Business

Trudeau’s environment department admits carbon tax has only reduced emissions by 1%

From LifeSiteNews

The Trudeau Liberals had first seemed to claim that the unpopular carbon tax had cut emissions by 33%, only to explain that the figure is merely a projection for 2030 and the actual reduction thus far stands at 1%.

The Liberal government has admitted that the carbon tax has only reduced greenhouse gas emissions by 1 percent following claims that the unpopular surcharge had cut emissions by 33 percent.

During a May 21 House of Commons environment committee meeting, Environment Minister Steven Guilbeault testified that the carbon tax cut greenhouse gas emissions by 33 percent, before his department backtracked to explain that the figure is a projection for the year 2030, and that the true figure sits at a mere 1 percent.

“I will be the first one to recognize it is complex,” said Guilbeault, according to information obtained by Blacklock’s Reporter.

“If you want simple answers, I am sorry. There is no simple answer when it comes to climate change or modeling,” he said, adding, “Carbon pricing works. This has never been clearer.”

“Carbon pricing alone accounts for around a third of emission reductions expected in Canada,” said Guilbeault, explaining this number was based on “complex statistical calculations.”

However, Conservative Members of Parliament (MPs) pointed out that the numbers provided by Guilbeault’s department do not add up to a 33 percent decrease in emissions, as the department had characterized.

“How many megatonnes of emissions have been directly reduced from your carbon tax since it was introduced?” Conservative MP Dan Mazier questioned.

According to Guilbeault, after the introduction of the carbon tax, emissions reduced by five megatonnes in 2018, fourteen megatonnes in 2019, seventeen megatonnes in 2020, eighteen megatonnes in 2021, and nineteen megatonnes in 2022.

However, the total tonnes of emissions reduced by the carbon tax comes to 73 million tonnes, or 2 percent, of the combined 3,597 million tonnes of emissions over the same five-year period, according to National Inventory Reports.

According to Blacklock’s, Guilbeault failed to explain how the environment department calculated a 33 percent benefit.

Conservative MP Michael Kram pressed Guilbeault, saying, “I want to make sure I have the math correct.”

“In 2022 emissions were at 708 megatonnes and the carbon tax was responsible for reducing 19 megatonnes,” he continued. “By my math that works out to a three percent reduction.”

Associate deputy environment minister Lawrence Hanson explained that the department’s 33 percent emissions cut is a projection of the emissions cut by 2030, not a current statistic.

“It’s the distinction between how much the carbon price might have affected emissions in one year versus how much in 2030,” said Hanson. “So when you heard us talking about its responsible for one third of reductions we were talking about the 2030 number.”

This explanation was echoed by Derek Hermanutz, director general of the department’s economic analysis directorate, who said, “When we talk about one third, it’s one third of our expected reductions. That’s getting to 2030.”

“Yes, but three percent of the total emissions have been reduced as a result of carbon pricing?” Kram pressed.

“No, emissions have declined three percent in total,” assistant deputy minister John Moffet responded.

“And so only one percent of that three percent is from the carbon tax?” Kram asked.

“To date,” Moffet replied.

Prime Minister Justin Trudeau’s carbon tax, framed as a way to reduce carbon emissions, has cost Canadian households hundreds of dollars annually despite rebates.

The increased costs are only expected to rise. A recent report revealed that a carbon tax of more than $350 per tonne is needed to reach Trudeau’s net-zero goals by 2050.

Currently, Canadians living in provinces under the federal carbon pricing scheme pay $80 per tonne, but the Trudeau government has a goal of $170 per tonne by 2030.

On April 1, Trudeau increased the carbon tax by 23 percent despite seven out of 10 provincial premiers and 70 percent of Canadians pleading with him to halt his plan.

Despite appeals from politicians and Canadians alike, Trudeau remains determined to increase the carbon tax regardless of its effects on citizens’ lives.

The Trudeau government’s current environmental goals – which are in lockstep with the United Nations’ 2030 Agenda for Sustainable Development – include phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum, the globalist group behind the socialist “Great Reset” agenda in which Trudeau and some of his cabinet are involved.

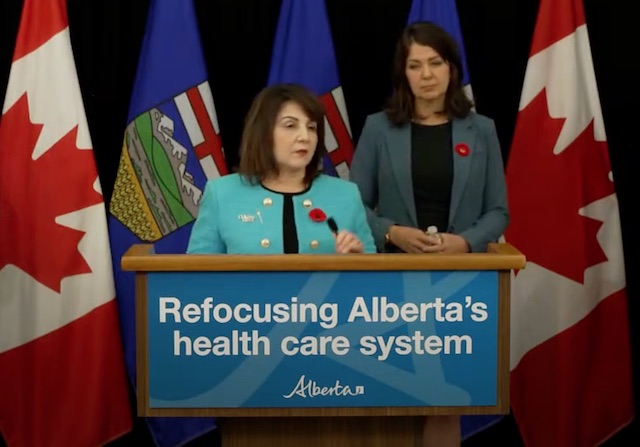

Alberta

Alberta fiscal update: second quarter is outstanding, challenges ahead

Alberta maintains a balanced budget while ensuring pressures from population growth are being addressed.

Alberta faces rising risks, including ongoing resource volatility, geopolitical instability and rising pressures at home. With more than 450,000 people moving to Alberta in the last three years, the province has allocated hundreds of millions of dollars to address these pressures and ensure Albertans continue to be supported. Alberta’s government is determined to make every dollar go further with targeted and responsible spending on the priorities of Albertans.

The province is forecasting a $4.6 billion surplus at the end of 2024-25, up from the $2.9 billion first quarter forecast and $355 million from budget, due mainly to higher revenue from personal income taxes and non-renewable resources.

Given the current significant uncertainty in global geopolitics and energy markets, Alberta’s government must continue to make prudent choices to meet its responsibilities, including ongoing bargaining for thousands of public sector workers, fast-tracking school construction, cutting personal income taxes and ensuring Alberta’s surging population has access to high-quality health care, education and other public services.

“These are challenging times, but I believe Alberta is up to the challenge. By being intentional with every dollar, we can boost our prosperity and quality of life now and in the future.”

Midway through 2024-25, the province has stepped up to boost support to Albertans this fiscal year through key investments, including:

- $716 million to Health for physician compensation incentives and to help Alberta Health Services provide services to a growing and aging population.

- $125 million to address enrollment growth pressures in Alberta schools.

- $847 million for disaster and emergency assistance, including:

- $647 million to fight the Jasper wildfires

- $163 million for the Wildfire Disaster Recovery Program

- $5 million to support the municipality of Jasper (half to help with tourism recovery)

- $12 million to match donations to the Canadian Red Cross

- $20 million for emergency evacuation payments to evacuees in communities impacted by wildfires

- $240 million more for Seniors, Community and Social Services to support social support programs.

Looking forward, the province has adjusted its forecast for the price of oil to US$74 per barrel of West Texas Intermediate. It expects to earn more for its crude oil, with a narrowing of the light-heavy differential around US$14 per barrel, higher demand for heavier crude grades and a growing export capacity through the Trans Mountain pipeline. Despite these changes, Alberta still risks running a deficit in the coming fiscal year should oil prices continue to drop below $70 per barrel.

After a 4.4 per cent surge in the 2024 census year, Alberta’s population growth is expected to slow to 2.5 per cent in 2025, lower than the first quarter forecast of 3.2 per cent growth because of reduced immigration and non-permanent residents targets by the federal government.

Revenue

Revenue for 2024-25 is forecast at $77.9 billion, an increase of $4.4 billion from Budget 2024, including:

- $16.6 billion forecast from personal income taxes, up from $15.6 billion at budget.

- $20.3 billion forecast from non-renewable resource revenue, up from $17.3 billion at budget.

Expense

Expense for 2024-25 is forecast at $73.3 billion, an increase of $143 million from Budget 2024.

Surplus cash

After calculations and adjustments, $2.9 billion in surplus cash is forecast.

- $1.4 billion or half will pay debt coming due.

- The other half, or $1.4 billion, will be put into the Alberta Fund, which can be spent on further debt repayment, deposited into the Alberta Heritage Savings Trust Fund and/or spent on one-time initiatives.

Contingency

Of the $2 billion contingency included in Budget 2024, a preliminary allocation of $1.7 billion is forecast.

Alberta Heritage Savings Trust Fund

The Alberta Heritage Savings Trust Fund grew in the second quarter to a market value of $24.3 billion as of Sept. 30, 2024, up from $23.4 billion at the end of the first quarter.

- The fund earned a 3.7 per cent return from July to September with a net investment income of $616 million, up from the 2.1 per cent return during the first quarter.

Debt

Taxpayer-supported debt is forecast at $84 billion as of March 31, 2025, $3.8 billion less than estimated in the budget because the higher surplus has lowered borrowing requirements.

- Debt servicing costs are forecast at $3.2 billion, down $216 million from budget.

Related information

Business

Trump’s government efficiency department plans to cut $500 Billion in unauthorized expenditures, including funding for Planned Parenthood

From LifeSiteNews

Elon Musk and Vivek Ramaswamy shared their plans to ‘take aim’ at ‘500 billion plus’ in federal expenses, including ‘nearly $300 million’ to ‘progressive groups like Planned Parenthood.’

Elon Musk and Vivek Ramaswamy are planning to ax taxpayer funding for Planned Parenthood as part of their forthcoming work for the next Trump administration, they revealed in a Wednesday op-ed in The Wall Street Journal.

The businessmen have been appointed by President Donald Trump to lead a new Department of Government Efficiency (DOGE), which will work from outside the official government structure to cut wasteful government spending and excess regulations, as well as “restructure federal agencies,” as Trump announced last week on Truth Social.

Musk and Ramaswamy shared Wednesday that as part of their work at DOGE to downsize government spending, they will be “taking aim at the $500 billion plus in annual federal expenditures that are unauthorized by Congress or being used in ways that Congress never intended,” thereby “delivering cost savings for taxpayers.”

They specifically called out Planned Parenthood as one institution that will lose taxpayer funding once DOGE kicks into gear. In their op-ed, the duo said the federal expenditures they plan on cutting includes the “nearly $300 million” dedicated “to progressive groups like Planned Parenthood.”

Musk and Ramaswamy also reportedly will take aim at the “$535 million a year to the Corporation for Public Broadcasting and $1.5 billion for grants to international organizations,” according to Catholic Vote, although they have not shared all of the federal spending they plan to cut or reduce.

“With a decisive electoral mandate and a 6-3 conservative majority on the Supreme Court, DOGE has a historic opportunity for structural reductions in the federal government,” the business duo wrote. “We are prepared for the onslaught from entrenched interests in Washington. We expect to prevail.”

Mogul and X owner Musk, who was outspoken before his DOGE appointment about the big problem of waste, noted last week that if the government is not made efficient, the country will go “bankrupt.”

He reposted a clip from a recent talk he gave in which he explained that not only is our defense budget “pretty gigantic” — a trillion dollars —but the interest the U.S. now owes on its debt is higher than this.

“This is not sustainable. That’s why we need the Department of Government Efficiency,” Musk said.

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoThe Most Devastating Report So Far

-

Business2 days ago

Business2 days agoCarbon tax bureaucracy costs taxpayers $800 million

-

ESG1 day ago

ESG1 day agoCan’t afford Rent? Groceries for your kids? Trudeau says suck it up and pay the tax!

-

John Stossel1 day ago

John Stossel1 day agoGreen Energy Needs Minerals, Yet America Blocks New Mines

-

Daily Caller1 day ago

Daily Caller1 day agoLos Angeles Passes ‘Sanctuary City’ Ordinance In Wake Of Trump’s Deportation Plan

-

Alberta1 day ago

Alberta1 day agoProvince considering new Red Deer River reservoir east of Red Deer

-

MAiD2 days ago

MAiD2 days agoOver 40% of people euthanized in Ontario lived in poorest parts of the province: government data

-

Addictions1 day ago

Addictions1 day agoBC Addictions Expert Questions Ties Between Safer Supply Advocates and For-Profit Companies