Alberta

TDF expresses concern over Election Canada’s new mis/disinformation policy

From The Democracy Fund

Written by TDF’s Legal Team

The Democracy Fund sends a letter to Elections Canada and Minister LeBlanc.

Elections Canada has recently developed a policy to monitor and dissuade the publication of “misinformation” and “disinformation.”

In January 2024, it launched its ElectoFacts website to provide “correct information about elections that Canadians can easily access.” Elections Canada claims that it does not intend to establish Elections Canada as “the arbiter of truth” that will actively monitor the accuracy of statements and information distributed by parties and candidates.

However, The Democracy Fund (TDF) fears that the ambiguous language and the apparent lack of legislative authority to engage in such an endeavour will lead to an expansion of the program. Elections Canada has also contacted social media companies to remove “inaccurate” information: this is troubling because it is arguably an infringement of free speech rights, and there appears to be no judicial oversight of this censorship.

Canadians have the right to criticize their government and its processes – even if this criticism is wrong, inapt, trivial, unfair or unjustified. Efforts by the Western governments to constrain criticism using fashionable terms such as “misinformation” or “disinformation” are just state censorship rebranded for modern audiences.

TDF outlined its concerns in a letter to the Office of the Chief Electoral Officer and the Minister of Public Safety, Democratic Institutions and Intergovernmental Affairs, Dominic LeBlanc.

Our letter is attached below.

February 9, 2024

via email

Stéphane Perrault

Acting Chief Electoral Officer

Office of the Chief Electoral Officer

Elections Canada

30 Victoria Street

Gatineau, Quebec

K1A 0M6

Dear Mr. Perrault,

Re: Elections Canada Misinformation/Disinformation Monitoring

We are a civil society organization and registered charity that defends and promotes civil liberties in Canada. We are writing to express our concerns regarding comments around election “misinformation” and “disinformation” on the Elections Integrity and 1 ElectoFacts website.2

On its Election Integrity website, under “Disinformation or Influence Campaign,” Elections Canada outlines several types of objectionable conduct, namely:

- Elections Canada: Influence campaigns aimed at discrediting parts of the electoral process.

- Political Parties/Candidates: Social media campaign to spread false information about a candidate.

- Electors: Foreign online campaign aimed at specific diaspora communities to influence their vote.

In addition, Elections Canada purports to monitor the “information environment” (the news media, the Web, social media, etc.) to detect:

- Incidents that could affect the smooth administration of a general election or by-election;

- Inaccurate information on the electoral process, which could prevent people from exercising their rights to register, vote or be a candidate; and,

- Social media accounts and websites that impersonate Elections Canada, which could lead to confusion.3

We note that Elections Canada has previously contacted social media companies – including Facebook, Twitter, Google, Snapchat, LinkedIn, Reddit, YouTube, TikTok, and Instagram:

- Elections Canada (EC) engages with digital platforms that have a significant Canadian presence as well as those that have reached out to EC.

- For the 44th general election (GE44), EC worked with Facebook/Instagram, Google/YouTube, Twitter, LinkedIn, Snapchat, and for the first time, TikTok and Reddit, to establish protocols for reporting cases of false information on the voting process and impersonation of EC.4

The purpose of this contact was to report online content to these platforms and, presumably, have them remove “false information.” This was done without prior judicial oversight and review.

There are a number of problems with this approach to monitoring online information.

First, it is not clear that Elections Canada has the legislative authority to report citizens or their online comments, or attempt to influence platforms to remove “false information.” Even if it did, doing so without judicial review and oversight is arguably improper.5 Where there was authority to regulate “false statements” in the Canada Elections Act6 (“the Act”), we note that the court, in Constitution Foundation v. Canada (Attorney General), held that s.91(1) of the Act breached s.2(b) of the Canadian Charter or Rights 7 and Freedoms.8

Importantly, the legality of prohibiting the publication of “false news” has been adjudicated by Canadian courts, and the relevant Criminal Code provisions have been 9 struck down.10

Second, the ability to identify “misinformation” and “disinformation” requires resolution of one of the most difficult problems in epistemology. Simply put, an assessment of the truth of a statement engages the central questions of epistemology: what is meant by the claim that a statement is true, and under what authoritative conditions can one be certain that a statement is true (“the Epistemic Problem”). This Epistemic Problem has bedeviled philosophers for millennia, and remains unresolved. Until such time as it is resolved, claims to epistemic certainty are unfounded.

There is no evidence that Elections Canada has resolved the Epistemic Problem. It cannot, therefore, arrogate to itself the required certainty on matters of truth or falsehood.

Third, we note that the language used by Elections Canada regarding “false information” is ambiguous. Linguistic ambiguity allows for expansive regulatory powers. Further, the language used does not allow for “false information” that is comedic, parodistic or satirical. As a result, removal or attempted removal of “false information” will be overbroad and imprecise.

Fourth, given the concerns outlined above, it is not clear that Elections Canada could implement any process that would be better at ascertaining truth than citizens using normal human discernment.

Consequently, any removal or attempted removal of “false information” will be an exercise in either arbitrary or politically-motivated censorship. This is particularly troubling because the type of “false information” that attracts attention usually relates to contested or controversial political and moral statements, rather than trivial falsehoods.

Worse still, in our experience, punishment for contravening speech laws is typically inflicted upon minority communities, vulnerable groups and political dissidents: those with privilege avoid sanction.

Finally, attempts to remove “false information” will ultimately result in the erosion of civil liberties and democratic engagement. The reduction in exposure to moral and political information – both true and false – prevents citizens from engaging with complex arguments, and, thereby, diminishes their critical-thinking capacity. For, if the information expressed was correct, participants would have gained the benefit of exchanging their wrong information for correct information. If the information expressed

was wrong, participants would have gained the benefit of intellectual justification for their beliefs, without which they possess not knowledge, but dead dogma.11

For these reasons, we would respectfully recommend that Elections Canada restrict its conduct to publishing factual information about elections and the electoral process. It is safer and more practicable for the citizens as Canada to remain the arbiters of truth.

As always, we would be pleased to meet with you to discuss our concerns and any questions you may have about our position.

Regards,

Mark A. Joseph

Senior Litigation Counsel

c.c.: Minister of Public Safety, Democratic Institutions and Intergovernmental Affairs

- Election Integrity and Security Including Foreign Interference

- ElectoFacts

- Supra, note 1.

- Agreements with social media platforms to address inaccurate information

- Little Sisters Book and Art Emporium v. Canada (Minister of Justice), [2000] 2 SCR 1120

- Canada Elections Act, S.C. 2000, c. 9

- Constitution Foundation v. Canada (Attorney General), 2021 ONSC 1224

- Canadian Charter of Rights and Freedoms, s.7, Part 1 of the Constitution Act, 1982, being Schedule B to the Canada Act 1982 (UK), 1982, c 11 a

- Criminal Code, RSC , 1985, c. C-46

- R. v. Zundel, [1992] 2 SCR 731

- Chicago. Mill, John Stuart. 2002. On Liberty. Dover Thrift Editions. Mineola, NY: Dover Publications.

About The Democracy Fund:

Founded in 2021, The Democracy Fund (TDF) is a Canadian charity dedicated to constitutional rights, advancing education and relieving poverty. TDF promotes constitutional rights through litigation and public education. TDF supports an access to justice initiative for Canadians whose civil liberties have been infringed by the government lockdowns and other public policy responses to the pandemic.

Alberta

The beauty of economic corridors: Inside Alberta’s work to link products with new markets

From the Canadian Energy Centre

Q&A with Devin Dreeshen, Minister of Transport and Economic Corridors

CEC: How have recent developments impacted Alberta’s ability to expand trade routes and access new markets for energy and natural resources?

Dreeshen: With the U.S. trade dispute going on right now, it’s great to see that other provinces and the federal government are taking an interest in our east, west and northern trade routes, something that we in Alberta have been advocating for a long time.

We signed agreements with Saskatchewan and Manitoba to have an economic corridor to stretch across the prairies, as well as a recent agreement with the Northwest Territories to go north. With the leadership of Premier Danielle Smith, she’s been working on a BC, prairie and three northern territories economic corridor agreement with pretty much the entire western and northern block of Canada.

There has been a tremendous amount of work trying to get Alberta products to market and to make sure we can build big projects in Canada again.

CEC: Which infrastructure projects, whether pipeline, rail or port expansions, do you see as the most viable for improving Alberta’s global market access?

Dreeshen: We look at everything. Obviously, pipelines are the safest way to transport oil and gas, but also rail is part of the mix of getting over four million barrels per day to markets around the world.

The beauty of economic corridors is that it’s a swath of land that can have any type of utility in it, whether it be a roadway, railway, pipeline or a utility line. When you have all the environmental permits that are approved in a timely manner, and you have that designated swath of land, it politically de-risks any type of project.

CEC: A key focus of your ministry has been expanding trade corridors, including an agreement with Saskatchewan and Manitoba to explore access to Hudson’s Bay. Is there any interest from industry in developing this corridor further?

Dreeshen: There’s been lots of talk [about] Hudson Bay, a trade corridor with rail and port access. We’ve seen some improvements to go to Churchill, but also an interest in the Nelson River.

We’re starting to see more confidence in the private sector and industry wanting to build these projects. It’s great that governments can get together and work on a common goal to build things here in Canada.

CEC: What is your vision for Alberta’s future as a leader in global trade, and how do economic corridors fit into that strategy?

Dreeshen: Premier Smith has talked about C-69 being repealed by the federal government [and] the reversal of the West Coast tanker ban, which targets Alberta energy going west out of the Pacific.

There’s a lot of work that needs to be done on the federal side. Alberta has been doing a lot of the heavy lifting when it comes to economic corridors.

We’ve asked the federal government if they could develop an economic corridor agency. We want to make sure that the federal government can come to the table, work with provinces [and] work with First Nations across this country to make sure that we can see these projects being built again here in Canada.

2025 Federal Election

The High Cost Of Continued Western Canadian Alienation

From EnergyNow.Ca

By Jim Warren

Energy Issues Carney Must Commit to if He Truly Cares About National Cohesion and be Different From Trudeau

If the stars fail to align in the majority of Western Canada’s favour and voters from Central Canada and the Maritimes re-elect a Liberal government on April 28, it will stand as a tragic rejection of the aspirations of the oil producing provinces and a threat to national cohesion.

As of today Mark Carney has not clearly and unequivocally promised to tear down the Liberal policy wall blocking growth in oil and gas exports. Yes, he recently claimed to favour energy corridors, but just two weeks earlier he backtracked on a similar commitment.

There are some promises Carney hopefully won’t honour. He has pledged to impose punitive emissions taxes on Canadian industry. But that’s supposedly alright because Carney has liberally sprinkled that promise with pixie dust. This will magically ensure any associated increases in the cost of living will disappear. Liberal wizardry will similarly vaporize any harm Carbon Tax 2.0 might do to the competitive capacity of Canadian exporters.

Carney has as also promised to impose border taxes on imports from countries that lack the Liberals’ zeal for saving the planet. These are not supposed to raise Canadians’ cost of living by much, but if they do we can take pride in doing our part to save the planet. We can feel good about ourselves while shopping for groceries we can’t afford to buy.

There is ample bad news in what Carney has promised to do. No less disturbing is what he has not agreed to do. Oil and gas sector leaders have been telling Carney what needs to be done, but that doesn’t mean he’s been listening.

The Build Canada Now action plan announced last week by western energy industry leaders lays out a concise five-point plan for growing the oil and gas sector. If Mark Carney wants to convince his more skeptical detractors that he is truly concerned about Canadian prosperity, he should consider getting a tattoo that celebrates the five points.

Yet, if he got onside with the five points and could be trusted, would it not be a step in the right direction? Sure, but it would also be great if unicorns were real.

The purpose of the Build Canada Now action plan couldn’t be much more clearly and concisely stated. “For the oil and natural gas sector to expand and energy infrastructure to be built, Canada’s federal political leaders can create an environment that will:

1. Simplify regulation. The federal government’s Impact Assessment Act and West Coast tanker ban are impeding development and need to be overhauled and simplified. Regulatory processes need to be streamlined, and decisions need to withstand judicial challenges.

2. Commit to firm deadlines for project approvals. The federal government needs to reduce regulatory timelines so that major projects are approved within 6 months of application.

3. Grow production. The federal government’s unlegislated cap on emissions must be eliminated to allow the sector to reach its full potential.

4. Attract investment. The federal carbon levy on large emitters is not globally cost competitive and should be repealed to allow provincial governments to set more suitable carbon regulations.

5. Incent Indigenous co-investment opportunities. The federal government needs to provide Indigenous loan guarantees at scale so industry may create infrastructure ownership opportunities to increase prosperity for communities and to ensure that Indigenous communities benefit from development.”

As they say the devil is often in the details. But it would be an error to complicate the message with too much detail in the context of an election campaign. We want to avoid sacrificing the good on behalf of the perfect. The plan needs to be readily understandable to voters and the media. We live in the age of the ten second sound bite so the plan has to be something that can be communicated succinctly.

Nevertheless, there is much more to be done. If Carney hopes to feel welcome in large sections of the west he needs to back away from many of promises he’s already made. And there are many Liberal policies besides Bill C-69 and C-48 that need to be rescinded or significantly modified.

Liberal imposed limitations on free speech have to go. In a free society publicizing the improvements oil and gas companies are making on behalf of environmental protection should not be a crime.

There is a morass of emissions reduction regulations, mandates, targets and deadlines that need to be rethought and/or rescinded. These include measures like the emissions cap, the clean electricity standard, EV mandates and carbon taxes. Similarly, plans for imposing restrictions on industries besides oil and gas, such as agriculture, need to be dropped. These include mandatory reductions in the use of nitrogen fertilizer and attacks (thus far only rhetorical) on cattle ranching.

A good starting point for addressing these issues would be meaningful federal-provincial negotiations. But that won’t work if the Liberals allow Quebec to veto energy projects that are in the national interest. If Quebec insists on being obstructive, the producing provinces in the west will insist that its equalization welfare be reduced or cancelled.

Virtually all of the Liberal policy measures noted above are inflationary and reduce the profitability and competitive capacity of our exporters. Adding to Canada’s already high cost of living on behalf of overly zealous, unachievable emissions reduction goals is unnecessary as well as socially unacceptable.

We probably all have our own policy change preferences. One of my personal favourites would require the federal government to cease funding environmental organizations that disrupt energy projects with unlawful protests and file frivolous slap suits to block pipelines.

Admittedly, it is a rare thing to have all of one’s policy preferences satisfied in a democracy. And it is wise to stick to a short wish list during a federal election campaign. Putting some of the foregoing issues on the back burner is okay provided we don’t forget them there.

But what if few or any of the oil and gas producing provinces’ demands are accepted by Carney and he still manages to become prime minister?

We are currently confronted by a dangerous level of geopolitical uncertainty. The prospects of a global trade war and its effects on an export-reliant country like Canada are daunting to say the least.

Dividing the country further by once again stifling the legitimate aspirations of the majority of people in Alberta and Saskatchewan will not be helpful. (I could add voters from the northeast and interior of B.C., and southwestern Manitoba to the club of the seriously disgruntled.)

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAlcohol tax and MP pay hike tomorrow (April 1)

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election2 days ago

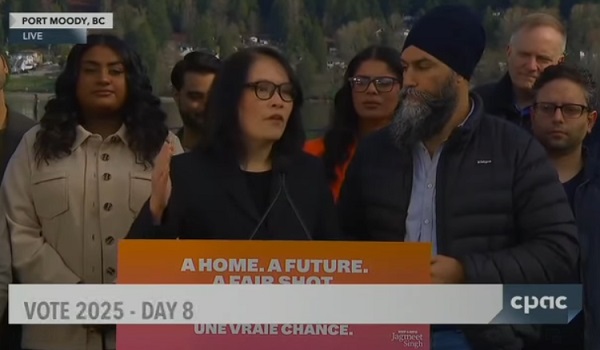

2025 Federal Election2 days agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFixing Canada’s immigration system should be next government’s top priority

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoAre the Jays Signing Or Declining? Only Vladdy & Bo Know For Sure