Fraser Institute

No evidence of ‘mass graves’ or ‘genocide’ in residential schools

From the Fraser Institute

” substantial pushback gradually developed among a group of retired judges, lawyers, professors, journalists and others who have had careers in researching and evaluating evidence. It’s no accident that most are retired, because that gives them some protection against attempts to silence them as “deniers.” “

The following is a summary of the 2023 book Grave Error: How the Media Misled Us (and the Truth About Residential Schools) by C.P. Champion and Tom Flanagan.

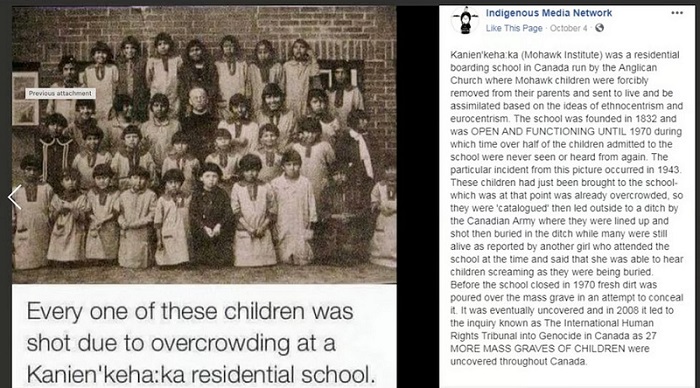

On May 27, 2021, Rosanne Casimir, Chief of the Tk’emlúps te Secwepemc (Kamloops Indian Band), announced that ground-penetrating radar (GPR) had located the remains of 215 “missing children” in an apple orchard on the site of a former residential school.

Politicians and media seized on the announcement, and stories of “mass unmarked graves” and “burials of missing children” ricocheted around Canada and indeed much of the world. Prime Minister Justin Trudeau set the tone of the public response by ordering Canadian flags to be flown at half-mast on all federal buildings to honour the “215 children whose lives were taken at the Kamloops residential school,” thus elevating the possible burials to the status of victims of foul play and making Canada sound like a charnel house of murdered children.

According to Canadian newspaper editors, the discovery of the so-called unmarked graves was the “news story of the year.” And the World Press Photo of the Year award went to a “haunting image of red dresses hung on crosses along a roadside, with a rainbow in the background, commemorating children who died at a residential school created to assimilate Indigenous children in Canada.”

These events created a narrative about the genocidal nature of residential schools, which were established in the 19th and 20th centuries by churches and the government to educate Indigenous children and assimilate them into Canadian society. That narrative went unchallenged at first. Yet substantial pushback gradually developed among a group of retired judges, lawyers, professors, journalists and others who have had careers in researching and evaluating evidence. It’s no accident that most are retired, because that gives them some protection against attempts to silence them as “deniers.” In the words of Janis Joplin, “Freedom’s just another word for nothin’ left to lose.” I published a book, which has been an Amazon Canada bestseller, proving Canadians’ desire for accurate information on this topic.

The book is a collection of some of the best pushback essays published in response to the Kamloops mythology. They analyze and critique the false narrative of unmarked graves, missing children, forced attendance and genocidal conditions at residential schools. The book’s title, Grave Error, summarizes the authors’ view of the Kamloops narrative. It is wrong, and not just wrong, but egregiously wrong. It deserves our sardonic title. And our book shows in detail just why and where the narrative is wrong.

Several of these authors, as well as others who have helped research and edit these publications, had for many years been writing for major metropolitan dailies, national magazines, academic journals, university presses and commercial publishers. However, they quickly learned that the corporate, legacy or mainstream media—in addition to religious leaders and politicians—have little desire to stand up to the narrative flow of a moral panic. They thus wrote about residential schools mainly in specialized journals such as The Dorchester Review, online daily media such as True North and the Western Standard, and online journals such as Unherd and History Reclaimed whose raison d’être is to challenge conventional wisdom.

For example, the first essay—“In Kamloops, Not One Body Has Been Found,” by Montreal historian Jacques Rouillard—has done more than any other single publication to punch holes in the false narrative of unmarked graves and missing children. Other essays punch more holes. Academic provocateur Frances Widdowson shows how the legend of murdered children and unmarked graves was spread by defrocked United Church minister Kevin Annett before it popped up at Kamloops. Retired professor Hymie Rubenstein and collaborators examine the “evidence” of unmarked graves, such as the results of the GPR, and find there’s nothing—repeat, nothing—there. Journalist Jonathan Kay explains how the media got the story completely wrong, generating the worst fake news in Canadian history. Retired professor Ian Gentles examines health conditions in the schools and shows that children were better off there than at home on reserves. My contribution criticizes the prolific but weak body of research purporting to show that attendance at residential schools created a historical trauma that’s responsible for the social pathologies in Indigenous communities. Retired professor Rodney Clifton recounts from personal experience how benign conditions could be in residential schools. And other essays explore other fallacies.

Our book demonstrates that all the major elements of the Kamloops narrative are either false or highly exaggerated. No unmarked graves have been discovered at Kamloops or elsewhere—not one. As of August 2023, there had been 20 announcements of soil “anomalies” discovered by GPR near residential schools across Canada; but most have not even been excavated, so what, if anything, lies beneath the surface remains unknown. Where excavations have taken place, no burials related to residential schools have been found.

In other words, there are no “missing children.” The fate of some children may have been forgotten with the passage of generations—forgotten by their own families, that is. But “forgotten” is not the same as “missing.” The myth of missing students arose from a failure of the Truth and Reconciliation Commission’s researchers to cross-reference the vast number of historical documents about residential schools and the children who attended them. The documentation exists, but the commissioners did not avail themselves of it.

Media stories about Indian residential schools are almost always accompanied by the frightening claim that 150,000 students were “forced to attend” these schools, but that claim is misleading at best. Children were not legally required to attend residential school unless no reserve day school was available; and even then, the law was only sporadically enforced. For students who did attend residential schools, an application form signed by a parent or other guardian was required. The simple truth is that many Indian parents saw residential schools as the best option available for their children.

Prior to 1990, residential schools enjoyed largely favourable media coverage, with many positive testimonials from former students. Indeed, alumni of residential schools comprised most of the emerging First Nations elite. But then Manitoba regional Chief Phil Fontaine appeared on a popular CBC television show hosted by Barbara Frum and claimed he had suffered sexual abuse at a residential school. He did not give details nor specify whether the alleged abusers were missionary priests, lay staff members or other students. Nonetheless, things went south quickly after Fontaine’s appearance, as claims of abuse multiplied and lawyers started to bring them to court.

To avoid clogging the justice system with lawsuits, the Liberal government of Paul Martin negotiated a settlement in 2005, which was accepted shortly afterwards by the Conservative government of Stephen Harper. Ultimately about $5 billion in compensation was paid to about 80,000 claimants, and in 2008 Prime Minister Harper publicly apologized for the existence of residential schools.

Harper might have thought that the payments and his apology would be the end of the story, but instead it became the beginning of a new chapter. The Truth and Reconciliation Commission (TRC) that he appointed took off in its own direction after the initial set of commissioners resigned and were replaced on short notice. The TRC held emotional public hearings around the country where “survivors” told their stories without fact-checking or cross-examination. The TRC concluded in 2015 that the residential schools amounted to “cultural genocide.”

Cultural genocide is a metaphor, an emotive term for assimilation or integration of an ethnic minority into an encompassing society. The next step, in turned out, was to start speaking with increasing boldness of a literal physical genocide involving real deaths. The claims about missing children, unmarked burials and “mass graves” reinforced a genocide scenario.

Perhaps sensing the weakness of their evidence-free position, purveyors of the genocide narrative are beginning to double down, demanding that criticism of their ideology be made illegal. For example, in 2022, Winnipeg NDP MP Leah Gazan, introduced a resolution declaring residential schools to be genocidal—the House of Commons gave unanimous consent.

So, there we are—a narrative about genocide in residential schools firmly established in the public domain while unbelievers are called heretics (“denialists”) and threatened with criminal prosecution. But don’t believe the hype, no matter how often the propositions are repeated. As the little boy said in Hans Christian Andersen’s fairytale, “The Emperor has no clothes.”

Author: Tom Flanagan

Business

Broken ‘equalization’ program bad for all provinces

From the Fraser Institute

By Alex Whalen and Tegan Hill

Back in the summer at a meeting in Halifax, several provincial premiers discussed a lawsuit meant to force the federal government to make changes to Canada’s equalization program. The suit—filed by Newfoundland and Labrador and backed by British Columbia, Saskatchewan and Alberta—effectively argues that the current formula isn’t fair. But while the question of “fairness” can be subjective, its clear the equalization program is broken.

In theory, the program equalizes the ability of provinces to deliver reasonably comparable services at a reasonably comparable level of taxation. Any province’s ability to pay is based on its “fiscal capacity”—that is, its ability to raise revenue.

This year, equalization payments will total a projected $25.3 billion with all provinces except B.C., Alberta and Saskatchewan to receive some money. Whether due to higher incomes, higher employment or other factors, these three provinces have a greater ability to collect government revenue so they will not receive equalization.

However, contrary to the intent of the program, as recently as 2021, equalization program costs increased despite a decline in the fiscal capacity of oil-producing provinces such as Alberta, Saskatchewan, and Newfoundland and Labrador. In other words, the fiscal capacity gap among provinces was shrinking, yet recipient provinces still received a larger equalization payment.

Why? Because a “fixed-growth rule,” introduced by the Harper government in 2009, ensures that payments grow roughly in line with the economy—even if the gap between richer and poorer provinces shrinks. The result? Total equalization payments (before adjusting for inflation) increased by 19 per cent between 2015/16 and 2020/21 despite the gap in fiscal capacities between provinces shrinking during this time.

Moreover, the structure of the equalization program is also causing problems, even for recipient provinces, because it generates strong disincentives to natural resource development and the resulting economic growth because the program “claws back” equalization dollars when provinces raise revenue from natural resource development. Despite some changes to reduce this problem, one study estimated that a recipient province wishing to increase its natural resource revenues by a modest 10 per cent could face up to a 97 per cent claw back in equalization payments.

Put simply, provinces that generally do not receive equalization such as Alberta, B.C. and Saskatchewan have been punished for developing their resources, whereas recipient provinces such as Quebec and in the Maritimes have been rewarded for not developing theirs.

Finally, the current program design also encourages recipient provinces to maintain high personal and business income tax rates. While higher tax rates can reduce the incentive to work, invest and be productive, they also raise the national standard average tax rate, which is used in the equalization allocation formula. Therefore, provinces are incentivized to maintain high and economically damaging tax rates to maximize equalization payments.

Unless premiers push for reforms that will improve economic incentives and contain program costs, all provinces—recipient and non-recipient—will suffer the consequences.

Authors:

Alberta

Alberta’s fiscal update projects budget surplus, but fiscal fortunes could quickly turn

From the Fraser Institute

By Tegan Hill

According to the recent mid-year update tabled Thursday, the Smith government projects a $4.6 billion surplus in 2024/25, up from the $2.9 billion surplus projected just a few months ago. Despite the good news, Premier Smith must reduce spending to avoid budget deficits.

The fiscal update projects resource revenue of $20.3 billion in 2024/25. Today’s relatively high—but very volatile—resource revenue (including oil and gas royalties) is helping finance today’s spending and maintain a balanced budget. But it will not last forever.

For perspective, in just the last decade the Alberta government’s annual resource revenue has been as low as $2.8 billion (2015/16) and as high as $25.2 billion (2022/23).

And while the resource revenue rollercoaster is currently in Alberta’s favor, Finance Minister Nate Horner acknowledges that “risks are on the rise” as oil prices have dropped considerably and forecasters are projecting downward pressure on prices—all of which impacts resource revenue.

In fact, the government’s own estimates show a $1 change in oil prices results in an estimated $630 million revenue swing. So while the Smith government plans to maintain a surplus in 2024/25, a small change in oil prices could quickly plunge Alberta back into deficit. Premier Smith has warned that her government may fall into a budget deficit this fiscal year.

This should come as no surprise. Alberta’s been on the resource revenue rollercoaster for decades. Successive governments have increased spending during the good times of high resource revenue, but failed to rein in spending when resource revenues fell.

Previous research has shown that, in Alberta, a $1 increase in resource revenue is associated with an estimated 56-cent increase in program spending the following fiscal year (on a per-person, inflation-adjusted basis). However, a decline in resource revenue is not similarly associated with a reduction in program spending. This pattern has led to historically high levels of government spending—and budget deficits—even in more recent years.

Consider this: If this fiscal year the Smith government received an average level of resource revenue (based on levels over the last 10 years), it would receive approximately $13,000 per Albertan. Yet the government plans to spend nearly $15,000 per Albertan this fiscal year (after adjusting for inflation). That’s a huge gap of roughly $2,000—and it means the government is continuing to take big risks with the provincial budget.

Of course, if the government falls back into deficit there are implications for everyday Albertans.

When the government runs a deficit, it accumulates debt, which Albertans must pay to service. In 2024/25, the government’s debt interest payments will cost each Albertan nearly $650. That’s largely because, despite running surpluses over the last few years, Albertans are still paying for debt accumulated during the most recent string of deficits from 2008/09 to 2020/21 (excluding 2014/15), which only ended when the government enjoyed an unexpected windfall in resource revenue in 2021/22.

According to Thursday’s mid-year fiscal update, Alberta’s finances continue to be at risk. To avoid deficits, the Smith government should meaningfully reduce spending so that it’s aligned with more reliable, stable levels of revenue.

Author:

-

ESG2 days ago

ESG2 days agoCan’t afford Rent? Groceries for your kids? Trudeau says suck it up and pay the tax!

-

John Stossel2 days ago

John Stossel2 days agoGreen Energy Needs Minerals, Yet America Blocks New Mines

-

Daily Caller2 days ago

Daily Caller2 days agoLos Angeles Passes ‘Sanctuary City’ Ordinance In Wake Of Trump’s Deportation Plan

-

Alberta2 days ago

Alberta2 days agoProvince considering new Red Deer River reservoir east of Red Deer

-

Addictions2 days ago

Addictions2 days agoBC Addictions Expert Questions Ties Between Safer Supply Advocates and For-Profit Companies

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoToronto cancels history, again: The irony and injustice of renaming Yonge-Dundas Square to Sankofa Square

-

conflict1 day ago

conflict1 day agoUS and UK authorize missile strikes into Russia, but are we really in danger of World War III?

-

armed forces1 day ago

armed forces1 day agoJudge dismisses Canadian military personnel’s lawsuit against COVID shot mandate