National

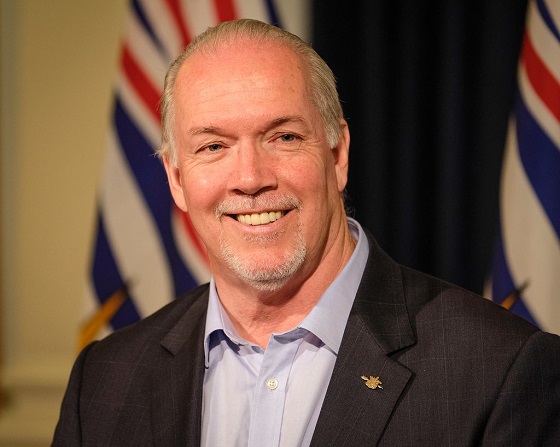

Former BC Premier John Horgan passes away at 65

From Resource Works

He will be remembered as a principled, pragmatic, and honest man, and a popular premier during uncertain times.

John Horgan has passed away at 65 after a courageous third battle with cancer.

A born-and-raised Vancouver Islander, Horgan was a tough and resilient man who will be remembered as a popular, pragmatic premier who brought principles and honesty with him while navigating a changing economic and political landscape.

Regardless of partisan affiliation or belief, there is no question that Horgan truly loved his home province of BC and cared deeply for its people and their future.

Horgan’s path to the premier’s office took him across Canada and beyond, first from Victoria to Ontario, then on to Australia, before returning home to Vancouver Island. Between attending university as a young man, Horgan worked in a pulp mill in Ocean Falls, a small community on the Central Coast of BC. This experience provided him with real insight into the province’s resource sector and the communities that depended on it then—and still do today.

From the 1990s, Horgan worked for the BC New Democratic Party in various staff roles before starting his own business after 2001. In 2005, he returned to politics by being elected as the MLA for Malahat-Juan de Fuca (now Langford-Juan de Fuca). Horgan was re-elected five times by the riding’s voters.

In 2014, Horgan became the leader of the BC NDP, and in 2017, he became Premier of BC, the first NDP premier in 16 years. Once in the premier’s office, Horgan championed pragmatic, progressive policies that strove to balance economic growth with sustainability. His work in developing the province’s liquefied natural gas (LNG) sector was invaluable.

From the outset, Horgan recognized LNG’s potential to modernize the BC economy and make it a key player in global energy markets, and he worked hard to attract investment to the sector. In 2018, he unveiled a new LNG framework that paved the way for LNG Canada’s $40 billion investment in a project that would bring thousands of jobs to northern BC.

Horgan was confident that the LNG sector could coexist with his government’s climate goals and that BC would play a role in reducing global carbon emissions. His pragmatic, forward-thinking vision centered on the ambitious goal of exporting LNG to Asian markets to help them reduce their reliance on higher-emitting energy sources.

Forestry was another sector where Horgan made his mark. Having once worked in a pulp mill, Horgan recognized the importance of forestry to both the province’s history and economy. His approach emphasized sustainability and partnerships with First Nations, while increasing domestic production and reducing log exports. His attempts to modernize forestry had mixed results, but there was no questioning the honesty and good faith he brought to the table.

Another notable aspect of Horgan’s leadership was his commitment to the rule of law, even when it aroused frustration from fellow progressives. In 2020, during the Coastal GasLink protests, Horgan made it clear that the court rulings in favor of the project meant it would proceed regardless. That same year, Horgan acknowledged that the Trans Mountain pipeline project, which his government opposed, would move forward after another court ruling mandated its completion.

It should also be noted that court rulings were some of the only defeats he ever faced as premier, as he led the NDP to a historic victory in the 2020 election. Horgan was also unafraid to take responsibility for policies that went awry, such as stepping back from an unpopular $789-million proposal to rebuild the Royal BC Museum and accepting the blame for it.

Horgan’s leadership of BC during the COVID-19 oubtreak is another part of his legacy that will not be forgotten, especially his trust in British Columbians to be responsible, leading to some of Canada’s most relaxed restrictions during the pandemic.

In 2022, Horgan stepped down after beating cancer for the second time in his life, saying, “While I have a lot of energy, I must acknowledge this may not be the case two years from now.”

Perhaps one of the most important aspects of Horgan’s legacy was that he was a well-liked politician across the political spectrum. While many disagreed with him over policies, few could question that he was an honest and principled leader when it came to steering economic change, respecting the rule of law, and taking responsibility for his actions as premier.

Horgan was a fair, honest, and open-minded man—qualities shared by the best people we meet in life and ones we can only hope all politicians will emulate. We will miss John Joseph Horgan and send our heartfelt condolences to his family, especially his wife and two children.

Energy

What does a Trump presidency means for Canadian energy?

From Resource Works

Heather-Exner Pirot of the Business Council of Canada and the Macdonald-Laurier Institute spoke with Resource Works about the transition to Donald Trump’s energy policy, hopes for Keystone XL’s revival, EVs, and more.

Do you think it is accurate to say that Trump’s energy policy will be the complete opposite of Joe Biden’s? Or will it be more nuanced than that?

It’s more nuanced than that. US oil and gas production did grow under Biden, as it did under Obama. It’s actually at record levels right now. The US is producing the most oil and gas per day that any nation has ever produced in the history of the world.

That said, the federal government in the US has imposed relatively little control over production. In the absence of restrictive emissions and climate policies that we have in Canada, most of the oil production decisions have been made based on market forces. With prices where they’re at currently, there’s not a lot of shareholder appetite to grow that significantly.

The few areas you can expect change: leasing more federal lands and off shore areas for oil and gas development; rescinding the pause in LNG export permits; eliminating the new methane fee; and removing Biden’s ambitious vehicle fuel efficiency standards, which would subsequently maintain gas demand.

I would say on nuclear energy, there won’t be a reversal, as that file has earned bipartisan support. If anything, a Trump Admin would push regulators to approve SMRs models and projects faster. They want more of all kinds of energy.

Is Keystone XL a dead letter, or is there enough planning and infrastructure still in-place to restart that project?

I haven’t heard any appetite in the private sector to restart that in the short term. I know Alberta is pushing it. I do think it makes sense for North American energy security – energy dominance, as the Trump Admin calls – and I believe there is a market for more Canadian oil in the USA; it makes economic sense. But it’s still looked at as too politically risky for investors.

To have it move forward I think you would need some government support to derisk it. A TMX model, even. And clear evidence of social license and bipartisan support so it can survive the next election on both sides of the border.

Frankly, Northern Gateway is the better project for Canada to restart, under a Conservative government.

Keystone XL was cancelled by Biden prior to the invasion of Ukraine in 2022. Do you think that the reshoring/friendshoring of the energy supply is a far bigger priority now?

It absolutely is a bigger priority. But it’s also a smaller threat. You need to appreciate that North America has become much more energy independent and secure than it has ever been. Both US and Canada are producing at record levels. Combined, we now produce more than the Middle East (41 million boe/d vs 38 million boe/d). And Canada has taken a growing share of US imports (now 60%) even as their import levels have declined.

But there are two risks on the horizon: the first is that oil is a non renewable resource and the US is expected to reach a peak in shale oil production in the next few years. No one wants to go back to the days when OPEC + had dominant market power. I think there will be a lot of demand for Canadian oil to fill the gap left by any decline in US oil production. And Norway’s production is expected to peak imminently as well.

The second is the need from our allies for LNG. Europe is still dependent on Russia for natural gas, energy demand is growing in Asia, and high industrial energy costs are weighing on both. More and cheaper LNG from North America is highly important for the energy security of our allies, and thus the western alliance as it faces a challenge from Russia, China and Iran.

Canada has little choice but to follow the US lead on many issues such as EVs and tariffs on China. Regarding energy policy, does Canada’s relative strength in the oil and gas sector give it a stronger hand when it comes to having an independent energy policy?

I don’t think we want an independent energy policy. I would argue we both benefit from alignment and interdependence. And we’ve built up that interdependence on the infrastructure side over decades: pipelines, refineries, transmission, everything.

That interdependence gives us a stronger hand in other areas of the economy. Any tariffs on Canadian energy would absolutely not be in American’s interests in terms of their energy dominance agenda. Trump wants to drop energy costs, not hike them.

I think we can leverage tariff exemptions in energy to other sectors, such as manufacturing, which is more vulnerable. But you have to make the case for why that makes sense for US, not just Canada. And that’s because we need as much industrial capacity in the west as we can muster to counter China and Russia. America First is fine, but this is not the time for America Alone.

Do you see provinces like Alberta and Saskatchewan being more on-side with the US than the federal government when it comes to energy?

Of course. The North American capital that is threatening their economic interests is not Washington DC; it’s Ottawa.

I think you are seeing some recognition – much belated and fast on the heels of an emissions cap that could shut in over 2 million boe of production! – that what makes Canada important to the United States and in the world is our oil and gas and uranium and critical minerals and agricultural products.

We’ve spent almost a decade constraining those sectors. There is no doubt a Trump Admin will be complicated, but at the very least it’s clarified how important those sectors are to our soft and hard power.

It’s not too late for Canada to flex its muscles on the world stage and use its resources to advance our national interests, and our allies’ interests. In fact, it’s absolutely critical that we do so.

armed forces

Judge dismisses Canadian military personnel’s lawsuit against COVID shot mandate

From LifeSiteNews

Associate Judge Catherine Coughlan rejected a lawsuit from more than 300 past and current members of the Canadian military who lost their jobs or were put on leave for not taking the experimental, dangerous COVID shots.

A Canadian federal judge has thrown out a lawsuit filed on behalf of some 330 past and current members of the nation’s military who lost their jobs or were placed on leave for refusing the experimental COVID shots, because she alleged that their lawsuit lacked “evidence” that the jabs were harmful.

The Canadian Armed Forces (CAF) members had sought some $1.3 million in damages from the government for having their charter rights violated due to the military’s 2021 COVID mandates, according to their lawsuit.

In a November 13 ruling, Edmonton-based Associate Judge Catherine Coughlan ruled in favor of the Trudeau government, and thus military’s COVID jab mandate, to strike down the case. Coughlan remarked that the plaintiffs’ case lacked “material facts” along with “evidence” and was filled with “vexatious language.”

READ: Canadian father files $35 million lawsuit against Pfizer over son’s jab-related death

“The only indications of bad faith are found when the pleadings baldly assert that, among other claims, Canada failed to carry out safety and efficacy testing for the vaccines, and that the Directives were premature and ‘promoted the fraudulent use of the biologics’,” she wrote, overlooking reports of thousands of injuries due to the shots in Canada alone.

As a result of the lawsuit being tossed, all plaintiffs are now on the hook to pay some $5,040 out of pocket in legal costs.

As reported by LifeSiteNews in June, documents obtained by LifeSiteNews show that the number of jab injuries in the CAF rose over 800 percent in 2021, with the most being credited to Moderna’s experimental COVID shot.

The CAF members’ lawsuit was filed in June of 2023 and overall sought some $1 million in damages, along with an extra $350,000 in general damages. The lawsuit also had a condition that there be a declaration made that mandating the COVID shots for military members was a violation of their charter rights.

READ: Israeli boy featured in COVID vaccine campaign dies of heart attack at age 8

LifeSiteNews reported in July that a member of Canada’s military who was injured after taking the experimental mRNA COVID jabs has been denied compensation from the nation’s Veterans Affairs department.

Under the CAF’s mandate, hundreds of military members were fired, or one could say, purged for not getting the COVID shots. This is in addition to the thousands of public servants fired for not agreeing to take the COVID shots.

The CAF eventually ended its COVID mandate in October 2022, which was months after the federal mandate was lifted, but members are still “strongly encouraged” to take the experimental shot.

The federal government under Prime Minister Justin Trudeau announced that its federal COVID shot workplace mandate would be dropped in June 2022, as would the mandate requiring domestic travelers have the shot to board planes and trains.

In November of 2023, a CAF member who spoke to LifeSiteNews under the condition of anonymity observed that the military considers members who refuse the COVID jab “a piece of garbage.”

READ: COVID shots have 200-times higher risk of brain clots than other jabs: new report

In March, LifeSiteNews reported on large personnel losses causing the CAF to consider dropping its remaining requirements altogether.

Although Canada has a Vaccine Injury Support Program (VISP) program, active members of the CAF, as well as veterans, are not eligible for the civilian program. According to Christensen, this leaves many COVID jab-injured CAF members and veterans with no recourse other than Veterans Affairs Canada.

COVID shot mandates, which came from provincial governments with the support of Trudeau’s federal government, split Canadian society. The mRNA shots themselves have been linked to a multitude of negative and often severe side effects, such as heart diseases, stroke, and death, including in children.

The shots also have connections to cell lines derived from aborted babies. As a result, many Catholics and other Christians refused to take them.

-

Business1 day ago

Business1 day agoCarbon tax bureaucracy costs taxpayers $800 million

-

Brownstone Institute1 day ago

Brownstone Institute1 day agoThe Most Devastating Report So Far

-

ESG21 hours ago

ESG21 hours agoCan’t afford Rent? Groceries for your kids? Trudeau says suck it up and pay the tax!

-

Daily Caller21 hours ago

Daily Caller21 hours agoLos Angeles Passes ‘Sanctuary City’ Ordinance In Wake Of Trump’s Deportation Plan

-

John Stossel19 hours ago

John Stossel19 hours agoGreen Energy Needs Minerals, Yet America Blocks New Mines

-

COVID-192 days ago

COVID-192 days agoDr. McCullough praises RFK Jr., urges him to pull COVID shots from the market

-

Business2 days ago

Business2 days agoOttawa’s avalanche of spending hasn’t helped First Nations

-

MAiD1 day ago

MAiD1 day agoOver 40% of people euthanized in Ontario lived in poorest parts of the province: government data