Alberta

Alberta’s emergency grid alert underscores vital role diverse energy mix plays in Canada

From the Canadian Energy Centre

By Cody Ciona

After a major cold spell affected the capacity of Alberta’s power grid to provide electricity, experts weigh in on the need for multiple sources of energy

The crucial need for Canada to have a flexible and diverse energy grid was given a practical demonstration this past weekend as frigid winter temperatures in Alberta prompted a grid emergency.

With temperatures in some places dropping to almost –50C with the wind chill, provincial officials issued an emergency alert asking Albertans to immediately reduce electricity usage, with the grid approaching maximum capacity during peak hours.

With wind and solar assets unable to contribute power and the unexpected shutdown of two natural gas plants, Albertans faced the possibility of rolling blackouts in dangerously cold conditions.

A day after the emergency, the Alberta Electric System Operator (AESO) thanked Albertans who responded quickly to reduce the demand load.

“This is an example of why we need to ensure that we have sufficient dispatchable, dependable generation available to us as a province to meet what is always our most challenging time, which is those cold, dark winter nights,” Michael Law, CEO of AESO, told the Calgary Herald.

The prospect of failure in the worst possible circumstances prompted energy analysts to highlight the critical need for a diverse and flexible energy grid.

“You could have had 50,000 megawatts, all the solar farms and wind farms in the world located in Alberta, and it still wouldn’t have come anywhere close to closing that gap,” University of Alberta economics professor Andrew Leach told CBC News.

Wind and solar can be major contributors to the grid when conditions allow, but when the sun goes down and the wind stops, base load power sources like natural gas reliably protect the system.

Leach said system operators need to plan for supply to manage adverse weather conditions to ensure the reliability of the grid.

“Whether it’s natural gas, nuclear, import capacity, battery storage, etc., geothermal, there’s nobody that’s arguing against that.”

With policymakers pushing for more electrification, University of Alberta industrial engineering professor Tim Weis said Alberta isn’t alone in the need for resilient and stable power supply.

“I think we need to wrestle with that and realize that we are moving into a world where there’s going to be more electrical demands on the system,” he told Global News.

“We are moving into a new world. We’re not the only ones facing some of these challenges. I think we’re a little bit behind responding in terms of dispatchable demand and allowing consumers the opportunity to automatically respond to some of these things.”

As the federal government aims to decarbonize Canada’s electricity generation by 2035 with sweeping regulations, flexibility for some jurisdictions is a key factor that needs to be addressed, said University of Calgary associate professor of economics Blake Shaffer.

“I do think that this shows us that no amount of renewables would push us to have solved that winter peak on Saturday,” he told CTV Calgary.

“And that means flexibility to have a gas fleet, for example, that is capable of being there for a few hours for a few days, maybe a few weeks a year. And we need the technical and economic setup to make that worth their while to be there,” Shaffer said.

“We saw this cold weather coming, everybody was preparing for it. The wind forecast was out a week ago we saw there was going to be no wind. Thankfully, the gas thermal fleet performed amazingly well.”

Natural gas generation was able to backstop the reduction in renewable power, said ARC Energy Research Institute executive director Jackie Forrest.

“The system delivered during the deep freeze this past weekend… so reliably that no one even noticed… I have long argued that gaseous fuels are needed in the mix for energy transition and the need to become cleaner; this is why,” said Forrest on X, formerly known as Twitter.

According to Forrest’s colleague, energy economist Peter Tertzakian, Alberta’s oil sands industry also plays a big role in power generation in the province with the prominence of natural gas-powered cogeneration facilities.

“The power that’s generated in this province during this cold spell, about 40 per cent of it comes from cogeneration. The bulk of which comes from the oil sands and all their big generators which have surplus electricity that they feed into the grid,” said Tertzakian on ARC Energy Institute’s latest podcast.

“I think it’s important to understand that any policies that affect oil sands also affect the electricity grid.”

Alberta

Alberta’s fiscal update projects budget surplus, but fiscal fortunes could quickly turn

From the Fraser Institute

By Tegan Hill

According to the recent mid-year update tabled Thursday, the Smith government projects a $4.6 billion surplus in 2024/25, up from the $2.9 billion surplus projected just a few months ago. Despite the good news, Premier Smith must reduce spending to avoid budget deficits.

The fiscal update projects resource revenue of $20.3 billion in 2024/25. Today’s relatively high—but very volatile—resource revenue (including oil and gas royalties) is helping finance today’s spending and maintain a balanced budget. But it will not last forever.

For perspective, in just the last decade the Alberta government’s annual resource revenue has been as low as $2.8 billion (2015/16) and as high as $25.2 billion (2022/23).

And while the resource revenue rollercoaster is currently in Alberta’s favor, Finance Minister Nate Horner acknowledges that “risks are on the rise” as oil prices have dropped considerably and forecasters are projecting downward pressure on prices—all of which impacts resource revenue.

In fact, the government’s own estimates show a $1 change in oil prices results in an estimated $630 million revenue swing. So while the Smith government plans to maintain a surplus in 2024/25, a small change in oil prices could quickly plunge Alberta back into deficit. Premier Smith has warned that her government may fall into a budget deficit this fiscal year.

This should come as no surprise. Alberta’s been on the resource revenue rollercoaster for decades. Successive governments have increased spending during the good times of high resource revenue, but failed to rein in spending when resource revenues fell.

Previous research has shown that, in Alberta, a $1 increase in resource revenue is associated with an estimated 56-cent increase in program spending the following fiscal year (on a per-person, inflation-adjusted basis). However, a decline in resource revenue is not similarly associated with a reduction in program spending. This pattern has led to historically high levels of government spending—and budget deficits—even in more recent years.

Consider this: If this fiscal year the Smith government received an average level of resource revenue (based on levels over the last 10 years), it would receive approximately $13,000 per Albertan. Yet the government plans to spend nearly $15,000 per Albertan this fiscal year (after adjusting for inflation). That’s a huge gap of roughly $2,000—and it means the government is continuing to take big risks with the provincial budget.

Of course, if the government falls back into deficit there are implications for everyday Albertans.

When the government runs a deficit, it accumulates debt, which Albertans must pay to service. In 2024/25, the government’s debt interest payments will cost each Albertan nearly $650. That’s largely because, despite running surpluses over the last few years, Albertans are still paying for debt accumulated during the most recent string of deficits from 2008/09 to 2020/21 (excluding 2014/15), which only ended when the government enjoyed an unexpected windfall in resource revenue in 2021/22.

According to Thursday’s mid-year fiscal update, Alberta’s finances continue to be at risk. To avoid deficits, the Smith government should meaningfully reduce spending so that it’s aligned with more reliable, stable levels of revenue.

Author:

Alberta

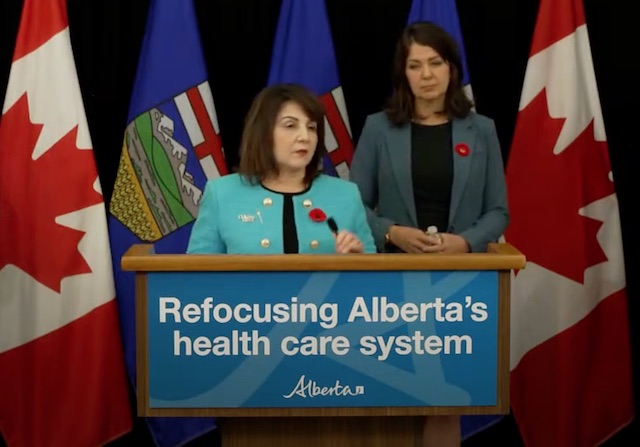

Premier Smith says Auto Insurance reforms may still result in a publicly owned system

Better, faster, more affordable auto insurance

Alberta’s government is introducing a new auto insurance system that will provide better and faster services to Albertans while reducing auto insurance premiums.

After hearing from more than 16,000 Albertans through an online survey about their priorities for auto insurance policies, Alberta’s government is introducing a new privately delivered, care-focused auto insurance system.

Right now, insurance in the province is not affordable or care focused. Despite high premiums, Albertans injured in collisions do not get the timely medical care and income support they need in a system that is complex to navigate. When fully implemented, Alberta’s new auto insurance system will deliver better and faster care for those involved in collisions, and Albertans will see cost savings up to $400 per year.

“Albertans have been clear they need an auto insurance system that provides better, faster care and is more affordable. When it’s implemented, our new privately delivered, care-centred insurance system will put the focus on Albertans’ recovery, providing more effective support and will deliver lower rates.”

“High auto insurance rates put strain on Albertans. By shifting to a system that offers improved benefits and support, we are providing better and faster care to Albertans, with lower costs.”

Albertans who suffer injuries due to a collision currently wait months for a simple claim to be resolved and can wait years for claims related to more serious and life-changing injuries to addressed. Additionally, the medical and financial benefits they receive often expire before they’re fully recovered.

Under the new system, Albertans who suffer catastrophic injuries will receive treatment and care for the rest of their lives. Those who sustain serious injuries will receive treatment until they are fully recovered. These changes mirror and build upon the Saskatchewan insurance model, where at-fault drivers can be sued for pain and suffering damages if they are convicted of a criminal offence, such as impaired driving or dangerous driving, or conviction of certain offenses under the Traffic Safety Act.

Work on this new auto insurance system will require legislation in the spring of 2025. In order to reconfigure auto insurance policies for 3.4 million Albertans, auto insurance companies need time to create and implement the new system. Alberta’s government expects the new system to be fully implemented by January 2027.

In the interim, starting in January 2025, the good driver rate cap will be adjusted to a 7.5% increase due to high legal costs, increasing vehicle damage repair costs and natural disaster costs. This protects good drivers from significant rate increases while ensuring that auto insurance providers remain financially viable in Alberta.

Albertans have been clear that they still want premiums to be based on risk. Bad drivers will continue to pay higher premiums than good drivers.

By providing significantly enhanced medical, rehabilitation and income support benefits, this system supports Albertans injured in collisions while reducing the impact of litigation costs on the amount that Albertans pay for their insurance.

“Keeping more money in Albertans’ pockets is one of the best ways to address the rising cost of living. This shift to a care-first automobile insurance system will do just that by helping lower premiums for people across the province.”

Quick facts

- Alberta’s government commissioned two auto insurance reports, which showed that legal fees and litigation costs tied to the province’s current system significantly increase premiums.

- A 2023 report by MNP shows

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoThe Most Devastating Report So Far

-

Business2 days ago

Business2 days agoCarbon tax bureaucracy costs taxpayers $800 million

-

ESG2 days ago

ESG2 days agoCan’t afford Rent? Groceries for your kids? Trudeau says suck it up and pay the tax!

-

John Stossel2 days ago

John Stossel2 days agoGreen Energy Needs Minerals, Yet America Blocks New Mines

-

Daily Caller2 days ago

Daily Caller2 days agoLos Angeles Passes ‘Sanctuary City’ Ordinance In Wake Of Trump’s Deportation Plan

-

Alberta2 days ago

Alberta2 days agoProvince considering new Red Deer River reservoir east of Red Deer

-

Addictions1 day ago

Addictions1 day agoBC Addictions Expert Questions Ties Between Safer Supply Advocates and For-Profit Companies

-

Aristotle Foundation1 day ago

Aristotle Foundation1 day agoToronto cancels history, again: The irony and injustice of renaming Yonge-Dundas Square to Sankofa Square