From The Center Square

The changes are expected to reduce the agency’s headcount from 82,000 to 62,000 full-time employees.

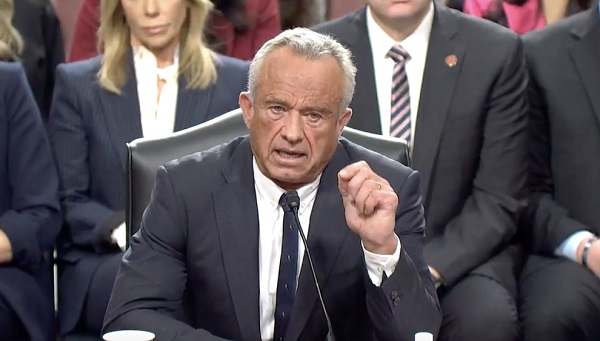

Robert F. Kennedy Jr. announced a significant restructuring of the U.S. Department of Health and Human Services on Thursday in a move to streamline the huge federal agency and cut costs.

Kennedy plans to trim about 10,000 employees from the agency’s workforce in addition to employees who left as part of a Deferred Resignation Program, similar to a buy out, earlier this year. The move is expected to save about $1.8 billion.

Kennedy said the restructuring won’t affect the agency’s critical services. When combined with HHS’ other efforts, including early retirement, the changes are expected to reduce the agency’s headcount from 82,000 to 62,000 full-time employees. The restructuring will also align the department with Kennedy’s goals for a healthier U.S. population.

“We aren’t just reducing bureaucratic sprawl. We are realigning the organization with its core mission and our new priorities in reversing the chronic disease epidemic,” Kennedy said. “This Department will do more – a lot more – at a lower cost to the taxpayer.”

Kennedy also said the restructuring of the department’s 28 divisions will get rid of redundant units, consolidating them into “15 new divisions, including a new Administration for a Healthy America, or AHA, and will centralize core functions such as Human Resources, Information Technology, Procurement, External Affairs, and Policy.” Regional offices will be reduced from 10 to 5.

The overhaul will implement the new “HHS priority of ending America’s epidemic of chronic illness by focusing on safe, wholesome food, clean water, and the elimination of environmental toxins. These priorities will be reflected in the reorganization of HHS.”

Kennedy also said the restructuring would improve taxpayers’ experience with HHS by making the agency more responsive and efficient. He also said the changes would ensure that Medicare, Medicaid, and other essential health services remain intact.

The Administration for a Healthy America will combine multiple agencies – the Office of the Assistant Secretary for Health, Health Resources and Services Administration, Substance Abuse and Mental Health Services Administration, Agency for Toxic Substances and Disease Registry, and National Institute for Occupational Safety and Health — into a single, unified entity, Kennedy said.

The Centers for Disease Control and Prevention will get the Administration for Strategic Preparedness and Response, which is responsible for national disaster and public health emergency response.

“Over time, bureaucracies like HHS become wasteful and inefficient even when most of their staff are dedicated and competent civil servants,” Kennedy said. “This overhaul will be a win-win for taxpayers and for those that HHS serves.”

Among the cuts: The U.S. Food and Drug Administration will shed about 3,500 full-time employees. Officials said the reduction won’t affect drug, medical device, or food reviewers, nor will it impact inspectors. The CDC will drop about 2,400 employees. The National Institutes of Health will cut about 1,200 employees. The Centers for Medicare & Medicaid Services will cut about 300 employees. The reorganization won’t affect Medicare and Medicaid services, officials said.