Economy

Federal government estimates don’t reflect true costs of national pharmacare

From the Fraser Institute

By Grady Munro and Mackenzie Moir

By borrowing to fund national pharmacare, the government can temporarily conceal the direct cost to Canadians, but Canadians inevitably must pay for this spending through higher taxes—something polling on national pharmacare suggests is a deal-breaker for many.

According to a new report from the Parliamentary Budget Officer (PBO), the price tag for the Trudeau government’s national pharmacare program is already expected to exceed the government’s original estimate. And the program will likely continue to grow more expensive.

In mid-April, the government reported the “first phase” of national pharmacare would cost $1.5 billion over five years, starting in 2024/25. For this first phase, which would “expand and enhance” existing public coverage of contraception and diabetes medications, the federal government must negotiate with each province and territory regarding the implementation of national coverage.

Yet just one month after the federal government released its cost estimate, the PBO now reports that this phase of national pharmacare will cost $1.9 billion over five years. In other words, before Ottawa has negotiated any deals with the provinces, the expected costs of national pharmacare have already increased by approximately $400 million.

It should come as no surprise. Since February, when the government and the federal NDP struck their pharmacare deal, the government has failed to acknowledge the program’s true costs. By borrowing to fund national pharmacare, the government can temporarily conceal the direct cost to Canadians, but Canadians inevitably must pay for this spending through higher taxes—something polling on national pharmacare suggests is a deal-breaker for many.

It’s also important to remember this is the first phase of national pharmacare, and the Trudeau government likely plans to further expand coverage to a list of “essential prescription drugs and related products.” Consequently, according to previous PBO estimates, costs of the fully-implemented program may reach $13.4 billion in annual federal and provincial spending by 2027/28.

Crucially, the cost estimates by both the federal government and the PBO fail to account for how Canadians and insurance organizations might respond to national pharmacare.

For example, in their most recent estimates they assume that nobody already covered by some type of drug insurance plan (this was 81 per cent of Canadians in 2019) will switch to the new national plan, or that no public or private insurers will adjust or renegotiate their plans. For Canadians previously insured privately but switch to the national plan, pharmacare will shift some portion of the costs currently borne by private providers onto the federal government. This will further increase the program’s price tag, which again is ultimately paid by taxpayers.

As the Trudeau government continues to implement national pharmacare, Canadians should be aware that current cost estimates don’t accurately reflect the true costs of the program. A larger-than-expected bill for Canadians is more than likely.

Authors:

Business

Saskatchewan becomes first Canadian province to fully eliminate carbon tax

From LifeSiteNews

Saskatchewan has become the first Canadian province to free itself entirely of the carbon tax.

On March 27, Saskatchewan Premier Scott Moe announced the removal of the provincial industrial carbon tax beginning April 1, boosting the province’s industry and making Saskatchewan the first carbon tax free province.

Under Moe’s direction, Saskatchewan has dropped the industrial carbon tax which he says will allow Saskatchewan to thrive under a “tariff environment.”

“I would hope that all of the parties running in the federal election would agree with those objectives and allow the provinces to regulate in this area without imposing the federal backstop,” he continued.

The removal of the tax is estimated to save Saskatchewan residents up to 18 cents a liter in gas prices.

The removal of the tax will take place on April 1, the same day the consumer carbon tax will reduce to 0 percent under Prime Minister Mark Carney’s direction. Notably, Carney did not scrap the carbon tax legislation: he just reduced its current rate to zero. This means it could come back at any time.

Furthermore, while Carney has dropped the consumer carbon tax, he has previously revealed that he wishes to implement a corporation carbon tax, the effects of which many argued would trickle down to all Canadians.

The Saskatchewan Association of Rural Municipalities (SARM) celebrated Moe’s move, noting that the carbon tax was especially difficult on farmers.

“I think the carbon tax has been in place for approximately six years now coming up in April and the cost keeps going up every year,” SARM president Bill Huber said.

“It puts our farming community and our business people in rural municipalities at a competitive disadvantage, having to pay this and compete on the world stage,” he continued.

“We’ve got a carbon tax on power — and that’s going to be gone now — and propane and natural gas and we use them more and more every year, with grain drying and different things in our farming operations,” he explained.

“I know most producers that have grain drying systems have three-phase power. If they haven’t got natural gas, they have propane to fire those dryers. And that cost goes on and on at a high level, and it’s made us more noncompetitive on a world stage,” Huber decalred.

The carbon tax is wildly unpopular and blamed for the rising cost of living throughout Canada. Currently, Canadians living in provinces under the federal carbon pricing scheme pay $80 per tonne.

2025 Federal Election

Fight against carbon taxes not over yet

As the federal government removes the consumer carbon tax, the Canadian Taxpayers Federation is calling on all party leaders to oppose all carbon taxes, including the hidden tax on business.

“Canadians fought hard to force Ottawa to back down on its consumer carbon tax and now the fight moves to stopping the hidden carbon tax on business,” said Franco Terrazzano, CTF Federal Director. “Canadians can’t afford a carbon tax on business that pushes up prices at the gas station and makes it harder for our businesses to compete while they’re already struggling with a trade war.”

Today, the federal government cut the consumer carbon tax rate to $0. This will reduce taxes by about 17 cents per litre of gasoline, 21 cents per litre of diesel and 15 cents per cubic metre of natural gas.

The federal government still imposes an industrial carbon tax on oil and gas, steel and fertilizer businesses, among others.

During the Liberal Party leadership race, Prime Minister Mark Carney said he would “improve and tighten” the industrial carbon tax and “extend the framework to 2035.”

Just 12 per cent of Canadians believe businesses pay most of the cost of the industrial carbon tax, according to a Leger poll commissioned by the CTF. Meanwhile, 70 per cent said businesses would pass most or some carbon tax costs on to consumers.

Conservative Party Leader Pierre Poilievre said he will “repeal the entire carbon tax law, including the tax on Canadian businesses and industries.”

“Carbon taxes on refineries make gas more expensive, carbon taxes on utilities make home heating more expensive and carbon taxes on fertilizer plants increase costs for farmers and that makes groceries more expensive,” Terrazzano said. “Canadians know Poilievre will end all carbon taxes and Canadians know Carney’s carbon tax costs won’t be zero.

“Carney owes Canadians a clear answer: How much will your carbon tax cost?”

-

2025 Federal Election2 days ago

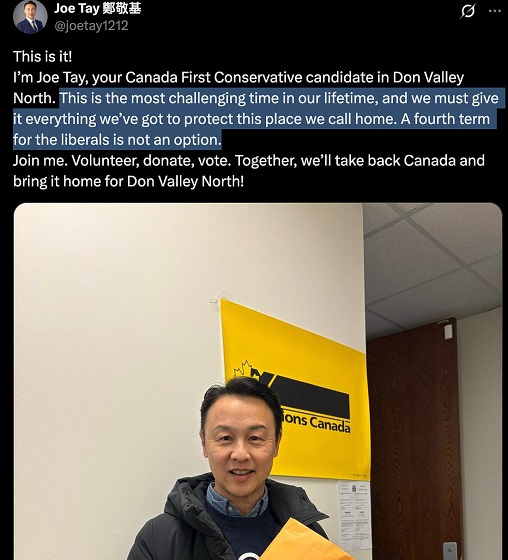

2025 Federal Election2 days agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAlcohol tax and MP pay hike tomorrow (April 1)

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFixing Canada’s immigration system should be next government’s top priority

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre, Conservatives receive election endorsement from large Canadian trade union

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoAre the Jays Signing Or Declining? Only Vladdy & Bo Know For Sure