Business

From Smug to Subservient, Justin Trudeau Bows to MAGA Realities at Mar-a-Lago

After years of mocking Trump and betting on a woke Washington, Trudeau now finds himself groveling to save Canada’s economy from MAGA’s hardball tactics.

Justin Trudeau has spent years mocking and deriding the MAGA movement, banking on a continuation of woke, progressive leadership in Washington. He bet everything on a Kamala Harris presidency, believing the days of Donald Trump’s America-first agenda were a distant memory. Now, with Trump back in office, Trudeau finds himself groveling at Mar-a-Lago, trying to salvage what’s left of Canada’s crumbling economic future.

This is the same Justin Trudeau who painted MAGA as a dangerous fringe movement, aligning himself with global elites and lecturing Americans on their supposed moral failings. He openly scoffed at Trump’s tariffs, his immigration policies, and his tough-on-China stance. Trudeau’s bet? That a Democrat-controlled America would reward his sycophantic pandering with favorable trade deals and continued subsidies for his progressive fantasies.

But Trudeau’s gamble failed. Trump is back, and Trudeau’s entire house of cards is collapsing. Canada’s economy, propped up by unfair trade advantages and U.S. energy consumption, is suddenly exposed. The 25% tariff threat on Canadian imports has Trudeau scrambling, not with bold leadership, but with empty promises and nervous laughter at Mar-a-Lago.

In a moment of pure irony, Trudeau, who once lectured Trump about values, now finds himself kneeling to kiss the ring. MAGA, what? Gone is the smug defiance, replaced by desperate platitudes about border security and economic cooperation. But let’s be clear: Trudeau isn’t there to protect Canadian interests; he’s there to save face. His government is woefully unprepared for Trump’s hardball tactics, and the Prime Minister’s office knows it.

During a recent dinner at Mar-a-Lago, President-elect Donald Trump reportedly suggested that Canada could become the 51st U.S. state if it couldn’t handle the economic impact of proposed tariffs. This remark came after Prime Minister Justin Trudeau expressed concerns that a 25% tariff on Canadian imports would “kill” Canada’s economy.

Trump’s comment underscores the significant economic interdependence between the two nations. In 2022, trade between the U.S. and Canada exceeded $900 billion, with the U.S. accounting for 63.4% of Canada’s global trade. This deep economic integration means that shifts in U.S. trade policy can have profound effects on Canada’s economy.

Trump’s quip about Canada becoming the “51st state” wasn’t just a joke; it was a power move, a reminder of who holds the cards in this relationship. While Trudeau nervously laughed, the message was clear: Canada needs the U.S. far more than the U.S. needs Canada. Trudeau’s weakness has brought us here. Instead of securing energy independence, he’s strangled Alberta’s oil industry with crippling regulations. Instead of standing up to China, he’s kowtowed to Beijing while relying on U.S. trade to keep his agenda afloat.

And now, Trudeau is at the mercy of a man he spent years mocking. Trump’s tariffs are a direct consequence of Trudeau’s inability to lead. His failure to address illegal immigration and the fentanyl crisis has made Canada not just a bad neighbor, but a liability.

Trudeau’s Liberals have always been more concerned with appearances than action, more focused on virtue signaling than real governance. But now, the bill has come due. And the man holding the ledger is none other than Donald J. Trump.

So here we are: Justin Trudeau, the woke globalist, reduced to pleading for mercy at Mar-a-Lago. His smugness replaced by desperation, his rhetoric exposed as hollow. MAGA what, indeed.

Subscribe to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

Business

While Canada’s population explodes, the federal workforce grows even faster

From the Fraser Institute

By Ben Eisen and Milagros Palacios

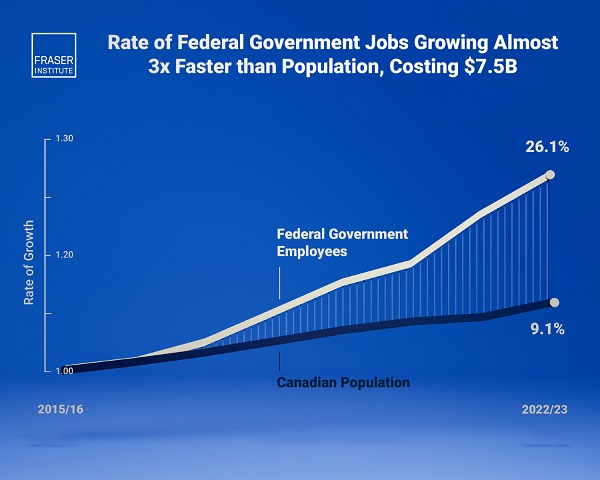

Hiring by the federal government in excess of population growth cost taxpayers $7.5 billion in 2022/23.

The federal workforce has grown more rapidly than the Canadian population starting in 2015/16, imposing significant costs on taxpayers, finds a new study published by the Fraser Institute, an independent, non-partisan Canadian public policy think tank.

Federal government employment has grown significantly faster than the Canadian population starting in 2015/16, and we’re already seeing the consequences,” said Ben Eisen, senior fellow at the Fraser Institute and author of Growing Government Workforce Puts Pressure on Federal Finances, the first in a series of studies on federal reform.

The study finds that between 2015/16 and 2022/23, the latest year of data available, the number of full-time federal workers has increased by 26.1 per cent compared to growth in the overall Canadian population of 9.1 per cent.

“Growth in federal employment has almost tripled the rate of population growth since 2015/16, which is simply unsustainable” commented Eisen.

How much will this growth in government cost Canadian taxpayers?

According to the study, if federal hiring had simply kept pace with the rate of Canada’s population growth taxpayers would have saved $7.5 billion.

The reduced spending on federal employees would lower the federal deficit, which is expected to exceed $35.3 billion in 2022/23.

“The growth in the number of federal employees has been a major contributor to the growth in federal government spending and the size of deficits in recent years,” Eisen said.

- The Canadian federal government workforce has grown more rapidly than the Canadian population starting in 2015/16, imposing significant costs on taxpayers.

- In fact, between 2015/16 and 2022/23, the latest year of data available, the number of full-time federal government workers has increased by 26.1 per cent, compared to growth in the overall Canadian population of 9.1 per cent.

- If federal hiring had simply kept pace with the rate of Canada’s population growth taxpayers would have saved $7.5 billion.

- The reduced spending on federal employees would lower the federal deficit, which is expected to exceed $35.3 billion in 2022/23.

Alberta

Alberta government’s fiscal update underscores need for rainy-day account

From the Fraser Institute

By Tegan Hill

According to the Smith government’s recent fiscal update, the government’s $2.9 billion projected budget surplus has increased to a $4.6 budget surplus in 2024/25 mainly due to higher-than-expected resource revenue. But the resource boom that fuels Alberta’s fiscal fortunes could end at any moment and pile more government debt on the backs of Albertans.

Resource revenue, fuelled by commodity prices (including oil and gas), is inherently volatile. For perspective, in just the last decade, the Alberta government’s annual resource revenue has been as low as $2.8 billion (2015/16) and accounted for just 6.5 per cent of total government revenue. In contrast, according to the Smith government’s fiscal update, projected resource revenue is $20.3 billion this fiscal year and will account for more than a quarter (26.1 per cent) of total government revenue.

But here’s the problem.

Successive Alberta governments—including the Smith government—have included nearly all resource revenue in the budget. In times of relatively high resource revenue, such as we’re currently experiencing, the government typically enjoys surpluses and, flush with cash, increases spending. But when resource revenues decline, the province’s finances turn to deficits.

The last time this happened Alberta ran nearly uninterrupted deficits from 2008/09 to 2020/21 while the province’s net financial position deteriorated by nearly $95 billion. As a result, Albertans went from paying $58 per person on annual provincial government debt interest costs to nearly $600 per person.

So how can the Smith government avoid the same fate as past Alberta governments who wallowed in red ink when the boom-and-bust cycle inevitably turned to bust?

The answer is simple—save during good times to help avoid deficits during bad times. The provincial government should determine a stable amount of resource revenue to be included in the budget annually and deposit any resource revenue above that amount automatically in a rainy-day account to be withdrawn in years when resource revenue falls below that stable amount.

This wouldn’t be Alberta’s first rainy-day account. In fact, the Alberta Sustainability Fund (ASF), established in 2003, was intended to operate this way. A major problem with the ASF, however, was that it was based in statutory law, which meant the Alberta government could unilaterally change the rules governing the fund. Consequently, the stable amount was routinely increased and by 2007 nearly all resource revenue was used for annual spending. The ASF was eventually drained and eliminated entirely in 2013. This time, the government should make the fund’s rules constitutional, which would help ensure it’s sustained over time.

Put simply, funds in a resurrected ASF will provide stability in the future by mitigating the impact of cyclical declines on the budget over the long term.

In the recent fiscal update, the Alberta government continues to risk relying on relatively high resource revenue to balance the budget. To avoid deficits and truly stabilize provincial finances for the future, the Smith government should reintroduce a rainy-day account.

Tegan Hill

Director, Alberta Policy, Fraser Institute

-

COVID-192 days ago

COVID-192 days agoNew York City workers fired for refusing COVID jab ask Trump, Vance, RFK Jr. to reinstate them

-

Business2 days ago

Business2 days agoTaxpayer watchdog says Canadian gov’t needs to use Trump ‘blueprint’ and create efficiency agency

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoMamas, Don’t Let Your Babies Grow Up To Be Running Backs (Pt.2)

-

illegal immigration1 day ago

illegal immigration1 day agoCourt rules in favor of Texas in razor wire case

-

National1 day ago

National1 day ago2SLGBTQIA+ group bullies small Canadian town for rejecting ‘pride flag’

-

COVID-191 day ago

COVID-191 day agoCanadian doctor ordered to pay back $600k she earned through mass COVID vaccination

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoHealth Risks from Water Fluoridation are not just in RFK’s Head

-

Daily Caller2 days ago

Daily Caller2 days agoLet Them Eat Cake