Economy

Trump Could Bring Back “America First”. What Could Happen to Canada’s Natural Resource Exports?

From EnergyNow.ca

A second Trump presidency likely means more tariffs, and Canada’s energy and forestry sectors will feel the impact.

As the passing of former Prime Minister Brian Mulroney was reported, we thought back to his ratification of the North American Free Trade Agreement (NAFTA) with the United States and Mexico.

The question now is: If Donald Trump becomes the next President of the U.S., what happens to the U.S.-Mexico-Canada Agreement (USMCA) of 2020? The USMCA came after Trump threatened to pull out of NAFTA in 2018.

On Monday, the Supreme Court of the United States recently overturned a ruling from the Colorado Supreme Court that barred Trump from appearing on the ballot during the 2024 presidential election, clearing a major obstacle in his goal of once again winning the presidency in November.

If Trump does win again in November, stand by for round two of the “America First” campaign of his first term.

“After decades of the status quo, President Trump has made it clear that Americans will no longer take back seat to the rest of the world,” said Ken Farnaso, who was a deputy national press secretary during Trump’s ultimately unsuccessful 2020 re-election campaign.

So prepare, for starters, for a 10 percent tariff on imports into the U.S. — and Canada is the second largest source of those imports.

Trump’s promised tariffs would hammer Canadian exports to the U.S. In 2021 (the latest figures we see), those exports were worth $355 billion, including oil ($78.8 billion), automobiles ($26.4 billion), and natural gas ($13.4 billion).

What would Trump do about increased exports of Canadian oil to the U.S. through the Trans Mountain Expansion Project? What about our natural-gas exports, which have helped the U.S. become the world’s biggest exporter of liquefied natural gas (LNG)?

And a Trump presidency would undoubtedly mean more trouble for Canada’s forestry sector. It has long been fighting “entirely unwarranted,” U.S. tariffs on our softwood lumber — and now has been told that America will soon boost the border-crossing charges to 13.86 percent, up from 8.05 percent.

(Under the U.S. Tariff Act, the Department of Commerce determines whether goods are being sold at less than fair value or if they’re benefiting from subsidies provided by foreign governments. U.S. producers insist that provincial stumpage fees are so low as to amount to an unfair subsidy.)

And on foreign affairs, note Trump’s tough promise for China: tariffs of 60 percent or higher on imported Chinese goods. And, he has added, “Maybe it’s going to be more than that.”

This comes after the trade war he triggered during his first term as president when he imposed $250 billion in China tariffs. That disrupted the global economy, hammered consumers, and hit stock markets.

U.S. stock-market watchers have shuddered at this new promise. Nikki Haley, who suspended her campaign for the Republican nomination on Wednesday morning, has said: “What Donald Trump’s about to do, is he’s going to raise every (American) household’s expenses by $2,600 a year.”

Trump has said nothing about current U.S.-Canada relations, but has in the past declared:

- “We lose with Canada — big-league. Tremendous, tremendous trade deficits with Canada.”

- “Canada has been very difficult to deal with. . . . They’re very spoiled.”

-

“Canada, what they’ve done to our dairy farm workers, it’s a disgrace.”

Roland Paris, a Canada-based associate fellow of the U.S. and the Americas Program writes:

“ Canada is not the only country bracing for Donald Trump’s possible return to the White House – but few have more at stake.”

“Three-quarters of Canada’s goods exports, accounting for more than one-quarter of the country’s gross domestic product, go to the U.S. Given Trump’s impulsiveness and deeply protectionist instincts, Canada’s business and political leaders are understandably nervous.”

Prime Minister Justin Trudeau told business leaders in Montreal: “It wasn’t easy the first time, and if there is a second time, it won’t be easy either.”

Indeed. If the second time begins with Trump being elected on November 5, and sworn in on January 20, 2025, it could be a nasty case of “Oh, Canada.”

Business

Saskatchewan becomes first Canadian province to fully eliminate carbon tax

From LifeSiteNews

Saskatchewan has become the first Canadian province to free itself entirely of the carbon tax.

On March 27, Saskatchewan Premier Scott Moe announced the removal of the provincial industrial carbon tax beginning April 1, boosting the province’s industry and making Saskatchewan the first carbon tax free province.

Under Moe’s direction, Saskatchewan has dropped the industrial carbon tax which he says will allow Saskatchewan to thrive under a “tariff environment.”

“I would hope that all of the parties running in the federal election would agree with those objectives and allow the provinces to regulate in this area without imposing the federal backstop,” he continued.

The removal of the tax is estimated to save Saskatchewan residents up to 18 cents a liter in gas prices.

The removal of the tax will take place on April 1, the same day the consumer carbon tax will reduce to 0 percent under Prime Minister Mark Carney’s direction. Notably, Carney did not scrap the carbon tax legislation: he just reduced its current rate to zero. This means it could come back at any time.

Furthermore, while Carney has dropped the consumer carbon tax, he has previously revealed that he wishes to implement a corporation carbon tax, the effects of which many argued would trickle down to all Canadians.

The Saskatchewan Association of Rural Municipalities (SARM) celebrated Moe’s move, noting that the carbon tax was especially difficult on farmers.

“I think the carbon tax has been in place for approximately six years now coming up in April and the cost keeps going up every year,” SARM president Bill Huber said.

“It puts our farming community and our business people in rural municipalities at a competitive disadvantage, having to pay this and compete on the world stage,” he continued.

“We’ve got a carbon tax on power — and that’s going to be gone now — and propane and natural gas and we use them more and more every year, with grain drying and different things in our farming operations,” he explained.

“I know most producers that have grain drying systems have three-phase power. If they haven’t got natural gas, they have propane to fire those dryers. And that cost goes on and on at a high level, and it’s made us more noncompetitive on a world stage,” Huber decalred.

The carbon tax is wildly unpopular and blamed for the rising cost of living throughout Canada. Currently, Canadians living in provinces under the federal carbon pricing scheme pay $80 per tonne.

2025 Federal Election

Fight against carbon taxes not over yet

As the federal government removes the consumer carbon tax, the Canadian Taxpayers Federation is calling on all party leaders to oppose all carbon taxes, including the hidden tax on business.

“Canadians fought hard to force Ottawa to back down on its consumer carbon tax and now the fight moves to stopping the hidden carbon tax on business,” said Franco Terrazzano, CTF Federal Director. “Canadians can’t afford a carbon tax on business that pushes up prices at the gas station and makes it harder for our businesses to compete while they’re already struggling with a trade war.”

Today, the federal government cut the consumer carbon tax rate to $0. This will reduce taxes by about 17 cents per litre of gasoline, 21 cents per litre of diesel and 15 cents per cubic metre of natural gas.

The federal government still imposes an industrial carbon tax on oil and gas, steel and fertilizer businesses, among others.

During the Liberal Party leadership race, Prime Minister Mark Carney said he would “improve and tighten” the industrial carbon tax and “extend the framework to 2035.”

Just 12 per cent of Canadians believe businesses pay most of the cost of the industrial carbon tax, according to a Leger poll commissioned by the CTF. Meanwhile, 70 per cent said businesses would pass most or some carbon tax costs on to consumers.

Conservative Party Leader Pierre Poilievre said he will “repeal the entire carbon tax law, including the tax on Canadian businesses and industries.”

“Carbon taxes on refineries make gas more expensive, carbon taxes on utilities make home heating more expensive and carbon taxes on fertilizer plants increase costs for farmers and that makes groceries more expensive,” Terrazzano said. “Canadians know Poilievre will end all carbon taxes and Canadians know Carney’s carbon tax costs won’t be zero.

“Carney owes Canadians a clear answer: How much will your carbon tax cost?”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAlcohol tax and MP pay hike tomorrow (April 1)

-

2025 Federal Election2 days ago

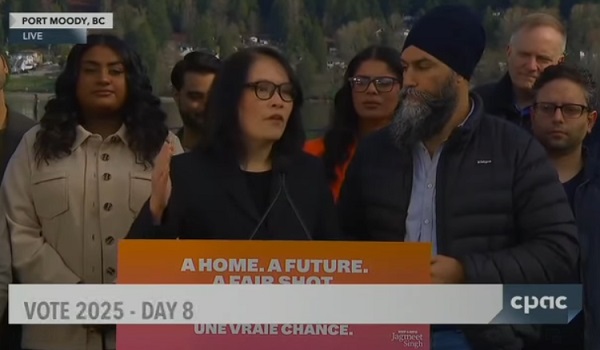

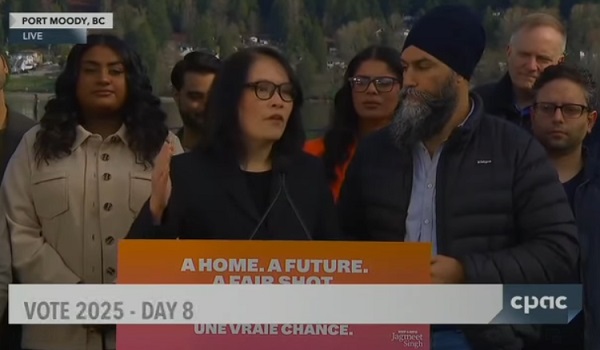

2025 Federal Election2 days agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFixing Canada’s immigration system should be next government’s top priority

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoAre the Jays Signing Or Declining? Only Vladdy & Bo Know For Sure