Fraser Institute

Dearth of medical resources harms Canadian patients

From the Fraser Institute

The imbalance between high spending and poor access to doctors, hospital beds and vital imaging technology, coupled with untimely access to services, can, and does, have a detrimental impact on patients.

Whether it’s a lack of family physicians or other health-care workers, Canadians know we have a serious health-care labour shortage on our hands. The implications of this shortage aren’t lost on patients (including Ellie O’Brien) who’ve possibly faced delays in accessing organ transplants because potential donors need a regular family doctor to screen them to begin the transplant process.

Given these access issues, coupled with some of the longest recorded wait times for medical procedures on record, is it any wonder that Canadians are dissatisfied with how their provincial governments handle health care?

While one instinct might be to demand governments spend more on health care, it’s not clear we’re getting good value in return for what’s already being spent. In fact, compared to 29 other high-income countries with universal health care, Canada spent the most on health care as a share of the economy at 12.6 per cent in 2021, the latest year of available comparable data (after adjusting for differences in the age structure of each country’s population).

But what do we get in return for this spending?

As far as medical resources go, not a whole lot. In 2021, Canadians had some of the fewest medical resources in the developed world. Out of 30 high-income countries with universal health care, Canada ranked 28th on physician availability at 2.8 per 1,000 people, far behind countries such as seventh-ranked Switzerland (4.5 physicians per 1,000) and tenth-ranked Australia (at 4.3 physicians per 1,000).

But doctors are just one part of the puzzle. Canada also ranked low on available hospital beds (23rd of 29 countries), meaning patients often face delays for hospital care. It can also mean that patients end up being treated for their illness outside a traditional patient room—such as a hospital hallway, a phenomenon that has spread to many provinces.

We also see a low availability of other key medical resources including diagnostic equipment. In 2019, Canada ranked 25th of 29 comparable countries with universal health care on the number of MRIs (10.3 units per million people) compared to top-ranked Japan, which had four times as many MRIs as Canada. And we ranked 26th out of 30 countries on CT scanners (14.9 scanners per million people) compared to second-ranked Australia, which had five times as many CT scanners. It’s also worth noting that a large a portion of Canada’s diagnostic machines are remarkably old.

It’s no accident that countries such as Australia, which actually spend less of its economy on health care compared to Canada, perform better than Canada on measures of resource availability and timeliness of care. Unlike Canada, Australia embraces its private sector as an integral part of its universal health-care system. With 41 per cent of all hospital care in Australia occurring in private hospitals in 2021/22, private hospitals can act as a pressure valve for the entire system, particularly in times of crisis. Indeed, the country outperforms Canada on measures of timely access to family doctor appointments, specialist care and non-emergency surgery, and has done so regularly for years.

The imbalance between high spending and poor access to doctors, hospital beds and vital imaging technology, coupled with untimely access to services, can, and does, have a detrimental impact on patients. For some, this problem can be life threatening. Without genuine reform based on real world lessons from higher performing universal health-care countries including Australia, it’s impossible to reasonably expect our health-care system to improve despite its hefty price tag.

Author:

Business

Carney government should apply lessons from 1990s in spending review

From the Fraser Institute

By Jake Fuss and Grady Munro

For the summer leading up to the 2025 fall budget, the Carney government has launched a federal spending review aimed at finding savings that will help pay for recent major policy announcements. While this appears to be a step in the right direction, lessons from the past suggest the government must be more ambitious in its review to overcome the fiscal challenges facing Canada.

In two letters sent to federal cabinet ministers, Finance Minister François-Philippe Champagne outlined plans for a “Comprehensive Expenditure Review” that will see ministers evaluate spending programs in each of their portfolios based on the following: whether they are “meeting their objectives” are “core to the federal mandate” and “complement vs. duplicate what is offered elsewhere by the federal government or by other levels of government.” Ultimately, as a result of this review, ministers are expected to find savings of 7.5 per cent in 2026/27, rising to 10 per cent the following year, and reaching 15 per cent by 2028/29.

This news comes after the federal government has recently made several major policy announcements that will significantly impact the bottom line. Most notably, the government added an additional $9.3 billion to the defence budget for this fiscal year, and committed to more than double the annual defence budget by 2035. Without any policies to offset the fiscal impact of this higher defence spending (along with other recent changes), this year’s budget deficit (which the Liberal’s election platform initially pegged at $62.3 billion) will likely surpass $70.0 billion, and potentially may reach as high as $92.2 billion.

A spending review is long overdue. Recent research suggests that each year the federal government spends billions towards programs that are inefficient and/or ineffective, and which should be eliminated to find savings. Moreover, past governments (both federal and provincial) have proven that fiscal adjustments based on spending reviews can be very successful—just look at the Chrétien government’s 1995 Program Review.

In its 1995 budget, the federal Chrétien government launched a comprehensive review of all federal spending that—along with several minor tax increases—ultimately balanced the federal budget in two years and helped Canada avert a fiscal crisis. Two aspects of this review were critical to its success: it reviewed all federal spending initiatives with no exceptions, and it was based on clear criteria that not only tested whether spending was efficient, but which also reassessed the federal government’s role in delivering programs and services to Canadians. Unfortunately, the Carney government’s review is missing these two critical aspects.

The Carney government already plans to exclude large swathes of the budget from its spending review. While it might be reasonable for the government to exclude defence spending given our recent commitments (though that doesn’t appear to be the plan), the Carney government has instead chosen to exclude all transfers to individuals (such as seniors’ benefits) and provinces (such as health-care spending) from any spending cuts. Based on the last official spending estimates for this year, these two areas alone represent a combined $254.6 billion—or more than half of total spending after excluding debt charges—that won’t be reviewed.

This is a major weakness in the government’s plan. Not only does this limit the dollar value of savings available, it also means a significant portion of the government’s budget is missing out on a reassessment that could lead to more effective delivery of services for Canadians.

For example, as part of the 1995 program review, the Chrétien government overhauled how it delivered welfare transfers to provincial governments. Specifically, the federal government replaced two previous programs with a new Canada Health and Social Transfer (CHST) that addressed some major flaws with how the government delivered welfare assistance. While the transition to the CHST did include a $4.6 billion reduction in spending on government transfers, the new structure gave the federal government better control over spending growth in the future and allowed provincial governments more flexibility to tailor social assistance programs to local needs and preferences.

In addition to considering all areas of spending, the Carney government’s spending review also needs to be more ambitious in its criteria. While the current criteria are an important start—for example, it’s critical the government identifies and eliminates spending programs that aren’t achieving their stated objectives or which are simply duplicating another program—the Carney government should take it one step further and explicitly reflect on the role of the federal government itself.

Among other criteria that focused on efficiency and affordability of programs, the 1995 program review also evaluated every spending program based on whether government intervention was even necessary, and whether or not the federal government specifically should be involved. As such, not only did the program review eliminate costly inefficiencies, it also included the privatization of government-owned entities such as Petro-Canada and Canadian National Railway—which generated considerable economic benefits for Canadians.

Today, the federal government devotes considerable amounts of spending each year towards areas that are outside of its jurisdiction and/or which government shouldn’t be involved in the first place—national pharmacare, national dental care, and national daycare all being prime examples. Ignoring the fact that many of these areas (including the three examples) are already excluded from the Carney government’s spending review, the government’s criteria makes no explicit effort to test whether a program is targeting an area that’s outside of the federal purview.

For instance, while the government will test whether or not a spending program fits within the federal mandate, that mandate will not actually ensure the government stays within its own jurisdictional lane. Instead, the mandate simply lays out the key priorities the Carney government intends to focus on—including vague goals including, “Bringing down costs for Canadians and helping them to get ahead” which could be used to justify considerable federal overreach. Similarly, the government’s other criterion to not duplicate programs offered by other levels of government provides little meaningful restriction on government spending that is outside of its jurisdiction so long as that spending can be viewed as “complementing” provincial efforts. In other words, this spending review is unlikely to meaningfully check the costly growth in the size of government that Canada has experienced over the last decade.

Simply put, the Carney government’s spending review, while a step in the right direction, is missing key elements that will limit its effectiveness. Applying key lessons from the Chrétien government’s spending review is crucial for success today.

Grady Munro

Policy Analyst, Fraser Institute

Fraser Institute

Before Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million annually

From the Fraser Institute

By Jock Finlayson and Steven Globerman

From 2000 to 2015, annual immigration averaged 617,800 immigrants, compared to a more than doubling to 1.4 million annually from 2016 to

2024 (excluding 2020), according to a new study published by the Fraser Institute, an independent non-partisan Canadian think-tank.

“Over the past decade, Canada’s immigration numbers have skyrocketed, most starkly since 2021,” said Jock Finlayson, senior fellow at the Fraser Institute and co-author of Canada’s Changing Immigration Patterns, 2000–2024.

The study finds from 2000 to 2015, immigration (including temporary foreign workers and international students) grew on average by 3.5 per cent per year. However, from 2016 to 2024 (excluding 2020) immigration grew annually at 21.3 per cent—more than six times the 2000-2015 pace.

The sharp rise in recent years reflects both planned increases in permanent immigrant inflows as well as unprecedented and largely unplanned growth in the numbers of temporary foreign workers, international students, and asylum seekers. For example, in 2024 alone, 485,600 permanent immigrants entered Canada, along with 518,200 international students and nearly one million (912,900) temporary foreign workers.

However, due to concerns about the impact of unprecedented in-migration on housing affordability, employment opportunities (or lack thereof), access to health care and other issues, late last year the federal government unveiled plans to substantially reduce immigration levels over the 2025-27 period, affecting permanent immigrants, international students, and other temporary visa holders.

The composition of immigration also changed dramatically during this period. From 2000 to 2015, the average share of total immigrants in the permanent category was 42.1 per cent while the non-permanent share (mainly international students and temporary workers) was 57.9 per cent. From 2016 to 2024 (excluding Covid 2020), permanent immigrants averaged 27.7 per cent of total in-migration versus 72.3 per cent for non-permanent.

“We’re in the midst of a housing crisis in Canada, and the unfortunate truth is we lack the necessary infrastructure to accommodate immigration at the 2022-24 rate,” said Steven Globerman, senior fellow at the Fraser Institute and study co-author.

“While the reductions announced late last year have been confirmed by the new government, the levels of immigration over the next two year will still be well above historic benchmarks.”

This study is the first in a series of papers from the authors on immigration.

Canada’s Changing Immigration Patterns, 2000—2024

- Immigration, after 2000 and especially after 2015, is characterized by substantial increases in the absolute number of immigrants admitted, as well the share admitted as temporary foreign workers and international students.

- For example, from 2000 to 2015, the total number of immigrants increased at a simple average annual rate of 4% compared to 15% from 2016 to 2024. As well, permanent admissions as a share of total admissions declined by .83 percentage points per year from 2000 to 2015 and by 1.1 percentage points per year from 2016 to 2024.

- These recent developments reflect changes in government policy. In particular, the International Mobility Program (IMP) of 2014 enabled Canadian employers to bring in greater numbers of temporary workers from abroad to fill lower-paying jobs.

- The Advisory Council on Economic Growth appointed by the Trudeau government in early 2016 recommended substantial increases in permanent immigration, as well as in the number of international students who would become eligible for permanent status after acquiring Canadian educational credentials. The Trudeau government enthusiastically embraced the recommendation.

- Recent immigrants to Canada seem better equipped to participate in the labour market than earlier cohorts. For example, over the period from 2011 to 2021, the percentage of established immigrants with a bachelor’s degree or higher increased, and the vast majority of admitted immigrants speak at least one of the official languages. Moreover, recent immigrants enjoy higher employment rates than did earlier cohorts.

- Nevertheless, public concern about the impact of increased immigration—primarily on the affordability of housing—has led the federal government to reduce planned levels of future immigration substantially.

Steven Globerman

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Business1 day ago

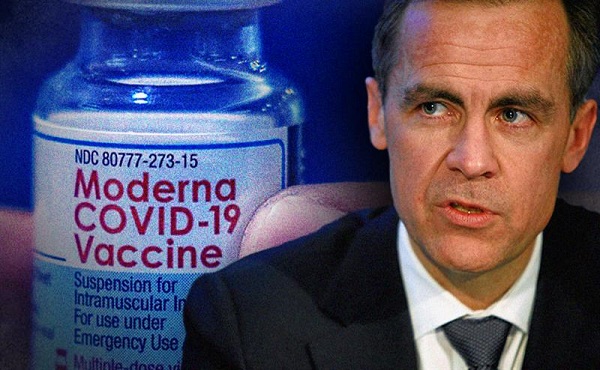

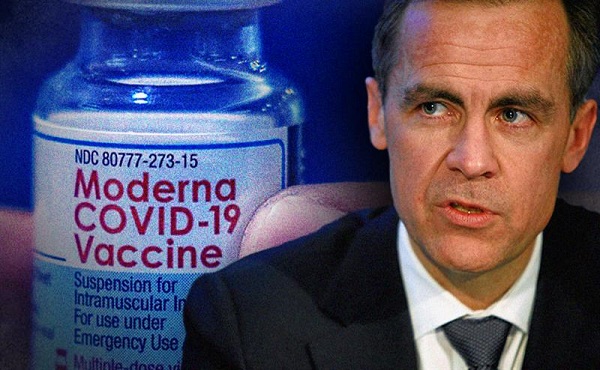

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Business2 days ago

Business2 days agoCarney government should apply lessons from 1990s in spending review

-

Business24 hours ago

Business24 hours agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Energy2 days ago

Energy2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

Red Deer1 day ago

Red Deer1 day agoWesterner Days Attraction pass and New Experiences!