International

House Passes Bipartisan Resolution Establishing Trump Assassination Attempt Task Force

From the Daily Caller News Foundation

From the Daily Caller News Foundation

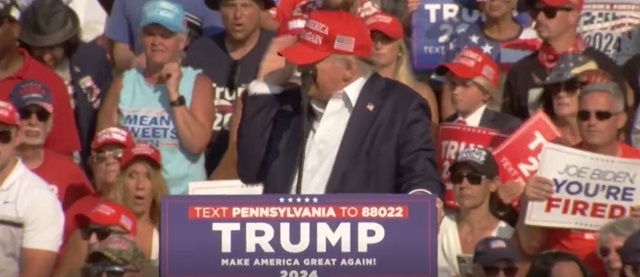

The House passed a resolution to form a bipartisan task force on Wednesday to investigate the assassination attempt of former President Donald Trump on July 13.

H.R. 1367, which was spearheaded by House Speaker Mike Johnson and House Minority Leader Hakeem Jeffries, passed the House in a unanimous vote. The task force was announced in the aftermath of U.S. Secret Service (USSS) Director Kimberly Cheatle’s evasive testimony before the House Oversight Committee on Monday, which sparked bipartisan outrage and her subsequent resignation on Tuesday.

The House voted 416-0 on the resolution.

“The security failures that allowed an assassination attempt on Donald Trump’s life are shocking,” Johnson and Jeffries said in a joint statement on Tuesday. “The task force will be empowered with subpoena authority and will move quickly to find the facts, ensure accountability, and make certain such failures never happen again.”

The task force will be composed of seven Republicans and six Democrats “in response to bipartisan demands for answers,” according to Johnson and Jeffries’ joint statement.

The resolution was also led by Republican Rep. Mike Kelly of Pennsylvania, who was in the front row of Trump’s rally in Butler County, Pennsylvania, when 20-year old Thomas Matthew Crooks shot at and wounded the former president, killing attendee Corey Comperatore and injuring James Copenhaver and David Dutch, who are both in stable condition as of Monday.

Crooks took aim at the Republican nominee from a rooftop positioned just 130 yards from the stage. The gunman was reportedly spotted by witnesses and flagged by the USSS almost an hour before Trump took the stage.

'Go Back To Guarding Doritos': GOP Rep Goes Ballistic On Secret Service Director For 'Shameful' Answers pic.twitter.com/wdgXC82cbC

— Daily Caller (@DailyCaller) July 22, 2024

Cheatle resigned the day after her testimony on Monday, saying that she took “full responsibility for the security lapse,” according to an email obtained by The Associated Press. Johnson said Cheatle’s resignation was “overdue,” but that there still “may be others in the line of authority” who were also at fault.

“She should have done this at least a week ago,” Johnson said in a press conference on Tuesday. “Now we have to pick up the pieces. We have to rebuild the American people’s faith and trust in the Secret Service as an agency.”

The Department of Homeland Security did not immediately respond to a request for comment from the Daily Caller News Foundation.

(Featured Image Media Credit: Screen Capture/CSPAN)

Business

Trump eyes end of capital gains tax in 2025

MxM News

MxM News

Quick Hit:

In a historic announcement that rattled markets and reignited debate over tax policy, President Donald Trump revealed plans to eliminate the capital gains tax starting in 2025. The unprecedented move would allow Americans to retain all profits from asset sales—whether in stocks, real estate, or other investments. Supporters tout it as a bold pro-growth measure, while critics warn it may cause budget strain and market instability.

Key Details:

-

President Trump announced the elimination of capital gains tax effective 2025, describing it as a move to reward success and promote wealth-building.

-

Currently, capital gains are taxed at rates up to 20%, with additional surcharges for high earners.

-

The announcement caused a major rally across financial markets, though critics claim the change favors the wealthy and could disrupt the economy.

Diving Deeper:

At a press conference on Monday, President Trump laid out a sweeping proposal to eliminate the capital gains tax in its entirety, calling it a “long-overdue correction” to what he described as a punitive tax on prosperity. “Why should you be punished for building wealth?” he asked. “This is America—we reward success.” If enacted, the change would allow investors to retain 100% of profits from the sale of assets such as stocks, homes, and businesses, with zero tax liability.

This proposal marks a sharp departure from decades of entrenched U.S. tax policy. Currently, long-term capital gains are taxed at rates ranging from 0% to 20%, with potential surcharges including the 3.8% Net Investment Income Tax for high earners. Trump’s plan would zero out those liabilities entirely starting in the 2025 tax year.

Conservative economists and market analysts have lauded the move as potentially the most transformative supply-side reform since the Reagan era. They argue that removing the tax will unshackle trillions of dollars currently locked in unrealized gains, spurring investment, entrepreneurship, and broader economic dynamism. “This is a game-changer,” said one pro-growth advocate. “It sends a clear message that America is back to being the most investment-friendly nation on Earth.”

Predictably, left-wing critics erupted. One Democratic senator labeled the measure a “grenade” that would detonate the federal budget and widen the wealth gap. Others warned of asset bubbles and increased volatility as investors rush to dump assets ahead of the reform’s implementation. These concerns, however, do not seem to have spooked the markets—at least not yet.

The Dow Jones Industrial Average jumped nearly 600 points following the announcement, while cryptocurrencies surged on expectations of tax-free gains. Real estate portals and trading platforms like Robinhood and E*TRADE saw surges in activity as users began strategizing around the policy’s timing. Online, the announcement triggered a wave of memes and commentary. The hashtag #NoCapGains began trending on X (formerly Twitter), with some calling it a “wealth liberation act” and others denouncing it as “Robin Hood in reverse.”

Legislation to formalize the proposal is expected to hit Congress within weeks. While Republicans have largely expressed support, Democrats are preparing for a fierce battle. It’s unclear whether some establishment Republicans—many of whom have been resistant to bold reform under Trump—will help move the bill forward or slow-walk it in favor of more moderate compromises.

Until the law is officially passed, financial advisors are urging caution. “The promise of zero capital gains tax is tempting,” one planner said, “but don’t bet the farm until it’s signed, sealed, and delivered.”

Still, with the 2025 tax season approaching fast, the stakes are enormous. If passed, Trump’s plan would not only mark one of the most dramatic tax overhauls in modern history—it would redefine the very incentives that drive American investment and wealth accumulation.

International

UN committee urges Canada to repeal euthanasia for non-terminally ill patients

From LifeSiteNews

The UN Committee on the Rights of Persons with Disabilities has warned against Canada’s euthanasia program, urging the repeal of legislation that allows the killing of non-terminally ill individuals.

Canada’s euthanasia regime has become too radical even for the anti-life United Nations, who recently called on the nation to repeal its law allowing non-terminally ill patients to qualify for death through the state’s “Medical Assistance in Dying” program.

In closing remarks published March 21, the UN Committee on the Rights of Persons with Disabilities argued that Canada should repeal its 2021 MAID expansion legislation that allowed those who are chronically ill but not terminally ill to be put to death by the state.

The committee said that Canada’s regime “establishes medically assisted dying for persons with disabilities based on negative, ableist perceptions of the quality and value of the life of persons with disabilities, including that ‘suffering’ is intrinsic to disability rather than the fact that inequality and discrimination cause and compound ‘suffering’ for persons with disabilities.”

It pointed out that “the concept of ‘choice’ creates a false dichotomy by setting up the premise that if persons with disabilities are suffering, it is valid for the State Party to enable their death.”

In Canada, euthanasia is divided into Track 1 and Track 2 requests. Track 1 requests deal with those whose death is allegedly imminent or foreseeable. Track 2 requests deal with those who are not terminally ill but have lost the will to live due to their having chronic health problems.

The UN committee took specific issue with Track 2 MAID, writing that it is “extremely concerned about the 2021 amendments to the State Party’s Criminal Code through Bill C-7 that expanded the eligibility criteria for obtaining Medical Assistance in Dying (MAID), known as ‘Track 2’ MAiD by removing the ‘foreseeable death’ criteria.”

The committee further recommended that Canada not euthanize its citizens for mental health reasons and abandon additional expansions of the program. Such an expansion is slated to come into effect in 2027.

It is worth noting that while Track 2 cases of MAID are indeed evil, so are Track 1 cases. The Catholic Church infallibly teaches that euthanasia is a grave evil tantamount to murder and must be rejected in all circumstances.

The UN committee’s criticism of Canada’s euthanasia regime comes after many have pointed out that the regime has spawned a culture of death and eugenics in the country, with the disabled and the poor often being those who request or who are even suggested to request death via Track 2 MAID.

In one case, a Nova Scotia grandmother revealed that doctors repeatedly offered her euthanasia while she underwent cancer treatment, making her feel as though she was “better off dead.”

“I felt like a problem that needed to be [gotten] rid of instead of a patient in need of treatment,” she said. “I don’t want to be asked if I want to die.”

Similarly, in May of last year, LifeSiteNews reported on a Canadian man who felt “completely traumatized” and violated that he was offered MAID “multiple times” instead of getting the proper care he needed while in the hospital.

The most recent reports show that MAID is the sixth highest cause of death in Canada. However, it was not listed as such in Statistics Canada’s top 10 leading causes of death from 2019 to 2022.

When asked why MIiD was left off the list, the agency said that it records the illnesses that led Canadians to choose to end their lives via euthanasia, not the actual cause of death, as the primary cause of death.

According to Health Canada, in 2022, 13,241 Canadians died by MAID lethal injections. This accounts for 4.1 percent of all deaths in the country for that year, a 31.2 percent increase from 2021.

-

Catherine Herridge2 days ago

Catherine Herridge2 days agoFBI imposed Hunter Biden laptop ‘gag order’ after employee accidentally confirmed authenticity: report

-

International2 days ago

International2 days agoTrump’s ‘Golden Dome’ defense shield must be built now, Lt. Gen. warns

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoDon’t let the Liberals fool you on electric cars

-

Crime2 days ago

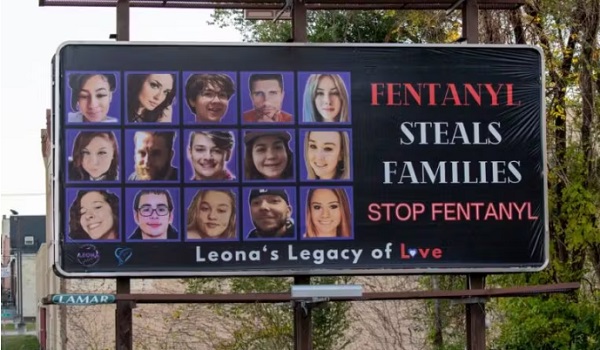

Crime2 days agoFirst Good Battlefield News From Trump’s Global War on Fentanyl

-

Courageous Discourse1 day ago

Courageous Discourse1 day agoEurope Had 127,350 Cases of Measles in 2024

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoLiberals Replace Candidate Embroiled in Election Interference Scandal with Board Member of School Flagged in Canada’s Election Interference Inquiry

-

espionage2 days ago

espionage2 days agoU.S. Experts Warn Canada Is Losing the Fight Against PRC Criminal Networks—Washington Has Run Out of Patience

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPierre Poilievre Declares War on Red Tape and Liberal Decay in Osoyoos