Automotive

U.S. politics looms large over Trudeau/Ford EV gamble

From the Fraser Institute

Political developments in the U.S. over the past few years have substantially increased the risk of any investment that relies on unrestricted access to the U.S. market

Last week, the Trudeau government and the Ford government announced a new multi-billion dollar taxpayer-funded subsidy for Honda to expand its Alliston, Ontario plant to manufacture electric vehicles (EV) and host a large EV battery plant. Eventually, the direct and indirect subsidies could total $10 billion from the two governments.

The Honda announcement follows earlier deals with Northvolt, Stellantis and Volkswagen to build and operate EV battery and auto assembly plants in Ontario. According to the Parliamentary Budget Officer, these three deals may total $50.7 billion after accounting for the cost of government borrowing to finance the subsidies and foregone corporate tax revenue from tax abatements tied to production.

Clearly, if future taxpayers across the country (not just in Ontario) are to avoid a huge additional tax burden or suffer reductions in government services, a lot needs to go right for Canada’s EV industry.

In particular, there must emerge sufficient market demand for EVs so these “investments” in the EV auto sector will be fully paid for by future tax revenues from corporate and personal income taxes levied on companies and workers in the EV sector. During their joint announcement of the Honda deal, both Prime Minister Trudeau and Premier Ford ignored this elephant in the room while claiming that the Honda deal will mean 240,000 vehicles a year manufactured at the site and 4,200 jobs preserved, while adding another 1,000 jobs.

By way of perspective, in 2023 around 185,000 EV vehicles were sold in Canada—about 11 per cent of all new cars sold in Canada that year. This is considerably less than the target capacity of the Honda complex and the total expected production capacity of Canada’s EV sector once all the various announced subsidized production facilities are in operation. In contrast, 1.2 million EVs were sold in the United States.

The demand for EVs in Canada will likely grow over time, especially given the increased incentive the federal government now has to ensure, through legislation or regulation, that Canadians retire their gas-powered vehicles and replace them with EVs. However, the long-run financial health of Canada’s EV sector requires continued access to the much larger U.S. market. Indeed, Honda’s CEO said his company chose Canada as the site for their first EV assembly plant in part because of Canada’s access to the U.S. market.

But political developments in the U.S. over the past few years have substantially increased the risk of any investment that relies on unrestricted access to the U.S. market. The trade protectionist bent of Donald Trump, the Republican nominee in the upcoming presidential election, is well known and he reportedly plans to impose a broad 10 per cent tariff on all manufactured imports to the U.S. if elected.

While the Canada-U.S.-Mexico Free Trade Agreement ostensibly gives Canadian-based EV producers tariff-free access to the U.S. market, Trump could terminate the treaty or at least insist on major changes in specific Canadian trade policies that he criticized during his first term, including supply management programs for dairy products. The trade agreement is up for trilateral review in 2025, which would allow a new Trump administration to demand political concessions such as increased Canadian spending on defence, in addition to trade concessions.

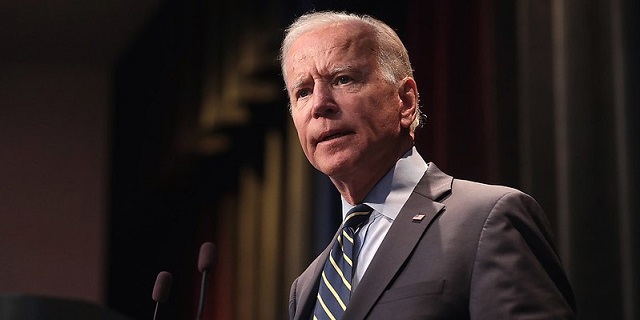

Nor would the re-election of President Joe Biden immunize Canada from protectionist risks. Biden has been a full-throated supporter of unionized U.S. auto workers and has staked his administration’s legacy on the successful electrification of the U.S. transportation sector through domestic production. Given his government’s financial commitment to growing a domestic EV sector, Biden might well impose trade restrictions on Canada if Canadian exports start to displace domestic production in the U.S.

In short, Canadian politicians, most notably Justin Trudeau and Doug Ford, have staked the future of Canada’s heavily subsidized domestic EV sector on the vagaries of the U.S. political process, which is increasingly embracing “America First” industrial policies. This may turn out to be a very costly gamble for Canadian taxpayers.

Author:

Automotive

Canada’s EV gamble is starting to backfire

Things have only gone from bad to worse for the global Electric Vehicle industry. And that’s a problem for Canada, because successive Liberal governments have done everything in their power to hitch our cart to that horse.

Earlier this month, the Trump Administration rolled back more Biden-era regulations that effectively served as a back-door EV mandate in the United States. These rules mandated that all passenger cars be able to travel at least 65.1 miles (and for light trucks, 45.2 miles) per gallon of gasoline or diesel, by the year 2031. Since no Internal Combustion Engine (ICE) vehicle could realistically conform to those standards, that would have essentially boxed them out of the market.

Trump’s rolling them back was a fulfillment of his campaign promise to end the Biden Administration’s stealth EV mandates. But it was also a simple recognition of the reality that EVs can’t compete on their own merits.

For proof of that, look no further than our second bit of bad news for EVs: Ford Motor Company has just announced a massive $19.5 billion write-down, almost entirely linked to its aggressive push into EVs. They’ve lost $13 billion on EVs in the past two years alone.

The company invested tens of billions on these go-carts, and lost their shirt when it turned out the market for them was miniscule.

Ford’s EV division president Andrew Frick explained, “Ford is following the customer. We are looking at the market as it is today, not just as everyone predicted it to be five years ago.”

Of course, five years ago, the market was assuming that government subsidies-plus-mandates would create a market for EVs at scale, which hasn’t happened.

As to what this portends for the market, the Wall Street Journal argued, “The company’s pivot from all-electric vehicles is a fresh sign that America’s roadways – after a push to remake them – will continue to look in the near future much like they do today, with a large number of gas-powered cars and trucks and growing use of hybrids.”

And that’s not just true in the U.S. Across the Atlantic, reports suggest the European Union is preparing to delay their own EV mandates to 2040. And the U.K.’s Labour government is considering postponing their own 2030 ICE vehicle ban to align with any EU change in policy.

It’s looking like fewer people around the world will be forced by their governments to buy EVs. Which means that fewer people will be buying EVs.

Now, that is a headache for Canada. Our leaders, at both the federal and provincial levels, have bet big on the success of EVs, investing billions in taxpayer dollars in the hopes of making Canada a major player in the global EV supply chain.

To bolster those investments, Ottawa introduced its Electric Vehicle mandate, requiring 100 per cent of new light-duty vehicle sales to be electric by 2035. This, despite the fact that EVs remain significantly more expensive than gas-and-diesel driven vehicles, they’re poorly suited to Canada’s vast distances and cold climate, and our charging infrastructure is wholly inadequate for a total transition to EVs.

But even if these things weren’t true, there still aren’t enough of us to make the government’s investment make sense. Their entire strategy depends on exporting to foreign markets that are rapidly cooling on EVs.

Collapsing demand south of the border – where the vast majority of the autos we build are sent – means that Canadian EVs will be left without buyers. And postponed (perhaps eventually canceled) mandates in Europe mean that we will be left without a fallback market.

Canadian industry voices are growing louder in their concern. Meanwhile, plants are already idling, scaling back production, or even closing, leaving workers out in the cold.

As GM Canada’s president, Kristian Aquilina, said when announcing her company’s cancellation of the BrightDrop Electric delivery van, “Quite simply, we just have not seen demand for these vehicles climb to the levels that we initially anticipated…. It’s simply a demand and a market-driven response.”

Prime Minister Mark Carney, while sharing much of the same environmental outlook as his predecessor, has already been compelled by economic realities to make a small adjustment – delaying the enforcement of the 2026 EV sales quotas by one year.

But a one-year pause doesn’t solve the problem. It kicks the can down the road.

Mr. Carney must now make a choice. He can double down on this troubled policy, continuing to throw good money after bad, endangering a lot of jobs in our automotive sector, while making transportation more expensive and less reliable for Canadians. Or he can change course: scrap the mandates, end the subsidies, and start putting people and prosperity ahead of ideology.

Here’s hoping he chooses the latter.

The writing is on the wall. Around the world, the forced transition to EVs is crashing into economic reality. If Canada doesn’t wake up soon, we’ll be left holding the bag.

Automotive

Ford’s EV Fiasco Fallout Hits Hard

From the Daily Caller News Foundation

I’ve written frequently here in recent years about the financial fiasco that has hit Ford Motor Company and other big U.S. carmakers who made the fateful decision to go in whole hog in 2021 to feed at the federal subsidy trough wrought on the U.S. economy by the Joe Biden autopen presidency. It was crony capitalism writ large, federal rent seeking on the grandest scale in U.S. history, and only now are the chickens coming home to roost.

Ford announced on Monday that it will be forced to take $19.5 billion in special charges as its management team embarks on a corporate reorganization in a desperate attempt to unwind the financial carnage caused by its failed strategies and investments in the electric vehicles space since 2022.

Cancelled is the Ford F-150 Lightning, the full-size electric pickup that few could afford and fewer wanted to buy, along with planned introductions of a second pricey pickup and fully electric vans and commercial vehicles. Ford will apparently keep making its costly Mustang Mach-E EV while adjusting the car’s features and price to try to make it more competitive. There will be a shift to making more hybrid models and introducing new lines of cheaper EVs and what the company calls “extended range electric vehicles,” or EREVs, which attach a gas-fueled generator to recharge the EV batteries while the car is being driven.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

“The $50k, $60k, $70k EVs just weren’t selling; We’re following customers to where the market is,” Farley said. “We’re going to build up our whole lineup of hybrids. It’s gonna be better for the company’s profitability, shareholders and a lot of new American jobs. These really expensive $70k electric trucks, as much as I love the product, they didn’t make sense. But an EREV that goes 700 miles on a tank of gas, for 90% of the time is all-electric, that EREV is a better solution for a Lightning than the current all-electric Lightning.”

It all makes sense to Mr. Farley, but one wonders how much longer the company’s investors will tolerate his presence atop the corporate management pyramid if the company’s financial fortunes don’t turn around fast.

To Ford’s and Farley’s credit, the company has, unlike some of its competitors (GM, for example), been quite transparent in publicly revealing the massive losses it has accumulated in its EV projects since 2022. The company has reported its EV enterprise as a separate business unit called Model-E on its financial filings, enabling everyone to witness its somewhat amazing escalating EV-related losses since 2022:

• 2022 – Net loss of $2.2 billion

• 2023 – Net loss of $4.7 billion

• 2024 – Net loss of $5.1 billion

Add in the company’s $3.6 billion in losses recorded across the first three quarters of 2025, and you arrive at a total of $15.6 billion net losses on EV-related projects and processes in less than four calendar years. Add to that the financial carnage detailed in Monday’s announcement and the damage from the company’s financial electric boogaloo escalates to well above $30 billion with Q4 2025’s damage still to be added to the total.

Ford and Farley have benefited from the fact that the company’s lineup of gas-and-diesel powered cars have remained strongly profitable, resulting in overall corporate profits each year despite the huge EV-related losses. It is also fair to point out that all car companies were under heavy pressure from the Biden government to either produce battery electric vehicles or be penalized by onerous federal regulations.

Now, with the Trump administration rescinding Biden’s harsh mandates and canceling the absurdly unattainable fleet mileage requirements, Ford and other companies will be free to make cars Americans actually want to buy. Better late than never, as they say, but the financial fallout from it all is likely just beginning to be made public.

- David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

International2 days ago

International2 days agoOttawa is still dodging the China interference threat

-

Agriculture13 hours ago

Agriculture13 hours agoEnd Supply Management—For the Sake of Canadian Consumers

-

Business2 days ago

Business2 days agoThere’s No Bias at CBC News, You Say? Well, OK…

-

Automotive2 days ago

Automotive2 days agoCanada’s EV gamble is starting to backfire

-

Alberta10 hours ago

Alberta10 hours agoAlberta Next Panel calls to reform how Canada works

-

Digital ID11 hours ago

Digital ID11 hours agoCanadian government launches trial version of digital ID for certain licenses, permits

-

Business8 hours ago

Business8 hours agoThe “Disruptor-in-Chief” places Canada in the crosshairs

-

Artificial Intelligence9 hours ago

Artificial Intelligence9 hours agoUK Police Pilot AI System to Track “Suspicious” Driver Journeys