International

Keir Stasi? UK government wants to prosecute ‘non-crime hate speech’

From LifeSiteNews

By Frank Wright

According to reports, the United Kingdom’s Home Secretary is seeking to reinstate the prosecution of ‘non-crime hate speech,’ overturning a 2021 court ruling which described the measure as a move towards a police state in Britain.

In the United Kingdom’s escalating war on the freedom of expression, the U.K. Home Secretary is seeking to reinstate the prosecution of “non-crime hate speech,” overturning a 2021 court ruling which described the measure as a move towards a police state in Britain.

According to an August 28 report in the U.K. Times, Home Secretary Yvette Cooper “faces a legal battle” to reinstate measures to interrogate, monitor, and even prosecute members of the public for a range of “non-criminal” remarks.

The measures were struck down in a case brought in 2021 by Harry Miller, the founder of U.K. policing campaign group Fair Cop. They are being reintroduced to “combat antisemitism and Islamophobia,” according to the U.K. Home Secretary.

Miller was visited at work by U.K. police to question him over an “anti-trans” joke he made on X (formerly Twitter). When Miller, a former policeman himself, brought a case against this “non-criminal hate speech,” the judge ruled that the effect of the police turning up at Mr. Miller’s place of work “because of his political opinions must not be underestimated.”

Mr. Justice Julian Knowles continued: “To do so would be to undervalue a cardinal democratic freedom. In this country we have never had a Cheka, a Gestapo or a Stasi. We have never lived in an Orwellian society.”

The measures advanced by the U.K. Home Secretary seek to make this “Orwellian society” a reality.

Recent changes to the U.K.’s Prevent strategy, a government operation to counter violent extremism, have seen “anti-abortion groups” bracketed with terrorists, and the inclusion of “anti-establishment sentiment” of any kind as adjacent to terrorism.

Home Secretary Yvette Cooper has announced the redefinition of “terrorism” to include “anti-establishment rhetoric,” “anti-LGBTQI+ sentiment,” “anti-abortion activism,” and any speech online or offline which it deems to be “extreme” – as a report from LifeSiteNews below shows.

READ: UK’s draconian ‘online safety’ laws are turning traditional values into criminal ‘hate speech’

The U.K.’s Terrorism Act has been used in recent weeks to arrest and interrogate three U.K. critics of Israel’s genocide in Gaza. Richard Medhurst, the son of British diplomats, was arrested and questioned for almost 24 hours on his return to the U.K. earlier this month.

In recent days, Sarah Wilkinson was arrested in her home under the Terrorism Act – for documenting Israel’s genocide. Richard Barnard, co-founder of Palestinian Action, has also been charged under the Terrorism Act following his arrest for doing the same.

As Kim Dotcom, himself the ongoing target of Deep State legal persecution, has remarked, this is not an issue of left or right. When the government is wrong, anyone who points this out is a target.

“Truth-tellers everywhere are under attack. As the propaganda media crumbles and people look for honest information elsewhere the deep state is abusing anti-terrorism and spy laws to intimidate and silence independent journalists,” he said.

In the U.K., this means journalists like Medhurst, and his fellow British journalist Kit Klarenberg, whose interrogation at Luton Airport in May 2023 was the first in a new wave of repression which designates truth telling as “terrorism” – and even treason.

Klarenberg’s interrogation saw him treated as a traitor in the pay of a foreign power. His investigations have shown how the CIA and MI6 created ISIS, how the Ukraine war is being directed and escalated towards Armageddon by the British state, and crucially how U.S. and U.K. foreign policy is dictated by the Zionist lobby. His investigations exposing state-level crimes have seen him labeled a “dangerous” individual by Deep State asset Facebook, a term usually reserved for violent terrorists.

In a report from February, he showed how the new U.K. National Security Act could see journalists like him face life imprisonment. Two years ago, he revealed “the journalist-run, intelligence-linked operation that warped British pandemic policy” – exposing the U.K. government’s partnership with media to manufacture consent to COVID-19 “vaccines” and lockdowns.

For naming actual foreign influence in the West, and the industry of death which is partnered with it, independent voices are being silenced as traitors and terrorists. Yet it is Klarenberg who revealed “British spies [are] constructing a secret terror army in Ukraine” – in 2022.

Western proxy war ‘playing with fire’: Russian foreign minister

Klarenberg’s reporting on the U.K.-backed Kursk offensive by Ukraine shows how far the British liberal-global state will go in gambling the lives of millions to preserve its own waning influence.

To prevent a U.S. “drawdown” from European war commitments, he says, the British state has propelled the Ukrainians into an escalation which risks full-scale nuclear war.

According to Russian Foreign Minister Sergei Lavrov, this policy is akin to “a child playing with matches.” In a warning to the West over the rising danger of nuclear war, Lavrov was reported by Reuters on August 27 as saying, “We are now confirming once again that playing with fire – and they are like small children playing with matches – is a very dangerous thing for grown-up uncles and aunts who are entrusted with nuclear weapons in one or another Western country.”

Lavrov’s remarks come in response to U.K.-backed Ukrainian demands for U.S. authorization to mount long range missile strikes on Russia – including on Moscow itself – using weapons supplied by NATO.

Former U.N. Weapons Inspector Scott Ritter warned in July that “the world faces a greater threat of a nuclear conflict between the U.S. and Russia than at any time since the Cuban Missile Crisis of 1962.”

Yet people who warn of the policies promoting Armageddon are accused of treason and arrested under terrorism laws. According to one former high level U.S. official, retired Colonel Lawrence Wilkerson, this chaos is allied to U.S. “imperial” war policies, which have led the U.S. international order into crisis.

The former chief of staff to the U.S. secretary of defense said in an interview given on August 29 that the U.S. empire was collapsing due to its commitment to so many “stupid wars.”

“I’m not against war. I’m against stupid war. I’m against endless war. I’m against imperial wars,” he told Judge Andrew Napolitano.

Critics of the “forever wars” in the U.S., U.K., and across the West are routinely smeared as “pro-Russian,” or even “antisemitic.”

GnasherJew are “a digital investigation team who operate under the radar, using OSINT to expose antisemites.”

You may know Sarah Wilkinson from her antisemitic pro Hamas Propaganda on social media.

It looks like after we reported her repeatedly to @TerrorismPolice finally she’s been arrested. 🥂

This is 👇🏼her son, like his mother he’s a Holocaust denier. pic.twitter.com/ydrFXriW8D

— GnasherJew®גנאשר (@GnasherJew) August 29, 2024

Zionists in the U.K. have been celebrating the result of their mass-reporting of independent voices against Israel’s genocide, labeling critics of Western-backed war crimes as “antisemitic violent thugs.”

Here’s one X post by “award winning journalist” David Collier:

Sarah Wilkinson from Palestine Action has been arrested.

What she is:

✅A Holocaust denier

✅An antisemitic conspiracy theorist

✅A terrorist supporter

✅A violent thugWhat she is not

❌A peace activist

❌A human rights activistGlad I could help.

— David Collier (@mishtal) August 29, 2024

In the U.S., figures such as John Bolton routinely decry the influence of hostile foreign powers such as Russia, China, and Iran, whilst ignoring the charge made by retired Colonel Douglas Macgregor and independent journalist Max Blumenthal that the “entire U.S. political establishment is bought and paid for by the Israel lobby,” and the “Zionist … occupation of the American mind.”

The moves by the U.K.’s liberal-globalist regime to categorize criticism of its policies as terrorism is an escalation in the war against Western civilization.

Telling the truth is treason and an act of terror. Disagreement is extremism. If you demand an alternative to the permanent state of emergency delivered by the liberal-global order, you can expect interrogation, arrest, and imprisonment in the birthplace of “liberal democracy.”

The legal persecution of the argument for life is a further indication of how regime change has changed our regime at home. It began with a promise of an earthly paradise, with the global export of the liberal system of elections and cheap consumer goods, following the collapse of the Soviet Union. Instead of heaven, it has delivered hell on earth.

As the liberal-global project unravels, all it can do now is terrorize its own populations for telling the truth about the industry of death behind the mask of the “rules-based order.”

Keir Starmer’s first speech as prime minister said “my government will be a force for good.” Two months later, the forces he has unleashed may see him rightfully dubbed “Keir Stasi.”

Economy

Trump opens door to Iranian oil exports

This article supplied by Troy Media.

U.S. President Donald Trump’s chaotic foreign policy is unravelling years of pressure on Iran and fuelling a surge of Iranian oil into global markets. His recent pivot to allow China to buy Iranian crude, despite previously trying to crush those exports, marks a sharp shift from strategic pressure to transactional diplomacy.

This unpredictability isn’t just confusing allies—it’s transforming global oil flows. One day, Trump vetoes an Israeli plan to assassinate Iran’s supreme leader, Ayatollah Khamenei. Days later, he calls for Iran’s unconditional surrender. After announcing a ceasefire between Iran, Israel and the United States, Trump praises both sides then lashes out at them the next day.

The biggest shock came when Trump posted on Truth Social that “China can now continue to purchase Oil from Iran. Hopefully, they will be purchasing plenty from the U.S., also.” The statement reversed the “maximum pressure” campaign he reinstated in February, which aimed to drive Iran’s oil exports to zero. The campaign reimposes sanctions on Tehran, threatening penalties on any country or company buying Iranian crude,

with the goal of crippling Iran’s economy and nuclear ambitions.

This wasn’t foreign policy—it was deal-making. Trump is brokering calm in the Middle East not for strategy, but to boost American oil sales to China. And in the process, he’s giving Iran room to move.

The effects of this shift in U.S. policy are already visible in trade data. Chinese imports of Iranian crude hit record levels in June. Ship-tracking firm Vortexa reported more than 1.8 million barrels per day imported between June 1 and 20. Kpler data, covering June 1 to 27, showed a 1.46 million bpd average, nearly 500,000 more than in May.

Much of the supply came from discounted May loadings destined for China’s independent refineries—the so-called “teapots”—stocking up ahead of peak summer demand. After hostilities broke out between Iran and Israel on June 12, Iran ramped up exports even further, increasing daily crude shipments by 44 per cent within a week.

Iran is under heavy U.S. sanctions, and its oil is typically sold at a discount, especially to China, the world’s largest oil importer. These discounted barrels undercut other exporters, including U.S. allies and global producers like Canada, reducing global prices and shifting power dynamics in the energy market.

All of this happened with full knowledge of the U.S. administration. Analysts now expect Iranian crude to continue flowing freely, as long as Trump sees strategic or economic value in it—though that position could reverse without warning.

Complicating matters is progress toward a U.S.-China trade deal. Commerce Secretary Howard Lutnick told reporters that an agreement reached in May has now been finalized. China later confirmed the understanding. Trump’s oil concession may be part of that broader détente, but it comes at the cost of any consistent pressure on Iran.

Meanwhile, despite Trump’s claims of obliterating Iran’s nuclear program, early reports suggest U.S. strikes merely delayed Tehran’s capabilities by a few months. The public posture of strength contrasts with a quieter reality: Iranian oil is once again flooding global markets.

With OPEC+ also boosting output monthly, there is no shortage of crude on the horizon. In fact, oversupply may once again define the market—and Trump’s erratic diplomacy is helping drive it.

For Canadian producers, especially in Alberta, the return of cheap Iranian oil can mean downward pressure on global prices and stiffer competition in key markets. And with global energy supply increasingly shaped by impulsive political decisions, Canada’s energy sector remains vulnerable to forces far beyond its borders.

This is the new reality: unpredictability at the top is shaping the oil market more than any cartel or conflict. And for now, Iran is winning.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Banks

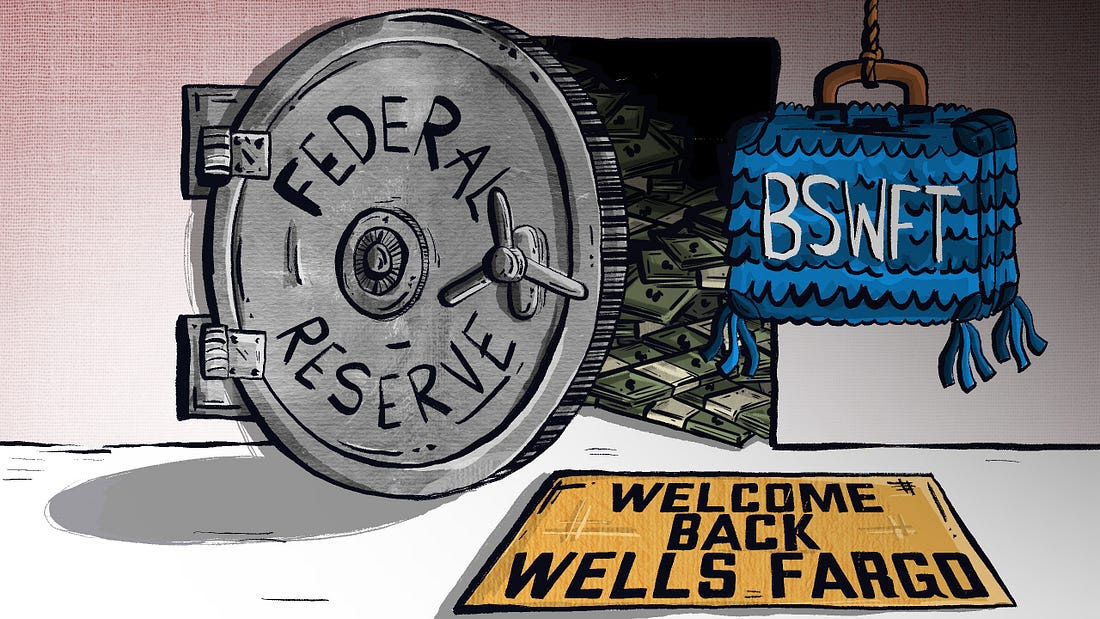

Welcome Back, Wells Fargo!

Racket News

Racket News

By Eric Salzman

The heavyweight champion of financial crime gets seemingly its millionth chance to show it’s reformed

The past two decades have been tough ones for Wells Fargo and the many victims of its sprawling crime wave. While the banking industry is full of scammers, Wells took turning time honored street-hustles into multi-billion dollar white-collar hustles to a new level.

The Federal Reserve announced last month that Wells Fargo is no longer subject to the asset growth restriction the Fed finally enforced in 2018 after multiple scandals. This was a major enforcement action that prohibited Wells from growing existing loan portfolios, purchasing other bank branches or entering into any new activities that would result in their asset base growing.

Upon hearing the news that Wells was being released from the Fed’s penalty box, my mind turned to this pivotal moment in the classic movie “Slapshot.”

Here are some of Wells Fargo’s lowlights both before and after the Fed’s enforcement action:

- December 2022: Wells Fargo paid more than $2 billion to consumers and $1.7 billion in civil penalties after the Consumer Financial Protection Bureau (CFPB) found mismanagement — including illegal fees and interest charges — in several of its biggest product lines, such as auto loans, mortgages, and deposit accounts.

- September 2021: Wells Fargo paid $72.6 million to the Justice Department for overcharging foreign exchange customers from 2010-2017.

- February 2020: Wells Fargo paid $3 billion to settle criminal and civil investigations by the Justice Department and SEC into its aggressive sales practices between 2002 and 2016. About $500 million was eventually distributed to investors.

- January 2020: The Office of the Comptroller of the Currency (OCC) banned two senior executives, former CEO John Stumpf and ex-Head of Community Bank Carrie Tolstedt, from the banking industry. Stumpf and Tolstedt also incurred civil penalties of $17.5 million and $17 million.

- August 2018: The Justice Department levied a $2.09 billion fine on Wells Fargo for its actions during the subprime mortgage crisis, particularly its mortgage lending practices between 2005 and 2007.

- April 2018: Federal regulators at the CFPB and OCC examined Wells’ auto loan insurance and mortgage lending practices and ordered the bank to pay $1 billion in damages.

- February 2018: The aforementioned Fed enforcement action. In addition to the asset growth restriction, Wells was ordered to replace three directors.

- October 2017: Wells Fargo admitted wrongdoing after 110,000 clients were fined for missing a mortgage payment deadline — delays for which the bank was ultimately deemed at fault.

- July 2017: As many as 570,000 Wells Fargo customers were wrongly charged for auto insurance on car loans after the bank failed to verify whether those customers already had existing insurance. As a result, up to 20,000 customers may have defaulted on car loans.

- September 2016: Wells Fargo acknowledged its employees had created 1.5 million deposit accounts and 565,000 credit card accounts between 2002 and 2016 that “may not have been authorized by consumers,” according to CFPB. As a result, the lender was forced to pay $185 million in damages to the CFPB, OCC, and City and County of Los Angeles.

Additionally, somehow in 2023 Wells even managed to drop $1 billion in a civil settlement with shareholders for overstating their progress in complying with their 2018 agreement with the Fed to clean themselves up!

I imagine if Wells were in any other business, it wouldn’t be allowed to continue. But Wells is part of the “Too Big to Fail” club. Taking away its federal banking charter would be too disruptive for the financial markets, so instead they got what ended up being a seven-year growth ban. Not exactly rough justice.

While not the biggest settlement, my favorite Wells scam was the 2021 settlement of the seven-year pilfering operation, ripping off corporate customers’ foreign exchange transactions.

Like many banks, Wells Fargo offers its corporate clients with global operations foreign exchange (FX) services. For example, if a company is based in the U.S. but has extensive dealings in Canada, it may receive payments in Canadian dollars (CAD) that need to be exchanged for U.S. dollars (USD) and vice versa. Wells, like many banks, has foreign exchange specialists who do these conversions. Ideally, the banks optimize their clients’ revenue and decrease risk, in return for a markup fee, or “spread.”

There’s a lot of trust involved with this activity as the corporate customers generally have little idea where FX is trading minute by minute, nor do they know what time of day the actual orders for FX transactions — commonly called “BSwifts” — come in. For an unscrupulous bank, it’s a license to steal, which is exactly what Wells did.

According to the complaint, Wells regularly marked up transactions at higher spreads than what was agreed upon. This was just one of the variety of naughty schemes Wells used to clobber their customers. My two favorites were “The Big Figure Trick” and the “BSwift Pinata.”

The Big Figure Trick

Let’s say a client needs to sell USD for CAD, and that the $1 USD is worth $1.32 CAD. In banking parlance, the 32 cents is called the “Big Figure.” Wells would buy the CAD at $1.32 for $1 USD and then transpose the actual exchange rate on the customer statement from $1.32 to $1.23. If the customer didn’t notice, Wells would pocket the difference. On a transaction where the client is buying 5 million CAD with USD, the ill-gotten gain for Wells would be about $277,000 USD!

Conversely, if the customer did notice the difference, Wells would just blame it on the grunts in its operational back office, saying they accidentally transposed the number and “correct” the transaction. From the complaint, here is some give and take between two Wells FX specialists:

“You can play the transposition error game if you get called out.” Another FX sales specialist noted to a colleague about a previous transaction that a customer “didn’t flinch at the big fig the other day. Want to take a bit more?”

The BSwift Piñata

The way this hustle would work is, let’s say the Wells corporate customer was receiving payment from one of their Canadian clients. The Canadian client’s bank would send a BSwift message to Wells. The Wells client was in the dark about the U.S. dollar-Canadian dollar exchange rate because it had no idea what time of day the message arrived. Wells took advantage of that by purchasing U.S. dollars for Canadian dollars first. For simplicity, think of the U.S. dollar-Canadian dollar exchange rate as a widget that Wells bought for $1. If the widget increased in value, say to $1.10 during the day, Wells would sell the widget they purchased for $1 to the client for $1.10 and pocket 10 cents. If the price of the widget Wells bought for $1 fell to 95 cents, Wells would just give up their $1 purchase to the client, plus whatever markup they agreed to.

Heads, Wells wins. Tails, client loses.

The complaint notes that a Wells FX specialist wrote that he:

“Bumped spreads up a pinch,” that “these clients who are in the mode of just processing wires will most likely not notice this slight change in pricing” and that it “could have a very quick positive impact on revenue without a lot of risk.”

Talk about a boiler room operation. Personally, I think calling what you are doing to a client a “piñata” should have easily put Wells in the Fed’s penalty box another 5 years at least!

Wells has been released from the Fed’s 2018 enforcement order. I would like to think they have learned their lesson and are reformed, but I would lay good odds against it. A leopard can’t change its spots.

Racket News is a reader-supported publication.

Consider becoming a free or paid subscriber.

-

Business2 days ago

Business2 days agoLatest shakedown attempt by Canada Post underscores need for privatization

-

Business2 days ago

Business2 days agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoHow Vimy Ridge Shaped Canada

-

Alberta2 days ago

Alberta2 days agoPierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

-

MxM News2 days ago

MxM News2 days agoUPenn strips Lia Thomas of women’s swimming titles after Title IX investigation

-

Alberta1 day ago

Alberta1 day agoAlberta Provincial Police – New chief of Independent Agency Police Service

-

International2 days ago

International2 days agoCBS settles with Trump over doctored 60 Minutes Harris interview

-

Energy2 days ago

Energy2 days agoIf Canada Wants to be the World’s Energy Partner, We Need to Act Like It