Business

How big things could get done—even in Canada

From the Fraser Institute

By Philip Cross

From Newfoundland’s Muskrat Falls hydro project, to Ottawa’s Firearms Registry and the Phoenix pay system, to Montreal’s 1976 Olympics, Canada is a gold medal winner when it comes to wasting tax payer dollars. It doesn’t have to be this way.

Last year, Bent Flyvbjerg, a Danish professor of economic geography specializing in megaprojects, and Canadian journalist Dan Gardner co-authored a book How Big Things Get Done. They investigate what they coin the “Iron Law of Megaprojects,” which holds they routinely come in well over budget, far past projected deadlines, and without the projected benefits.

Unfortunately for taxpayers, the book contains numerous examples of Canadian megaprojects that follow this Law of Megaprojects. The federal government’s infamous firearms registry is a textbook template for how IT projects can go terribly wrong, ending up 590 per cent over budget. The Muskrat Falls hydro project in Newfoundland is cited as a classic demonstration of what happens when hiring a firm with little direct experience managing such a large complex project. Most famously, the 1976 Montreal Olympic Games wins the title for the largest cost overrun in Olympic history, finishing 720 per cent over budget. The authors suggest Montreal’s “Big Owe” stadium “should be considered the unofficial mascot of the modern Olympic Games.”

One thing all these Canadian examples have in common is extensive government involvement. Not that governments learned from their past mistakes. The federal government’s Phoenix pay system fiasco demonstrates that IT remains a black hole, with the government recently announcing it would abandon Phoenix after spending $3.5 billion trying to implement it. Several light train projects across the country have gone off the rails, the poster boy being the system in Ottawa, which is years behind schedule and already $2.5 billion over budget.

There are several reasons why government projects are chronically prone to failure. One is that politicians, especially late in their careers, want legacies in the form of monumental tangible projects irrespective of whether they effectively meet a public need. You can see this dynamic clearly at work today in Canada, as the Trudeau government pushes for a prohibitively expensive (probably more than $100 billion) high-speed rail connection between Windsor and Quebec City. Meanwhile, Ontario Premier Doug Ford promotes a traffic tunnel underneath Highway 401 between Brampton and Scarborough, and Quebec Premier Francois Legault revives plans for a third link connecting Quebec City to the south shore of the St. Lawrence River. While Canada clearly needs more transportation infrastructure, these projects are not the most cost-effective way of meeting the needs of commuters.

Governments deceptively deploy several tricks to help get uneconomic projects built. They routinely produce unrealistically low-cost estimates to make wasteful ego-driven projects appear affordable. Another tried and true tactic is to just “start digging a hole and make it so big, there’s no alternative to coming up with the money to fill it in,” as former San Francisco mayor Willie Brown admitted. This approach preys on the mistaken belief that large sunk costs mean scrapping a project “would be interpreted by the public as ‘throwing away’ the billions of dollars already spent” when it is actually a textbook example of throwing good money after bad.

Unlike other studies of how major infrastructure projects typically are over budget, Flyvbjerg and Gardner have some concrete recommendations on how to manage large projects that respect deadlines and budgets.

These steps include careful consideration of the actual goals of the project (airlines can meet the need for fast transport in the Windsor-Quebec corridor without the expense of high-speed rail), detailed planning and preparation followed by swift execution to minimize costly surprises (summarized by their advice to “think slow, act fast”), accounting for the cost of similar projects in the past, and breaking large projects into smaller modules to allow projects to scale back when they run into trouble. A good example of these principles at work in Canada were several oilsands projects built before 2015, when severe shortages were addressed by firms using modularity and synchronizing their work schedules to free up scarce labour and materials.

However, one major flaw in Flyvbjerg and Gardner’s analysis is their failure to understand the economics of renewable energy. They cite solar and wind projects as examples of projects that routinely finish under budget, a major factor in their declining cost. But building renewable energy is not their only cost to the energy grid, as back-up plants must be maintained for those periods when the sun is not shining or the wind is not blowing, as noted in a recent article by Bjorn Lomborg. The expense of maintaining plants that often are idle raises overall costs. This is why jurisdictions that rely extensively on renewable energy, such as Germany and California, have high energy costs that must be paid either by customers or taxpayers.

However, apart from this mistake, there is much governments and taxpayers can learn from How Big Things Get Done.

Author:

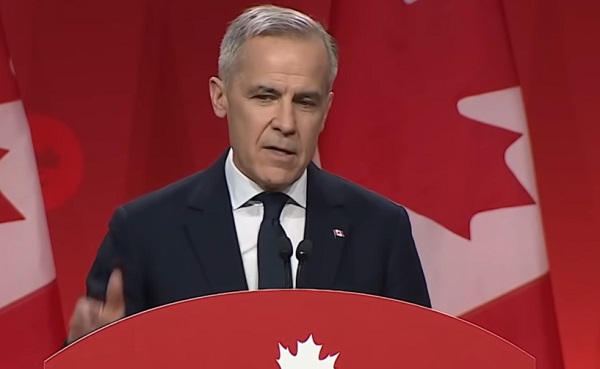

2025 Federal Election

Carney needs to cancel gun ban and buyback

Gage Haubrich

Gage Haubrich

The Canadian Taxpayers Federation is calling on Liberal Leader Mark Carney to stop the gun ban and buyback after he announced he would continue with the scheme.

“Carney needs to scrap this plan and stop wasting taxpayer’s money on it,” said Gage Haubrich, CTF Prairie Director. “Planning to spend potentially billions of dollars on a program that is not going to make Canadians safer is a waste of money.

“Carney needs to be cancelling this wasteful plan, not doubling down on it.”

Conservative Leader Pierre Poilievre is promising to get rid of Ottawa’s gun bans.

The government said the buyback would cost taxpayers $200 million in 2019. Only buying back the guns could cost up to $756 million, according to the Parliamentary Budget Officer. Government documents show that the buyback is now likely to cost almost $2 billion.

The banned gun list includes more than 2,000 different types of firearms.

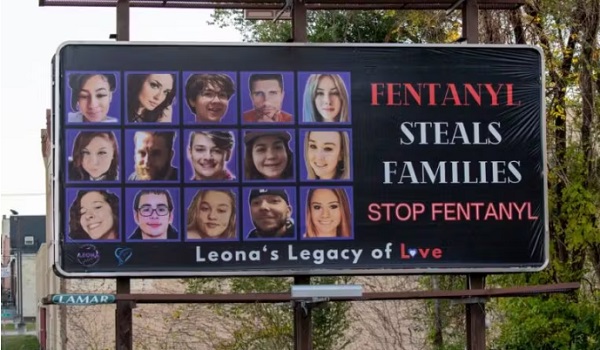

Every year since the gun ban was announced in 2020, violent gun crime in Canada has increased.

New Zealand conducted a similar, but more extensive, gun ban and buyback in 2019. New Zealand had 1,216 violent firearm offenses in 2023. That’s 349 more offences than the year before the buyback.

Experts also agree that the buyback won’t make Canadians any safer.

The National Police Federation, the union representing the RCMP, says Ottawa’s buyback “diverts extremely important personnel, resources, and funding away from addressing the more immediate and growing threat of criminal use of illegal firearms.”

“Buyback programs are largely ineffective at reducing gun violence, in large part because the people who participate in such programs are not likely to use those guns to commit violence,” said University of Toronto professor Jooyoung Lee

“Experts say that this gun ban and buyback won’t do anything to make Canadians safer,” Haubrich said. “Carney needs to listen to the experts and commit to cancelling this scheme before it costs taxpayers any more money.”

Business

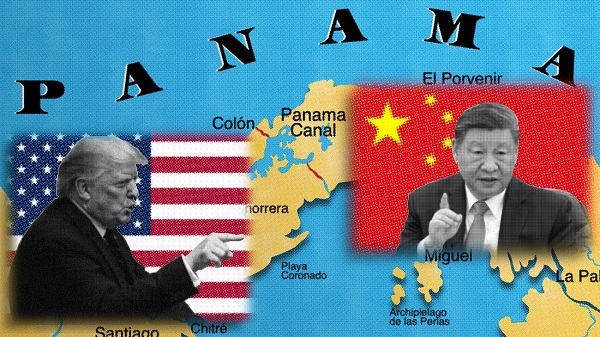

Timeline: Panama Canal Politics, Policy, and Tensions

By Greg Collard and James Rushmore

By Greg Collard and James Rushmore

Hegseth’s visit to Panama includes strongly-worded speeches directed at China

While the trade war with China plays out, another war of political rhetoric is heating up again over the Panama Canal.

Defense Secretary Pete Hegseth was in Panama this week, and pointed out America’s military presence and joint training exercises with Panamanians. Though he said the U.S. doesn’t seek war and that “war with China is certainly not inevitable,” he had a strong military message for the CCP:

Racket News is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Our relationship is growing in part to meet communist China’s rising challenge. China-based companies continue to control critical infrastructure in the canal area that gives China the potential to conduct surveillance activities across Panama. This makes Panama and the United States less secure, less prosperous, and less sovereign.

He said “China will not weaponize this canal,” and it will stay that way “through the deterrent power of the strongest, most effective, and most lethal fighting force in the world.”

Hegseth followed up Wednesday with a similar message to the Central American Security Conference.

The era of capitulating to coercion by the communist Chinese is over. They’re growing an adversarial control of strategic land and critical infrastructure in this hemisphere cannot and will not stand. To accomplish this, our countries cannot face these shared threats alone. We have to face them together. America will confront, will deter, and if necessary defeat these threats alongside all of you, our close and valued partners. Our mission is simple: achieve peace through strength through an America first approach. We’re doing this by restoring the warrior ethos, rebuilding our military and reestablishing deterrence.

Obviously, that didn’t go over well with China. Its embassy in Panama accuses the U.S. of hypocrisy as it “repeats ad nauseam the ‘Chinese interference and influence.’” It noted the U.S. invaded Panama in 1989 and asked: “Who represents the real threat to the Channel? People will make their own judgment.”

(In making that judgment, a reminder that the U.S. still controlled the Panama Canal in 1989, and Panama was run by dictator Manuel Noriega who had been indicted in the U.S. on drug crimes. He was also a former CIA informant, and American officials knew about his crimes — which included helping Pablo Escobar — for years before doing anything about it).

China’s influence over the Canal has grown since 2017, when Panama severed ties with Taiwan and established diplomatic relations with China. A Chinese company controls the largest port on the Atlantic side of the Canal, and a Hong Kong company, CK Hutchinson, controls ports on both ends of the Canal. Last month, BlackRock, an American investment firm, reached a deal to buy CK Hutchinson’s ports, but that deal could be in jeopardy of falling through. Chinese firms are also building a bridge across the Canal.

President Trump has said the U.S. should have never given up the canal to Panama, which occurred on Dec. 31, 1999, as agreed to in treaties that President Carter signed in 1977 and won Senate approval the following year.

While critics place a lot of blame on Carter, Presidents Nixon and Ford started the negotiations. There was bipartisan support to reach a deal (there was even a tentative deal in place in 1967, but a coup in Panama ended those negotiations) because there were tensions and sometimes violence between locals and Americans. The audio below is from a 1976 NBC story that describes life inside the barbed wire fence that surrounded the Canal Zone: “Its 40,000 American residents, both military and civilian, enjoy a suburban lifestyle.” Panamanians on the other side of the fence were resentful.

Ronald Reagan changed the political debate over the Canal during his primary challenge to Ford in 1976. Opposition to any deal with Panama became the focus of his campaign. Reagan says in the ad below: “We bought it, we paid for it, and General Torrijos (Panama’s dictator) should be told we’re going to keep it.”

The message was effective. Reagan won 24 states, and Ford didn’t secure the GOP nomination until the Republican National Convention.

Today’s debate over the Panama Canal

The Panama Canal was not a campaign issue in 2024. Trump first complained about passage rates charged to the Navy and U.S. shipping companies in two December 21 social media posts. Trump wrote that if the situation does not improve, “we will demand that the Panama Canal be returned to us, in full, and without question. To the Officials of Panama, please be guided accordingly!”

He repeated those criticisms and threats in a speech the following day:

It was not given for the benefit of others by a token of cooperation, but it was given to Panama and to the people of Panama, but it has provisions. You gotta treat us fairly, and they haven’t treated us fairly. If the principles, both moral and legal, of this magnanimous gesture of giving are not followed, then we demand that the Panama Canal be returned to the United States of America in full, quickly and without question.

Congresswoman Debbie Wasserman Schultz called that “preposterous.” House Minority Leader Hakeem Jeffries also dismissed the idea of regaining control of the Panama Canal.

But Democratic Congressman Jared Moskowitz said Trump has a point. He dismissed the idea of taking the Canal by force, but said “the United States reasserting its history in the Panama Canal is actually a good, important, strategic issue.”

At a hearing in January, Senate Commerce Committee Chairman Ted Cruz voiced concern about the bridge that Chinese firms are building across the Canal.

The partially-completed bridge gives China the ability to block the Canal without warning, and the ports give China ready observation posts to time that action. This situation poses acute risks to U.S. national security.

A witness at that hearing, George Mason international law professor Eugene Kontorovich, testified that the presence of a Chinese company essentially means the Chinese military has a presence in the Canal.

In a communist regime, distinctions between private and government-owned firms are not as absolute or clear-cut as in a Western liberal society. This is particularly the case for the People’s Republic of China (PRC), which has an official doctrine known as “Military-Civilian Fusion,” a top-level strategy of the CCP Central Committee since 2019.

Here’s a timeline of key events in the history of the Panama Canal leading up to this week’s speeches from Hegseth.

January 22, 1903

The U.S. and Colombia, which controlled what is now Panama, agree to a treaty that gives the U.S. rights to the land to build the Canal in return for $10 million and $250,000 annually. However, Colombia’s congress rejects the deal.

November 3, 1903

With the backing of the U.S., Panama declares its independence from Colombia.

November 18, 1903

The U.S. and Panama sign the Hay-Bunau-Varilla Treaty, which establishes the Panama Canal Zone and “grants to the United States all the rights, power and authority within the zone.” The treaty has the same financial terms that Colombia’s Congress rejected. It’s ratified by the Senate and approved by President Theodore Roosevelt in February 1904.

August 15, 1914

The Panama Canal opens to shipping.

January 9, 1964

Panamanian rioters invade the Canal Zone and attempt to substitute the U.S. flag with a Panamanian one. The riots last three days, killing 22 Panamanians and four U.S. troops.

September 7, 1977

President Jimmy Carter and Panamanian dictator Omar Torrijos sign the Torrijos-Carter Treaties. Panama will take control of the Canal on Dec. 31, 1999. President Carter says:

This agreement thus forms a new partnership to ensure that this vital waterway, so important to all of us, will continue to be well-operated, safe, and open to shipping by all nations now and in the future. Under these accords, Panama will play an increasingly important role in the operation and defense of the Canal during the next 23 years, and after that, the United States will still be able to counter any threat to the Canal’s neutrality and openness for use.

Panama gains control of the Canal. Army Secretary Louis Caldera, the head of the U.S. delegation at the handover ceremony, says:

The United States could not aspire to be a good neighbor to Latin America and continue occupying and dividing the territory of a country considered a friend.

December 21, 2024

On Truth Social, President-elect Trump slams Panama for charging the United States “exorbitant prices and rates of passage” to use the Canal. He claims that China is influencing the canal’s management, before adding, “This complete ‘rip-off’ of our Country will immediately stop.”

In a follow-up post, Trump adds:

December 22, 2024

While delivering a speech in Phoenix, Trump asks, “Has anyone ever heard of the Panama Canal? Because we’re being ripped off at the Panama Canal like we’re being ripped off everywhere else.”

When an audience member suggests taking back the Canal, Trump responds, “That’s a good idea.”

Panamanian President Jose Raul Mulino responds to Trump in a video he posts on X:

Mulino also issues a written statement, citing the Torrijos-Carter Treaties: “Every square meter of the Panama Canal and its adjacent area belong to PANAMA, and will continue to be. The sovereignty and independence of our country are not negotiable.”

He adds that passage rates are determined by “market conditions, international competition, operating costs and the maintenance and modernization needs of the interoceanic waterway,” and insists upon the Canal’s “permanent neutrality” and “open and safe operation for all nations.” He also rejects the notion that China wields any special influence over the Canal: “The Canal has no direct or indirect control from China, nor the European Union, nor the United States or any other power.”

Trump’s response:

Trump also shares an AI-generated image with the following caption:

December 23, 2024

Panamanian protesters gather outside the U.S. embassy to protest Trump.

Among the chants: “Get out invading gringo” and “Trump, animal, leave the Canal alone.”

They burn an American flag and set fire to an image of Trump.

“Donald Trump and his imperial delusion cannot claim even a single centimeter of land in Panama,” says one protester.

December 25, 2024

Trump posts the following Christmas message:

Minutes later, he announces that Miami-Dade County Commissioner Kevin Marino Cabrera will serve as the next U.S. ambassador to Panama, “a Country that is ripping us off on the Panama Canal, far beyond their wildest dreams.”

December 26, 2024

Panamian President Murino holds a press conference to send a message to Trump that the Canal is not for sale.

The Canal is Panamanian and belongs to Panamanians. There’s no possibility of opening any kind of conversation around this reality, which has cost the country blood, sweat and tears.

He also denies Trump’s claim that the Chinese military has any presence in the Canal, saying, “There are no Chinese soldiers in the Canal, for the love of God.”

January 7, 2025

During a press conference at Mar-a-Lago, Trump refuses to rule out using military force to acquire the Panama Canal. He claims that it was “built for our military” and “is vital to our country.” He once again argues that the Canal is “being operated by China.”

January 9, 2025

Republican Congressman Dusty Johnson of South Dakota introduces the Panama Canal Repurchase Act of 2025, which authorizes the President and the Secretary of State to “initiate and conduct negotiations with appropriate counterparts of the Government of the Republic of Panama to reacquire the Panama Canal.”

Panama Canal Administrator Ricaurte Vásquez tells the Associated Press that the Canal cannot charge lower rates to U.S. ships. He speaks of his desire to “maintain the established rules,” insists that the Canal is a neutral economic zone, and says that the Chinese companies operating in its ports have no special influence over how the Canal is run.

January 20, 2025

During his inauguration address, President Trump describes how “American ships [that use the Panama Canal] are being severely overcharged and not treated fairly in any way, shape, or form.” He repeats his assertion that China controls the Canal and closes with the following: “We gave it to Panama, and we’re taking it back.”

Trump’s comments prompt another statement from Mulino in which he says, “The Canal was not a concession from anyone.”

Panama also sends the statement to the U.N. Security Council.

February 2, 2025

Secretary of State Marco Rubio arrives in Panama City to meet with Mulino.

Mulino attempts to assuage Rubio’s concerns about Chinese influence by announcing that Panama would allow its membership in China’s Belt and Road Initiative to expire. He also vows to allow more U.S. investments in Panama.

Later that day, Trump reiterates his interest in obtaining the Canal. He tells reporters that “something very powerful is going to happen” if Panama does not cede control over the waterway.

Secretary of State Rubio is in Panama right now, and we’re talking about the Panama Canal. What they’ve done is terrible. They violated the agreement. They’re not allowed to violate the agreement.

China is running the Panama Canal. That was not given to China; that was given to Panama, foolishly. But they violated the agreement, and we’re going to take it back, or something very powerful is going to happen.

March 4, 2025

A consortium led by BlackRock announces that it will purchase CK Hutchison’s holdings in the Panama Ports Company, which owns and operates two ports on each side of the canal. CK Hutchison is owned by Hong Kong billionaire Li Ka-shing, and it reportedly felt “political pressure to exit the ports business.” The deal is worth over $19 billion.

Trump references the deal during his address to the joint session of Congress that evening (1:19:50 of the video below).

March 5, 2025

In an X post, Mulino denies Trump’s implication that the BlackRock deal lays the groundwork for a U.S. takeover of the Canal. He accuses Trump of lying.

March 13, 2025

NBC News reports that the Trump administration plans to bolster the U.S. military presence in Panama. Military officials tell NBC that, while the goal is to eventually reclaim control over the Canal, a U.S. invasion remains unlikely.

March 20, 2025

The Chinese government threatens to block CK Hutchison from selling its controlling interest in the two Panama Canal ports to BlackRock.

April 7, 2025

A Panamanian government investigation finds that CK Hutchison owes the country’s government over $300 million in fees because it did not properly renew its contract to operate its two ports along the Canal. This development has the potential to delay or even jeopardize the company’s deal with BlackRock.

Later that night, Secretary of Defense Pete Hegseth arrives in Panama. He will speak at the reopening of an American port and address the Central American Security Conference. He is the first secretary of defense to visit Panama in two decades.

April 8, 2025

Hegseth meets with Mulino and Panama Canal Authority Administrator Ricaurte Vazquez.

They release a joint statement that says they agree to “strengthen bilateral Canal security cooperation,” guarantee “the expedited transit of warships and auxiliary vessels of the Republic of Panama and the United States, improve bilateral cyber cooperation,” and allocate Army Corps of Engineers resources towards ensuring the Canal’s sustainability. They also announce that they will move toward adopting a new mechanism for U.S. payment of Canal tolls and charges. The Defense Secretary praises Mulino for withdrawing Panama from the Belt and Road Initiative.

Panama’s version of their joint statement includes an additional detail: It says that Hegseth “recognized Panama’s leadership and inalienable sovereignty over the Panama Canal and its adjacent areas.”

Racket News is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

-

Also Interesting1 day ago

Also Interesting1 day agoMortgage Mayhem: How Rising Interest Rates Are Squeezing Alberta Homeowners

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoConservative Party urges investigation into Carney plan to spend $1 billion on heat pumps

-

Alberta2 days ago

Alberta2 days agoAlberta’s embrace of activity-based funding is great news for patients

-

COVID-192 days ago

COVID-192 days agoMassive new study links COVID jabs to higher risk of myocarditis, stroke, artery disease

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCommunist China helped boost Mark Carney’s image on social media, election watchdog reports

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCorporate Media Isn’t Reporting on Foreign Interference—It’s Covering for It

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFifty Shades of Mark Carney

-

Also Interesting2 days ago

Also Interesting2 days agoExploring Wildrobin Technological Advancements in Live Dealer Games