Energy

A carbon tax by any other name

From Canadians for Affordable Energy

Written By Dan McTeague

It turns out that the story circulating last week from The Toronto Star that the Liberals were considering a “rebranding” of their Carbon Taxation program was true. On Wednesday the Liberals announced that the previously known “Climate Action Incentive Payment,” will now be referred to as the “Canada Carbon Rebate.” This was done “in an attempt to tackle what it calls confusion and misconceptions about the scheme.”

According to Liberal Minister Seamus O’Regan “If we can speak the language that people speak, because people say the words ‘carbon,’ they say the words, ‘rebate,’ right? And if we can speak that language, that’s important, so people understand what’s going on here.”

The Liberals seem to actually believe that the problem Canadians have with the carbon tax, and their growing support for Pierre Poilievre’s Conservatives to “Axe the Tax,” has simply been a matter of Canadians not “understand[ing] what is going on.”

The implication, of course, is that Canadians aren’t really struggling to pay their bills, feed their families and heat their homes right now. That their lives haven’t gotten more expensive overall as the cost of fuel has risen steadily.

That they’re just confused by poor branding — probably some high-priced marketing firm’s fault, really — and that once Trudeau & Co. find the right words, people will finally be happy to pay the tax, and be grateful to get some of their money back, since doing so will — somehow — save the planet.

Which is ridiculous.

It’s worth pointing out that this isn’t even the first time Trudeau’s carbon tax has been rebranded. You might recall that prior to 2018, the scheme was referred to as “carbon pricing” or simply the “carbon tax.” If you look back at Hansard records — the records of Parliamentary debate — you can see that in October 2018, Liberal MPs began referring to the scheme as a ‘price on pollution.’ Of course, calling carbon dioxide, a gas on which all life on earth depends, “pollution” was an obvious attempt to justify taxing Canadians for it.

But no matter what they call the thing, they are determined not to let it go.

Recent polls have indicated that the carbon tax is losing support from Canadians. A Nanos poll showed nearly half of Canadians think the carbon tax is ineffective; another poll indicates most Canadians want it reduced or killed altogether.

So why are the Liberals clinging so desperately to this tax that Canadians don’t support? Going so far as to rebrand, reframe, recommunicate rather than scrap it?

I might start to sound like a broken record here, but the only way to understand the context of the carbon tax, the second carbon tax (the Clean Fuel Standard,) an emissions cap, electric vehicle mandates and on and on, is to recognize that they are all components of the insane Net-Zero-by-2050 scheme dreamed up by Justin Trudeau and his UN and World Economic Forum cronies.

A carbon tax is simply one of the pillars of their Net Zero Agenda which they contend will enable Canada to achieve this nebulous goal of Net Zero emissions by 2050.

Though apparently to achieve it, the tax will need to get progressively more punishing. On April 1 the carbon tax goes up another $15, to $80 per ton, and will continue to rise yearly until it hits $170 a ton in 2030. Canadians are already feeling the pinch and it is hard to imagine it getting worse. But Liberals aren’t concerned with the struggles of everyday people and that is the reality. This has become a communications issue to them, not an existential one.

As to the new name itself, the Trudeau Liberals love to pay lip service to their rebate scheme and claim that Canadians are getting back more than they pay. But as we well know even the Independent Parliamentary Budget Officer found that, contrary to what their talking point, a substantial majority of households are paying more in carbon taxes than they get back.

Their communications plan too is so unhinged that they are pitching the carbon tax as an affordability measure designed to help struggling Canadians. Of course this begs the question: If Canadians are getting back more than they pay in carbon taxes, why take the money in the first place?

The rubber is hitting the road and Canadians have had enough. No matter what it’s called, the carbon tax has made our lives worse.

That will continue to be true, no matter what they call it.

Dan McTeague is President of Canadians for Affordable Energy

Business

Carney doubles down on NET ZERO

If you only listened to the mainstream media, you would think Justin Trudeau’s carbon tax is long gone. But the Liberal government’s latest budget actually doubled down on the industrial carbon tax.

While the consumer carbon tax may be paused, the industrial carbon tax punishes industry for “emitting” pollution. It’s only a matter of time before companies either pass the cost of the carbon tax to consumers or move to a country without a carbon tax.

Dan McTeague explains how Prime Minister Carney is doubling down on net zero scams.

Artificial Intelligence

AI Faces Energy Problem With Only One Solution, Oil and Gas

From the Daily Caller News Foundation

Which came first, the chicken or the egg? It’s one of the grand conundrums of history, and it is one that is impacting the rapidly expanding AI datacenter industry related to feeding its voracious electricity needs.

Which comes first, the datacenters or the electricity required to make them go? Without the power, nothing works. It must exist first, or the datacenter won’t go. Without the datacenter, the AI tech doesn’t go, either.

Logic would dictate that datacenter developers who plan to source their power needs with proprietary generation would build it first, before the datacenter is completed. But logic is never simple when billions in capital investment is at risk, along with the need to generate profits as quickly as possible.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Building a power plant is a multi-year project, which itself involves heavy capital investment, and few developers have years to wait. The competition with China to win the race to become the global standard setters in the AI realm is happening now, not in 2027, when a new natural gas plant might be ready to go, or in 2035, the soonest you can reasonably hope to have a new nuclear plant in operation.

Some developers still virtue signal about wind and solar, but the industry’s 99.999% uptime requirement renders them impractical for this role. Besides, with the IRA subsidies on their way out, the economics no longer work.

So, if the datacenter is the chicken in this analogy and the electricity is the egg, real-world considerations dictate that, in most cases, the chicken must come first. That currently leaves many datacenter developers little choice but to force their big demand loads onto the local grid, often straining available capacity and causing utility rates to rise for all customers in the process.

This reality created a ready-made political issue that was exploited by Democrats in the recent Virginia and New Jersey elections, as they laid all the blame on their party’s favorite bogeyman, President Donald Trump. Never mind that this dynamic began long before Jan. 20, when Joe Biden’s autopen was still in charge: This isn’t about the pesky details, but about politics.

In New Jersey, Democrat winner Mikie Sherrill exploited the demonization tactic, telling voters she plans to declare a state of emergency on utility costs and freeze consumers’ utility rates upon being sworn into office. What happens after that wasn’t specified, but it made a good siren song to voters struggling to pay their utility bills each month while still making ends meet.

In her Virginia campaign, Democrat gubernatorial winner Abigail Spanberger attracted votes with a promise to force datacenter developers to “pay their own way and their fair share” of the rising costs of electricity in her state. How she would make that happen is anyone’s guess and really didn’t matter: It was the tactic that counted, and big tech makes for almost as good a bogeyman as Trump or oil companies.

For the Big Tech developers, this is one of the reputational prices they must pay for putting the chicken before the egg. On the positive side, though, this reality is creating big opportunity in other states like Texas. There, big oil companies Chevron and ExxonMobil are both in talks with hyperscalers to help meet their electricity needs.

Chevron has plans to build a massive power generation facility that would exploit its own Permian Basin natural gas production to provide as much as 2.5 gigawatts of power to regional datacenters. CEO Mike Wirth says his team expects to make a final investment decision early next year with a target to have the first plant up and running by the end of 2027.

ExxonMobil CEO Darren Woods recently detailed his company’s plans to leverage its expertise in the realm of carbon capture and storage to help developers lower their emissions profiles when sourcing their needs via natural gas generation.

“We secured locations. We’ve got the existing infrastructure, certainly have the know-how in terms of the technology of capturing, transporting and storing [carbon dioxide],” Woods told investors.

It’s an opportunity-rich environment in which companies must strive to find ways to put the eggs before the chickens before ambitious politicians insert themselves into the process. As the recent elections showed, the time remaining to get that done is growing short.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

Crime1 day ago

Crime1 day agoCBSA Bust Uncovers Mexican Cartel Network in Montreal High-Rise, Moving Hundreds Across Canada-U.S. Border

-

Environment1 day ago

Environment1 day agoThe Myths We’re Told About Climate Change | Michael Shellenberger

-

Energy2 days ago

Energy2 days agoIt should not take a crisis for Canada to develop the resources that make people and communities thrive.

-

Dr John Campbell2 days ago

Dr John Campbell2 days agoCures for Cancer? A new study shows incredible results from cheap generic drug Fenbendazole

-

Artificial Intelligence1 day ago

Artificial Intelligence1 day agoAI Faces Energy Problem With Only One Solution, Oil and Gas

-

Health1 day ago

Health1 day agoLack of adequate health care pushing Canadians toward assisted suicide

-

Alberta24 hours ago

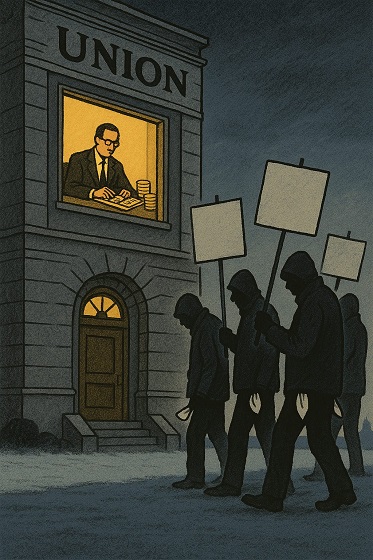

Alberta24 hours agoATA Collect $72 Million in Dues But Couldn’t Pay Striking Teachers a Dime

-

Media23 hours ago

Media23 hours agoBreaking News: the public actually expects journalists to determine the truth of statements they report