations to come.”

He’s not exaggerating. According to Rustad, by the end of this fiscal period, B.C.’s debt will have nearly tripled since the NDP took power. Let that sink in—tripled. And no, this isn’t just some abstract macroeconomic trend. This hits you. Directly.

Rustad laid it out. These downgrades mean higher borrowing costs for the province. That’s code for more taxpayer money getting funneled into interest payments instead of hospitals, schools, or—God forbid—tax relief.

“By the end of this fiscal plan, even before the downgrade and before the loss of billions in carbon tax revenue, interest payments were projected to hit $7 billion annually,” Rustad said. “That’s about 30% of personal income tax revenue—just to pay the interest.”

That’s money you send to Victoria every month—just lighting it on fire.

And with the downgrade? Expect to pay another $1 billion more in interest. That’s around $200 per person, per year. Not for roads. Not for services. Just to keep the debt monster fed.

Meanwhile, Premier David Eby—well, he’s had months to plan for replacing the carbon tax, and guess what? Still no plan. Rustad told me he expected Eby to raise industrial taxes to make up the difference, but even that hasn’t happened yet. For now, the hole is just growing—a $2 billion loss in carbon tax revenue on top of an $11 billion deficit.

So What Does This Mean for the Average Mom?

In response to a direct question about what this credit downgrade means for a mother living on a fixed income, Opposition Leader John Rustad laid out the long-term consequences in no uncertain terms:

“The average person will not notice this immediately. But what it does mean is higher borrowing costs, So with the massive deficit and debt, more money will need to be spent on interest payments. By the end of this fiscal, before loss of billions in carbon tax revenue and before the debt downgrades, interest payments would increase to about $7 billion by the end of the fiscal plan. To put that in perspective, that would be the equivalent of 30% or more of personal income taxes just to pay interest.”

He continued:

“The debt downgrades mean the province will have to pay more in interest—likely 1/4 to 1/2% more. On $220+ billion, that could mean $1 billion more in interest. That could be about $200 per man, woman and child annually in more interest by 2027.”

And with no plan to rein in spending, Rustad issued a stark warning:

“The compounding problem is: will this mean service cuts, more taxes, or yet more debt to be paid by our children?”

Final Thoughts

So here’s a question no one on CBC is going to ask: What actually happens when a progressive government can’t manage a budget? I’ll tell you. You get poorer. That’s what happens. You, the person who gets up every day and works a real job, pays the price while the people in charge keep living large off your labour.

Let’s walk through it. First, you pay provincial income tax—a tax just for working. Imagine that. You go out, earn a living, and the government takes a cut just because you dared to be productive. Then there’s the PST—you buy something, anything, and you get taxed again. Why? Because you had the audacity to participate in the economy.

And then there’s the carbon tax, the holy grail of progressive grifts. This wasn’t about saving the planet—it was about propping up the very same government that couldn’t manage a piggy bank, let alone a provincial budget. That tax was floating David Eby’s spending addiction. Now it’s gone, and surprise—there’s no plan to replace it. Just more debt, more interest, and more economic chaos.

But wait—here’s the part that really insults your intelligence. After taxing you into the ground, they turn around and say, “Don’t worry, we’ll give you a rebate.” A rebate? You mean you’re going to give me back a tiny fraction of the money you stole from me and act like you’re doing me a favour? Please. That’s not generosity—it’s gaslighting. It’s economic abuse wrapped in a government cheque.

And that’s why I keep saying it: fiscal responsibility matters. Because I’d rather have that money in my wallet, feeding my kids, paying my bills, building my future—than watching David Eby burn it on pet projects, political theatre, and bloated bureaucracy.

But here’s the thing—there is hope. It’s not all doom and despair. In the last election, something incredible happened. The BC Conservatives, a party written off by the elites and ignored by the media, pulled off a political miracle. They surged from obscurity to contention—why? Because regular people are waking up. Because the voters who pay the bills, raise the kids, and still believe in common sense are done being treated like ATMs for a government that doesn’t even pretend to respect them.

And maybe—just maybe—after a little more pain, after a little more David Eby-style financial recklessness, the voters of this province will finally realize why fiscal responsibility matters. Not because it sounds good in a press release, but because without it, your future vanishes. Your freedom shrinks. And the people in charge? They just keep spending.

So next time, when the ballots are counted and the smoke clears, maybe British Columbia will finally remember who this province belongs to—not to bureaucrats, not to activists, not to the political class in Victoria—but to you.

And that day can’t come soon enough.

Subscribe to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

-

Alberta2 days ago

Alberta2 days agoOwner sells gas for 80 cents per litre to show Albertans how low prices ‘could’ be

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoMORE OF THE SAME: Mark Carney Admits He Will Not Repeal the Liberal’s Bill C-69 – The ‘No Pipelines’ Bill

-

Break The Needle1 day ago

Break The Needle1 day agoWhy psychedelic therapy is stuck in the waiting room

-

Automotive1 day ago

Automotive1 day agoTrump Must Act to Halt the Tesla Terror Campaign

-

2025 Federal Election1 day ago

2025 Federal Election1 day ago‘Coordinated and Alarming’: Allegations of Chinese Voter Suppression in 2021 Race That Flipped Toronto Riding to Liberals and Paul Chiang

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoThree cheers for Poilievre’s alcohol tax cut

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoDon’t let the Liberals fool you on electric cars

-

Opinion2 days ago

Opinion2 days agoSome scientists advocate creating human bodies for ‘spare parts.’