Business

Red Deer City Budget 2025: An Opportunity for Council to Step Up for Taxpayers

Opinion on Red Deer City Budget 2025

By Al Poole

I have lived in Red Deer for 45 years and loved every year. So happy to be here.

Having said that, I see things, patterns over time, that worry me. When I worry I dig deeper – I just need to understand.

Budget 2025: Wow – a massive document. I can only imagine what it cost to build this document. Even more concerning – the amount of time and effort for council members to understand. Crazy!

I will say up front – I wonder if anyone on council has a good grasp on operations performance

based on the budget – as presented. If I am correct, what does that say for citizens of Red Deer

understanding? [note: I do not equate understanding with agreement]

This could be so much easier. Council needs to insist this becomes clearer and easier to understand. (I can help).

As in the past, generally, I find this another document reads from a position of fear and defensiveness – simply looks like justifying “what we do is already the best”. Why would you do that to yourselves?

It starts at the top – the City Manager message is not inspiring. It lacks the leadership that says I got this and here is what I am going to do to correct our current course.

Upfront, an area that confuses me is the reserve transfers. I find it hard to get a real good grasp on spending. I will work to close that gap soon.

Back to the document, a couple of things that caught my attention and I find encouraging. In the

Executive Summary, item 4 on page 5: establish expectations of Administration to achieve a positive variance to budget. I presume this means a fair budget that requires Administration to be more effective and efficient in executing its work (i.e. not only from more tax revenue). I applaud you writing it down – achieving it is akin to retained earnings in my work world (for City – healthy reserves). Second, the citizen surveys in the spring and then the fall. They serve as a great guide for Council and Administration.

The City’s current financial situation is not great. If you understand and accept how we got here – the path forward becomes clearer. Based on what I see in the document you have not understood or accepted. It still appears it’s the taxpayer who is carrying most of the load.

It is interesting that the citizen surveys point to reducing the size of City organization. That tells me everyone, without knowing the details, has a good sense that the City Operations are not as effective or efficient as they could be. I know some of you know it to be true, as well.

Ok – let’s delve into the budget. I like the breakout in TTAX sheet, page 65. I commend Administration for projecting a positive variance over 4% Good job. Now, a bold move demonstrating real leadership would be to take the projected 2024-year end outcome and make that the 2025 budget — and still deliver a positive variance in 2025. Instead, all of that seems to have been lost – the 2025 budget is 6.3% higher. Who thought this an acceptable approach.

Secondly, Considerations and Bold Moves on page 71. The title is impressive — the content is anything but bold.

If you were to assume, based on preamble, I started this review with skepticism – you would be correct. The two items above, a 6.3% increase to base budget and lack of bold moves are absolute derailers for me. Given our financial position – regardless of how we got here – I am ok with, as a taxpayer, to help improve the financial position of my city. Note: I said help – not carry it all. You totally missed it. Why would I as a tax paying citizen, or any other citizen believe we are being served by strong informed leadership? In essence you are pushing all of the fix onto us.

In closing – to keep it clear and simple: show me the math to $18,201,505 tax revenue increase. I can not find a pathway to that number. I realize MGA dictates certain rules you must follow – but it does not stop you from presenting a clear picture. Also, why would you list $512,317,612 – like it is the cash you will spend. Roughly, $89M is non-cash – it is an accounting transaction. I would like to see a summary of financials so I can reasonably assess how operations are doing — akin to EBITDA line in the for-profit world. In the absence of that summary, I have little confidence in Councils ability to reasonably assess operating performance.

I know from experience large organizations tend to grow organically and suffer from increasing

inefficiency over time unless specific actions are taken to correct the course.

You have a chance as Council and Administration to demonstrate leadership – the type that earns

trust and respect. Step up!

It is my intent to be helpful. I am happy to chat in more detail.

Al

PS: Please do not come back to me with it is a complicated operation and you do not understand.

I concede City operations have complicated elements but the nice thing about complicated – it

leads to prescriptive processes/procedures (easy to monitor and evaluate). Now on the revenue

side – there are some complexities that require more nuanced solutions.

Al Poole is a business and community leader. Former Site Leader Joffre Complex, Poole served with the United Way Central Alberta and Red Deer College.

Automotive

Trump warns U.S. automakers: Do not raise prices in response to tariffs

MxM News

MxM News

Quick Hit:

Former President Donald Trump warned automakers not to raise car prices in response to newly imposed tariffs, arguing that the move would ultimately benefit the industry by strengthening American manufacturing. However, automakers are signaling that price increases may be unavoidable.

Key Details:

- Trump told auto executives on a recent call that his administration would look unfavorably on price hikes due to tariffs.

- A 25% tariff on imported vehicles and parts is set to take effect on April 2, likely driving up costs for U.S. automakers.

- Industry analysts predict vehicle prices could rise 11% to 12% in response, despite Trump’s insistence that tariffs will benefit American manufacturing.

Diving Deeper:

In a conference call with leading automakers earlier this month, former President Donald Trump issued a stern warning: do not use his new tariffs as an excuse to raise car prices. While Trump presented the tariffs as a boon for American manufacturing, industry leaders remain unconvinced, arguing that the financial burden will inevitably lead to higher costs for consumers.

Trump’s administration is pressing ahead with a 25% tariff on all imported vehicles and parts, set to take effect on April 2. The move is aimed at reshaping trade dynamics in the auto industry, encouraging domestic manufacturing, and reversing what Trump calls the damaging effects of President Joe Biden’s electric vehicle mandates. Despite this, automakers say that rising costs on foreign parts—which many depend on—will leave them little choice but to pass expenses onto consumers.

“You’re going to see prices going down, but going to go down specifically because they’re going to buy what we’re doing, incentivizing companies to—and even countries—companies to come into America,” Trump stated at a recent event, reinforcing his stance that the tariffs will ultimately lower costs in the long run.

However, industry insiders are pushing back, warning that a rapid shift to domestic production is unrealistic. “Tariffs, at any level, cannot be offset or absorbed,” said Ray Scott, CEO of Lear, a major automotive parts supplier. His concern reflects broader anxieties within the industry, as automakers calculate the financial strain of the tariffs. Analysts at Morgan Stanley estimate that vehicle prices could increase between 11% and 12% in the coming months as the new tariffs take effect.

Automakers have been bracing for the fallout. Detroit’s major manufacturers and industry suppliers have voiced their concerns, emphasizing that transitioning supply chains and manufacturing operations back to the U.S. will take years. Meanwhile, auto retailers have stocked up on inventory, temporarily shielding consumers from price hikes. But once that supply runs low—likely by May—the full impact of the tariffs could hit.

Within the Trump administration, inflation remains a pressing concern, though Trump himself rarely discusses it publicly. His economic team is aware of the potential for tariffs to drive up costs, yet the administration’s stance remains firm: automakers must adapt without raising prices. It remains unclear, however, what actions Trump might take should automakers defy his warning.

The auto industry isn’t alone in its concerns. Executives across multiple sectors, from oil and gas to food manufacturing, have been lobbying against major tariffs, arguing that they will inevitably result in higher prices for American consumers. While Trump has largely dismissed these warnings, some analysts suggest that public dissatisfaction with rising costs played a key role in shaping the outcome of the 2024 election.

With the tariffs set to take effect in just weeks, automakers are left grappling with a difficult reality: absorb billions in new costs or risk the ire of a White House determined to remake America’s trade policies.

Business

Labor Department cancels “America Last” spending spree spanning five continents

MxM News

MxM News

Quick Hit:

The U.S. Department of Labor has scrapped nearly $600 million in foreign aid grants, including $10 million aimed at promoting “gender equity in the Mexican workplace.”

Key Details:

-

Labor Secretary Lori Chavez-DeRemer and Deputy Secretary Keith Sonderling were credited with delivering $237 million in savings through the latest round of canceled programs.

-

Among the defunded initiatives: $12.2 million for “worker empowerment” efforts in South America, $6.25 million to improve labor rights in Central American agriculture, and $5 million to promote women’s workplace participation in West Africa.

-

The Department of Government Efficiency described the cuts as necessary to realign U.S. labor policy with national interests and applauded the elimination of all 69 international grants managed by the Bureau of International Labor Affairs.

Diving Deeper:

The U.S. Department of Labor on Wednesday canceled $577 million in foreign aid grants, including a controversial $10 million program aimed at promoting “gender equity in the Mexican workplace,” according to documents obtained by The Washington Post. The sweeping decision to terminate all 69 active international labor grants comes as part of a larger restructuring effort led by John Clark, a senior DOL official appointed during the Trump administration.

Clark directed the department’s Bureau of International Labor Affairs (ILAB) to shut down its entire grant portfolio, citing a “lack of alignment with agency priorities and national interest.” The memo explaining the cancellations was first reported by The Washington Post and highlights a broader shift in federal labor policy toward domestic-focused initiatives.

Among the eliminated grants were high-dollar projects that had drawn criticism from watchdog groups for years. These included $12.2 million designated for “worker empowerment in South America,” $6.25 million targeting labor conditions in Honduras, Guatemala, and El Salvador, and $5 million to elevate women’s workplace participation in West Africa. Other defunded programs involved $4.3 million to support foreign migrant workers in Malaysia, $3 million to improve social protections for internal migrants in Bangladesh, and $3 million to promote “safe and inclusive work environments” in Lesotho.

The Department of Government Efficiency, also involved in the review, labeled the grants as “America Last” initiatives, and pointed to the lack of measurable outcomes and limited benefits to American workers. The agency commended the leadership of Labor Secretary Lori Chavez-DeRemer and Deputy Secretary Keith Sonderling for securing $237 million in savings during this round alone.

The cuts mark the second major cost-saving move under Chavez-DeRemer’s leadership in as many weeks. Just days earlier, she canceled an additional $33 million in funding, including a $1.5 million grant focused on increasing transparency in Uzbekistan’s cotton sector. Chavez-DeRemer, a former Republican congresswoman from Oregon, was confirmed as Labor Secretary on March 11th by a bipartisan Senate vote of 67-32.

-

Alberta2 days ago

Alberta2 days agoAlberta Institute urging Premier Smith to follow Saskatchewan and drop Industrial Carbon Tax

-

Addictions2 days ago

Addictions2 days agoShould fentanyl dealers face manslaughter charges for fatal overdoses?

-

Alberta2 days ago

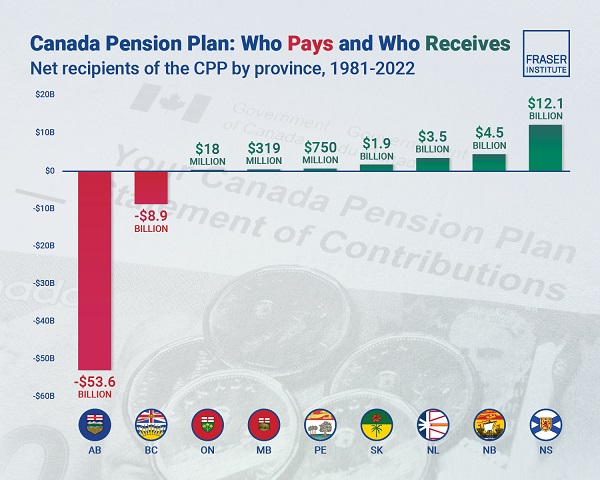

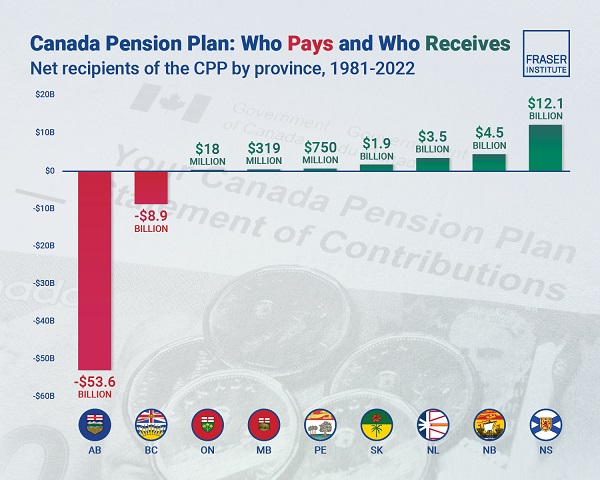

Alberta2 days agoAlbertans have contributed $53.6 billion to the retirement of Canadians in other provinces

-

Also Interesting1 day ago

Also Interesting1 day agoThe bizarre story of Taro Tsujimoto

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoChinese Gangs Dominate Canada: Why Will Voters Give Liberals Another Term?

-

Energy2 days ago

Energy2 days agoEnergy, climate, and economics — A smarter path for Canada

-

Health24 hours ago

Health24 hours agoRFK Jr. Drops Stunning Vaccine Announcement

-

J.D. Tuccille1 day ago

J.D. Tuccille1 day agoSignal Chat Controversy Is an Endorsement of Encryption Software