Economy

Janet Yellen Calls For $78,000,000,000,000 To Tackle Climate Change

From the Daily Caller News Foundation

From the Daily Caller News Foundation

U.S. Treasury Secretary Janet Yellen said during a speech in Belem, Brazil, on Saturday that the price tag for a global transition to a low-carbon economy amounts to $78 trillion in financing through 2050.

Yellen said that in order to achieve the goal of net-zero global carbon emissions, there would need to be $3 trillion globally in annual financing for the cause, which she said is a top priority for the Biden administration, according to the speech. In order to contribute to this, Yellen vowed to finance green initiatives in developing countries through multilateral development banks and develop “clean energy technologies.”

“The transition will require no less than $3 trillion in new capital from many sources each year between now and 2050,” Yellen said during the speech. “This can be leveraged to support pathways to sustainable and inclusive growth, including for countries that have historically received less investment.”

“Neglecting to address climate change and the loss of nature and biodiversity is not just bad environmental policy,” Yellen said during the speech. “It is bad economic policy.”

Yellen boasted in her speech about the commitments the Biden administration has put forth toward forwarding these green initiatives to achieve their “climate goals.”

“At home, we are implementing the Inflation Reduction Act, the most significant climate legislation in our nation’s history,” Yellen said during the speech. “It is driving hundreds of billions of dollars of investments in the clean energy technologies and industries that will propel us toward our climate goals and fuel our economic growth.”

The Inflation Reduction Act allocated $370 billion to subsidize climate initiatives like electric vehicles and other technologies that are essential to President Joe Biden’s green agenda.

“Climate change is literally an existential threat to our nation and to the world,” Biden said during a speech addressing climate change in July of 2022. “As President, I’ll use my executive powers to combat climate — the climate crisis in the absence of congressional actions, notwithstanding their incredible action.”

During her speech, Yellen advocated for these climate initiatives to be implemented “beyond our borders.”

“Our ambitions at home are matched by our ambitions abroad,” Yellen said during the speech. “We know that we can only achieve our climate and economic goals — from reducing global emissions to adapting and building resilience, from strengthening markets to bolstering supply chains — if we also lead efforts far beyond our borders.”

The Treasury Department did not immediately respond to a request for comment from the Daily Caller News Foundation.

Business

Saskatchewan becomes first Canadian province to fully eliminate carbon tax

From LifeSiteNews

Saskatchewan has become the first Canadian province to free itself entirely of the carbon tax.

On March 27, Saskatchewan Premier Scott Moe announced the removal of the provincial industrial carbon tax beginning April 1, boosting the province’s industry and making Saskatchewan the first carbon tax free province.

Under Moe’s direction, Saskatchewan has dropped the industrial carbon tax which he says will allow Saskatchewan to thrive under a “tariff environment.”

“I would hope that all of the parties running in the federal election would agree with those objectives and allow the provinces to regulate in this area without imposing the federal backstop,” he continued.

The removal of the tax is estimated to save Saskatchewan residents up to 18 cents a liter in gas prices.

The removal of the tax will take place on April 1, the same day the consumer carbon tax will reduce to 0 percent under Prime Minister Mark Carney’s direction. Notably, Carney did not scrap the carbon tax legislation: he just reduced its current rate to zero. This means it could come back at any time.

Furthermore, while Carney has dropped the consumer carbon tax, he has previously revealed that he wishes to implement a corporation carbon tax, the effects of which many argued would trickle down to all Canadians.

The Saskatchewan Association of Rural Municipalities (SARM) celebrated Moe’s move, noting that the carbon tax was especially difficult on farmers.

“I think the carbon tax has been in place for approximately six years now coming up in April and the cost keeps going up every year,” SARM president Bill Huber said.

“It puts our farming community and our business people in rural municipalities at a competitive disadvantage, having to pay this and compete on the world stage,” he continued.

“We’ve got a carbon tax on power — and that’s going to be gone now — and propane and natural gas and we use them more and more every year, with grain drying and different things in our farming operations,” he explained.

“I know most producers that have grain drying systems have three-phase power. If they haven’t got natural gas, they have propane to fire those dryers. And that cost goes on and on at a high level, and it’s made us more noncompetitive on a world stage,” Huber decalred.

The carbon tax is wildly unpopular and blamed for the rising cost of living throughout Canada. Currently, Canadians living in provinces under the federal carbon pricing scheme pay $80 per tonne.

2025 Federal Election

Fight against carbon taxes not over yet

As the federal government removes the consumer carbon tax, the Canadian Taxpayers Federation is calling on all party leaders to oppose all carbon taxes, including the hidden tax on business.

“Canadians fought hard to force Ottawa to back down on its consumer carbon tax and now the fight moves to stopping the hidden carbon tax on business,” said Franco Terrazzano, CTF Federal Director. “Canadians can’t afford a carbon tax on business that pushes up prices at the gas station and makes it harder for our businesses to compete while they’re already struggling with a trade war.”

Today, the federal government cut the consumer carbon tax rate to $0. This will reduce taxes by about 17 cents per litre of gasoline, 21 cents per litre of diesel and 15 cents per cubic metre of natural gas.

The federal government still imposes an industrial carbon tax on oil and gas, steel and fertilizer businesses, among others.

During the Liberal Party leadership race, Prime Minister Mark Carney said he would “improve and tighten” the industrial carbon tax and “extend the framework to 2035.”

Just 12 per cent of Canadians believe businesses pay most of the cost of the industrial carbon tax, according to a Leger poll commissioned by the CTF. Meanwhile, 70 per cent said businesses would pass most or some carbon tax costs on to consumers.

Conservative Party Leader Pierre Poilievre said he will “repeal the entire carbon tax law, including the tax on Canadian businesses and industries.”

“Carbon taxes on refineries make gas more expensive, carbon taxes on utilities make home heating more expensive and carbon taxes on fertilizer plants increase costs for farmers and that makes groceries more expensive,” Terrazzano said. “Canadians know Poilievre will end all carbon taxes and Canadians know Carney’s carbon tax costs won’t be zero.

“Carney owes Canadians a clear answer: How much will your carbon tax cost?”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAlcohol tax and MP pay hike tomorrow (April 1)

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

2025 Federal Election2 days ago

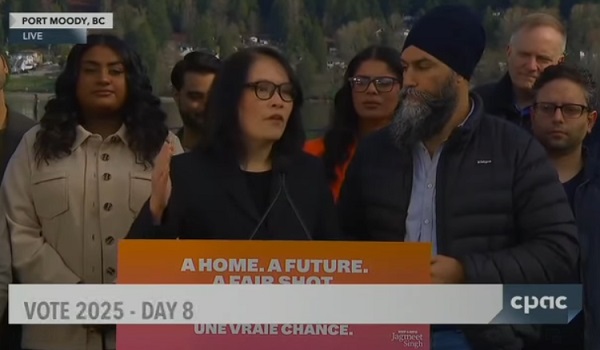

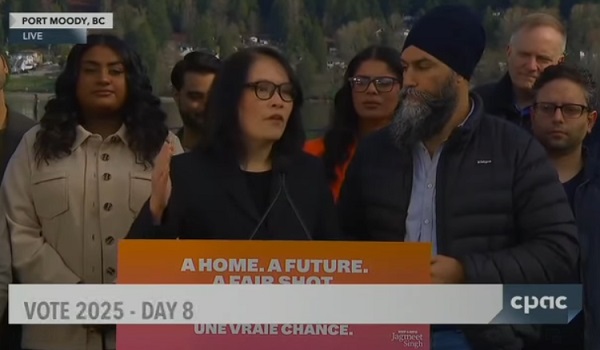

2025 Federal Election2 days agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFixing Canada’s immigration system should be next government’s top priority

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoAre the Jays Signing Or Declining? Only Vladdy & Bo Know For Sure