Energy

Transmountain Pipeline Expansion Project a success?

From the Frontier Centre for Public Policy

The Transmountain Mountain Pipeline expansion project (TMEP) was completed on May 01, 2024. Its startup the following month ended an eleven-year saga of tectonic federal energy policy initiatives, climate change requirements, federal regulatory restructuring, and indigenous reconciliation. That it was finished at all is a triumph, but there was muted celebration.

The original proponent for TMEP was Kinder Morgan (KM), who filed its application with the federal energy regulator in 2013. The expansion would be constructed in the existing right of way of the existing pipeline and increase capacity from 300,000 barrels of oil and refined products to 890,000 barrels of oil per day. This included expansion of the existing dock and loading facilities. Protests began virtually the next day. The cost estimate at that time was $7.4 billion for the 1,150 km pipeline and related facilities. The federal regulator and the federal government approved the project in 2016.

Between 2016 and 2018, the intensity of the protests against TMEP and a new government formed in British Columbia that vowed it would use any means possible to make sure TMX would not be built created significant hurdles. KM warned that the protest’s impact and B.C.’s regulatory and legal challenges were creating significant uncertainty, and the project would be delayed at least a year, stopping all non-essential spending. Ultimately KM decided it would not continue with the project because of the increased execution risk and cost to complete the project that the legal and regulatory challenges, and increasing protests, posed.

The project’s shelving by KM led to the federal government acquiring all the Kinder Morgan assets, including TM for $4.7 billion in 2018. Construction then began in 2019. The execution risks remained the same with the legal and regulatory challenges. They were compounded by a legal challenge to the substance of the federal government’s consultation with indigenous people, which was their constitutional duty. The courts agreed that the federal government had not met its constitutional duty to consult and ordered that it be redone. This led to further delays and in 2020 the cost estimate increased to $12.6 billion, then increased again to $21.4 billion in 2022. Ultimately, the federal regulator imposed 157 conditions on TMEP that it had to meet before it could operate.

COVID, extensive flooding and regulatory delays led to a further cost increase up to $30.9 billion in 2023. The final updated cost increased to $34 billion in 2024 due to labour costs, inflation, and materials delays.

The foregoing “Coles notes” version of events sets out the challenges endured by TMX as of Thursday, May 23, 2024. It also highlights that delays in a major project like TMEP have a massive impact on costs. But what gets lost in all this is that in 2013 KM, a public company, made a commercial decision to proceed with the project. There was and still is a huge market pull for the pipeline and the incremental oil volumes. There is huge economic and strategic value for Canada that will benefit all sectors of the economy and indigenous communities, who will most likely end with significant pipeline ownership.

Market access for Canada’s oil production in the Pacific markets will change the oil trading dynamics and value for Canadian production. Canada has the third largest oil reserves in the world. Canada is among the best in its class for environmental, safety, social and governance of its energy production. Canada is also among the best in pipeline construction and safety. So, who best to execute a monumental project like TMX?

We need to reflect and admire the skill, diligence, and perseverance of everyone involved with bringing to fruition TMX as a world class, state of the art major piece of energy infrastructure.

Yes, TMX is a success but the process through which it had to persevere was a failure and we should reflect and learn from it. In the end, despite the final cost, Canada will reap the economic benefits from TMX for decades because the world needs oil and Canada has lots of it.

Chris Bloomer is a board member of FCPP and the former president and CEO of the Canadian Energy Pipeline Association. He has held senior executive positions in the energy industry in Canada and internationally.

Energy

Here’s what they don’t tell you about BC’s tanker ban

From Resource Works

By Tom Fletcher

Crude oil tankers have sailed and docked on the British Columbia coast for more than 70 years, with no spills

BC Premier David Eby staged a big media event on Nov. 6 to once again restate his opposition to an oil pipeline from Alberta to the Prince Rupert area.

The elaborate ceremony to sign a poster-sized document called the “North Coast Protection Declaration” was dutifully covered by provincial and national media, despite having no actual news content. It is not a response to Alberta’s plan to finance preliminary work on a new oil pipeline, Eby insisted. It’s to confirm the direction of growing the BC economy without, you know, any more oil pipelines.

The event at the opulent Vancouver Convention Centre West was timed to coincide with the annual BC Cabinet and First Nations Leaders Gathering, a diplomatic effort set up 10 years ago by former premier Christy Clark. This year’s event featured more than 1,300 delegates from 200 First Nations and every BC government ministry.

A high-profile event with little real news

The two-day gathering features 1,300 meetings, “plus plenary and discussion sessions on a variety of topics, including major projects, responding to racism, implementation of the Declaration Act, and more,” the premier’s office announced.

Everyone’s taxpayer-funded hotels and expense accounts alone are an impressive boost to the economy. Aside from an opening news conference and the declaration event at the end, the whole thing is closed to the public.

The protection declaration is a partnership between the BC government and the Coastal First Nations, Eby said. As I mentioned in my Oct. 15 commentary, Coastal First Nations sounds like a tribal council, but it isn’t. It’s an environmental group started in the late 1990s by the David Suzuki Foundation, with international eco-foundation funding over the years that led to the current name, Coastal First Nations Great Bear Initiative.

The evolution of the Coastal First Nations initiative

Their current project is the Great Bear Sea, funded by $200 million from the federal government, $60 million from BC, and $75 million from “philanthropic investors.” This is similar to the Great Bear Rainforest conservation project, backed by mostly US billionaire charity funds, that persuaded Justin Trudeau to turn the voluntary tanker exclusion zone into Canadian law.

Leadoff speaker in Vancouver was the current Coastal First Nations president, Heiltsuk Chief Marilyn Slett. She repeated a well-worn story about her remote Central Coast community of Bella Bella still struggling with the effects of an “oil spill” in 2016.

In fact, the 2016 event was the sinking of a tugboat that ran aground while pushing an empty fuel barge back down from Alaska to a refinery in Washington to be refilled. The “oil spill” was the diesel fuel powering the tugboat, which basic chemistry suggests would have evaporated long ago.

Fuel dependence on the remote BC coast

Remote coastal settlements are entirely dependent on fuel shipments, and Bella Bella is no different. It has no road or power grid connections, and the little seaside village is dominated by large fuel tanks that have to be refilled regularly by barge to keep the lights on.

Alaska North Slope crude has been shipped by tanker to Washington and beyond for more than 60 years. Yes, there’s a North Coast “exclusion zone” where US-bound tankers go west around Haida Gwaii rather than down the Inside Passage, but once the ships reach Vancouver Island, they sail inside right past Victoria to refineries at Cherry Point, March Point, and other US stops.

Through the tall windows of the Vancouver convention centre, you can watch Aframax crude tankers sail past under the Second Narrows and Lions Gate bridges, after loading diluted bitumen crude from the expanded Westridge Terminal in Burnaby. That is, of course, the west end of the Trans Mountain Pipeline, which has operated since 1954 with no spills, including the branch line down to the Cherry Point complex.

There are many more crude tankers exiting Vancouver now that the TMX expansion is complete, but they aren’t filled all the way because the Second Narrows is too shallow to allow that. A dredging project is in the works to allow Aframax-sized tankers to fill up.

A global market for Alberta crude emerges

They enter and exit Burrard Inlet surrounded by tethered tugboats to prevent grounding, even if the tanker loses power in this brief stretch of a long voyage that now takes Alberta crude around the world. Since the TMX expansion, shipments that used to go mostly to California now are reaching Korea, Japan, China, Hong Kong, and Singapore as well.

The US captive discount has shrunk, the tripled pipeline capacity is rapidly filling up, and pumping stations are being added. This is the very definition of Mark Carney’s nation-building projects to get Canada out of the red.

The idea that the North Coast can host fuel barges, LNG tankers, bunker-fired cruise ships, and freighters but can’t tolerate Canadian crude along with the US tankers is a silly urban myth.

Tom Fletcher has covered BC politics and business as a journalist since 1984. [email protected]. X: @tomfletcherbc

Energy

The Carney Government is Hijacking the Phase “Energy Superpower” to Advance Their Agenda

From Energy Now

By Jim Warren

Lately, the spin doctors in the prime minister’s office (PMO) have been hijacking perfectly good words and altering their meaning in the service of the Liberal agenda.

For budgetary purposes “operating expenses” have become “investments.” Similarly, the term “energy superpower” no longer means what people typically think it means. Back in the day when the concept “energy superpower” was popularized, it was used to describe oil rich countries like Saudi Arabia, the other Gulf states and OPEC members.

Those countries are home to the oil sheiks—the leaders of OPEC who capitalized on their dominant position in global energy markets to affect the global oil supply and prices. They also used their control over oil as a source of leverage in the realm of geopolitics.

Wikipedia, the font of knowledge for lazy columnists, describes the traditional meaning of energy superpower as follows “…a country that supplies large amounts of energy resources (crude oil, natural gas, coal, etc.) to a significant number of other countries – and therefore has the potential to influence world markets for political or economic gains. Energy superpower status might be exercised, for example, by significantly influencing the price on global markets or by withholding supplies.”

During the 2025 election campaign Mark Carney’s notion of what constitutes an energy superpower was aligned with the conventional definition. A CTV news report the day after the federal election reminded viewers that on “April 8 at a campaign stop in Calgary, Carney pledged to position Canada as a ‘world energy superpower,’ calling for new [oil] pipelines, including one to Eastern Canada.”

By September of 2025, Carney and his Energy Minister Timothy Hodgson had obviously adopted a new definition. They still boast about making Canada an energy superpower but no longer referred to oil production and new export pipelines as things integral to that goal.

But wait, on Friday November 7 the prime minister told attendees at Canadian Club event in Toronto not to worry the long sought pipeline “was going to happen.”

Pardon me if I’m not convinced. Over the three months prior to Friday the Liberals had left us to assume becoming an energy superpower could happen without increasing oil production and exports.

We are still left with a riddle—what do the Carney Liberals actually mean when they promise Canadians we will achieve “energy superpower” status if crude oil, Canada’s single most valuable export commodity is no longer one of the key components of the strategy to get us there?

Actually, Canada was well on its way to achieving the status of a world class energy superpower until the Trudeau Liberals assumed office. Our budding superpower ambitions were foreclosed on by the Liberals’ growth killing BANANA* legislation which thwarted efforts to increase oil production and exports. The blue-eyed sheiks of Western Canada have been handcuffed and denounced as authors of the upcoming climate apocalypse.

(*BANANA – Build Absolutely Nothing Anywhere Near Anything)

The communications wizards in the PMO abandoned the traditional definition without actually telling anyone they were doing so. They have quietly adopted a fossil fuel-free version of what it means to be a supremely powerful purveyor of energy, but haven’t explained what that entails.

If they chose to be honest with Canadians they would say what they really mean is “green energy superpower.” But if they came clean, it would probably trigger a national unity crisis. Better to leave things loose until the budget has been approved.

Despite wishful thinking in Ottawa, Canada is a long way from winning the race for medals in the field of clean, green energy production. But, we’re so far behind the leaders that Mark Carney thinks he’s first.

Powering the dream of a net zero world will presumably rely heavily on the approximately 28 critical minerals and rare earths required for wind turbines, advanced electric motors and batteries. Canada makes it to the medals podium for just three of the 28. According to a 2024 report published by Our World in Data, Canada is in third place globally for uranium and aluminum production, and cobalt refining.

Australia, a Western-style capitalist democracy which punches close to our weight by many economic measures is far ahead of Canada when it comes to critical minerals production and proven reserves. China is in a class of its own—clearly the world leader in rare earth production and proven reserves, miles ahead of the rest of the world. When it comes to mining and refining of critical minerals Canada has a lot of catching up to do.

Canada is similarly a long way from superpower status when it comes to the manufacturing of polysilicon, the compound required to produce solar electricity, and wind turbines.

Canada does not have any commercial level producers of polysilicon. China has several firms that manufacture it, one of which GCL-Poly has a 22% share of the global market. Polysilicon is also produced by firms in the US, South Korea, Germany, Japan, Norway and Qatar. There once was a company in Canada which imported polysilicon from China which it then used to make solar panels. Apparently it has moved its operations to the US.

Globally, there are approximately 39 manufacturers of large, grid-scale wind turbines located in some 14 different countries. The world’s largest manufacturer, Vestas, is headquartered in Denmark. No large wind turbines are manufactured in Canada. Our role is limited to installation, operations and maintenance.

And, given recent events it is unlikely Canada is going to become a global superpower for the manufacturing of electric vehicles any time soon.

Canada is in third place globally for the production of hydroelectricity, although our 364.2 terawatt-hours (TWH) of electricity we generate pales in comparison with China’s 4,183.4 TWH of hydroelectric production. While the environmentally virtuous may find grounds for bragging rights with respect to our country’s hydro production, it means little in terms of leverage in a global market place. Sure Canadian producers sell electricity into the US power grid, but they are unable to sell it anywhere else. Ocean spanning transmission lines won’t work, too much power is lost when sending power long distances and selling electricity stored in batteries is not commercially viable—the batteries required are simply too big and insanely expensive.

For the foreseeable future the only way Canada can claim superpower status as a producer of clean energy is if the definition is radically changed. Apparently being identified as a clean green energy superpower can now mean that a country makes use of an impressive level of the stuff—the criteria required to be deemed an “impressive producer” is apparently one of those post-modern woke notions whereby each country is entitled to its own green energy truth.

This echoes the casual way social media mavens award superpower status to supposedly inspiring personal characteristics – my superpower is multi-tasking, or baking sourdough bread, or being an avid recycler. It makes about as much sense as claiming you are a hero because you held a guy’s mitts so he could dial 911 to report an accident.

It is sad, but true, that Canada was well on its way to energy superpower status prior to the federal Liberals coming to office in 2015. Crude oil was then and remains Canada’s single most valuable export product. We currently export approximately 4.2 million barrels per day which was worth 153 billion USD in 2024. Back in 2013 and early 2014 when world prices were good the oil industry was generating as much as three to four percent of Canada’s GDP.

Clearly Canada could be doing a whole lot better economically if the federal government got behind the oil industry and removed the barriers to growth in production and exports. Danielle Smith has been trying to alert the Canadian government and public to the reality that completion of a single million barrels per day oil pipeline from Alberta to Prince Rupert could contribute $20 to $30 billion in new revenues to Canada’s GDP, depending on world prices.

That would be a giant leap forward on the path to being a real energy superpower.

-

Energy2 days ago

Energy2 days agoCarney bets on LNG, Alberta doubles down on oil

-

Alberta2 days ago

Alberta2 days agoAlberta on right path to better health care

-

Indigenous2 days ago

Indigenous2 days agoTop constitutional lawyer slams Indigenous land ruling as threat to Canadian property rights

-

Alberta2 days ago

Alberta2 days agoCarney government’s anti-oil sentiment no longer in doubt

-

Alberta2 days ago

Alberta2 days agoAlberta Emergency Alert test – Wednesday at 1:55 PM

-

Alberta1 day ago

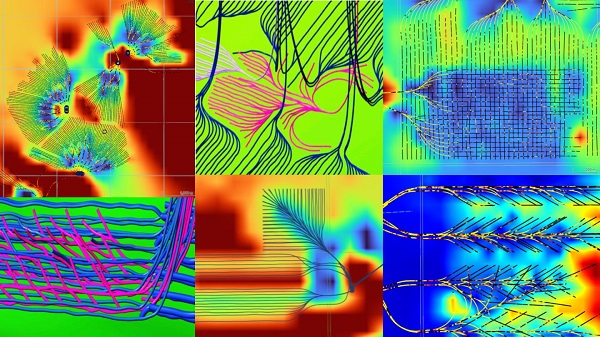

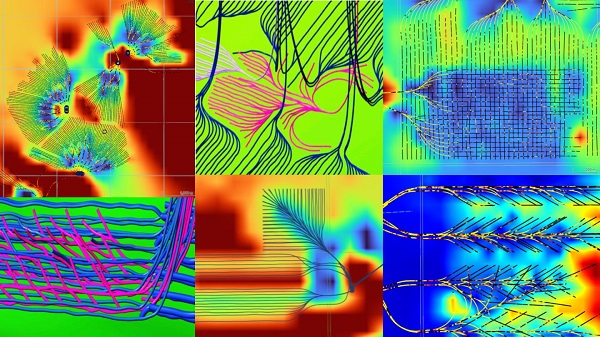

Alberta1 day ago‘Weird and wonderful’ wells are boosting oil production in Alberta and Saskatchewan

-

Business1 day ago

Business1 day agoCanada is failing dismally at our climate goals. We’re also ruining our economy.

-

Health2 days ago

Health2 days agoSPARC Kindness Tree: A Growing Tradition in Capstone