Fraser Institute

Endless spending increases will not fix Canada’s health-care system

From the Fraser Institute

By Mackenzie Moir and Jake Fuss

Canada’s health-care system ranked as the most expensive (as a share of the economy) among 30 universal health-care countries. And despite these relatively high levels of spending, Canada continues to lag behind its peers on key indicators of performance.

In February 2023, the federal government announced the money they send to the provinces for health care would increase, yet again. Despite being billed as a fix for health care, these spending increases will not actually provide any relief for Canadian patients.

The Canada Health Transfer (CHT), the main federal financial tool for funding provincial health care, has increased from $34.0 billion in 2015/16 to $52.1 billion this year (2024/25), a 53.1 per cent increase in about a decade. Moreover, the federal government has committed to increases in the transfer at a guaranteed 5 per cent until 2027/28.

This latest increase in the CHT, however, is only one part of the $46.2 billion in new money being doled out over the next 10 years. More than half (roughly $25 billion) is currently being given to provinces who’ve signed up to work towards a number of “shared priorities” with Ottawa, such as mental health and substance abuse.

Clearly, the federal government has decided to substantially increase health-care spending in more than one way. But will it produce results?

These periodic “fixes” occasionally championed by Ottawa every few years are nothing new. And unfortunately, the data show that longstanding problems, including long waits for medical care and doctor shortages, will persist even though Canada is certainly no slouch when compared to its peers on health-care spending.

A recent study found that, when adjusted for differences in age (because older populations tend to spend more on health care), Canada’s health-care system ranked as the most expensive (as a share of the economy) among 30 universal health-care countries. And despite these relatively high levels of spending, Canada continues to lag behind its peers on key indicators of performance.

For example, Canada had some of the fewest physicians (ranked 28th of 30 countries), hospital beds (ranked 23rd of 29) and diagnostic technology such as MRIs (ranking 25th of 29 countries) and CT scanners (ranking 26th out of 30 countries) compared to other high-income countries with universal health care.

It also ranked at or near the bottom on measures such as same-day medical appointments, how easy it is to find afterhours care, and the timeliness of specialist appointments and surgical care.

And wait times have been getting worse. Just last year Canada recorded the longest ever delay for non-emergency care at 27.7 weeks, a 198 per cent increase from the 9.3 week wait experienced in 1993 (the first year national estimates were published).

But it’s not just the health-care system that’s in shambles, despite our high spending. Our federal finances are, too. Years of substantial increases in federal spending have strained the country’s finances. The Trudeau government’s latest budget projects a deficit of $39.8 billion this year, with more spent on debt interest ($54.1 billion) than on what the federal government gives to the provinces for health care.

Again, these periodic injections of federal funds to the provinces to supposedly fix health care are nothing new. Ottawa has relied on this strategy in the past and wait times have grown longer over the last three decades. Endless increases in spending will not fix our health-care system.

Authors:

Fraser Institute

Premier Eby seeks to suspend democracy in B.C.

From the Fraser Institute

By Niels Veldhuis and Tegan Hill

Last week, B.C. Premier David Eby proposed new legislation to give himself and his cabinet sweeping powers to unilaterally change almost any provincial law and regulation without legislative approval or review. While the legislation—dubbed the Economic Stabilization (Tariff Response) Act—has yet to be enacted into law, the fact that the government proposed such unprecedented powers is deeply concerning and a genuine threat to our democracy.

Only five months ago, British Columbians went to the polls and delivered a sobering victory to Eby’s incumbent NDP government, which lost 8 of its 55 seats and ended up with 47 of 93 seats, the narrowest “majority” possible. The popular vote was nearly dead-even between the NDP (44.86 per cent) and the upstart Conservative Party (43.28 per cent).

Even Premier Eby acknowledged the voters sent his government a message and promised to work together with other parties. “After a close and hard-fought campaign, it’s now time to come together to deliver for people,” he said. “British Columbians have asked us to work together and make life better for them.”

“Work together” in a democracy means embracing a deliberative and, at times, messy process. Thoughtful policymaking takes time. It’s a core feature of democracy. No leader has all the knowledge to act unilaterally to do what’s right. We need the legislature to weigh competing viewpoints through rigorous and transparent debate—that’s how our system works.

Yet according to the Eby government, the Economic Stabilization (Tariff Response) Act will lead to the opposite and provide “temporary authority to cabinet… to modify the application or effect of B.C. laws and regulations.” In other words, if approved, it will allow Premier Eby and his cabinet to override provincial laws, regulations, bylaws, rules, resolutions, practices, policies, standards, procedures and other measures without approval or review by the elected legislature. That’s not how our system is supposed to work.

To put it more starkly, the Eby government is telling British Columbians that 23 cabinet ministers and four ministers of state can sufficiently decide almost any matter pertaining to the government without democratic approval or input from opposition parties. It is by all measures an extraordinary circumvention of the province’s democratic institutions.

Premier Eby, of course, knows the extraordinary nature of this type of undemocratic authority. “In extraordinary times,” he told reporters last week, “we need extraordinary powers.” And he wants these extraordinary powers for the next two years.

While President Trump’s tariffs are terrible economic policy and very damaging to Canada and other countries, many governments throughout history have tried these policies. Like in the past, our politicians and policymakers must deal with tariffs and other economic challenges purposefully and deliberately within democratic constraints, which include transparent debates, reviews, re-assessments, and genuine deliberations that include opposition parties.

Instead, Premier Eby wants absolute power and control.

As British Columbians will no doubt conclude, there’s something fundamentally wrong with suspending democracy because we’re in challenging times. We often deal with significant challenges. Should our governments have suspended democracy in the wake of 9/11, the limited outbreak of SARS, the financial crisis of 2008-09 or COVID?

Finally, this dim view of democratic constraints is not new to the Eby government. Just last year, Premier Eby tried to pass one of the most significant and fundamental legislative changes in B.C. history, giving more than 200 First Nations veto power over land-use decisions in the province. Eby hoped to rush his legalisation through the legislature without full transparency or meaningful public input, and without disclosing any analysis of its economic impact. When British Columbians caught wind of his plan, there was an uproar, and before October’s election, Eby shelved the legislation (for now, at least).

Here we are again, mere months later, with Premier Eby wanting to make unprecedented changes to our democracy in response to an economic policy from another democratically elected government that, while damaging, is hardly an existential threat.

To call the Economic Stabilization (Tariff Response) Act a significant overreach would be a gross understatement. It’s an affront to our democracy.

Alberta

Albertans have contributed $53.6 billion to the retirement of Canadians in other provinces

From the Fraser Institute

By Tegan Hill and Nathaniel Li

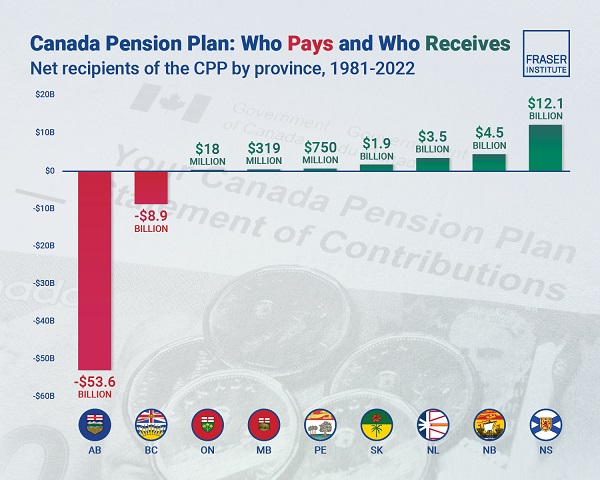

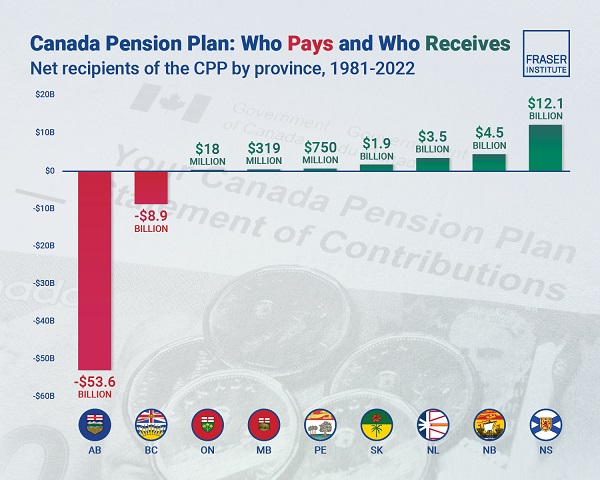

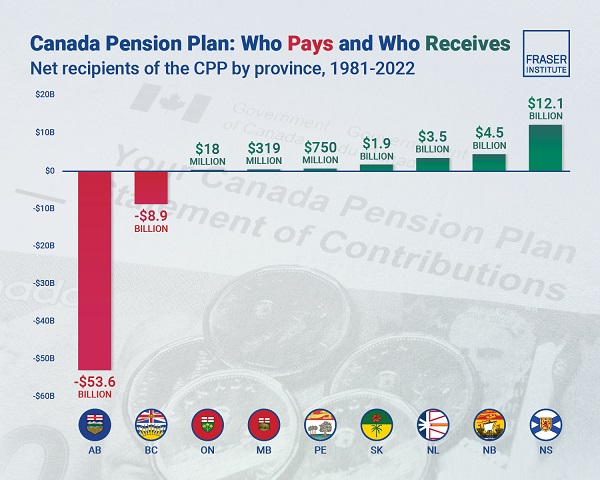

Albertans contributed $53.6 billion more to CPP then retirees in Alberta received from it from 1981 to 2022

Albertans’ net contribution to the Canada Pension Plan —meaning the amount Albertans paid into the program over and above what retirees in Alberta

received in CPP payments—was more than six times as much as any other province at $53.6 billion from 1981 to 2022, finds a new report published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Albertan workers have been helping to fund the retirement of Canadians from coast to coast for decades, and Canadians ought to know that without Alberta, the Canada Pension Plan would look much different,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Understanding Alberta’s Role in National Programs, Including the Canada Pension Plan.

From 1981 to 2022, Alberta workers contributed 14.4 per cent (on average) of the total CPP premiums paid—Canada’s compulsory, government- operated retirement pension plan—while retirees in the province received only 10.0 per cent of the payments. Alberta’s net contribution over that period was $53.6 billion.

Crucially, only residents in two provinces—Alberta and British Columbia—paid more into the CPP than retirees in those provinces received in benefits, and Alberta’s contribution was six times greater than BC’s.

The reason Albertans have paid such an outsized contribution to federal and national programs, including the CPP, in recent years is because of the province’s relatively high rates of employment, higher average incomes, and younger population.

As such, if Alberta withdrew from the CPP, Alberta workers could expect to receive the same retirement benefits but at a lower cost (i.e. lower payroll tax) than other Canadians, while the payroll tax would likely have to increase for the rest of the country (excluding Quebec) to maintain the same benefits.

“Given current demographic projections, immigration patterns, and Alberta’s long history of leading the provinces in economic growth, Albertan workers will likely continue to pay more into it than Albertan retirees get back from it,” Hill said.

Understanding Alberta’s Role in National Programs, Including the Canada Pension Plan

- Understanding Alberta’s role in national income transfers and other important programs is crucial to informing the broader debate around Alberta’s possible withdrawal from the Canada Pension Plan (CPP).

- Due to Alberta’s relatively high rates of employment, higher average incomes, and younger population, Albertans contribute significantly more to federal revenues than they receive back in federal spending.

- From 1981 to 2022, Alberta workers contributed 14.4 percent (on average) of the total CPP premiums paid while retirees in the province received only 10.0 percent of the payments. Albertans net contribution was $53.6 billion over the period—approximately six times greater than British Columbia’s net contribution (the only other net contributor).

- Given current demographic projections, immigration patterns, and Alberta’s long history of leading the provinces in economic growth and income levels, Alberta’s central role in funding national programs is unlikely to change in the foreseeable future.

- Due to Albertans’ disproportionate net contribution to the CPP, the current base CPP contribution rate would likely have to increase to remain sustainable if Alberta withdrew from the plan. Similarly, Alberta’s stand-alone rate would be lower than the current CPP rate.

Tegan Hill

Director, Alberta Policy, Fraser Institute

-

Alberta2 days ago

Alberta2 days agoAlberta Institute urging Premier Smith to follow Saskatchewan and drop Industrial Carbon Tax

-

Addictions1 day ago

Addictions1 day agoShould fentanyl dealers face manslaughter charges for fatal overdoses?

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFool Me Once: The Cost of Carney–Trudeau Tax Games

-

Alberta1 day ago

Alberta1 day agoAlbertans have contributed $53.6 billion to the retirement of Canadians in other provinces

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoChinese Gangs Dominate Canada: Why Will Voters Give Liberals Another Term?

-

Automotive2 days ago

Automotive2 days agoTrump announces 25% tariff on foreign automobiles as reciprocal tariffs loom

-

Also Interesting23 hours ago

Also Interesting23 hours agoThe bizarre story of Taro Tsujimoto

-

Energy1 day ago

Energy1 day agoEnergy, climate, and economics — A smarter path for Canada