Business

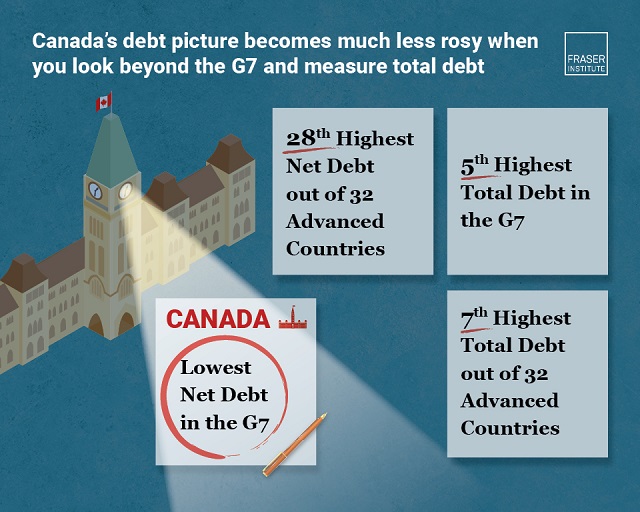

Canada’s debt ranking falls from best in G7 to 7th worst of 32 advanced countries when total debt is measured

From the Fraser Institute

By Jake Fuss, and Milagros Palacios and Callum MacLeod

Canada’s relative debt position is much worse than the federal government suggests when a larger group of advanced countries are included and total debt—not just net debt—is measured, finds a new study released today by the Fraser Institute, an independent, non-partisan, Canadian public policy think-tank.

“The federal government is very quick to point out that the country’s net debt relative to the size of the economy (GDP) is lowest in the G7, but Canada’s true debt position is much worse than Ottawa lets on,” said Jake Fuss, director of fiscal studies at the Fraser Institute and co-author of Caution Required When Comparing Canada’s Debt to that of Other Countries, 2024.

The study finds that Canada’s relative debt position, instead of being the best of the G7, falls significantly when total debt is measured instead of measuring debt after adjusting for financial assets. Net debt, which is the measure used by the federal government, offsets a part of the country’s total debt by including financial assets.

Specifically, Canada ranks 26th of 32 developed countries for its total (gross) debt as a share of the economy. In other words, Canada’s total debt relative to GDP is the 5th highest in the G7 and 7th highest amongst the industrialized world (32 advanced countries).

The reason Canada’s debt position declines so dramatically when total debt—and not net debt—is measured is because net debt includes the assets of the Canada Pension Plan and the Quebec Pension Plan, which unlike the public pension programs of other developed countries invests in non-government assets such as stocks and bonds.

As of December 2023, the combined assets of the CPP and QPP, some $716.7 billion, represented more than one-quarter of the difference between Canada’s total debt and net debt.

“The government cannot use the assets of the CPP and the QPP to repay its debt, so it is disingenuous to include those assets in Canada’s debt calculations,” Fuss said. “Canada is not the low-debt jurisdiction that Ottawa suggests, and Canadians should be aware of the true state of the country’s indebtedness.”

- The federal government continues to rationalize its debt-financed spending based on international comparisons showing Canada with the lowest level of debt in the G7.

- Of the two broad measures of debt, gross debt includes most forms of debt while net debt is a narrower measure that accounts for financial assets held by governments.

- By using net debt as a share of the economy (GDP), Canada ranks 5th lowest of 32 countries and lowest amongst the G7. By using gross debt as a share of the economy, Canada falls to 26th of 32 countries and 3rd lowest in the G7.

- Canada experiences the largest change in its indebtedness ranking—falling 21 places—when the measure shifts from net debt to gross debt.

- One reason for this pronounced change in ranking is that net debt includes the assets of the Canada and Quebec Pension Plans, which have unique approaches to funding public retirement plans: unlike most other industrialized countries, the CPP and QPP invest in non-government assets including equities and corporate bonds.

- As of December 31, 2023, according to Statistics Canada data, there were net assets in the combined CPP and QPP of $716.7 billion.

- According to IMF data, the difference between Canada’s gross and net debt was approximately $2.7 trillion at the end of 2023, which means the assets of CPP and QPP explain more than one-quarter of the difference.

2025 Federal Election

Alcohol tax and MP pay hike tomorrow (April 1)

The Canadian Taxpayers Federation is calling on all party leaders to stop a pair of bad policies that are scheduled to happen automatically on April 1: pay raises for members Parliament and another alcohol tax increase.

“Party leaders owe taxpayers answers to these two questions: Why do you think you deserve a pay raise and why should Canadians pay higher taxes on beer and wine?” said Franco Terrazzano, CTF Federal Director. “Politicians don’t deserve a raise while millions of Canadians are struggling.

“And the last thing Canadians need is another tax hike when they pour a cold one or uncork a bottle with that special someone.”

MPs give themselves pay raises each year on April 1, based on the average annual increase in union contracts with corporations with 500 or more employees.

The CTF estimates tomorrow’s pay raise will amount to an extra $6,200 for backbench MPs, $9,200 for ministers and $12,400 for the prime minister, based on contract data published by the federal government.

After tomorrow’s pay raise, backbench MPs will receive a $209,300 annual salary, according to CTF estimates. A minister will collect $309,100 and the prime minister will take home $418,600.

Meanwhile, the alcohol escalator automatically increases excise taxes on beer, wine and spirits every year on April 1, without a vote in Parliament. Alcohol taxes will increase by two per cent tomorrow, costing taxpayers about $40 million this year, according to Beer Canada estimates.

The alcohol escalator tax has cost taxpayers more than $900 million since it was imposed in 2017, according to Beer Canada estimates.

“Politicians are padding their pockets on the same day they’re raising beer taxes and that’s wrong,” Terrazzano said. “If party leaders want to prove they care about taxpayers, they should stop the MP pay raises.

“And if party leaders care about giving Canadian brewers, distillers and wineries a fighting chance against tariffs, it’s time to stop hitting them with alcohol tax hikes year after year.”

The CTF released Leger polling showing 79 per cent of Canadians oppose tomorrow’s MP pay raise.

2025 Federal Election

Poilievre To Create ‘Canada First’ National Energy Corridor

From Conservative Party Communications

Poilievre will create the ‘Canada First’ National Energy Corridor to rapidly approve & build the infrastructure we need to end our energy dependence on America so we can stand up to Trump from a position of strength.

Conservative Leader Pierre Poilievre announced today he will create a ‘Canada First’ National Energy Corridor to fast-track approvals for transmission lines, railways, pipelines, and other critical infrastructure across Canada in a pre-approved transport corridor entirely within Canada, transporting our resources within Canada and to the world while bypassing the United States. It will bring billions of dollars of new investment into Canada’s economy, create powerful paycheques for Canadian workers, and restore our economic independence.

“After the Lost Liberal decade, Canada is poorer, weaker, and more dependent on the United States than ever before,” said Poilievre. “My ‘Canada First National Energy Corridor’ will enable us to quickly build the infrastructure we need to strengthen our country so we can stand on our own two feet and stand up to the Americans.”

In the corridor, all levels of government will provide legally binding commitments to approve projects. This means investors will no longer face the endless regulatory limbo that has made Canadians poorer. First Nations will be involved from the outset, ensuring that economic benefits flow directly to them and that their approval is secured before any money is spent.

Between 2015 and 2020, Canada cancelled 16 major energy projects, resulting in a $176 billion hit to our economy. The Liberals killed the Energy East pipeline and passed Bill C-69, the “No-New-Pipelines” law, which makes it all but impossible to build the pipelines and energy infrastructure we need to strengthen the Canadian economy. And now, the PBO projects that the ‘Carney cap’ on Canadian energy will reduce oil and gas production by nearly 5%, slash GDP by $20.5 billion annually, and eliminate 54,400 full-time jobs by 2032. An average mine opening lead time is now nearly 18 years—23% longer than Australia and 38% longer than the US. As a result of the Lost Liberal Decade, Canada now ranks 23rd in the World Bank’s Ease of Doing Business Index for 2024, a seven-place drop since 2015.

“In 2024, Canada exported 98% of its crude oil to the United States. This leaves us too dependent on the Americans,” said Poilievre. “Our Canada First National Energy Corridor will get us out from under America’s thumb and enable us to build the infrastructure we need to sell our natural resources to new markets, bring home jobs and dollars, and make us sovereign and self-reliant to stand up to Trump from a position of strength.”

Mark Carney’s economic advice to Justin Trudeau made Canada weaker while he and his rich friends made out like bandits. While he advised Trudeau to cancel Canadian energy projects, his own company spent billions on pipelines in South America and the Middle East. And unlike our competitors Australia and America, which work with builders to get projects approved, Mark Carney and Steven Guilbeault’s radical “keep-it-in-the-ground” ideology has blocked development, killed jobs, and left Canada dependent on foreign imports.

“The choice is clear: a fourth Liberal term that will keep our resources in the ground and keep us weak and vulnerable to Trump’s threats, or a strong new Conservative government that will approve projects, build an economic fortress, bring jobs and dollars home, and put Canada First—For a Change.”

-

Business1 day ago

Business1 day agoDOGE discovered $330M in Small Business loans awarded to children under 11

-

COVID-191 day ago

COVID-191 day ago17-year-old died after taking COVID shot, but Ontario judge denies his family’s liability claim

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoThe High Cost Of Continued Western Canadian Alienation

-

Economy2 days ago

Economy2 days agoSolar and Wind Power Are Expensive

-

Business2 days ago

Business2 days agoWhy a domestic economy upgrade trumps diversification

-

Daily Caller1 day ago

Daily Caller1 day agoCover up of a Department of Energy Study Might Be The Biggest Stain On Biden Admin’s Legacy

-

Economy2 days ago

Economy2 days agoClearing the Path: Why Canada Needs Energy Corridors to Compete

-

Business2 days ago

Business2 days agoTariff-driven increase of U.S. manufacturing investment would face dearth of workers