Business

Federal government should stay in its lane

From the Fraser Institute

By Jason Clemens and Jake Fuss

There’s been more talk this year than normal about the need for governments, particularly Ottawa, to “stay in their own lane.” But what does this actually mean when it comes to the practical taxing, spending and regulating done by provincial and federal governments?

The rules of the road, so to speak, are laid out in sections 91 and 92 of the Canadian Constitution. As noted economist Jack Mintz recently explained, the federal government was allocated responsibility for areas of national priority such as defence and foreign relations, criminal law, and national industries such as transportation, communication and financial institutions. The provinces, on the other hand, were allotted responsibilities deemed to be closer to the people such as health care, education, social services and municipalities.

Simply put, the principle of staying in one’s lane means the federal and provincial governments respect one another’s areas of responsibility and work collaboratively when there are joint interests and/or overlapping responsibilities such as environmental issues.

The experience of the mid-1990s through to roughly 2015 shows the tangible benefits of having each level of government focus on their areas of responsibility. Recall that the Liberal Chrétien government fundamentally removed itself from several areas of provincial jurisdiction, particularly welfare and social services, in its historic 1995 budget.

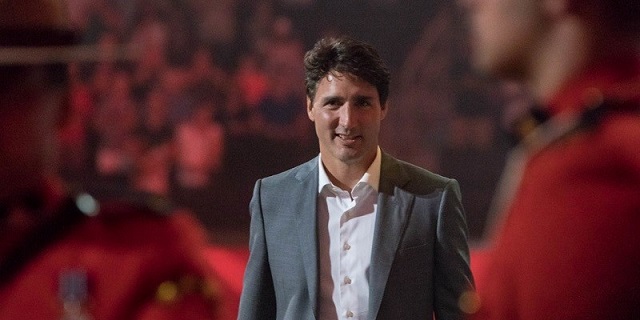

But the election of the Trudeau government in 2015 represented a marked change in approach. The tax and spending policies of the Trudeau government, which broke a 20-year consensus, favoured ever-increasing spending, higher taxes and much higher levels of borrowing. Federal spending (excluding interest payments on debt) has increased from $273.6 billion in 2015-16 when Trudeau first took office to an expected $483.6 billion this year, an increase of 76.7 per cent.

Federal taxes on most Canadians, including the middle class, have also increased despite the Trudeau government promising lower taxes. And despite the tax increases, borrowing has also increased. Consequently, the national debt has ballooned from $1.1 trillion when Trudeau took office to an estimated $2.1 trillion this year.

Despite these massive spending increases, there are serious questions about core areas of federal responsibility. Consider, for example, the major problems with Canada’s defence spending.

Canada has been called out by both NATO officials and our counterparts within NATO for failing to meet our commitments. As a NATO country, Canada is committed to spend 2 per cent of the value of our economy (GDP) annually on defence. The latest estimate is that Canada will spend 1.4 per cent of GDP on defence and we’re the only country without a plan to reach the target by 2030. The Parliamentary Budget Officer recently estimated that to reach our NATO commitment, defence spending would have to increase by $21.3 billion in 2029-30, which given the state of federal finances would entail much higher borrowing and/or higher taxes.

So, while the Trudeau government has increased federal spending markedly, it has not spent those funds on core areas of federal responsibility. Instead, Trudeau’s Ottawa has increasingly involved itself in provincial areas of responsibility. Consider three new national initiatives that are all squarely provincial areas of responsibility: pharmacare, $10-a-day daycare and dental care.

And the amounts involved in these programs are not incidental. In Budget 2021, the Trudeau government announced $27.2 billion over five years for the new $10-a-day daycare initiative, Budget 2023 committed $13.0 billion for the dental benefit over five years, and Budget 2024 included a first step towards national pharmacare with spending of $1.5 billion over five years to cover most contraceptives and some diabetes medications.

So, while the Trudeau government has deprioritized core areas of federal responsibility such as defence, it has increasingly intruded on areas of provincial responsibility.

Canada works best when provincial and federal governments recognize and adhere to their roles within Confederation as was more the norm for more than two decades. The Trudeau government’s intrusion into provincial jurisdiction has increased tensions with the provinces, likely created unsustainable new programs that will ultimately put enormous financial pressure on the provinces, and led to a less well-functioning federal government. Staying in one’s lane makes sense for both driving and political governance.

Authors:

Business

Resurfaced Video Shows How Somali Scammers Used Day Care Centers To Scam State

From the Daily Caller News Foundation

A resurfaced 2018 video from a Minneapolis-area TV station shows how Somali scammers allegedly bilked Minnesota out of millions of dollars for services that they never provided.

Independent journalist Nick Shirley touched off a storm on social media Friday after he posted a photo of one day-care center, which displayed a banner calling it “The Greater Learing Center” on X, along with a 42-minute video that went viral showing him visiting that and other day-care centers. The surveillance video, which aired on Fox 9 in 2018 after being taken in 2015, showed parents taking kids into the center, then leaving with them minutes later, according to Fox News.

“They were billing too much, they went up to high,” Hennepin County attorney Mike Freeman told Fox 9 in 2018. “It’s hard to imagine they were serving that many people. Frankly if you’re going to cheat, cheat little, because if you cheat big, you’re going to get caught.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Democratic Gov. Tim Walz of Minnesota was accused of engaging in “systemic” retaliation against whistleblowers in a Nov. 30 statement by state employees. Assistant United States Attorney Joe Thompson announced on Dec. 18 that the amount of suspected fraud in Minnesota’s Medicaid program had reached over $9 billion.

After Shirley’s video went viral, FBI Director Kash Patel announced the agency was already sending additional resources in a Sunday post on X, citing the case surrounding Feeding Our Future, which at one point accused the Minnesota government of racism during litigation over the suspension of funds after earlier allegations of fraud.

KSTP reported that the Quality Learning Center, one of the centers visited by Shirley, had 95 citations for violations from one Minnesota agency between 2019 to 2023.

President Donald Trump announced in a Nov. 21 post on Truth Social that he would end “Temporary Protected Status” for Somalis in the state in response to allegations of welfare fraud and said that the influx of refugees had “destroyed our country.”

Business

Disclosures reveal Minnesota politician’s husband’s companies surged thousands-fold amid Somali fraud crisis

Rep. Ilhan Omar’s latest financial disclosures reveal seemingly sudden wealth accumulation inside her household, even as Minnesota grapples with revelations of massive fraud that may have siphoned more than $9 billion from government programs. The numbers, drawn from publicly filed congressional reports, show two companies tied to Omar’s husband, Tim Mynett, surging in value at a pace that raises more questions than answers.

According to the filings, Rose Lake Capital LLC — a business advisory firm Mynett co-founded in 2022 — jumped from an assessed range of $1 to $1,000 in 2023 to between $5 million and $25 million in 2024. Even using the most conservative assumptions allowed under Congress’ broad valuation ranges, the company’s value would have increased thousands of times in a single year. The firm advertises itself as a facilitator of “deal-making, mergers and acquisitions, banking, politics and diplomacy.”

Archived versions of Rose Lake’s website once showcased an eye-catching lineup of political heavyweights: former Ambassador to Bahrain Adam Ereli, former Sen. Max Baucus, and prominent Democratic National Committee alumni William Derrough and Alex Hoffman. But as scrutiny surrounding Omar intensifies — particularly over whether her political network intersected with sprawling fraud schemes exposed in Minnesota — the company has quietly scrubbed its online footprint. Names and biographies of team members have vanished, and the firm has not clarified whether these figures remain involved. Omar’s office offered no comment when asked to explain the company’s sudden growth or the removal of its personnel listings.

Mynett, Omar’s third husband, has long been a controversial presence in her political orbit, but the dramatic swell in his business holdings comes at a moment when trust in Minnesota’s oversight systems is already badly shaken. Federal and state investigators now estimate that fraud involving pandemic-era and nonprofit programs may exceed $9 billion, a staggering figure for a state often held up as a model of progressive governance. For many residents, the revelation that Omar’s household wealth soared during the same period only deepens skepticism about who benefited from Minnesota’s expansive social-spending apparatus.

The financial story doesn’t stop with Rose Lake. A second Mynett-linked entity, ESTCRU LLC — a boutique winery registered in Santa Rosa, California — reported an assessed value of $1 million to $5 million in 2024. Just a year earlier, Omar disclosed its worth at $15,000 to $50,000. Despite the dramatic valuation spike, ESTCRU’s online storefront does not appear to function, its last social media activity dates back to early 2023, and the phone number listed on its website is no longer in service. As with Rose Lake, Omar’s office declined to comment on the winery’s sudden rise in reported value.

The House clerk has yet to release 2025 disclosures, leaving unanswered how these companies are performing today — and how such explosive growth materialized in the first place.

-

Business7 hours ago

Business7 hours agoICYMI: Largest fraud in US history? Independent Journalist visits numerous daycare centres with no children, revealing massive scam

-

Daily Caller1 day ago

Daily Caller1 day agoWhile Western Nations Cling to Energy Transition, Pragmatic Nations Produce Energy and Wealth

-

Daily Caller1 day ago

Daily Caller1 day agoUS Halts Construction of Five Offshore Wind Projects Due To National Security

-

Alberta1 day ago

Alberta1 day agoAlberta Next Panel calls for less Ottawa—and it could pay off

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoBe Careful What You Wish For In 2026: Mark Carney With A Majority

-

Energy2 days ago

Energy2 days agoWhy Japan wants Western Canadian LNG

-

Business2 days ago

Business2 days agoLand use will be British Columbia’s biggest issue in 2026

-

Business2 days ago

Business2 days agoMainstream media missing in action as YouTuber blows lid off massive taxpayer fraud