Economy

Honest discussion about taxes must include bill Canadian families pay

From the Fraser Institute

By Jake Fuss

Every year at the Fraser Institute, we calculate the total tax bill—which includes income taxes, property taxes, sales taxes, fuel taxes, etc.—for the average Canadian family. This year we found the average family paid 43.0 per cent of its annual income in taxes in 2023—more than it spent on basic necessities such as food, clothing and housing combined, and significantly higher than the 33.5 per cent it paid in 1961.

Put differently, the average family’s tax bill has increased 2,705 per cent since 1961—or 180.3 per cent after adjusting for inflation.

And yet, in a recent column, Star contributing columnist Linda McQuaig said we’re “distorting the public debate over taxes” by publishing these facts while stating that the effective tax rate the average family pays has only “increased by 28 per cent since 1961.” Presumably, she arrived at her 28 per cent figure by calculating the change in the share of income going to taxes from 33.5 per cent (in 1961) to 43.0 per cent (in 2023). And yes, that’s one way to measure tax increases. But again, the inflation-adjusted dollar value—what the average family actually pays—of the tax bill has increased by 180.3 per cent. That’s not distortion, that’s explaining the increase in terms everyone can understand.

Of course, these aren’t simply academic points. Taxes, particularly at a time when families are struggling with the cost of living, have real-world effects. According to a recent poll, 74 per cent of respondents feel the average family is overtaxed, and 80 per cent believe the average family should pay 40 per cent or less of its income in total taxes.

Another important question is whether families get value for the taxes they pay. Polling shows nearly half (44 per cent) of Canadians feel they receive “poor” or “very poor” value from government services while only 16 per cent believe they receive “good” or “great” value. This should be no surprise. Health-care wait times are at record highs. Student test scores are declining. And Canada routinely fails to meet our NATO defence spending commitments.

Meanwhile, governments waste taxpayer dollars on pet projects such as a federal infrastructure bank, which, despite a budget of at least $13.2 billion, has delivered only two relatively minor projects in seven years. Or handouts to new electric vehicle (EV) owners that cost taxpayers—including Canadians unable to afford EVs—more than $587 million annually.

Can we really say governments are using our money wisely?

Unfortunately, many governments are doubling down. Municipalities such as Vancouver and Toronto raised property taxes by at least 7.5 per cent this year. Toronto city council has even floated the idea of a municipal sales tax. It’s hard to argue that you want to make life more affordable for families by leaving less money in their pockets.

And of course, the Trudeau government recently raised taxes on capital gains. But despite claims to the contrary, this tax hike won’t only affect wealthy investors. According to an analysis by economist Jack Mintz, 50 per cent of taxpayers who claim more than $250,000 of capital gains in a year earned less than $117,592 in normal annual income from 2011 to 2021. These include Canadians with modest annual incomes who own businesses, second homes or stocks, and who may choose to sell those assets once or infrequently in their lifetimes (when they retire, for example).

Finally, more tax hikes are likely on the horizon. The federal government and eight provinces are currently running budget deficits, meaning they’re not taxing enough to keep up with spending. Deficits produce debt, which will be passed onto future generations of Canadians in the form of higher taxes.

If governments across Canada want to leave more money in the pockets of Canadians, they should reduce taxes. And everyone should want an honest discussion about taxes in Canada, based on facts, not distortions.

Author:

Business

Carbon tax bureaucracy costs taxpayers $800 million

From the Canadian Taxpayers Federation

By Ryan Thorpe

The cost of administering the federal carbon tax and rebate scheme has risen to $283 million since it was imposed in 2019, according to government records obtained by the Canadian Taxpayers Federation.

By 2030, the cost of administering the carbon tax is expected to total $796 million, according to the records.

“Not only does the carbon tax make our gas, heating and groceries more expensive, but taxpayers are also hit with a big bill to fund Prime Minister Justin Trudeau’s battalion of carbon tax bureaucrats,” said Franco Terrazzano, CTF Federal Director. “Trudeau should make life more affordable and slash the cost of the bureaucracy by scrapping the carbon tax.”

The government records were released in response to an order paper question from Conservative MP John Barlow (Foothills).

The carbon tax and rebate scheme cost taxpayers $84 million in 2023, according to the records.

There were 461 federal bureaucrats tasked with administering the carbon tax and rebate scheme last year, according to the records.

The CTF previously reported administering the carbon tax cost taxpayers $199 million between 2019 and 2022.

Projected costs for administering the carbon tax and rebate scheme between 2024 and 2030 are $513 million, according to the records.

That would bring total administration costs for the carbon tax and rebate scheme up to $796 million by 2030.

But the true hit to taxpayers is even higher, as the records do not include costs associated with the Fuel Charge Tax Credit for Farmers or the Canada Carbon Rebate for Small Businesses.

“It’s magic math to believe the feds can raise taxes, skim hundreds-of-millions off the top to hire hundreds of new bureaucrats and then somehow make everyone better off with rebates,” Terrazzano said.

The carbon tax will cost the average household up to $399 this year more than the rebates, according to the Parliamentary Budget Officer, the government’s independent, non-partisan budget watchdog.

The PBO also notes that, “Canada’s own emissions are not large enough to materially impact climate change.”

The government also charges its GST on top of the carbon tax. The PBO report shows this carbon tax-on-tax will cost taxpayers $400 million this year. That money isn’t rebated back to Canadians.

The carbon tax currently costs 17 cents per litre of gasoline, 21 cents per litre of diesel and 15 cents per cubic metre of natural gas.

By 2030, the carbon tax will cost 37 cents per litre of gasoline, 45 cents per litre of diesel and 32 cents per cubic metre of natural gas.

Economy

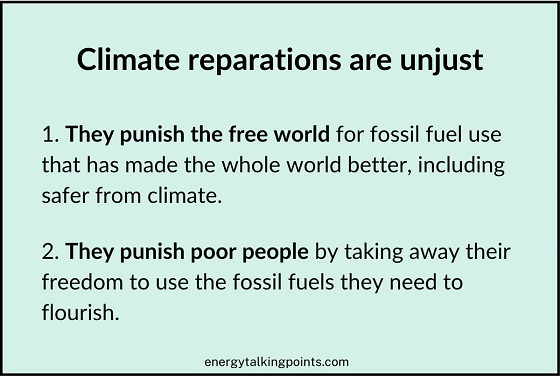

COP 29 leaders demand over a $1 trillion a year in climate reparations from ‘wealthy’ nations. They don’t deserve a nickel.

COP 29 is calling for over $1 trillion in annual climate reparations

- A major theme of COP 29 is that the world should set a “New Collective Quantified Goal” wherein successful nations pay poor nations over $1 trillion a year to 1) make up for climate-related harm and 2) build them new “green energy” economies. In other words, climate reparations.¹

- What would $1 trillion a year in climate reparations mean for you and your family?Assuming the money was paid equally by households considered high income (>$50 per day), your household would have to pay more than $5,000 a year in climate reparations taxes!²

- Climate reparations are based on two false assumptions:1. Free, wealthy countries, through their fossil fuel use, have made the world worse for poor countries.

2. The poor world’s main problem is dealing with climate change, which wealth transfers will help them with.

But free, fossil-fueled countries have made life better for poor countries

- Free, wealthy countries, through their fossil fuel use, have not made the world worse for poor countries—they have made it far, far better.Observe what has happened to global life expectancies and income as fossil fuel use has risen. Life has gotten much better for everyone.³

- The wealthy world’s fossil fuel use has improved life worldwide because by using fossil fuel energy to be incredibly productive, we have 1) made all kinds of goods cheaper and 2) been able to engage in life-saving aid, particularly in the realms of food, medicine, and sanitation.

- Without the historic use of fossil fuels by the wealthy world, there would be no super-productive agriculture to feed 8 billion humans, no satellite-based weather warning systems, etc. Most of the individuals in poor countries would not even be alive today.

Free, fossil-fueled countries have made the poor safer from climate

- The wealthy world’s fossil fuel use has been particularly beneficial in the realm of climate.Over the last 100 years, the death rate from climate-related disasters plummeted by 98% globally.

A big reason is millions of lives saved from drought via fossil-fueled crop transport.⁴

- The “climate reparations” movement ignores the fact that the wealthy world’s fossil fuel use has made life better, including safer from climate, in the poor world.This allows it to pretend that the poor world’s main problem is dealing with rising CO2 levels.

The poor world’s problem is poverty, not rising CO2 levels

- The poor world’s main problem is not rising CO2 levels, it is poverty—which is caused by lack of freedom, including the crucial freedom to use fossil fuels.Poverty makes everything worse, including the world’s massive natural climate danger and any danger from more CO2.

- While it’s not true that the wealthy world has increased climate danger in the poor world—we have reduced it—it is true that the poor world is more endangered by climate than the wealthy world is.The solution is for the poor to get rich. Which requires freedom and fossil fuels.⁵

Escaping poverty requires freedom and fossil fuels

- Every nation that has risen out of poverty has done so via pro-freedom policies—specifically, economic freedom.

That’s how resource-poor places like Singapore and Taiwan became prosperous. Resource-rich places like Congo have struggled due to lack of economic freedom.

- Even China, which is unfree in many ways (including insufficient protections against pollution) dramatically increased its standard of living via economic freedom—particularly in the realm of industrial development where it is now in many ways much freer than the US and Europe.

- A crucial freedom involved in rising prosperity has been the freedom to use fossil fuels.Fossil fuels are a uniquely cost-effective source of energy, providing energy that’s low-cost, reliable, versatile, and scalable to billions of people in thousands of places.⁶

- Time and again nations have increased their prosperity, including their safety from climate, via economic freedom and fossil fuels.Observe the 7X increase in fossil fuel use in China and India over the past 4 decades, which enabled them to industrialize and prosper.⁷

- For the world’s poorest people to be more prosperous and safer from climate, they need more freedom and more fossil fuels.The “climate reparations” movement seeks to deny them both.

- The wealthy world should communicate to the poor world that economic freedom is the path to prosperity, and encourage the poor world to reform its cultural and political institutions to embrace economic freedom—including fossil fuel freedom.Our leaders are doing the opposite.

Climate reparations pay off dictators to take away fossil fuel freedom

- Instead of promoting economic freedom, including fossil fuel freedom, wealthy climate reparations advocates like Antonio Guterres are offering to entrench anti-freedom regimes by paying off their dictators and bureaucrats to eliminate fossil fuel freedom.This is disgusting.⁸

- The biggest victim of “climate reparations” will be the world’s poorest countries, whose dictators will be paid off to prevent the fossil fuel freedom that has allowed not just the US and Europe but also China and India to dramatically increase their prosperity.

- The biggest beneficiary of “climate reparations” will be China, which is already emitting more CO2 than the US and Europe combined. (Though less per capita.)While we flagellate and cripple ourselves, China will use fossil fuels in its quest to become the world’s superpower.⁹

- The second biggest beneficiary of “climate reparations” will be corrupt do-gooders who get to add anti-fossil-fuel strings to “reparations” dollars and dictate how it’s spent—which will surely include lots of dollars for unreliable solar panels and wind turbines made in China.

Leaders must reject reparations and champion fossil fuel freedom

- We need leaders in the US and Europe who proudly:1. Champion the free world’s use of fossil fuels as an enormous good for the world, including its climate safety.

2. Encourage the poor world to embrace economic freedom and fossil fuels.

Tell your Representative to do both.

Popular links

- EnergyTalkingPoints.com: Hundreds of concise, powerful, well-referenced talking points on energy, environmental, and climate issues.

- My new book Fossil Future: Why Global Human Flourishing Requires More Oil, Coal, and Natural Gas—Not Less.

- Speaking and media inquiries

“Energy Talking Points by Alex Epstein” is my free Substack newsletter designed to give as many people as possible access to concise, powerful, well-referenced talking points on the latest energy, environmental, and climate issues from a pro-human, pro-energy perspective.

Share Energy Talking Points by Alex Epstein

1 Scientific American – COP27 Summit Yields ‘Historic Win’ for Climate Reparations but Falls Short on Emissions Reductions

Phys.org – COP29 climate finance deal ‘must cover loss and damage,’ experts urge

COP29 official website – Fund for responding to Loss and Damage ready to accept contributions

2 Global population was about 8.02 billion in 2023.

About 7% of world population are considered high income, which translates into about 562 million individuals. Considering 3 people per average household in high income households, this translates into about 187 million households.

Pew Research – Are you in the global middle class? Find out with our income calculator

$1 trillion per annum paid by 187 million households means the average household would pay about $5,300 per year.

3 Maddison Database 2010 at the Groningen Growth and Development Centre, Faculty of Economics and Business at University of Groningen

4 UC San Diego – The Keeling Curve

For every million people on earth, annual deaths from climate-related causes (extreme temperature, drought, flood, storms, wildfires) declined 98%–from an average of 247 per year during the 1920s to 2.5 in per year during the 2010s.

Data on disaster deaths come from EM-DAT, CRED / UCLouvain, Brussels, Belgium – www.emdat.be (D. Guha-Sapir).

Population estimates for the 1920s from the Maddison Database 2010, the Groningen Growth and Development Centre, Faculty of Economics and Business at University of Groningen. For years not shown, population is assumed to have grown at a steady rate.

Population estimates for the 2010s come from World Bank Data.

5 UC San Diego – The Keeling Curve

Data on disaster deaths come from EM-DAT, CRED / UCLouvain, Brussels, Belgium – www.emdat.be (D. Guha-Sapir).

Population estimates come from World Bank Data.

6 Our World in Data – Energy Production and Consumption

7 BP – Statistical Review of World Energy

8 UN News – ‘Pay up or humanity will pay the price’, Guterres warns at COP29 climate summit

9 Our World in Data – Annual CO₂ emissions from fossil fuels, by world region

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoThe Most Devastating Report So Far

-

Business2 days ago

Business2 days agoCarbon tax bureaucracy costs taxpayers $800 million

-

ESG1 day ago

ESG1 day agoCan’t afford Rent? Groceries for your kids? Trudeau says suck it up and pay the tax!

-

John Stossel1 day ago

John Stossel1 day agoGreen Energy Needs Minerals, Yet America Blocks New Mines

-

Daily Caller1 day ago

Daily Caller1 day agoLos Angeles Passes ‘Sanctuary City’ Ordinance In Wake Of Trump’s Deportation Plan

-

Alberta1 day ago

Alberta1 day agoProvince considering new Red Deer River reservoir east of Red Deer

-

MAiD2 days ago

MAiD2 days agoOver 40% of people euthanized in Ontario lived in poorest parts of the province: government data

-

Addictions1 day ago

Addictions1 day agoBC Addictions Expert Questions Ties Between Safer Supply Advocates and For-Profit Companies