Alberta

Alberta government must reform spending to avoid deficits

From the Fraser Institute

By Tegan Hill

According to Premier Danielle Smith, the Alberta government is creating a new committee—composed of the premier, Finance Minister Nate Horner, Technology and Innovation Minister Nate Glubish, three treasury board members, and three private members—to review government spending in the province. Smith says the committee will find savings so her government can deliver on the promised personal income tax cut. But in fact, the need for a thorough program review is much broader than that.

A bit of background.

During the election campaign, Smith promised to create a new 8 per cent tax bracket for personal income below $60,000, which is expected to cost provincial coffers $1.4 billion annually. While the Smith government’s 2024 budget delayed this tax cut, the premier recently said a “substantial” cut is coming soon.

According to Smith, the committee will review “every single program in every single department to see if there are ways that we can remove wasteful spending, move spending from low-priority areas to high-priority areas, find ways that we can use technology to be able to deliver services better, and accelerate that personal income tax cut.”

Again, the idea of a program-by-program review is a good one. But the goal must span beyond finding savings for a single personal income tax cut. Alberta has a big spending problem and it must be meaningfully addressed.

Simply put, Alberta governments have a bad habit of increasing spending during the good times of high resource revenue and budget surpluses, like the province is currently experiencing, but fail to rein in spending when resource revenues fall. This pattern has led to historically high levels of government spending—and budget deficits—even in more recent years.

To be clear, the Smith government introduced a rule to limit increases in operating spending (e.g. spending on annual items such as government employee compensation) to the rate of population growth and inflation. But while this a step in the right direction, the government’s earlier spending increases since 2022 mean it continues to rely on relatively high—but very volatile—resource revenue to balance its budget.

Indeed, according to this year’s provincial budget, program spending this year will reach $14,334 per Albertan, which is $1,603 more per person (inflation-adjusted) than the government originally planned to spend in the 2022 mid-year budget update, Smith’s first fiscal plan as premier.

In total, the Alberta government will spend a projected $6,037 more per Albertan (inflation-adjusted) over four years from 2023/24 to 2026/27 than it planned in the 2022 mid-year budget update.

In other words, the government’s current plan to restrain spending by the rate of inflation and population growth is starting from a higher base level of spending. As a result, Alberta remains at risk of incurring a budget deficit when relatively high resource revenue declines.

For perspective, if resource revenue fell to its average over the last 10 years—rather than being at historic highs—the government’s $367 million projected surplus for this year would immediately fall to a deficit of $7.4 billion, even before the billion-dollar tax cut that Smith says is coming soon.

The Alberta government should use its program review to more closely align ongoing spending with stable ongoing levels of government revenue rather than onetime windfalls. Otherwise, Alberta will continue on its boom-and-bust rollercoaster that inevitably leads back to deficits and more debt.

Author:

Alberta

Alberta takes big step towards shorter wait times and higher quality health care

From the Fraser Institute

On Monday, the Smith government announced that beginning next year it will change the way it funds surgeries in Alberta. This is a big step towards unlocking the ability of Alberta’s health-care system to provide more, better and faster services for the same or possibly fewer dollars.

To understand the significance of this change, you must understand the consequences of the current (and outdated) approach.

Currently, the Alberta government pays a lump sum of money to hospitals each year. Consequently, hospitals perceive patients as a drain on their budgets. From the hospital’s perspective, there’s little financial incentive to serve more patients, operate more efficiently and provide superior quality services.

Consider what would happen if your local grocery store received a giant bag of money each year to feed people. The number of items would quickly decline to whatever was most convenient for the store to provide. (Have a favourite cereal? Too bad.) Store hours would become less convenient for customers, alongside a general decline in overall service. This type of grocery store, like an Alberta hospital, is actually financially better off (that is, it saves money) if you go elsewhere.

The Smith government plans to flip this entire system on its head, to the benefit of patients and taxpayers. Instead of handing out bags of money each year to providers, the new system—known as “activity-based funding”—will pay health-care providers for each patient they treat, based on the patient’s particular condition and important factors that may add complexity or cost to their care.

This turns patients from a drain on budgets into a source of additional revenue. The result, as has been demonstrated in other universal health-care systems worldwide, is more services delivered using existing health-care infrastructure, lower wait times, improved quality of care, improved access to medical technologies, and less waste.

In other words, Albertans will receive far better value from their health-care system, which is currently among the most expensive in the world. And relief can’t come soon enough—for example, last year in Alberta the median wait time for orthopedic surgeries including hip and knee replacements was 66.8 weeks.

The naysayers argue this approach will undermine the province’s universal system and hurt patients. But by allowing a spectrum of providers to compete for the delivery of quality care, Alberta will follow the lead of other more successful universal health-care systems in countries such as Australia, Germany, the Netherlands and Switzerland and create greater accountability for hospitals and other health-care providers. Taxpayers will get a much better picture of what they’re paying for and how much they pay.

Again, Alberta is not exploring an untested policy. Almost every other developed country with universal health care uses some form of “activity-based funding” for hospital and surgical care. And remember, we already spend more on health care than our counterparts in nearly all of these countries yet endure longer wait times and poorer access to services generally, in part because of how we pay for surgical care.

While the devil is always in the details, and while it’s still possible for the Alberta government to get this wrong, Monday’s announcement is a big step in the right direction. A funding model that puts patients first will get Albertans more of the high-quality health care they already pay for in a timelier fashion. And provide to other provinces an example of bold health-care reform.

Alberta

Alberta’s embrace of activity-based funding is great news for patients

From the Montreal Economic Institute

From the Montreal Economic Institute

Alberta’s move to fund acute care services through activity-based funding follows best practices internationally, points out an MEI researcher following an announcement made by Premier Danielle Smith earlier today.

“For too long, the way hospitals were funded in Alberta incentivized treating fewer patients, contributing to our long wait times,” explains Krystle Wittevrongel, director of research at the MEI. “International experience has shown that, with the proper funding models in place, health systems become more efficient to the benefit of patients.”

Currently, Alberta’s hospitals are financed under a system called “global budgeting.” This involves allocating a pre-set amount of funding to pay for a specific number of services based on previous years’ budgets.

Under the government’s newly proposed funding system, hospitals receive a fixed payment for each treatment delivered.

An Economic Note published by the MEI last year showed that Quebec’s gradual adoption of activity-based funding led to higher productivity and lower costs in the province’s health system.

Notably, the province observed that the per-procedure cost of MRIs fell by four per cent as the number of procedures performed increased by 22 per cent.

In the radiology and oncology sector, it observed productivity increases of 26 per cent while procedure costs decreased by seven per cent.

“Being able to perform more surgeries, at lower costs, and within shorter timelines is exactly what Alberta’s patients need, and Premier Smith understands that,” continued Mrs. Wittevrongel. “Today’s announcement is a good first step, and we look forward to seeing a successful roll-out once appropriate funding levels per procedure are set.”

The governments expects to roll-out this new funding model for select procedures starting in 2026.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

-

Also Interesting2 days ago

Also Interesting2 days agoMortgage Mayhem: How Rising Interest Rates Are Squeezing Alberta Homeowners

-

Alberta2 days ago

Alberta2 days agoAlberta takes big step towards shorter wait times and higher quality health care

-

Justice2 days ago

Justice2 days agoCanadian government sued for forcing women to share spaces with ‘transgender’ male prisoners

-

Business1 day ago

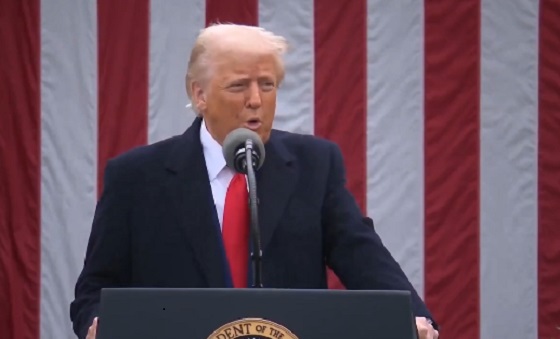

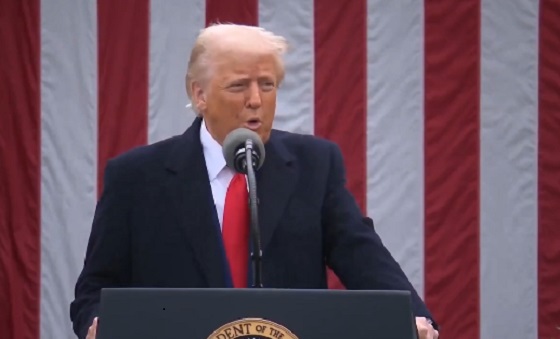

Business1 day agoStocks soar after Trump suspends tariffs

-

COVID-191 day ago

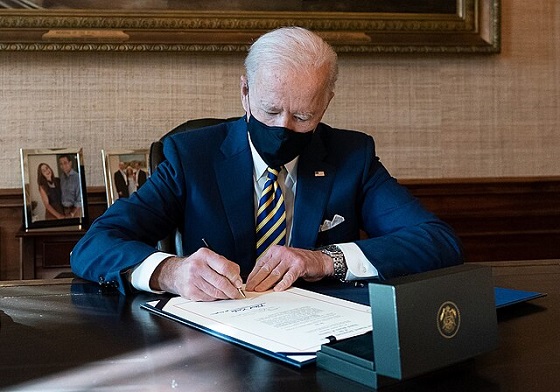

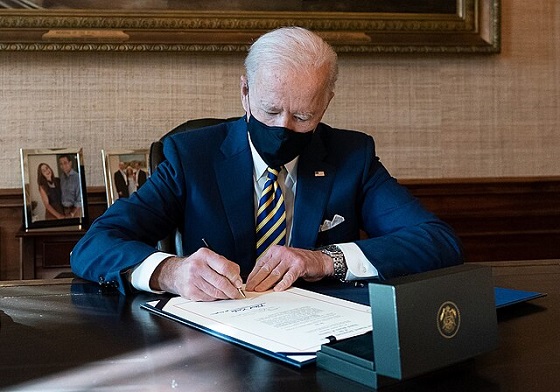

COVID-191 day agoBiden Admin concealed report on earliest COVID cases from 2019

-

MAiD2 days ago

MAiD2 days agoDisability rights panel calls out Canada, US states pushing euthanasia on sick patients

-

COVID-192 days ago

COVID-192 days agoRandy Hillier wins appeal in Charter challenge to Covid lockdowns

-

Business2 days ago

Business2 days agoTrump raises China tariffs to 125%, announces 90-day pause for countries who’ve reached out to negotiate