Alberta

New tax bracket among features of Alberta’s 2024 Budget

Budget 2024: A responsible plan for a growing province

Budget 2024 is a responsible plan to strengthen health care and education, build safe communities and manage resources wisely to support a growing Alberta.

With a steady focus on fiscal responsibility and wise spending, Alberta’s government will continue to meet the needs of Albertans today and tomorrow. Budget 2024 presents three more years of balanced budgets, beginning with a forecast surplus of $367 million in 2024-25. Budget 2024 strengthens the vital services Albertans rely on and ensures those services remain sustainable over the long run.

“Alberta is growing. Budget 2024 is a plan that manages the pressures faced by a growing province today while securing the future for generations who follow. I’m proud of the choices we made in this budget that support Albertans’ top priorities and prepare our province to meet the challenges that lie ahead. Budget 2024 invests today and saves for tomorrow so we can continue to be the nation’s economic engine.”

Budget 2024 is a responsible plan that puts Albertans and Alberta families first by investing in their health, education, safety, and economic growth and success. Priority investments include:

- Health and mental health supports: $26.2 billion in operating dollars, a 4.4 per cent increase over the forecast for 2023-24.

- Education supports: $9.3 billion in operating expenses, a 4.4 per cent increase from last year, to support record enrolment growth, hire hundreds more education staff including teachers and educational assistants, and support students with specialized needs.

- Social supports: $2.9 billion in 2024-25 to Albertans through the Assured Income for the Severely Handicapped program, the Alberta Seniors Benefit and other social support programs, plus $355 million for Alberta Child and Family Benefit payments to help low-income families, indexing payments to inflation and providing for more eligible clients.

- Workforce supports: An increase of $102 million over three years to add 3,200 apprenticeship classroom seats in high-demand areas and support curriculum updates to the apprenticeship program, as well as $62.4 million over three years to expand physician education, including through rural health training centres.

- Public safety supports: $1.2 billion in 2024-25 operating expense for Public Safety and Emergency Services to support police and mental health crisis teams, deploy street-level police officers to tackle crime in Calgary and Edmonton, and provide $74 million to the Alberta Emergency Management Agency.

- Wildfire supports: $151 million operating expense over the next three years for enhancements to the Wildfire Management Program and $55 million in capital investment for new firefighting equipment and facilities.

- The fiscal framework provides the flexibility the government needs to respond quickly to disasters and emergencies as they arise, including a $2-billion contingency.

- Water management and drought preparedness supports: $1.3 billion in capital funding over the next three years, including $251 million to better prepare the province for floods and droughts; $272 million for irrigation projects; and $539 million to support municipal water supply and wastewater infrastructure.

- Budget 2024 also provides additional operating support of $19 million over three years for the Strategy to Increase Water Availability and $9 million for water management initiatives.

- Capital supports: In total, $25 billion over three years in capital funding to build schools, hospitals, roads and other infrastructure, supporting 24,000 direct jobs and 13,000 indirect jobs across the province.

Alberta is well-positioned to remain the economic engine of Canada, with real gross domestic product forecast to grow 2.9 per cent in 2024, but the province continues to face challenges. While Alberta’s growing population is supporting economic activity and helping to ease labour shortages, it is also increasing demand for housing, health care, education and other public services. Ongoing geopolitical turmoil, uncertainty from federal government policies and high consumer prices risk dampening growth. Budget 2024 prepares Alberta to face those headwinds, with its responsible plan that invests in Albertans today and builds prosperity for tomorrow.

The fiscal framework introduced in spring 2023 requires the government to use at least half of any available surplus cash to pay down debt, freeing up more money to support Albertans. Taxpayer-supported debt will be reduced by a forecast $3.2 billion in the 2023-24 fiscal year. With the government’s commitment to paying down debt, the total taxpayer-supported debt will be $78.4 billion at the end of 2024-25.

High interest rates and the need to refinance maturing debt are driving up debt-servicing costs (the interest payments and fees on the debt) paid by taxpayers. As a result, debt-servicing costs are growing by $229 million in 2024-25 to $3.4 billion. While high interest rates on refinanced maturing debt are driving up those costs in the short term, the government’s strategic debt repayment plan will save Albertans millions in the long term.

The province is retaining more than $1 billion in investment earnings from 2023-24 in the Alberta Heritage Savings Trust Fund. Alberta’s government will also deposit another $2 billion from the Alberta Fund, increasing the value of the Heritage Savings Trust Fund to a forecast $25 billion. This is a significant investment in the future of Albertans and the province’s main long-term savings fund

Revenue

- In 2024-25, total revenue is estimated to be $73.5 billion, which is $2.1 billion lower than the third-quarter forecast for 2023-24.

- Revenue from personal income taxes is estimated to increase to $15.6 billion in 2024-25, up $365 million from the third-quarter forecast, and grow in the following two years as more people continue to move to Alberta.

- Corporate income tax revenue is estimated at $7 billion in 2024-25, down $176 million from the third-quarter forecast for 2023-24, but rising over the next two years.

- Non-renewable resource revenue is estimated to drop to $17.3 billion in 2024-25, from $19.4 billion forecast for 2023-24, and is forecast to pick up over the medium term.

Expense

- Total expense in 2024-25 is $73.2 billion, a 3.9 per cent increase from the forecast for 2023-24.

- Total expense is expected to be $74.6 billion in 2025-26 and $76.2 billion in 2026-27.

- Total operating expense in 2024-25 is $60.1 billion, a 3.9 per cent increase from the 2023-24 forecast.

- A contingency of $2 billion will help the province respond to disasters and emergencies and other in-year expense pressures, a $500-million increase from 2023-24.

Surplus

- A surplus of $367 million is forecast for 2024-25.

- Surpluses of $1.4 billion and $2.6 billion are forecast for 2024-25 and 2025-26, respectively.

Economic outlook

- In 2024, real gross domestic product is expected to grow by 2.9 per cent, up from the 2.6 per cent forecast at mid-year.

- Strong population growth is expected to continue at 3.7 per cent in the 2024 calendar year, down from 4.1 per cent growth in 2023.

Energy and economic assumptions, 2024-25

- West Texas Intermediate oil (USD/bbl) $74

- Western Canadian Select @ Hardisty (CND/bbl) $76.80

- Light-heavy differential (USD/bbl) $16

- ARP natural gas (CND/GJ) $2.90

- Conventional crude production (000s barrels/day) 507

- Raw bitumen production (000s barrels/day) 3,429

- Canadian dollar exchange rate (USD¢/CDN$) 75.90

- Interest rate (10-year Canada bonds, per cent) 3.70

Related information

Related news

- Budget 2024: Putting Albertans and Alberta families first (Feb 29, 2024)

- Budget 2024: Investing in safe, welcoming communities (Feb 29, 2024)

- Budget 2024: Maintaining Alberta’s economic advantage (Feb 29, 2024)

Alberta

Alberta takes big step towards shorter wait times and higher quality health care

From the Fraser Institute

On Monday, the Smith government announced that beginning next year it will change the way it funds surgeries in Alberta. This is a big step towards unlocking the ability of Alberta’s health-care system to provide more, better and faster services for the same or possibly fewer dollars.

To understand the significance of this change, you must understand the consequences of the current (and outdated) approach.

Currently, the Alberta government pays a lump sum of money to hospitals each year. Consequently, hospitals perceive patients as a drain on their budgets. From the hospital’s perspective, there’s little financial incentive to serve more patients, operate more efficiently and provide superior quality services.

Consider what would happen if your local grocery store received a giant bag of money each year to feed people. The number of items would quickly decline to whatever was most convenient for the store to provide. (Have a favourite cereal? Too bad.) Store hours would become less convenient for customers, alongside a general decline in overall service. This type of grocery store, like an Alberta hospital, is actually financially better off (that is, it saves money) if you go elsewhere.

The Smith government plans to flip this entire system on its head, to the benefit of patients and taxpayers. Instead of handing out bags of money each year to providers, the new system—known as “activity-based funding”—will pay health-care providers for each patient they treat, based on the patient’s particular condition and important factors that may add complexity or cost to their care.

This turns patients from a drain on budgets into a source of additional revenue. The result, as has been demonstrated in other universal health-care systems worldwide, is more services delivered using existing health-care infrastructure, lower wait times, improved quality of care, improved access to medical technologies, and less waste.

In other words, Albertans will receive far better value from their health-care system, which is currently among the most expensive in the world. And relief can’t come soon enough—for example, last year in Alberta the median wait time for orthopedic surgeries including hip and knee replacements was 66.8 weeks.

The naysayers argue this approach will undermine the province’s universal system and hurt patients. But by allowing a spectrum of providers to compete for the delivery of quality care, Alberta will follow the lead of other more successful universal health-care systems in countries such as Australia, Germany, the Netherlands and Switzerland and create greater accountability for hospitals and other health-care providers. Taxpayers will get a much better picture of what they’re paying for and how much they pay.

Again, Alberta is not exploring an untested policy. Almost every other developed country with universal health care uses some form of “activity-based funding” for hospital and surgical care. And remember, we already spend more on health care than our counterparts in nearly all of these countries yet endure longer wait times and poorer access to services generally, in part because of how we pay for surgical care.

While the devil is always in the details, and while it’s still possible for the Alberta government to get this wrong, Monday’s announcement is a big step in the right direction. A funding model that puts patients first will get Albertans more of the high-quality health care they already pay for in a timelier fashion. And provide to other provinces an example of bold health-care reform.

Alberta

Alberta’s embrace of activity-based funding is great news for patients

From the Montreal Economic Institute

From the Montreal Economic Institute

Alberta’s move to fund acute care services through activity-based funding follows best practices internationally, points out an MEI researcher following an announcement made by Premier Danielle Smith earlier today.

“For too long, the way hospitals were funded in Alberta incentivized treating fewer patients, contributing to our long wait times,” explains Krystle Wittevrongel, director of research at the MEI. “International experience has shown that, with the proper funding models in place, health systems become more efficient to the benefit of patients.”

Currently, Alberta’s hospitals are financed under a system called “global budgeting.” This involves allocating a pre-set amount of funding to pay for a specific number of services based on previous years’ budgets.

Under the government’s newly proposed funding system, hospitals receive a fixed payment for each treatment delivered.

An Economic Note published by the MEI last year showed that Quebec’s gradual adoption of activity-based funding led to higher productivity and lower costs in the province’s health system.

Notably, the province observed that the per-procedure cost of MRIs fell by four per cent as the number of procedures performed increased by 22 per cent.

In the radiology and oncology sector, it observed productivity increases of 26 per cent while procedure costs decreased by seven per cent.

“Being able to perform more surgeries, at lower costs, and within shorter timelines is exactly what Alberta’s patients need, and Premier Smith understands that,” continued Mrs. Wittevrongel. “Today’s announcement is a good first step, and we look forward to seeing a successful roll-out once appropriate funding levels per procedure are set.”

The governments expects to roll-out this new funding model for select procedures starting in 2026.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

-

Also Interesting1 day ago

Also Interesting1 day agoMortgage Mayhem: How Rising Interest Rates Are Squeezing Alberta Homeowners

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoConservative Party urges investigation into Carney plan to spend $1 billion on heat pumps

-

Alberta2 days ago

Alberta2 days agoAlberta’s embrace of activity-based funding is great news for patients

-

2025 Federal Election1 day ago

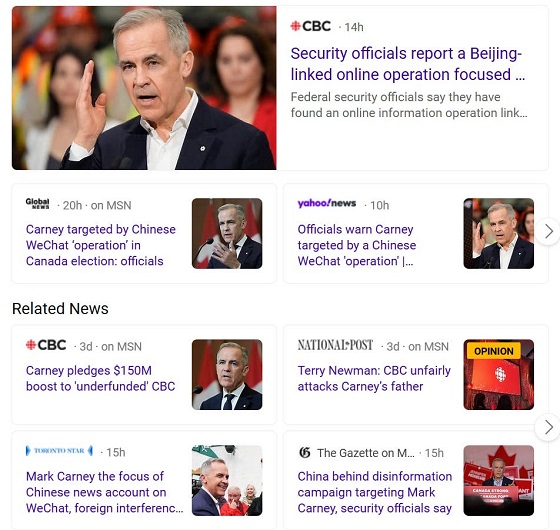

2025 Federal Election1 day agoCommunist China helped boost Mark Carney’s image on social media, election watchdog reports

-

COVID-192 days ago

COVID-192 days agoMassive new study links COVID jabs to higher risk of myocarditis, stroke, artery disease

-

Also Interesting1 day ago

Also Interesting1 day agoExploring Wildrobin Technological Advancements in Live Dealer Games

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCorporate Media Isn’t Reporting on Foreign Interference—It’s Covering for It

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFifty Shades of Mark Carney