Fraser Institute

Latest federal budget will continue trend of negative outcomes for Canadians

From the Fraser Institute

By Matthew Lau

From the third quarter of 2015 to the fourth quarter of 2023, growth in real GDP per-person (a common indicator of living standards) was less than 1 per cent cumulatively versus more than 15 per cent in the United States. This despite—or more accurately, because of—massive government spending including on corporate subsidies

Reading the federal budget, which the Trudeau government tabled last week, is not an activity likely to improve the equanimity of Canadians suffering from over-taxation and anxious about stagnating living standards. The fact is, the budget sets Canadians even further behind with increased costs and higher taxes, which are sure to reduce productivity and investment further.

In terms of taxes, the main headline is the increase to the capital gains tax to a two-thirds inclusion rate for amounts over $250,000 per year. With Canada’s business investment numbers already dismal, the capital gains tax hike makes things worse by discouraging entrepreneurship and distorting economic decisions to favour present day consumption instead of saving and investment. Indeed, because people know the money they earned today will be taxed more heavily when they invest it tomorrow, the capital gains tax hike reduces incentives to work and earn today.

When it comes to costs, the “total expenses” line in the fiscal tables is most instructive. In last year’s budget, the Trudeau government said it would spend $496.9 billion in 2023-24 and $513.5 billion in 2024-25, rising to $556.9 billion by 2027-28 for a total of $2.6 trillion over five years. But according to this year’s budget, its $505.1 billion for 2023-24, $537.6 billion in 2024-25 and $588.2 billion by 2027-28, for a total of $2.8 trillion over the same five-year period, with both higher program spending and greater borrowing costs contributing to the increase.

In other words, the Trudeau government overspent its budget last year by an estimated $8.2 billion, has increased its spending for this year by $24.1 billion, and will now overspend last year’s fiscal plan by a total of $120.8 billion over five years. And that’s assuming the Liberals stick to the spending plan they just tabled. The Trudeau government has a track record of blowing past its original spending targets, often by astonishing margins, a trend continued in its latest budget. So taxpayers might reasonably expect even the significantly increased costs presented in this latest budget are an understatement.

Canadians might find the exorbitant costs of federal spending easier to accept if they saw some benefits commensurate to the spending, but they have not. From the third quarter of 2015 to the fourth quarter of 2023, growth in real GDP per-person (a common indicator of living standards) was less than 1 per cent cumulatively versus more than 15 per cent in the United States. This despite—or more accurately, because of—massive government spending including on corporate subsidies and other initiatives the government claimed would boost economic growth. Clearly, such growth has not materialized.

The latest budget increased spending for the national child-care program, but the thing has been a disaster from coast to coast, with families unable to find spots, daycare operators in dire straits, and costs to taxpayers ballooning. Similarly, while health-care spending has risen over the years, access to medical care has gone down. Spending and regulation related to climate change have exploded under the Trudeau government, but the environmental benefits of initiatives such as electric vehicle consumer subsidies and plastic bans, if there are any environmental benefits at all, are nowhere near high enough to offset the burden to taxpayers and consumers.

Clearly, the Trudeau government’s ramp-up in spending and increased taxation, as the GDP and investment figures show, have produced severely negative outcomes for eight years. By ramping spending and taxation up yet higher, it will help continue these negative outcomes.

Author:

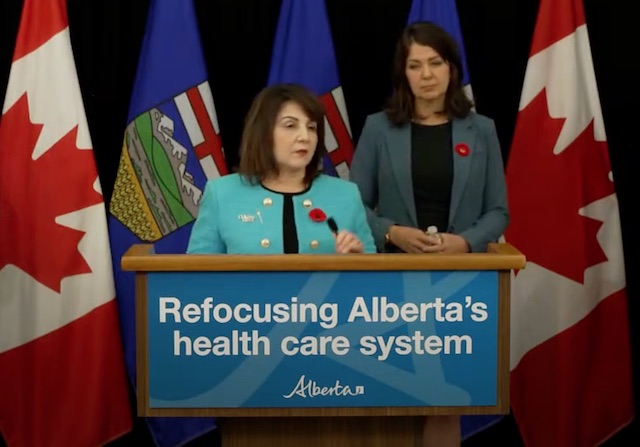

Alberta

Alberta’s fiscal update projects budget surplus, but fiscal fortunes could quickly turn

From the Fraser Institute

By Tegan Hill

According to the recent mid-year update tabled Thursday, the Smith government projects a $4.6 billion surplus in 2024/25, up from the $2.9 billion surplus projected just a few months ago. Despite the good news, Premier Smith must reduce spending to avoid budget deficits.

The fiscal update projects resource revenue of $20.3 billion in 2024/25. Today’s relatively high—but very volatile—resource revenue (including oil and gas royalties) is helping finance today’s spending and maintain a balanced budget. But it will not last forever.

For perspective, in just the last decade the Alberta government’s annual resource revenue has been as low as $2.8 billion (2015/16) and as high as $25.2 billion (2022/23).

And while the resource revenue rollercoaster is currently in Alberta’s favor, Finance Minister Nate Horner acknowledges that “risks are on the rise” as oil prices have dropped considerably and forecasters are projecting downward pressure on prices—all of which impacts resource revenue.

In fact, the government’s own estimates show a $1 change in oil prices results in an estimated $630 million revenue swing. So while the Smith government plans to maintain a surplus in 2024/25, a small change in oil prices could quickly plunge Alberta back into deficit. Premier Smith has warned that her government may fall into a budget deficit this fiscal year.

This should come as no surprise. Alberta’s been on the resource revenue rollercoaster for decades. Successive governments have increased spending during the good times of high resource revenue, but failed to rein in spending when resource revenues fell.

Previous research has shown that, in Alberta, a $1 increase in resource revenue is associated with an estimated 56-cent increase in program spending the following fiscal year (on a per-person, inflation-adjusted basis). However, a decline in resource revenue is not similarly associated with a reduction in program spending. This pattern has led to historically high levels of government spending—and budget deficits—even in more recent years.

Consider this: If this fiscal year the Smith government received an average level of resource revenue (based on levels over the last 10 years), it would receive approximately $13,000 per Albertan. Yet the government plans to spend nearly $15,000 per Albertan this fiscal year (after adjusting for inflation). That’s a huge gap of roughly $2,000—and it means the government is continuing to take big risks with the provincial budget.

Of course, if the government falls back into deficit there are implications for everyday Albertans.

When the government runs a deficit, it accumulates debt, which Albertans must pay to service. In 2024/25, the government’s debt interest payments will cost each Albertan nearly $650. That’s largely because, despite running surpluses over the last few years, Albertans are still paying for debt accumulated during the most recent string of deficits from 2008/09 to 2020/21 (excluding 2014/15), which only ended when the government enjoyed an unexpected windfall in resource revenue in 2021/22.

According to Thursday’s mid-year fiscal update, Alberta’s finances continue to be at risk. To avoid deficits, the Smith government should meaningfully reduce spending so that it’s aligned with more reliable, stable levels of revenue.

Author:

Business

Ottawa’s avalanche of spending hasn’t helped First Nations

From the Fraser Institute

By Tom Flanagan

When Justin Trudeau came to power in 2015, he memorably said that the welfare of Indigenous Canadians was his highest priority. He certainly has delivered on his promise, at least in terms of shovelling out money.

During his 10 years in office, budgeted Indigenous spending has approximately tripled, from about $11 billion to almost $33 billion. Prime Minister Trudeau’s instruction to the Department of Justice to negotiate rather than litigate class actions has resulted in paying tens of billions of dollars to Indigenous claimants over alleged wrongs in education and other social services. And his government has settled specific claims—alleged violations of treaty terms or of the Indian Act—at four times the previous rate, resulting in the award of at least an additional $10 billion to First Nations government.

But has this avalanche of money really helped First Nations people living on reserves, who are the poorest segment of Canadian society?

One indicator suggests the answer is yes. The gap between reserves and other communities—as measured by the Community Well-Being Index (CWB), a composite of income, employment, housing and education—fell from 19 to 16 points from 2016 to 2021. But closer analysis shows that the reduction in the gap, although real, cannot be due to the additional spending described above.

The gain in First Nations CWB is due mainly to an increase in the income component of the CWB. But almost all of the federal spending on First Nations, class-action settlements and specific claims do not provide taxable income to First Nations people. Rather, the increase in income documented by the CWB comes from the greatly increased payments legislated by the Liberals in the form of the Canada Child Benefit (CCB). First Nations people have a higher birth rate than other Canadians, so they have more children and receive more (on average) from the Canada Child Benefit. Also, they have lower income on average than other Canadians, so the value of the CCB is higher than comparable non-Indigenous families. The result? A gain in income relative to other Canadians, and thus a narrowing of the CWB gap between First Nations and other communities.

There’s an important lesson here. Tens of billions in additional budgetary spending and legal settlements did not move the needle. What did lead to a measurable improvement was legislation creating financial benefits for all eligible Canadian families with children regardless of race. Racially inspired policies are terrible for many reasons, especially because they rarely achieve their goals in practise. If we want to improve life for First Nations people, we should increase opportunities for Canadians of all racial backgrounds and not enact racially targeted policies.

Moreover, racial policies are also fraught with unintended consequences. In this case, the flood of federal money has made First Nations more dependent rather than less dependent on government. In fact, from 2018 to 2022, “Own Source Revenue” (business earnings plus property taxes and fees) among First Nations bands increased—but not as much as transfers from government. The result? Greater dependency on government transfers.

This finding is not just a statistical oddity. Previous research has shown that First Nations who are relatively less dependent on government transfers tend to achieve higher living standards (again, as measured by the CWB index). Thus, the increase in dependency presided over by the Trudeau government does not augur well for the future.

One qualification: this finding is not as robust as I would like because the number of band governments filing reports on their finances has drastically declined. Of 630 First Nation governments, only 260 filed audited statements for fiscal 2022. All First Nations are theoretically obliged by the First Nations Financial Transparency Act, 2013, to publish such statements, but the Trudeau government announced there would be no penalties for non-compliance, leading to a precipitous decline in reporting.

This is a shame, because First Nations, as they often insist, are governments, not private organizations. And like other governments, they should make their affairs visible to the public. Also, most of their income comes from Canadian taxpayers. Both band members and other Canadians have a right to know how much money they receive, how it’s being spent and whether it’s achieving its intended goals.

Author:

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoThe Most Devastating Report So Far

-

Business2 days ago

Business2 days agoCarbon tax bureaucracy costs taxpayers $800 million

-

ESG1 day ago

ESG1 day agoCan’t afford Rent? Groceries for your kids? Trudeau says suck it up and pay the tax!

-

John Stossel1 day ago

John Stossel1 day agoGreen Energy Needs Minerals, Yet America Blocks New Mines

-

Daily Caller1 day ago

Daily Caller1 day agoLos Angeles Passes ‘Sanctuary City’ Ordinance In Wake Of Trump’s Deportation Plan

-

Alberta1 day ago

Alberta1 day agoProvince considering new Red Deer River reservoir east of Red Deer

-

Addictions1 day ago

Addictions1 day agoBC Addictions Expert Questions Ties Between Safer Supply Advocates and For-Profit Companies

-

Aristotle Foundation1 day ago

Aristotle Foundation1 day agoToronto cancels history, again: The irony and injustice of renaming Yonge-Dundas Square to Sankofa Square