Business

Provincial governments should follow Manitoba’s lead and allow the online sale of alcoholic beverages from other provinces

From the Montreal Economic Institute

By Shal Marriott and Gabriel Giguère

Removing Interprovincial Barriers to Online Alcohol Sales

Canada’s provincial and territorial governments should allow consumers to shop online for alcoholic beverages produced elsewhere in the country, indicates an MEI publication.

“The restrictions imposed by provincial alcohol monopolies are such that it is sometimes easier for a Canadian producer to sell its products on the other side of the world than in the province next door,” explains Shal Marriott, research associate at the MEI and author of the study. “By allowing producers to sell their products online, directly to consumers, our provincial governments would remove obstacles to their growth.”

In 2019, the federal, provincial, and territorial governments had committed to improving interprovincial trade in alcoholic beverages. This commitment stems directly from the Canadian Free Trade Agreement, signed two years before.

Manitoba is the only province to allow its residents to shop online for Canadian alcoholic beverages from other provinces, without restriction.

British Columbia, Saskatchewan, Alberta, and Nova Scotia have partial restrictions, allowing consumers to shop online for certain categories of products from specific parts of the country.

Ontario, Quebec, New Brunswick, Prince Edward Island, and Newfoundland and Labrador each continue to prohibit consumers from shopping online for alcoholic beverages from outside the province.

“By opening the door to this online commerce, our provincial governments would allow consumers to discover new products that they otherwise cannot purchase at home,” says Ms. Marriott. “This is the kind of simple measure that could also give our microbreweries, our wineries, and our distilleries a helping hand.”

The alcoholic beverage sector contributes over $4.4 billion to the Canadian economy, according to the latest available data.

Viewpoint calling on Canada’s provincial governments to allow the unrestricted online purchase and shipment of alcoholic beverages from one province to another

* * *

This Viewpoint was prepared by Shal Marriott, Research Associate at the MEI, in collaboration with Gabriel Giguère, Senior Policy Analyst at the MEI. The MEI’s Regulation Series aims to examine the often unintended consequences for individuals and businesses of various laws and rules, in contrast with their stated goals.

In October 2012, retiree Gerard Comeau was stopped by the RCMP and fined for bringing a too large quantity of beer and liquor from Quebec into New Brunswick, violating the personal exemption limit in place. In its ruling on the Comeau case in April 2018, the Supreme Court of Canada upheld provincial governments’ right to maintain such restrictions, provided they did not intentionally impede interprovincial alcohol trade.(1)

A year later, however, the federal government and the provinces agreed on an Action Plan “to enhance interprovincial trade of alcoholic beverages,” stemming from the 2017 Canadian Free Trade Agreement (CFTA).(2) This included increasing, and ultimately eliminating, personal use exemption limits (which set the amount of alcohol one can bring back from another province) and creating e-commerce platforms.(3)

Some progress has been made to raise or remove personal exemption limits across the country, meaning that Canadians can now import and transport alcohol more easily across most provincial lines for personal consumption, without penalty.(4) Most provinces, however, have failed to liberalize other areas of interprovincial alcohol trade, such as interprovincial online retail sales of alcoholic products, thus depriving Canadians of the benefits of greater competition, namely a broader choice of products and lower prices.

The Current State of Online Alcohol Retail Sales

There have been some efforts to allow greater freedom in online alcohol sales, such as Saskatchewan and British Columbia allowing a limited form of direct-to-consumer sales and shipping of wine and craft spirits from producers in the other province.(5) However, most Canadian provinces continue to prohibit the online retail sale of alcoholic beverages from other provinces directly to their consumers. For example, the Société des alcools du Québec (SAQ) states that while producers are not restricted formally from offering to sell to residents of Quebec, it is illegal for those Quebec residents to make such purchases and have them shipped into the province.(6)

As can be seen in Table 1, few provinces allow producers from other provinces to ship directly to consumers. Manitoba is the only Canadian province with no interprovincial online purchasing restrictions. The restrictions that have been removed in Western provinces and Nova Scotia are also relatively limited (and mainly concern wine). Quebec and Ontario retain complete prohibitions, which is hardly surprising as they are also among the provinces that have made the least progress towards the liberalization of internal trade more broadly.(7)

While we see some improvement in Alberta’s willingness to allow some direct-to-consumer shipments, continued protectionism still exists in the province’s alcohol trade. For example, in January 2024, the Alberta Gaming, Liquor and Cannabis (AGLC) corporation argued that direct-to-consumer shipping was having a negative impact on the provincial liquor monopoly.(8) In reaction, it threatened to stop selling BC wines in its stores until this practice ceased, and this position was seemingly supported by the Alberta government as there was no action to condemn the stance of the AGLC.(9)

Although a memorandum of understanding was reached six months later, ending a temporary ban that had been imposed, this showcases that provincial liquor monopolies, and provincial governments, are willing to enforce interprovincial trade barriers that ultimately deprive Canadian producers and consumers.(10)

The Benefits of Direct-to-Consumer Purchasing Online

There has been a general growth in the online consumer goods market, but Canadian producers and consumers of alcohol products have been unable to fully participate in, and benefit from, this opportunity. This protects provincial alcohol monopolies with their brick-and-mortar stores, which are thus shielded from online competition, at the expense of consumers and producers, whose ability to engage in trade with each other is limited.(11)

Liquor monopolies thus find it easier to impose artificially high prices on the products they retail. The SAQ, for instance, imposes markups on bottles of wine which, when combined with excise and sales taxes, can account for over 75% of the retail price of the product.(12)

Abolishing these restrictions on interprovincial shipping directly to consumers would allow Canadians in any province to freely order online from alcohol producers anywhere in the country. Online sales are one of the most convenient ways for consumers to purchase alcohol from other provinces. Opening up this type of commerce would also be good for smaller breweries, wineries, and distilleries, allowing them to expand their reach within the domestic market.

The federal government has declared a commitment to an increasingly liberalized domestic alcohol market.(13) Yet, this liberalization is being hindered by provincial governments and alcohol monopolies that limit the growth of the domestic market. For the sake of Canadian consumers and producers alike, the provinces should simply allow the unrestricted online purchase and shipment of alcohol from other provinces.

Business

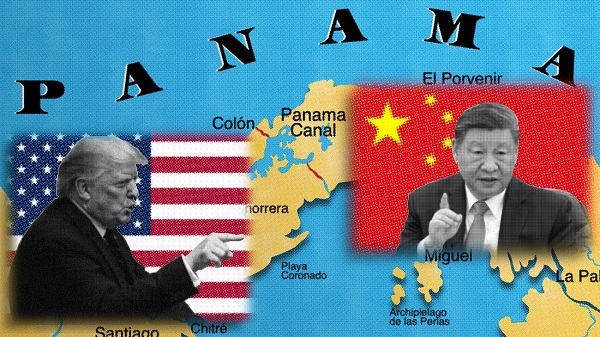

Timeline: Panama Canal Politics, Policy, and Tensions

By Greg Collard and James Rushmore

By Greg Collard and James Rushmore

Hegseth’s visit to Panama includes strongly-worded speeches directed at China

While the trade war with China plays out, another war of political rhetoric is heating up again over the Panama Canal.

Defense Secretary Pete Hegseth was in Panama this week, and pointed out America’s military presence and joint training exercises with Panamanians. Though he said the U.S. doesn’t seek war and that “war with China is certainly not inevitable,” he had a strong military message for the CCP:

Racket News is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Our relationship is growing in part to meet communist China’s rising challenge. China-based companies continue to control critical infrastructure in the canal area that gives China the potential to conduct surveillance activities across Panama. This makes Panama and the United States less secure, less prosperous, and less sovereign.

He said “China will not weaponize this canal,” and it will stay that way “through the deterrent power of the strongest, most effective, and most lethal fighting force in the world.”

Hegseth followed up Wednesday with a similar message to the Central American Security Conference.

The era of capitulating to coercion by the communist Chinese is over. They’re growing an adversarial control of strategic land and critical infrastructure in this hemisphere cannot and will not stand. To accomplish this, our countries cannot face these shared threats alone. We have to face them together. America will confront, will deter, and if necessary defeat these threats alongside all of you, our close and valued partners. Our mission is simple: achieve peace through strength through an America first approach. We’re doing this by restoring the warrior ethos, rebuilding our military and reestablishing deterrence.

Obviously, that didn’t go over well with China. Its embassy in Panama accuses the U.S. of hypocrisy as it “repeats ad nauseam the ‘Chinese interference and influence.’” It noted the U.S. invaded Panama in 1989 and asked: “Who represents the real threat to the Channel? People will make their own judgment.”

(In making that judgment, a reminder that the U.S. still controlled the Panama Canal in 1989, and Panama was run by dictator Manuel Noriega who had been indicted in the U.S. on drug crimes. He was also a former CIA informant, and American officials knew about his crimes — which included helping Pablo Escobar — for years before doing anything about it).

China’s influence over the Canal has grown since 2017, when Panama severed ties with Taiwan and established diplomatic relations with China. A Chinese company controls the largest port on the Atlantic side of the Canal, and a Hong Kong company, CK Hutchinson, controls ports on both ends of the Canal. Last month, BlackRock, an American investment firm, reached a deal to buy CK Hutchinson’s ports, but that deal could be in jeopardy of falling through. Chinese firms are also building a bridge across the Canal.

President Trump has said the U.S. should have never given up the canal to Panama, which occurred on Dec. 31, 1999, as agreed to in treaties that President Carter signed in 1977 and won Senate approval the following year.

While critics place a lot of blame on Carter, Presidents Nixon and Ford started the negotiations. There was bipartisan support to reach a deal (there was even a tentative deal in place in 1967, but a coup in Panama ended those negotiations) because there were tensions and sometimes violence between locals and Americans. The audio below is from a 1976 NBC story that describes life inside the barbed wire fence that surrounded the Canal Zone: “Its 40,000 American residents, both military and civilian, enjoy a suburban lifestyle.” Panamanians on the other side of the fence were resentful.

Ronald Reagan changed the political debate over the Canal during his primary challenge to Ford in 1976. Opposition to any deal with Panama became the focus of his campaign. Reagan says in the ad below: “We bought it, we paid for it, and General Torrijos (Panama’s dictator) should be told we’re going to keep it.”

The message was effective. Reagan won 24 states, and Ford didn’t secure the GOP nomination until the Republican National Convention.

Today’s debate over the Panama Canal

The Panama Canal was not a campaign issue in 2024. Trump first complained about passage rates charged to the Navy and U.S. shipping companies in two December 21 social media posts. Trump wrote that if the situation does not improve, “we will demand that the Panama Canal be returned to us, in full, and without question. To the Officials of Panama, please be guided accordingly!”

He repeated those criticisms and threats in a speech the following day:

It was not given for the benefit of others by a token of cooperation, but it was given to Panama and to the people of Panama, but it has provisions. You gotta treat us fairly, and they haven’t treated us fairly. If the principles, both moral and legal, of this magnanimous gesture of giving are not followed, then we demand that the Panama Canal be returned to the United States of America in full, quickly and without question.

Congresswoman Debbie Wasserman Schultz called that “preposterous.” House Minority Leader Hakeem Jeffries also dismissed the idea of regaining control of the Panama Canal.

But Democratic Congressman Jared Moskowitz said Trump has a point. He dismissed the idea of taking the Canal by force, but said “the United States reasserting its history in the Panama Canal is actually a good, important, strategic issue.”

At a hearing in January, Senate Commerce Committee Chairman Ted Cruz voiced concern about the bridge that Chinese firms are building across the Canal.

The partially-completed bridge gives China the ability to block the Canal without warning, and the ports give China ready observation posts to time that action. This situation poses acute risks to U.S. national security.

A witness at that hearing, George Mason international law professor Eugene Kontorovich, testified that the presence of a Chinese company essentially means the Chinese military has a presence in the Canal.

In a communist regime, distinctions between private and government-owned firms are not as absolute or clear-cut as in a Western liberal society. This is particularly the case for the People’s Republic of China (PRC), which has an official doctrine known as “Military-Civilian Fusion,” a top-level strategy of the CCP Central Committee since 2019.

Here’s a timeline of key events in the history of the Panama Canal leading up to this week’s speeches from Hegseth.

January 22, 1903

The U.S. and Colombia, which controlled what is now Panama, agree to a treaty that gives the U.S. rights to the land to build the Canal in return for $10 million and $250,000 annually. However, Colombia’s congress rejects the deal.

November 3, 1903

With the backing of the U.S., Panama declares its independence from Colombia.

November 18, 1903

The U.S. and Panama sign the Hay-Bunau-Varilla Treaty, which establishes the Panama Canal Zone and “grants to the United States all the rights, power and authority within the zone.” The treaty has the same financial terms that Colombia’s Congress rejected. It’s ratified by the Senate and approved by President Theodore Roosevelt in February 1904.

August 15, 1914

The Panama Canal opens to shipping.

January 9, 1964

Panamanian rioters invade the Canal Zone and attempt to substitute the U.S. flag with a Panamanian one. The riots last three days, killing 22 Panamanians and four U.S. troops.

September 7, 1977

President Jimmy Carter and Panamanian dictator Omar Torrijos sign the Torrijos-Carter Treaties. Panama will take control of the Canal on Dec. 31, 1999. President Carter says:

This agreement thus forms a new partnership to ensure that this vital waterway, so important to all of us, will continue to be well-operated, safe, and open to shipping by all nations now and in the future. Under these accords, Panama will play an increasingly important role in the operation and defense of the Canal during the next 23 years, and after that, the United States will still be able to counter any threat to the Canal’s neutrality and openness for use.

Panama gains control of the Canal. Army Secretary Louis Caldera, the head of the U.S. delegation at the handover ceremony, says:

The United States could not aspire to be a good neighbor to Latin America and continue occupying and dividing the territory of a country considered a friend.

December 21, 2024

On Truth Social, President-elect Trump slams Panama for charging the United States “exorbitant prices and rates of passage” to use the Canal. He claims that China is influencing the canal’s management, before adding, “This complete ‘rip-off’ of our Country will immediately stop.”

In a follow-up post, Trump adds:

December 22, 2024

While delivering a speech in Phoenix, Trump asks, “Has anyone ever heard of the Panama Canal? Because we’re being ripped off at the Panama Canal like we’re being ripped off everywhere else.”

When an audience member suggests taking back the Canal, Trump responds, “That’s a good idea.”

Panamanian President Jose Raul Mulino responds to Trump in a video he posts on X:

Mulino also issues a written statement, citing the Torrijos-Carter Treaties: “Every square meter of the Panama Canal and its adjacent area belong to PANAMA, and will continue to be. The sovereignty and independence of our country are not negotiable.”

He adds that passage rates are determined by “market conditions, international competition, operating costs and the maintenance and modernization needs of the interoceanic waterway,” and insists upon the Canal’s “permanent neutrality” and “open and safe operation for all nations.” He also rejects the notion that China wields any special influence over the Canal: “The Canal has no direct or indirect control from China, nor the European Union, nor the United States or any other power.”

Trump’s response:

Trump also shares an AI-generated image with the following caption:

December 23, 2024

Panamanian protesters gather outside the U.S. embassy to protest Trump.

Among the chants: “Get out invading gringo” and “Trump, animal, leave the Canal alone.”

They burn an American flag and set fire to an image of Trump.

“Donald Trump and his imperial delusion cannot claim even a single centimeter of land in Panama,” says one protester.

December 25, 2024

Trump posts the following Christmas message:

Minutes later, he announces that Miami-Dade County Commissioner Kevin Marino Cabrera will serve as the next U.S. ambassador to Panama, “a Country that is ripping us off on the Panama Canal, far beyond their wildest dreams.”

December 26, 2024

Panamian President Murino holds a press conference to send a message to Trump that the Canal is not for sale.

The Canal is Panamanian and belongs to Panamanians. There’s no possibility of opening any kind of conversation around this reality, which has cost the country blood, sweat and tears.

He also denies Trump’s claim that the Chinese military has any presence in the Canal, saying, “There are no Chinese soldiers in the Canal, for the love of God.”

January 7, 2025

During a press conference at Mar-a-Lago, Trump refuses to rule out using military force to acquire the Panama Canal. He claims that it was “built for our military” and “is vital to our country.” He once again argues that the Canal is “being operated by China.”

January 9, 2025

Republican Congressman Dusty Johnson of South Dakota introduces the Panama Canal Repurchase Act of 2025, which authorizes the President and the Secretary of State to “initiate and conduct negotiations with appropriate counterparts of the Government of the Republic of Panama to reacquire the Panama Canal.”

Panama Canal Administrator Ricaurte Vásquez tells the Associated Press that the Canal cannot charge lower rates to U.S. ships. He speaks of his desire to “maintain the established rules,” insists that the Canal is a neutral economic zone, and says that the Chinese companies operating in its ports have no special influence over how the Canal is run.

January 20, 2025

During his inauguration address, President Trump describes how “American ships [that use the Panama Canal] are being severely overcharged and not treated fairly in any way, shape, or form.” He repeats his assertion that China controls the Canal and closes with the following: “We gave it to Panama, and we’re taking it back.”

Trump’s comments prompt another statement from Mulino in which he says, “The Canal was not a concession from anyone.”

Panama also sends the statement to the U.N. Security Council.

February 2, 2025

Secretary of State Marco Rubio arrives in Panama City to meet with Mulino.

Mulino attempts to assuage Rubio’s concerns about Chinese influence by announcing that Panama would allow its membership in China’s Belt and Road Initiative to expire. He also vows to allow more U.S. investments in Panama.

Later that day, Trump reiterates his interest in obtaining the Canal. He tells reporters that “something very powerful is going to happen” if Panama does not cede control over the waterway.

Secretary of State Rubio is in Panama right now, and we’re talking about the Panama Canal. What they’ve done is terrible. They violated the agreement. They’re not allowed to violate the agreement.

China is running the Panama Canal. That was not given to China; that was given to Panama, foolishly. But they violated the agreement, and we’re going to take it back, or something very powerful is going to happen.

March 4, 2025

A consortium led by BlackRock announces that it will purchase CK Hutchison’s holdings in the Panama Ports Company, which owns and operates two ports on each side of the canal. CK Hutchison is owned by Hong Kong billionaire Li Ka-shing, and it reportedly felt “political pressure to exit the ports business.” The deal is worth over $19 billion.

Trump references the deal during his address to the joint session of Congress that evening (1:19:50 of the video below).

March 5, 2025

In an X post, Mulino denies Trump’s implication that the BlackRock deal lays the groundwork for a U.S. takeover of the Canal. He accuses Trump of lying.

March 13, 2025

NBC News reports that the Trump administration plans to bolster the U.S. military presence in Panama. Military officials tell NBC that, while the goal is to eventually reclaim control over the Canal, a U.S. invasion remains unlikely.

March 20, 2025

The Chinese government threatens to block CK Hutchison from selling its controlling interest in the two Panama Canal ports to BlackRock.

April 7, 2025

A Panamanian government investigation finds that CK Hutchison owes the country’s government over $300 million in fees because it did not properly renew its contract to operate its two ports along the Canal. This development has the potential to delay or even jeopardize the company’s deal with BlackRock.

Later that night, Secretary of Defense Pete Hegseth arrives in Panama. He will speak at the reopening of an American port and address the Central American Security Conference. He is the first secretary of defense to visit Panama in two decades.

April 8, 2025

Hegseth meets with Mulino and Panama Canal Authority Administrator Ricaurte Vazquez.

They release a joint statement that says they agree to “strengthen bilateral Canal security cooperation,” guarantee “the expedited transit of warships and auxiliary vessels of the Republic of Panama and the United States, improve bilateral cyber cooperation,” and allocate Army Corps of Engineers resources towards ensuring the Canal’s sustainability. They also announce that they will move toward adopting a new mechanism for U.S. payment of Canal tolls and charges. The Defense Secretary praises Mulino for withdrawing Panama from the Belt and Road Initiative.

Panama’s version of their joint statement includes an additional detail: It says that Hegseth “recognized Panama’s leadership and inalienable sovereignty over the Panama Canal and its adjacent areas.”

Racket News is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

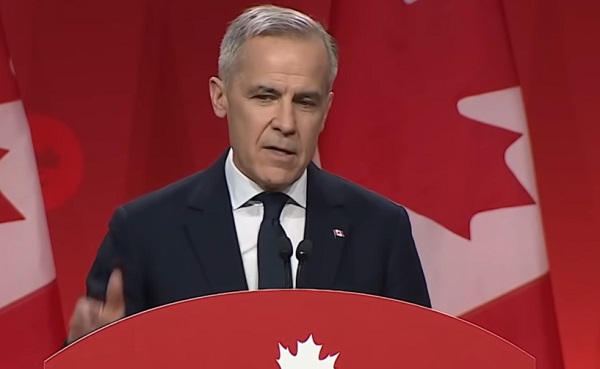

2025 Federal Election

Poilievre Announces Plan To Cut Taxes By $100,000 Per Home

From Conservative Party Communications

Plan incentivizes municipalities to cut building taxes while taking sales tax off for $100,000 savings per home.

Conservative Leader Pierre Poilievre announced that on top of axing the sales tax on new homes, a Conservative government will incentivize municipalities to cut building taxes, for a total savings of $100,000 on an average home in Canada’s big cities. For every dollar of relief a municipality offers in development charges, a Conservative government will reimburse 50%, up to a maximum of $50,000 in savings for new homebuyers.

Poilievre already announced his plan to eliminate the sales tax on new homes under $1.3 million, which will save homebuyers up to $65,000. Combining the two policies will lower the cost of a new home by up to $115,000. For an average home in the GTA or Vancouver, the savings will be approximately $100,000. Conservatives will also require cities to publicly disclose their development charges and explain how the federal reimbursement will be used so Canadians can hold municipalities accountable when they build bureaucracy instead of homes.

“After the Lost Liberal Decade that saw housing costs double, it’s time for a new Conservative government that will provide affordable homes for Canadians,” said Poilievre. “The Liberals have broken the promise that hard work buys an affordable home in a safe neighbourhood. Conservatives will restore it by building more, taxing less, and lowering costs for homebuyers to save $100,000 on a new home.”

Taxes and development charges are now more than 30% of new home costs in Ontario and British Columbia. In Toronto, development charges skyrocketed from under $30,000 to nearly $140,000 during the Lost Liberal Decade, and across Canada, they’ve increased by $27,000 in just two years. These government charges are passed on to homebuyers, turning the dream of homeownership into a nightmare for everyday workers and young Canadians.

Instead of standing up to municipal gatekeepers who jacked up development charges to fund bureaucracy, Liberals rewarded them. After the Liberals gave the City of Toronto $471 million, the city increased charges 42%, leading to a 39% drop in housing starts. Ottawa and Victoria also raised taxes after receiving Liberal funding. In Victoria, housing starts fell by 55% even as development charges went up by 258%.

During the Lost Liberal Decade, with Mark Carney as their economic advisor, housing costs in Canada doubled, rising faster than in any other G7 country. It now takes longer to save for a down payment than it does to pay off a mortgage. And 80% of Canadians now believe homeownership is only possible for the rich.

Mark Carney is recycling the same old Liberal promises that didn’t work for the last decade. He says these Liberal policies will make housing affordable, but under the Liberals, costs have doubled. As usual with Liberals, Carney thinks more government is the answer. He says he wants the government to build homes, but his plan will just add more bureaucracy to a government that can’t get anything built and can’t even issue passports on time. Carney and the Liberals have no plan to actually help people buy their own homes.

“Mark Carney doesn’t understand the struggles everyday Canadians face being priced out of their communities and losing the dream of homeownership to taxes and inflation,” Poilievre said. “We can’t afford a fourth Liberal term of government run by out-of-touch elites. Only a new Conservative government will put hard-working Canadians First–For a Change–and restore the promise of homeownership by building more, taxing less, and bulldozing bureaucratic barriers.”

-

Also Interesting23 hours ago

Also Interesting23 hours agoMortgage Mayhem: How Rising Interest Rates Are Squeezing Alberta Homeowners

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoMark Carney’s radical left-wing, globalist record proves he is Justin Trudeau 2.0

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoConservative Party urges investigation into Carney plan to spend $1 billion on heat pumps

-

COVID-192 days ago

COVID-192 days agoMassive new study links COVID jabs to higher risk of myocarditis, stroke, artery disease

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoDon’t double-down on net zero again

-

Alberta2 days ago

Alberta2 days agoAlberta’s embrace of activity-based funding is great news for patients

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCommunist China helped boost Mark Carney’s image on social media, election watchdog reports

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFifty Shades of Mark Carney