Economy

Ottawa’s homebuilding plans might discourage much-needed business investment

From the Fraser Institute

In the minds of most Canadians, there’s little connection between housing affordability and productivity growth, a somewhat wonky term used mainly by economists. But in fact, the connection is very real.

To improve affordability, the Trudeau government recently announced various financing programs to encourage more investment in residential housing including $6 billion for the Canada Housing Infrastructure Fund and $15 billion for an apartment construction loan program.

Meanwhile, Carolyn Rogers, senior deputy governor of the Bank of Canada, recently said weak business investment is contributing to Canada’s weak growth in productivity (essentially the value of economic output per hour of work). Therefore, business investment to promote productivity growth and income growth for workers is also an economic priority.

But here’s the problem. There’s only so much financial capital at reasonable interest rates to go around.

Because Canada is a small open economy, it might seem that Canadian investors have unlimited access to offshore financial capital, but this is not true. Foreign lenders and investors incur foreign exchange risk when investing in Canadian-dollar denominated assets, and the risk that Canadian asset values will decline in real value. Suppliers of financial capital expect to receive higher yields on their investments for taking on more risk. Hence, investment in residential housing (which the Trudeau government wants to promote) and investment in business assets (which the Bank of Canada warns is weak) compete against each other for scarce financial capital supplied by both domestic and foreign savers.

For perspective, investment in residential housing as a share of total investment increased from 22.4 per cent in 2000 to 41.3 per cent in 2021. Over the same period, investment in two asset categories critical to improving productivity—information and communications equipment and intellectual property products including computer software—decreased from 30.3 per cent of total domestic investment in 2000 to 22.7 per cent in 2021.

What are the potential solutions?

Of course, more financial capital might be available at existing interest rates for domestic investment in residential housing and productivity-enhancing business assets if investment growth declines in other asset categories such as transportation, roads and hospitals. But these assets also contribute to improved productivity and living standards.

Regulatory and legal pressures on Canadian pension funds to invest more in Canada and less abroad would also free up domestic savings for increased investments in residential housing, machinery and equipment and intellectual property products. But this amounts to an implicit tax on Canadians with domestic pension fund holdings to subsidize other investors.

Alternatively, to increase domestic savings, governments in Canada could increase consumption taxes (e.g. sales taxes) while reducing or even eliminating capital gains taxes, which reduce the after-tax expected returns to investing in businesses, particularly riskier new and emerging domestic companies. (Although according to the recent federal budget, the Trudeau government plans to increase capital gains taxes.)

Or governments could reduce the regulatory burden on private-sector businesses, especially small and medium-sized enterprises, so financial capital and other inputs used to comply with often duplicative or excessive regulation can be used to invest in productivity-enhancing assets. And governments could eliminate restrictions on foreign investment in large parts of the Canadian economy including telecommunications, banking and transportation. By increasing competition, governments can improve productivity.

Eliminating such restrictions would also arguably increase the supply of foreign financial capital flowing into Canada to the extent that large foreign investors would prefer to manage their Canadian assets rather than take portfolio investment positions in Canadian-owned companies.

Canadians would undoubtedly benefit from increases in housing construction (and subsequently, increased affordability) and improved productivity from increased business investment. However, government subsidies to home builders, including the billions recently announced by the Trudeau government, simply move available domestic savings from one set of investments to another. The policy goal should be to increase the availability of risk-taking financial capital so the costs of capital decrease for Canadian investors.

Author:

Business

Taxpayer watchdog calls Trudeau ‘out of touch’ for prioritizing ‘climate change’ while families struggle

From LifeSiteNews

The prime minister told a G20 panel this week that fighting so-called ‘climate change’ should be more important to families than putting food on the table or paying rent.

Canada’s leading taxpayer watchdog blasted Prime Minister Justin Trudeau for being completely “out of touch” with everyday Canadians after the PM earlier this week suggested his climate “change” policies, including a punitive carbon tax, are more important for families than trying to stay financially afloat.

In speaking to LifeSiteNews, Canadian Taxpayers Federation (CTF) federal director Franco Terrazzano said Trudeau’s recent comments show his government “continues to prove it’s out of touch with its carbon tax.”

“Canadians don’t support the carbon tax because we know it makes life more expensive and it doesn’t help the environment,” Terrazzano told LifeSiteNews.

Terrazzano’s comments come after Trudeau told a G20 panel earlier this week that fighting so-called “climate change” should be more important to families than putting food on the table or paying rent.

Speaking to the panel, Trudeau commented that it is “really, really easy” to “put climate change as a slightly lower priority” when one has “to be able to pay the rent this month” or “buy groceries” for their “kids,” but insisted that “we can’t do that around climate change.”

Terrazzano said that the Trudeau government’s carbon tax in reality “impacts nearly all aspects of life in Canada by making it more expensive to fuel up our cars, heat our homes and buy food.”

“The carbon tax also puts a huge hole in our economy that we can’t afford,” he said to LifeSiteNews, adding that if Trudeau really wanted to help Canadians and “prove it understands the struggles facing Canadians,” then it should “scrap the carbon tax to make life more affordable.”

On Thursday, Trudeau, who is facing abysmal polling numbers, announced he would introduce a temporary pause on the federal Goods and Services Tax (GST) for some goods.

Conservative Party of Canada leader Pierre Poilievre this afternoon said about Trudeau’s temporary tax holiday that if he is serious about helping Canadians, he would cut the carbon tax completely.

People’s Party of Canada (CPC) leader Maxime Bernier called the move by Trudeau a cheap trick to try and “bribe” Canadians, noting that it will not work.

“What a ridiculous gimmick. Bribing Canadians temporarily with borrowed money,” Bernier wrote.

“When the real solution is to stop growing the bureaucracy, cut wasteful spending, stop sending billions to Ukraine, eliminate subsidies to businesses and activist groups, stop creating new unsustainable and unconstitutional social programs, eliminate the deficit, and THEN, cut taxes for real. None of which he will do of course.”

As reported by LifeSiteNews, a survey found that nearly half of Canadians are just $200 away from financial ruin as the costs of housing, food and other necessities has gone up massively since Trudeau took power in 2015.

In addition to the increasing domestic carbon tax, LifeSiteNews reported last week that Minister of Environment Steven Guilbeault wants to create a new “global’ carbon tax applied to all goods shipped internationally that could further drive-up prices for families already struggling with inflated costs.

Not only is the carbon tax costing Canadian families hundreds of dollars annually, but Liberals also have admitted that the tax has only reduced greenhouse gas emissions by 1 percent.

Economy

COP 29 leaders demand over a $1 trillion a year in climate reparations from ‘wealthy’ nations. They don’t deserve a nickel.

COP 29 is calling for over $1 trillion in annual climate reparations

- A major theme of COP 29 is that the world should set a “New Collective Quantified Goal” wherein successful nations pay poor nations over $1 trillion a year to 1) make up for climate-related harm and 2) build them new “green energy” economies. In other words, climate reparations.¹

- What would $1 trillion a year in climate reparations mean for you and your family?Assuming the money was paid equally by households considered high income (>$50 per day), your household would have to pay more than $5,000 a year in climate reparations taxes!²

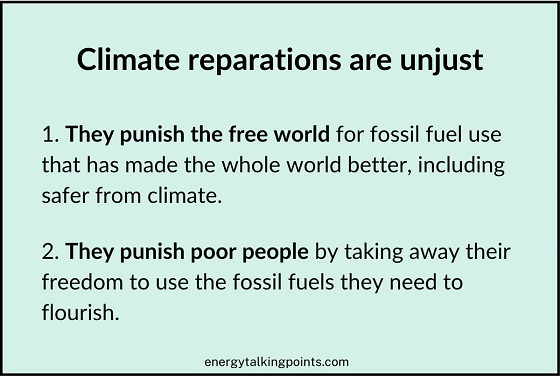

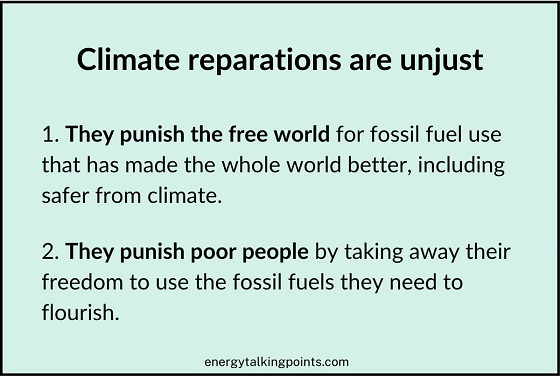

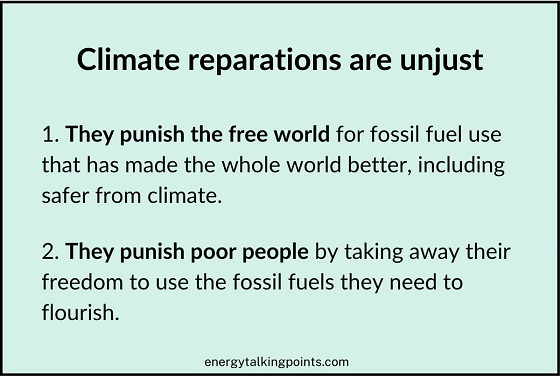

- Climate reparations are based on two false assumptions:1. Free, wealthy countries, through their fossil fuel use, have made the world worse for poor countries.

2. The poor world’s main problem is dealing with climate change, which wealth transfers will help them with.

But free, fossil-fueled countries have made life better for poor countries

- Free, wealthy countries, through their fossil fuel use, have not made the world worse for poor countries—they have made it far, far better.Observe what has happened to global life expectancies and income as fossil fuel use has risen. Life has gotten much better for everyone.³

- The wealthy world’s fossil fuel use has improved life worldwide because by using fossil fuel energy to be incredibly productive, we have 1) made all kinds of goods cheaper and 2) been able to engage in life-saving aid, particularly in the realms of food, medicine, and sanitation.

- Without the historic use of fossil fuels by the wealthy world, there would be no super-productive agriculture to feed 8 billion humans, no satellite-based weather warning systems, etc. Most of the individuals in poor countries would not even be alive today.

Free, fossil-fueled countries have made the poor safer from climate

- The wealthy world’s fossil fuel use has been particularly beneficial in the realm of climate.Over the last 100 years, the death rate from climate-related disasters plummeted by 98% globally.

A big reason is millions of lives saved from drought via fossil-fueled crop transport.⁴

- The “climate reparations” movement ignores the fact that the wealthy world’s fossil fuel use has made life better, including safer from climate, in the poor world.This allows it to pretend that the poor world’s main problem is dealing with rising CO2 levels.

The poor world’s problem is poverty, not rising CO2 levels

- The poor world’s main problem is not rising CO2 levels, it is poverty—which is caused by lack of freedom, including the crucial freedom to use fossil fuels.Poverty makes everything worse, including the world’s massive natural climate danger and any danger from more CO2.

- While it’s not true that the wealthy world has increased climate danger in the poor world—we have reduced it—it is true that the poor world is more endangered by climate than the wealthy world is.The solution is for the poor to get rich. Which requires freedom and fossil fuels.⁵

Escaping poverty requires freedom and fossil fuels

- Every nation that has risen out of poverty has done so via pro-freedom policies—specifically, economic freedom.

That’s how resource-poor places like Singapore and Taiwan became prosperous. Resource-rich places like Congo have struggled due to lack of economic freedom.

- Even China, which is unfree in many ways (including insufficient protections against pollution) dramatically increased its standard of living via economic freedom—particularly in the realm of industrial development where it is now in many ways much freer than the US and Europe.

- A crucial freedom involved in rising prosperity has been the freedom to use fossil fuels.Fossil fuels are a uniquely cost-effective source of energy, providing energy that’s low-cost, reliable, versatile, and scalable to billions of people in thousands of places.⁶

- Time and again nations have increased their prosperity, including their safety from climate, via economic freedom and fossil fuels.Observe the 7X increase in fossil fuel use in China and India over the past 4 decades, which enabled them to industrialize and prosper.⁷

- For the world’s poorest people to be more prosperous and safer from climate, they need more freedom and more fossil fuels.The “climate reparations” movement seeks to deny them both.

- The wealthy world should communicate to the poor world that economic freedom is the path to prosperity, and encourage the poor world to reform its cultural and political institutions to embrace economic freedom—including fossil fuel freedom.Our leaders are doing the opposite.

Climate reparations pay off dictators to take away fossil fuel freedom

- Instead of promoting economic freedom, including fossil fuel freedom, wealthy climate reparations advocates like Antonio Guterres are offering to entrench anti-freedom regimes by paying off their dictators and bureaucrats to eliminate fossil fuel freedom.This is disgusting.⁸

- The biggest victim of “climate reparations” will be the world’s poorest countries, whose dictators will be paid off to prevent the fossil fuel freedom that has allowed not just the US and Europe but also China and India to dramatically increase their prosperity.

- The biggest beneficiary of “climate reparations” will be China, which is already emitting more CO2 than the US and Europe combined. (Though less per capita.)While we flagellate and cripple ourselves, China will use fossil fuels in its quest to become the world’s superpower.⁹

- The second biggest beneficiary of “climate reparations” will be corrupt do-gooders who get to add anti-fossil-fuel strings to “reparations” dollars and dictate how it’s spent—which will surely include lots of dollars for unreliable solar panels and wind turbines made in China.

Leaders must reject reparations and champion fossil fuel freedom

- We need leaders in the US and Europe who proudly:1. Champion the free world’s use of fossil fuels as an enormous good for the world, including its climate safety.

2. Encourage the poor world to embrace economic freedom and fossil fuels.

Tell your Representative to do both.

Popular links

- EnergyTalkingPoints.com: Hundreds of concise, powerful, well-referenced talking points on energy, environmental, and climate issues.

- My new book Fossil Future: Why Global Human Flourishing Requires More Oil, Coal, and Natural Gas—Not Less.

- Speaking and media inquiries

“Energy Talking Points by Alex Epstein” is my free Substack newsletter designed to give as many people as possible access to concise, powerful, well-referenced talking points on the latest energy, environmental, and climate issues from a pro-human, pro-energy perspective.

Share Energy Talking Points by Alex Epstein

1 Scientific American – COP27 Summit Yields ‘Historic Win’ for Climate Reparations but Falls Short on Emissions Reductions

Phys.org – COP29 climate finance deal ‘must cover loss and damage,’ experts urge

COP29 official website – Fund for responding to Loss and Damage ready to accept contributions

2 Global population was about 8.02 billion in 2023.

About 7% of world population are considered high income, which translates into about 562 million individuals. Considering 3 people per average household in high income households, this translates into about 187 million households.

Pew Research – Are you in the global middle class? Find out with our income calculator

$1 trillion per annum paid by 187 million households means the average household would pay about $5,300 per year.

3 Maddison Database 2010 at the Groningen Growth and Development Centre, Faculty of Economics and Business at University of Groningen

4 UC San Diego – The Keeling Curve

For every million people on earth, annual deaths from climate-related causes (extreme temperature, drought, flood, storms, wildfires) declined 98%–from an average of 247 per year during the 1920s to 2.5 in per year during the 2010s.

Data on disaster deaths come from EM-DAT, CRED / UCLouvain, Brussels, Belgium – www.emdat.be (D. Guha-Sapir).

Population estimates for the 1920s from the Maddison Database 2010, the Groningen Growth and Development Centre, Faculty of Economics and Business at University of Groningen. For years not shown, population is assumed to have grown at a steady rate.

Population estimates for the 2010s come from World Bank Data.

5 UC San Diego – The Keeling Curve

Data on disaster deaths come from EM-DAT, CRED / UCLouvain, Brussels, Belgium – www.emdat.be (D. Guha-Sapir).

Population estimates come from World Bank Data.

6 Our World in Data – Energy Production and Consumption

7 BP – Statistical Review of World Energy

8 UN News – ‘Pay up or humanity will pay the price’, Guterres warns at COP29 climate summit

9 Our World in Data – Annual CO₂ emissions from fossil fuels, by world region

-

Brownstone Institute13 hours ago

Brownstone Institute13 hours agoThe Most Devastating Report So Far

-

Economy1 day ago

Economy1 day agoCOP 29 leaders demand over a $1 trillion a year in climate reparations from ‘wealthy’ nations. They don’t deserve a nickel.

-

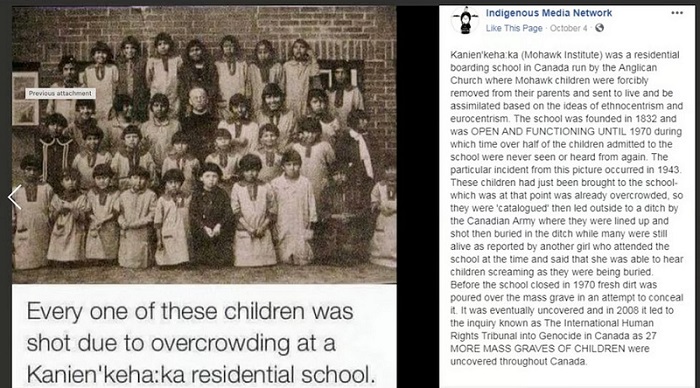

Censorship Industrial Complex17 hours ago

Censorship Industrial Complex17 hours agoAnother Mass Grave?

-

Alberta16 hours ago

Alberta16 hours agoMAiD In Alberta: Province surveying Albertans about assisted suicide policies

-

Alberta23 hours ago

Alberta23 hours agoOn gender, Alberta is following the science

-

Energy1 day ago

Energy1 day agoOttawa’s proposed emission cap lacks any solid scientific or economic rationale

-

International1 hour ago

International1 hour agoElon Musk praises families on X: ‘We should teach fear of childlessness,’ not pregnancy

-

Bruce Dowbiggin12 hours ago

Bruce Dowbiggin12 hours agoCHL Vs NCAA: Finally Some Sanity For Hockey Families