Canadian Energy Centre

These three Indigenous women are leading the future of Canadian LNG

Crystal Smith, chief councillor of the Haisla Nation, Karen Ogen, CEO of the First Nations LNG Alliance, and Eva Clayton, president of the Nisga’a Nation.

From the Canadian Energy Centre

‘By being owners in these projects, we can meaningfully contribute to a cleaner and more just world’

Three female Indigenous leaders in British Columbia are leading the future of Canadian LNG.

Eva Clayton is president of the Nisga’a Nation, a joint venture partner in the proposed Ksi Lisims LNG project. Karen Ogen, former elected chief of the Wet’suwet’en First Nation, is CEO of the First Nations LNG Alliance. And Crystal Smith is elected chief of the Haisla Nation, majority owner of the proposed Cedar LNG project, which is in the final stages of preparing for the green light to proceed.

“By being owners in these projects, we can meaningfully contribute to a cleaner and more just world,” said Smith, who was first elected chief of the coastal nation in 2017, during the B.C. Natural Resources Forum earlier this year.

“From an Indigenous perspective, we’re continuously taught to take care of our environment, to take care of our land, and to take only what is required. To think in a global context, I truly believe that in supporting the LNG industry, we are in fact doing that.”

Eva Clayton, back left, President of the Nisga’a Lisims Government (joint venture owner of the proposed Ksi Lisims LNG project), Crystal Smith, back right, Haisla Nation Chief Councillor (joint venture owner of proposed Cedar LNG project), and Karen Ogen, front right, CEO of the First Nations LNG Alliance pose for a photograph on the HaiSea Wamis zero-emission tugboat outside the LNG2023 conference, in Vancouver, B.C., Monday, July 10, 2023. CP Images photo

The global liquefied natural gas industry is rising in importance as emerging economies in Asia look to move away from coal-fired power and European nations reduce reliance on Russia

In 2023, LNG demand reached a record 404 million tonnes, according to Shell’s latest industry outlook. Over the next two decades it is expected to rise by nearly 70 per cent, reaching 685 million tonnes by 2040.

Canada’s first LNG export terminal – located on Haisla territory – is nearing completion and preparing for startup next year.

Smith said the nation has seen great benefits from its support of the LNG Canada project, but owning Cedar LNG with partner Pembina Pipeline Corporation takes the opportunity to a new level.

“We have a bigger vision that provides better education, better health care, better justice, and a better future for our people,” she said.

“We can train our people with the skills needed to secure well-paying, family supporting jobs on Cedar LNG and other projects. We can build critical community infrastructure like our new health center and our youth center in Haisla territory.”

Smith said LNG is helping fund programs that reconnect Haisla people with their culture and language, “a language that virtually disappeared with my generation.”

“We are reigniting our potential through culture and language. And that is perhaps the most powerful thing of all. When I think of my daughter speaking Haisla with my grandchildren, that is what drives me each and every day.”

To the north in the Nass Valley, near B.C.’s border with Alaska, Clayton said the Nisga’a Nation is also using its partnerships in LNG to reconnect with language and culture.

The community owns Ksi Lisims along with Rockies LNG (a coalition of Canadian natural gas producers) and Texas-based developer Western LNG.

Construction of the LNG Canada export terminal is now more than 90 per cent complete. Photo courtesy LNG Canada

“The cultural benefits for the Nisga’a Nation will only be more enhanced as we move forward with the project,” said Clayton, who was first elected president of the community in 2016.

“There are ongoing programs that are in place so that our people and our young people will continue to speak the language. What I’ve noticed is that many of our elders that have been teaching this language are aging out. And so now we see a new generation of young people coming up to speak the language and teach language.”

In B.C.’s central interior, the Wet’suwet’en Nation is facing a loss of culture and language, Ogen said. It’s a situation that can be helped with the economic opportunities of LNG.

“We’re at a place in our community since the pandemic where we have maybe one or two fluent speakers left. That’s really not good news,” said Ogen, who served as chief from 2010 to 2016.

“We want to be able to promote our language in our community and continue promoting our culture in our community because we have very few people in my generation that have traditional names.”

Partnering in development projects like the recently completed Coastal GasLink pipeline (which will supply natural gas to the LNG Canada terminal as well as Cedar LNG) helps communities with access to clean drinking water, housing, health, wellness and education, Ogen said.

She helped found the First Nations LNG Alliance in 2015 with the goal to educate communities about the potential benefits of development.

As construction on Coastal GasLink winds down, crews are working to cleanup and reclaim the land. Clay and topsoil removed during construction has been stored on site and will now be used to contour the land to its previous shape to re-establish original drainage patterns. Photo courtesy Coastal GasLink

“I’ve learned a lot in this job. Being a girl from the rez, being a social worker, and then getting into this field, it’s something I didn’t aspire to. But for me, I’m passionate about it because of what it means to our people on the ground,” she said.

Ogen has shared that message internationally, including during a trade mission to China last fall. The smog from burning coal in Beijing heightened her conviction about the benefits of Canadian LNG in Asia, she said.

“We were given a presentation on how China still wants B.C.’s natural resources; they still want our LNG,” Ogen said.

“B.C. and Canada need to hear those loud messages because we’re at an economic opportunity that’ll help us address the greenhouse gas emissions globally.”

Clayton said she has heard the same thing.

“The messaging that I get from the international world is that they need our LNG. The Germans, Japanese, all of them are wondering why they’re not getting gas from their allies. We have a responsibility as Canadians to help the world get off of coal,” she said.

“We are working together for the benefit of our children. These major projects, every decision that we make is for the future of our children, the future of Canada, the world really when you think about the kind of industry we’re getting into, LNG.”

Smith’s Cedar LNG could be the first Indigenous-led project in the world. Pembina Pipeline plans to spend up to $300 million advancing it to a final investment decision by mid-year.

“Every time I hear about it, I literally start shaking and getting goosebumps. I’ll have many sleepless nights from now until that decision is made,” Smith said.

“Our nation has had the ability to benefit from LNG development in our territory, but let’s not let it be the last.

“There are so many other LNG projects with indigenous leadership in B.C. that have the potential to make a significant impact on the future of Indigenous people and also help fight climate change.”

Alberta

The beauty of economic corridors: Inside Alberta’s work to link products with new markets

From the Canadian Energy Centre

Q&A with Devin Dreeshen, Minister of Transport and Economic Corridors

CEC: How have recent developments impacted Alberta’s ability to expand trade routes and access new markets for energy and natural resources?

Dreeshen: With the U.S. trade dispute going on right now, it’s great to see that other provinces and the federal government are taking an interest in our east, west and northern trade routes, something that we in Alberta have been advocating for a long time.

We signed agreements with Saskatchewan and Manitoba to have an economic corridor to stretch across the prairies, as well as a recent agreement with the Northwest Territories to go north. With the leadership of Premier Danielle Smith, she’s been working on a BC, prairie and three northern territories economic corridor agreement with pretty much the entire western and northern block of Canada.

There has been a tremendous amount of work trying to get Alberta products to market and to make sure we can build big projects in Canada again.

CEC: Which infrastructure projects, whether pipeline, rail or port expansions, do you see as the most viable for improving Alberta’s global market access?

Dreeshen: We look at everything. Obviously, pipelines are the safest way to transport oil and gas, but also rail is part of the mix of getting over four million barrels per day to markets around the world.

The beauty of economic corridors is that it’s a swath of land that can have any type of utility in it, whether it be a roadway, railway, pipeline or a utility line. When you have all the environmental permits that are approved in a timely manner, and you have that designated swath of land, it politically de-risks any type of project.

CEC: A key focus of your ministry has been expanding trade corridors, including an agreement with Saskatchewan and Manitoba to explore access to Hudson’s Bay. Is there any interest from industry in developing this corridor further?

Dreeshen: There’s been lots of talk [about] Hudson Bay, a trade corridor with rail and port access. We’ve seen some improvements to go to Churchill, but also an interest in the Nelson River.

We’re starting to see more confidence in the private sector and industry wanting to build these projects. It’s great that governments can get together and work on a common goal to build things here in Canada.

CEC: What is your vision for Alberta’s future as a leader in global trade, and how do economic corridors fit into that strategy?

Dreeshen: Premier Smith has talked about C-69 being repealed by the federal government [and] the reversal of the West Coast tanker ban, which targets Alberta energy going west out of the Pacific.

There’s a lot of work that needs to be done on the federal side. Alberta has been doing a lot of the heavy lifting when it comes to economic corridors.

We’ve asked the federal government if they could develop an economic corridor agency. We want to make sure that the federal government can come to the table, work with provinces [and] work with First Nations across this country to make sure that we can see these projects being built again here in Canada.

Alberta

Alberta’s massive oil and gas reserves keep growing – here’s why

From the Canadian Energy Centre

Q&A with Mike Verney, executive vice-president, McDaniel & Associates

New analysis commissioned by the Alberta Energy Regulator has increased the province’s natural gas reserves by 440 per cent, bumping Canada into the global top 10.

Alberta’s oil reserves – already fourth in the world – also increased by seven billion barrels.

The report was conducted by Calgary-based consultancy McDaniel & Associates. Executive vice-president Mike Verney explains what it means.

CEC: What are “reserves” and why do they matter?

Verney: Reserves are commercial quantities of oil and gas to be recovered in the future. They are key indicators of future production potential.

For companies, that’s a way of representing the future value of their operations. And for countries, it’s important to showcase the runway they have in terms of the future of their oil and gas.

Some countries that have exploited a lot of their resource in the past have low reserves remaining. Canada is in a position where we still have a lot of meat on the bone in terms of those remaining quantities.

CEC: How long has it been since Alberta’s oil and gas reserves were comprehensively assessed?

Verney: Our understanding is the last fully comprehensive review was over a decade ago.

CEC: Does improvement in technology and innovation increase reserves?

Verney: Technological advancements and innovation play a crucial role in increasing reserves. New technologies such as advanced drilling techniques (e.g., hydraulic fracturing, horizontal drilling), enhanced seismic imaging and improved extraction methods enable companies to discover and access previously inaccessible reserves.

As these reserves get developed, the evolution of technology helps companies develop them better and better every year.

CEC: Why have Alberta’s natural gas reserves increased?

Verney: Most importantly, hydraulic fracturing has unlocked material volume, and that’s one of the principal reasons why the new gas estimate is so much higher than what it was in the past.

The performance of the wells that are being drilled has also gotten better since the last comprehensive study.

The Montney competes with every American tight oil and gas play, so we’re recognizing the future potential of that with the gas reserves that are being assigned.

In addition, operators continue to expand the footprint of the Alberta Deep Basin.

CEC: Why have Alberta’s oil reserves increased?

Verney: We discovered over two billion barrels of oil reserves associated with multilateral wells, which is a new technology. In a multilateral well, you drill one vertical well to get to the zone and then once you hit the zone you drill multiple legs off of that one vertical spot. It has been a very positive game-changer.

Performance in the oil sands since the last comprehensive update has also gone better than expected. We’ve got 22 thermal oil sands projects that are operating, and in general, expectations in terms of recovery are higher than they were a decade ago.

Oil sands production has grown substantially in the past decade, up 70 per cent, from two million to 3.4 million barrels per day. The growth of several projects has increased confidence in the commercial viability of developing additional lands.

CEC: What are the implications of Alberta’s reserves in terms of the province’s position as a world energy supplier?

Verney: We’re seeing LNG take off in the United States, and we’re seeing lots of demand from data centers. Our estimate is that North America will need at least 30 billion cubic feet per day of more gas supply in the next few years, based on everything that’s been announced. That is a very material number, considering the United States’ total natural gas production is a little over 100 billion cubic feet per day.

In terms of oil, since the shale revolution in 2008 there’s been massive growth from North America, and the rest of the world hasn’t grown oil production. We’re now seeing that the tight plays in the U.S. aren’t infinite and are showing signs of plateauing.

Specifically, when we look at the United States’ largest oil play, the Permian, it has essentially been flat at 5.5 million barrels per day since December 2023. Flat production from the Permian is contrary to the previous decade, where we saw tight oil production grow by half a million barrels per day per year.

Oil demand has gone up by about a million barrels a day per year for the past several decades, and at this point we do expect that to continue, at the very least in the near term.

Given the growing demand for oil and the stagnation in supply growth since the shale revolution, it’s expected that Alberta’s oil sands reserves will become increasingly critical. As global oil demand continues to rise, and with limited growth in production from other sources, oil sands reserves will be relied upon more heavily.

-

2025 Federal Election2 days ago

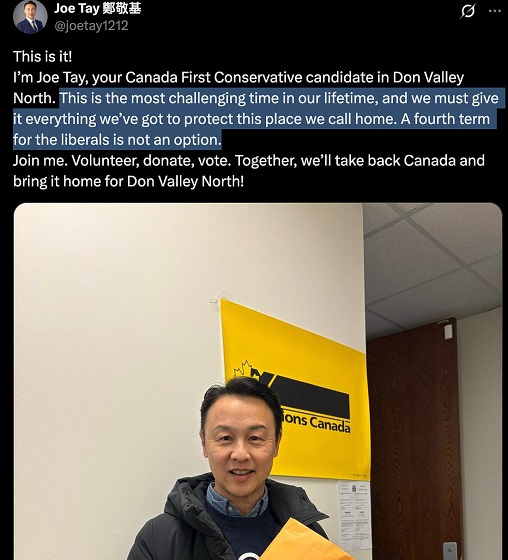

2025 Federal Election2 days agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAlcohol tax and MP pay hike tomorrow (April 1)

-

2025 Federal Election2 days ago

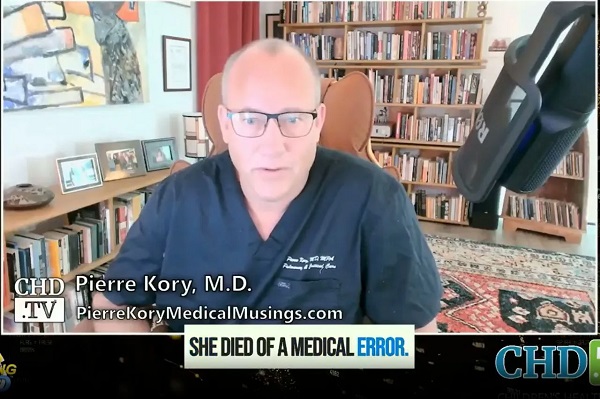

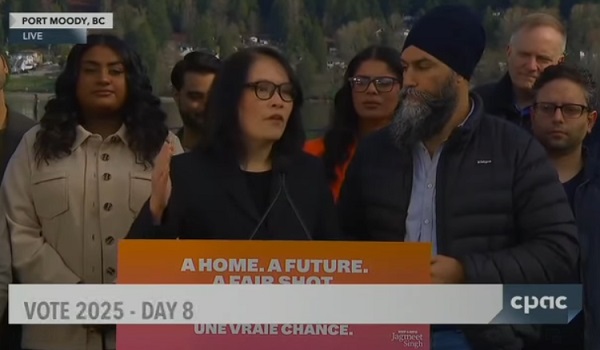

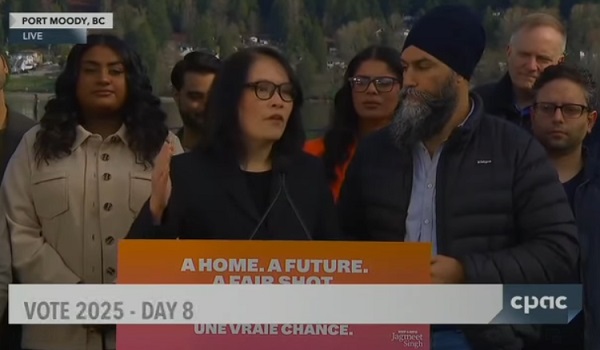

2025 Federal Election2 days agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFixing Canada’s immigration system should be next government’s top priority

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre, Conservatives receive election endorsement from large Canadian trade union