Business

Elon Musk says X will disobey Brazil court order to censor accounts, calls on judge to be impeached

Elon Musk, Frederic Legrand – COMEO/Shutterstock

From LifeSiteNews

Elon Musk stated that his social media platform will likely be forced to shut down operations in Brazil as a result of non-compliance with the court order, but argued that ‘principles matter more than profit.’

Elon Musk has pushed back on demands made in a Brazilian court order to censor certain accounts and called for the impeachment of a leading Supreme Court judge.

On Saturday, April 6, X (formerly known as Twitter) announced that it “has been forced by court decisions to block certain popular accounts in Brazil” under the threat of daily fines if the company fails to comply.

Shortly after the announcement, X owner Elon Musk said that the company would resist these demands, even if it had to shut down its operations in Brazil.

“We are lifting all restrictions,” the billionaire wrote. “This judge has applied massive fines, threatened to arrest our employees, and cut off access to 𝕏 in Brazil.”

“As a result, we will probably lose all revenue in Brazil and have to shut down our office there. But principles matter more than profit.”

In another post on X, Musk announced that his social media platform would publish the demands made by Supreme Court judge and head of Brazil’s Superior Electoral Court Alexandre de Moraes. Musk also called for de Moraes to be impeached and referred to him as “Brazil’s Darth Vader.”

“Coming shortly, 𝕏 will publish everything demanded by @Alexandre [de Moraes] and how those requests violate Brazilian law. This judge has brazenly and repeatedly betrayed the constitution and people of Brazil. He should resign or be impeached. Shame @Alexandre, shame.”

— Te𝕏asLindsay™ (@TexasLindsay_) April 7, 2024

A few days prior, journalist Michael Shellenberger published the “Twitter Files Brazil,” which showed how the Deep State, led by de Moraes, had interfered in the 2022 presidential election by pressuring social media platforms to ban accounts that supported sitting president Jair Bolsonaro or questioned the electoral systems.

READ: New ‘Twitter Files’ show how Brazil’s deep state interfered in the 2022 presidential election

Shellenberger wrote:

On March 30, 2022, the day after de Moraes took office as president of the TSE, the TSE mandated Twitter to, within a week and under the threat of a daily fine of 50,000 BRL (US$ 10,000), supply data on the monthly trend statistics for the hashtags #VotoImpressoNAO (“PrinteVoteNo”) and #VotoDemocraticoAuditavel (“DemocraticAuditableVote”).

In 2022, the court coerced Twitter into censoring several accounts, including two elected House members, for allegedly spreading “disinformation” under the threat of heavy fines. Twitter initially pushed back on these requests and appealed the orders but ended up complying with some of the requests due to the pressure of the heavy penalties.

Under Musk’s leadership, the social media platform appears to reject the censorship demands made by de Moraes and risk the shutdown of the company in Brazil.

“At any moment, Brazil’s Supreme Court could shut off all access to X/Twitter for the people of Brazil,” Shellenberger wrote on April 7 while reporting from Brazil. “It is not an exaggeration to say that Brazil is on the brink of dictatorship at the hands of a totalitarian Supreme Court Justice named Alexandre de Moraes.”

“President Lula da Silva is participating in the push toward totalitarianism,” he added. “Since taking office, Lula has massively increased government funding of the mainstream news media, most of which are encouraging increased censorship.”

In response to Musk’s announcement to disobey the court order, Brazil’s Attorney General Jorge Messias demanded “urgent regulations” of social media platforms. According to the Financial Times, Messias said, “It is urgent to regulate social networks.”

“We cannot live in a society in which billionaires domiciled abroad have control of social networks and put themselves in a position to violate the rule of law, failing to comply with court orders and threatening our authorities,” he added.

Musk called on users in Brazil to download and use a VPN (virtual private network) to be able to use the social media platform, should the government restrict access to X.

Business

Saskatchewan becomes first Canadian province to fully eliminate carbon tax

From LifeSiteNews

Saskatchewan has become the first Canadian province to free itself entirely of the carbon tax.

On March 27, Saskatchewan Premier Scott Moe announced the removal of the provincial industrial carbon tax beginning April 1, boosting the province’s industry and making Saskatchewan the first carbon tax free province.

Under Moe’s direction, Saskatchewan has dropped the industrial carbon tax which he says will allow Saskatchewan to thrive under a “tariff environment.”

“I would hope that all of the parties running in the federal election would agree with those objectives and allow the provinces to regulate in this area without imposing the federal backstop,” he continued.

The removal of the tax is estimated to save Saskatchewan residents up to 18 cents a liter in gas prices.

The removal of the tax will take place on April 1, the same day the consumer carbon tax will reduce to 0 percent under Prime Minister Mark Carney’s direction. Notably, Carney did not scrap the carbon tax legislation: he just reduced its current rate to zero. This means it could come back at any time.

Furthermore, while Carney has dropped the consumer carbon tax, he has previously revealed that he wishes to implement a corporation carbon tax, the effects of which many argued would trickle down to all Canadians.

The Saskatchewan Association of Rural Municipalities (SARM) celebrated Moe’s move, noting that the carbon tax was especially difficult on farmers.

“I think the carbon tax has been in place for approximately six years now coming up in April and the cost keeps going up every year,” SARM president Bill Huber said.

“It puts our farming community and our business people in rural municipalities at a competitive disadvantage, having to pay this and compete on the world stage,” he continued.

“We’ve got a carbon tax on power — and that’s going to be gone now — and propane and natural gas and we use them more and more every year, with grain drying and different things in our farming operations,” he explained.

“I know most producers that have grain drying systems have three-phase power. If they haven’t got natural gas, they have propane to fire those dryers. And that cost goes on and on at a high level, and it’s made us more noncompetitive on a world stage,” Huber decalred.

The carbon tax is wildly unpopular and blamed for the rising cost of living throughout Canada. Currently, Canadians living in provinces under the federal carbon pricing scheme pay $80 per tonne.

Automotive

Electric cars just another poor climate policy

From the Fraser Institute

The electric car is widely seen as a symbol of a simple, clean solution to climate change. In reality, it’s inefficient, reliant on massive subsidies, and leaves behind a trail of pollution and death that is seldom acknowledged.

We are constantly reminded by climate activists and politicians that electric cars are cleaner, cheaper, and better. Canada and many other countries have promised to prohibit the sale of new gas and diesel cars within a decade. But if electric cars are really so good, why would we need to ban the alternatives?

And why has Canada needed to subsidize each electric car with a minimum $5,000 from the federal government and more from provincial governments to get them bought? Many people are not sold on the idea of an electric car because they worry about having to plan out where and when to recharge. They don’t want to wait for an uncomfortable amount of time while recharging; they don’t want to pay significantly more for the electric car and then see its used-car value decline much faster. For people not privileged to own their own house, recharging is a real challenge. Surveys show that only 15 per cent of Canadians and 11 per cent of Americans want to buy an electric car.

The main environmental selling point of an electric car is that it doesn’t pollute. It is true that its engine doesn’t produce any CO₂ while driving, but it still emits carbon in other ways. Manufacturing the car generates emissions—especially producing the battery which requires a large amount of energy, mostly achieved with coal in China. So even when an electric car is being recharged with clean power in BC, over its lifetime it will emit about one-third of an equivalent gasoline car. When recharged in Alberta, it will emit almost three-quarters.

In some parts of the world, like India, so much of the power comes from coal that electric cars end up emitting more CO₂ than gasoline cars. Across the world, on average, the International Energy Agency estimates that an electric car using the global average mix of power sources over its lifetime will emit nearly half as much CO₂ as a gasoline-driven car, saving about 22 tonnes of CO₂.

But using an electric car to cut emissions is incredibly ineffective. On America’s longest-established carbon trading system, you could buy 22 tonnes of carbon emission cuts for about $660 (US$460). Yet, Ottawa is subsidizing every electric car to the tune of $5,000 or nearly ten times as much, which increases even more if provincial subsidies are included. And since about half of those electrical vehicles would have been bought anyway, it is likely that Canada has spent nearly twenty-times too much cutting CO₂ with electric cars than it could have. To put it differently, Canada could have cut twenty-times more CO₂ for the same amount of money.

Moreover, all these estimates assume that electric cars are driven as far as gasoline cars. They are not. In the US, nine-in-ten households with an electric car actually have one, two or more non-electric cars, with most including an SUV, truck or minivan. Moreover, the electric car is usually driven less than half as much as the other vehicles, which means the CO₂ emission reduction is much smaller. Subsidized electric cars are typically a ‘second’ car for rich people to show off their environmental credentials.

Electric cars are also 320–440 kilograms heavier than equivalent gasoline cars because of their enormous batteries. This means they will wear down roads faster, and cost societies more. They will also cause more air pollution by shredding more particulates from tire and road wear along with their brakes. Now, gasoline cars also pollute through combustion, but electric cars in total pollute more, both from tire and road wear and from forcing more power stations online, often the most polluting ones. The latest meta-study shows that overall electric cars are worse on particulate air pollution. Another study found that in two-thirds of US states, electric cars cause more of the most dangerous particulate air pollution than gasoline-powered cars.

These heavy electric cars are also more dangerous when involved in accidents, because heavy cars more often kill the other party. A study in Nature shows that in total, heavier electric cars will cause so many more deaths that the toll could outweigh the total climate benefits from reduced CO₂ emissions.

Many pundits suggest electric car sales will dominate gasoline cars within a few decades, but the reality is starkly different. A 2023-estimate from the Biden Administration shows that even in 2050, more than two-thirds of all cars globally will still be powered by gas or diesel.

Source: US Energy Information Administration, reference scenario, October 2023

Fossil fuel cars, vast majority is gasoline, also some diesel, all light duty vehicles, the remaining % is mostly LPG.

Electric vehicles will only take over when innovation has made them better and cheaper for real. For now, electric cars run not mostly on electricity but on bad policy and subsidies, costing hundreds of billions of dollars, blocking consumers from choosing the cars they want, and achieving virtually nothing for climate change.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoAlcohol tax and MP pay hike tomorrow (April 1)

-

2025 Federal Election2 days ago

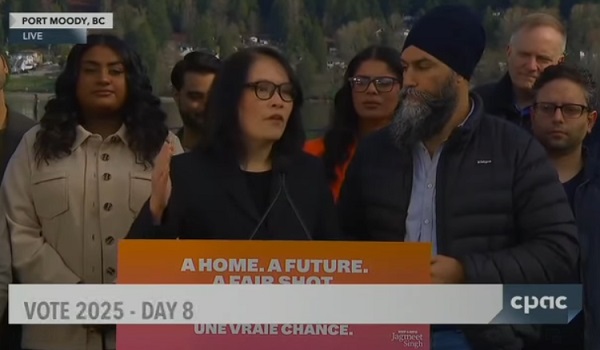

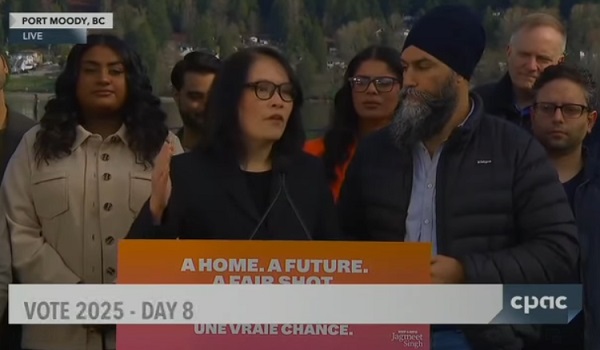

2025 Federal Election2 days agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFixing Canada’s immigration system should be next government’s top priority

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoAre the Jays Signing Or Declining? Only Vladdy & Bo Know For Sure